India Spices Market Size, Share, Trends and Forecast by Product Type, Application, Form, and Region, 2026-2034

India Spices Market Summary:

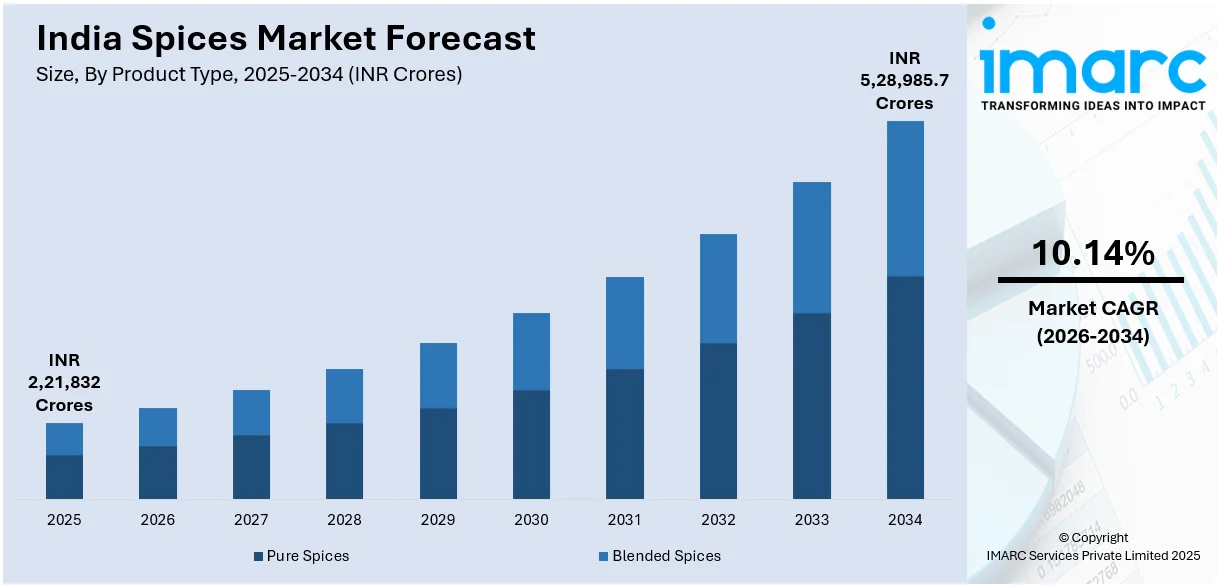

The India spices market size was valued at INR 2,21,832 Crores in 2025 and is projected to reach INR 5,28,985.71 Crores by 2034, growing at a compound annual growth rate of 10.14% from 2026-2034.

The market is driven by deeply rooted culinary traditions, rising consumer preference for authentic flavors, increasing demand from the food processing industry, and growing awareness of the health benefits associated with traditional spices. Expanding organized retail channels and premiumization trends are further propelling market growth. Rising disposable incomes and urbanization are boosting demand for convenient, packaged spice products across diverse consumer segments, contributing to a significant India spices market share.

Key Takeaways and Insights:

- By Product Type: Pure spices dominate the market with a share of 63% in 2025, driven by the essential role of individual spices in traditional Indian cooking and widespread household consumption patterns.

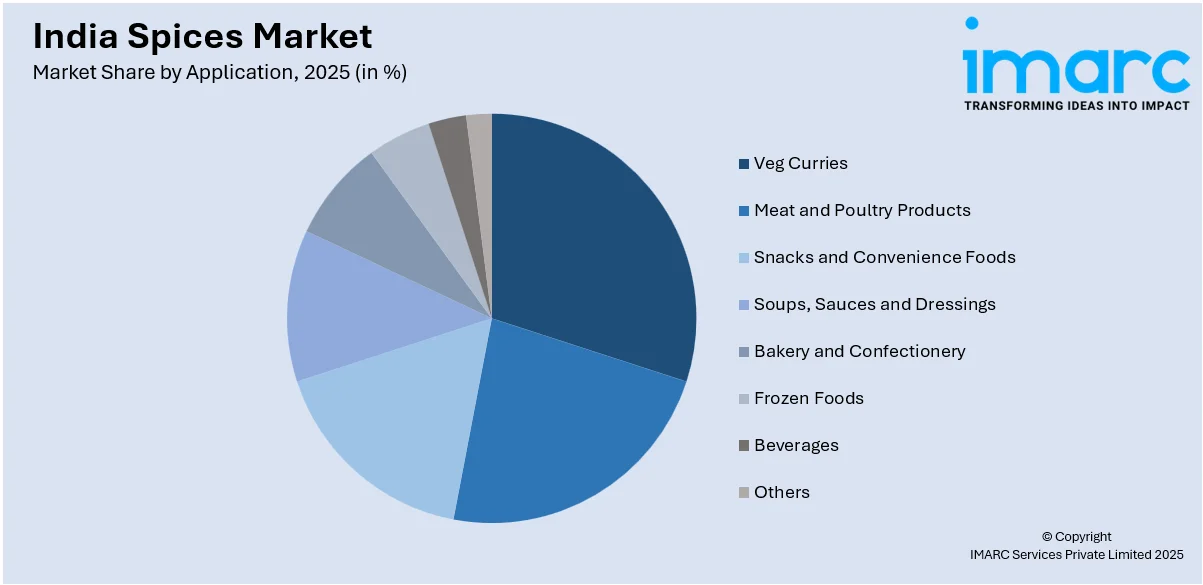

- By Application: Veg curries lead the market with a share of 29% in 2025, owing to India's predominantly vegetarian population and the integral role of spices in enhancing regional vegetable cuisines.

- By Form: Packets represent the largest segment with a market share of 67% in 2025, driven by consumer preference for hygienic, portion-controlled packaging, extended shelf-life benefits, and widespread retail distribution channel networks.

- By Region: North India leads the market with a share of 30% in 2025, owing to the region's spice-intensive culinary traditions, dense population centers, higher per capita spice consumption, and well-established commercial procurement infrastructure networks.

- Key Players: The India spices market exhibits a highly fragmented competitive landscape, with established national brands actively competing alongside numerous regional and local manufacturers across diverse price segments, product categories, and distribution channels serving varied consumer preferences. Some of the key players operating in the market include Aachi Masala Foods (P) Ltd, Aashirvaad Spices (ITC Limited), Badshah Masala, Catch Foods (DS Group), Everest Food Products Private Limited, Goldiee Group, Mahashian Di Hatti Private Limited, Orkla India Pvt Ltd., and Patanjali Ayurved Limited.

To get more information on this market Request Sample

The India spices market is experiencing robust expansion fueled by the country's rich culinary heritage and the indispensable role of spices in daily cooking practices across diverse regional cuisines. According to reports, in 2025, Mehsana exported ₹3,995 Crore worth of cumin, Isabgol, and fennel seeds to 101 countries; 25% went to China, 16% to Bangladesh, 10% to UAE, and 5% to the US. Moreover, growing health consciousness among consumers is driving demand for natural, additive-free spice products with recognized medicinal and therapeutic properties. The rapid expansion of the food service industry, including restaurants, quick-service outlets, and cloud kitchens, is creating sustained institutional demand for quality spice ingredients. Urbanization and changing lifestyles are accelerating the shift toward packaged and branded spice products that offer convenience without compromising authenticity or traditional flavor profiles. Rising export opportunities and government initiatives supporting spice cultivation and processing infrastructure are strengthening the supply ecosystem, while premiumization trends are encouraging continuous product innovation across organic and specialty spice categories.

India Spices Market Trends:

Growing Preference for Organic and Clean-Label Spices

Consumer awareness regarding pesticide residues and chemical contamination is driving a significant shift toward organic and clean-label spice products. In June 2025, ITC completed the Rs472.50 Crore acquisition of Sresta Natural Bioproducts, owner of 24 Mantra Organic, expanding its organic spices and food products portfolio domestically and internationally. Moreover, health-conscious buyers are increasingly seeking spices cultivated through sustainable agricultural practices without synthetic fertilizers or harmful additives. This trend is particularly pronounced among urban consumers and younger demographics who prioritize transparency in sourcing and production methods. Retailers are expanding dedicated organic sections, while manufacturers are investing in certifications and traceability systems.

Expansion of Ready-to-Cook Spice Blends

The convenience-driven lifestyle of modern consumers is accelerating demand for ready-to-cook spice blends that simplify meal preparation. As per sources, in June 2025, ZOFF Foods partnered with Reliance Retail to launch its Quick Homestyle Food range, including 5-Minute Gravies and 1-Minute Marinades, across 400+ stores nationwide. Furthermore, busy professionals and nuclear families are increasingly relying on pre-mixed masalas that deliver consistent flavors without extensive preparation time. Manufacturers are responding with innovative product formulations catering to regional recipes and international cuisines.

Digital Commerce Transformation in Spice Retailing

E-commerce platforms are fundamentally reshaping how consumers discover and purchase spice products across India. According to reports, in October 2025, ZOFF Foods reported that 75 percent of its revenue comes from online retail, with 65 percent of that from quick commerce channels, targeting Rs 170 Crore turnover this year. Moreover, online marketplaces offer extensive product assortments, competitive pricing, and doorstep delivery convenience that traditional retail cannot easily replicate. Direct-to-consumer brands are leveraging digital channels to build customer relationships and gather valuable feedback for product innovation. Subscription models and bulk purchasing options are gaining popularity among regular spice consumers.

Market Outlook 2026-2034:

The India spices market is anticipated to generate substantial revenue growth throughout the forecast period, supported by sustained domestic consumption and expanding export opportunities. Rising health awareness and growing preference for natural food ingredients are expected to drive demand across all product categories. The premiumization trend will continue creating revenue opportunities in organic and specialty segments. Technological advancements in processing and packaging are projected to enhance product quality and shelf life. Government initiatives promoting spice cultivation and processing infrastructure development will strengthen supply capabilities. The market generated a revenue of INR 2,21,832 Crores in 2025 and is projected to reach a revenue of INR 5,28,985.71 Crores by 2034, growing at a compound annual growth rate of 10.14% from 2026-2034.

India Spices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Pure Spices |

63% |

|

Application |

Veg Curries |

29% |

|

Form |

Packets |

67% |

|

Region |

North India |

30% |

Product Type Insights:

- Pure Spices

- Chilli

- Turmeric

- Coriander

- Cumin

- Pepper

- Tamarind

- Asafoetida

- Bay Leaf

- Clove

- Cardamom

- Cinnamon

- Tulsi Leaf

- Others

- Blended Spices

- Garam Masala

- Non-Veg Masala

- Kitchen King and Sabzi Masala

- Chole and Channa Masala

- Chat Masala

- Sambhar and Rasham Masala

- Paneer and Curry Masala

- Pav Bhaji Masala

- Jaljeera Masala

- Others

Pure spices dominate with a market share of 63% of the total India spices market in 2025.

Pure spices constitute the dominant segment in the India spices market, reflecting the fundamental importance of individual spices in traditional cooking practices across the entire country. Indian households maintain consistent procurement patterns for essential spices including turmeric, chilli powder, coriander, cumin, and pepper, which form the foundation of diverse regional cuisines and daily meal preparations. As per sources, Sunpure launched turmeric, red chilli, and coriander powders, targeting INR 150 crore revenue from the food category, emphasizing sustainably sourced pure spices with no artificial additives.

The widespread availability of pure spices through diverse retail channels, from neighbourhood kirana stores to modern supermarkets and hypermarkets, ensures consistent market penetration across both urban and rural areas effectively. Traditional consumers prefer purchasing whole spices for home grinding, believing this preserves aromatic compounds, essential oils, and flavor intensity more effectively. The segment also benefits significantly from institutional demand originating from restaurants, hotels, and food processors requiring bulk quantities of specific spices for standardized recipe formulations and consistent product quality.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Veg Curries

- Meat and Poultry Products

- Snacks and Convenience Foods

- Soups, Sauces and Dressings

- Bakery and Confectionery

- Frozen Foods

- Beverages

- Others

Veg curries lead with a share of 29% of the total India spices market in 2025.

Vegetable curries represent the leading application segment in the India spices market, driven by the country's substantial vegetarian population and deeply rooted cultural dietary traditions and preferences. Spices play an essential and irreplaceable role in transforming simple vegetables into flavorful and nutritious dishes, making this segment fundamental to daily consumption patterns across all Indian households. As per sources, in 2025, Orika launched its Korean All Purpose Seasoning in India, bringing bold K-flavours to everyday meals and introducing an innovative self-cleaning, clog-free sprinkler for effortless cooking.

The segment benefits from deeply ingrained cooking habits where spice-enhanced vegetable preparations constitute staple meals across all socioeconomic demographics and diverse income groups consistently. Growing restaurant sectors, food service establishments, and institutional catering services maintain steady and reliable demand for curry-specific spice requirements throughout the entire year. Health and wellness trends favoring plant-based diets and vegetarian lifestyles are further reinforcing the centrality of vegetable preparations in traditional Indian cuisine, ensuring sustained and continuously growing spice consumption across the entire country.

Form Insights:

- Packets

- Sprinkler

- Crusher

Packets exhibit a clear dominance with a 67% share of the total India spices market in 2025.

Packets dominate the market in India, reflecting strong consumer preference for hygienic, convenient, and consistently portioned products that meet modern household requirements effectively. Modern packaging technologies ensure extended shelf life and effectively protect aromatic properties and essential oils, making packets the preferred choice for urban consumers across the entire country. In September 2024, iD Fresh Food entered the branded spices category with three spice variants packaged to preserve freshness and aroma for up to 12 months, featuring QR codes on each packet for quality transparency.

The organized retail expansion across tier-one and tier-two cities has significantly accelerated packet adoption rates, with supermarkets, hypermarkets, and modern trade outlets offering extensive branded spice assortments to increasingly discerning consumers nationwide. Packaging innovations including resealable pouches, single-use sachets, and premium containers effectively cater to diverse usage occasions and evolving consumer preferences. The segment continues gaining substantial market share as hygiene consciousness, quality awareness, and brand preference increase consistently across all consumer demographics and geographic regions throughout the entire country.

Regional Insights:

- South India

- North India

- West and Central India

- East India

North India dominates with a market share of 30% of the total India spices market in 2025.

North India holds the largest regional share in the India spices market, supported by deeply rooted spice-intensive culinary traditions and substantial population concentration across major states and territories. States including Uttar Pradesh, Delhi, Punjab, Rajasthan, and Madhya Pradesh demonstrate exceptionally high per capita spice consumption driven by distinctive regional cuisine characteristics and cultural food preferences. The robust agricultural infrastructure and well-established spice trade networks effectively support efficient and timely distribution across both urban and rural areas throughout the entire region.

The region benefits significantly from diverse food processing activities and flourishing food service sectors that generate sustained commercial spice demand throughout the entire year consistently. Cultural practices, religious festivals, and traditional celebrations involving elaborate meal preparations create periodic demand spikes across all spice categories. Strong retail infrastructure, including traditional wholesale markets, neighborhood stores, and modern trade formats such as supermarkets and hypermarkets, ensures comprehensive market coverage, accessibility, and consistent product availability to diverse consumers across all income segments and demographics.

Market Dynamics:

Growth Drivers:

Why is the India Spices Market Growing?

Rising Health Consciousness and Functional Food Demand

Growing consumer awareness regarding the therapeutic properties of traditional Indian spices is significantly driving market expansion across all demographic segments. Spices including turmeric, ginger, black pepper, and cinnamon are increasingly recognized for their anti-inflammatory, antioxidant, and immunity-boosting properties by health-conscious consumers. This health-focused perspective is transforming spices from mere flavor enhancers to functional food ingredients with substantial perceived wellness benefits. As per sources, in September 2025, Patanjali popularized Ayurvedic spice products like turmeric capsules, haldi churna, and spice-infused tonics, making traditional Indian spices accessible for daily wellness and preventive health routines.

Expansion of Food Processing and Hospitality Industries

The rapidly growing food processing sector and expanding hospitality industry are creating substantial institutional demand for quality spice products across India. Quick-service restaurants, cloud kitchens, catering services, and institutional food providers require consistent spice supplies meeting standardized quality specifications and flavor profiles. The proliferation of regional cuisine restaurants across metropolitan areas is driving demand for authentic spice blends and specialty ingredients. Food manufacturers producing ready-to-eat meals, snacks, and convenience foods rely heavily on spice ingredients for flavor differentiation, providing stable market growth throughout the year.

Urbanization and Changing Consumer Lifestyles

Accelerating urbanization and evolving lifestyle patterns are fundamentally transforming spice consumption dynamics across India, particularly in major metropolitan areas and emerging cities. Urban consumers increasingly prefer branded, packaged spice products offering convenience, hygiene assurance, and consistent quality for their daily cooking requirements. According to reports, in April 2024, the Spice Board of India directed Everest and MDH to provide details of quality checks after certain products were halted in Hong Kong and Singapore, highlighting growing emphasis on compliance and hygiene in branded spice products. Moreover, dual-income households with limited meal preparation time are driving demand for ready-to-use spice blends and convenience-oriented packaging formats.

Market Restraints:

What Challenges the India Spices Market is Facing?

Price Volatility and Supply Chain Vulnerabilities

The India spices market faces significant challenges from price fluctuations driven by monsoon-dependent agricultural production and seasonal supply variations across regions. Weather disruptions, pest infestations, and crop failures can create acute supply shortages affecting procurement costs and product availability. These uncertainties complicate inventory management for manufacturers and create margin pressures across the entire value chain.

Quality Adulteration and Authenticity Concerns

Widespread adulteration practices in unorganized market segments significantly undermine consumer confidence and create reputational challenges for the broader industry. The addition of artificial colors, fillers, and inferior substitutes compromises product quality and potentially poses serious health risks. Ensuring authenticity and maintaining quality standards across fragmented supply chains remains an ongoing challenge for all market participants.

Competition from Unorganized Sector

The substantial presence of unorganized manufacturers offering lower-priced products creates significant competitive pressure on branded spice producers across market segments. Price-sensitive consumers, particularly in rural and semi-urban markets, often prefer economical alternatives available through traditional retail channels. This fragmented competition substantially limits premiumization opportunities and constrains margin expansion for organized industry players throughout the country.

Competitive Landscape:

The India spices market exhibits a highly fragmented competitive structure characterized by the coexistence of established national brands, regional manufacturers, and numerous local players operating across diverse geographic territories. Competition occurs across multiple dimensions including product quality, pricing strategies, distribution reach, and brand equity. Organized players are investing in backward integration, quality certifications, and brand building to differentiate themselves from unorganized competitors. Innovation in product formulations, packaging formats, and convenience offerings serves as a key competitive strategy. Distribution network strength significantly influences market positioning, with successful players maintaining presence across traditional and modern retail channels.

Some of the key players include:

- Aachi Masala Foods (P) Ltd

- Aashirvaad Spices (ITC Limited)

- Badshah Masala

- Catch Foods (DS Group)

- Everest Food Products Private Limited

- Goldiee Group

- Mahashian Di Hatti Private Limited

- Orkla India Pvt Ltd.

- Patanjali Ayurved Limited

Recent Developments:

- In December 2025, Vasant became India’s first spice brand to launch an AI avatar, Masala Mausi, aimed at guiding home cooks with culinary tips, spice pairing, and regional recipes, enhancing digital engagement while blending tradition with technology, strengthening brand presence, and connecting with younger, tech-savvy consumers across India.

- In April 2025, KPG Spices, owned by Marvel King Ltd, aimed to double its revenue to Rs 100 Crore for FY 2025-26 by launching whole spices across North India, expanding its presence into UP, Rajasthan, and the Northeast, and growing its network to 1 Lakh retail outlets, including e-commerce and quick-commerce channels.

India Spices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Crores |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Veg Curries, Meat and Poultry Products, Snacks and Convenience Foods, Soups, Sauces and Dressings, Bakery and Confectionery, Frozen Foods, Beverages, Others |

| Forms Covered | Packets, Sprinkler, Crusher |

| Regions Covered | South India, North India, West and Central India, East India |

| Companies Covered | Aachi Masala Foods (P) Ltd, Aashirvaad Spices (ITC Limited), Badshah Masala, Catch Foods (DS Group), Everest Food Products Private Limited, Goldiee Group, Mahashian Di Hatti Private Limited, Orkla India Pvt Ltd., Patanjali Ayurved Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India spices market size was valued at INR 2,21,832 Crores in 2025.

The India spices market is expected to grow at a compound annual growth rate of 10.14% from 2026-2034 to reach INR 5,28,985.71 Crores by 2034.

Pure spices held the largest market share, driven by their essential role in traditional Indian cooking practices, widespread household consumption patterns, strong consumer loyalty, and established procurement preferences prioritizing freshness and authenticity over convenience-oriented alternatives.

Key factors driving the India spices market include rising health consciousness, expanding food processing and hospitality industries, urbanization-driven preference for packaged products, growing export opportunities, premiumization trends, and increasing demand for organic and specialty spice categories.

Major challenges include price volatility due to monsoon-dependent production, widespread adulteration undermining quality standards, intense competition from unorganized sector players, fragmented supply chains, inconsistent product quality, and maintaining authenticity across diverse distribution networks throughout the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)