India Sports Nutrition Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, and Region, 2026-2034

India Sports Nutrition Market Summary:

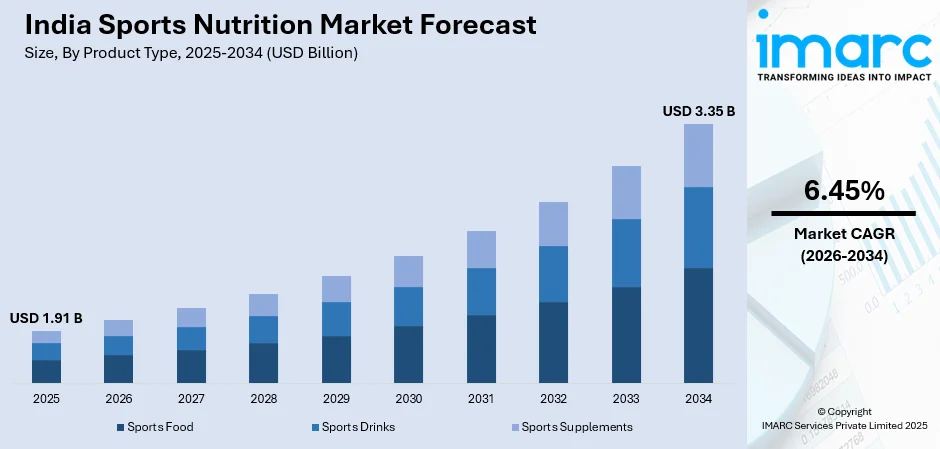

The India sports nutrition market size was valued at USD 1.91 Billion in 2025 and is projected to reach USD 3.35 Billion by 2034, growing at a compound annual growth rate of 6.45% from 2026-2034.

The India sports nutrition market is recording robust growth, propelled by an increase in the prevalence of fitness and sports culture in the country. With growing numbers of gyms, fitness centers, and sports training academies, demand for performance-enhancing nutritional products has consequently increased among athletes and health-conscious consumers. Consumer interest in such products has also been catalyzed by growing social media fitness influencers and celebrity endorsements, who have established them as an elemental part of the modern active lifestyle.

Key Takeaways and Insights:

-

By Product Type: Sports drinks dominate the market with a share of 66.32% in 2025, driven by their widespread availability, convenient consumption, and effectiveness in providing rapid hydration and energy replenishment during physical activities.

-

By Raw Material: Animal derived lead the market with a share of 72.15% in 2025, owing to the high bioavailability of whey protein and consumer preference for established protein sources with proven efficacy in muscle recovery.

-

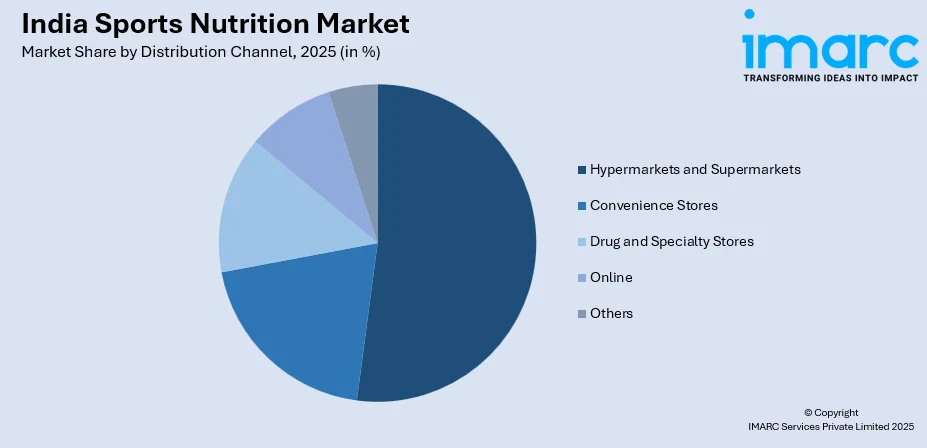

By Distribution Channel: Hypermarkets and supermarkets dominate the market with a share of 52.18% in 2025, attributed to their extensive retail networks, product variety, and the ability for consumers to physically examine products before purchase.

-

By Region: North India lead the market with a share of 34% revenue share in 2025, driven by higher concentration of urban centers, fitness clubs, and health-conscious consumers in metropolitan areas like Delhi and Chandigarh.

-

Key Players: The India sports nutrition market exhibits moderate competitive intensity, with both domestic and international players competing across various price segments. Some of the key players include, Avid Nutrilabs, Glanbia Performance Nutrition India Pvt. Ltd., Guardian Healthcare Services Pvt. Ltd., Herbalife India, MuscleBlaze, Nutramarc Sports Nutrition & Company, Olympia Nutrition, PepsiCo Inc., QNTSPORT.in, Inc., Scitron, Steadfast Nutrition, and The Coca-Cola Company.

To get more information on this market Request Sample

The India sports nutrition market is witnessing a paradigm shift as fitness consciousness permeates beyond professional athletes to mainstream consumers. The proliferation of boutique fitness studios, CrossFit boxes, and HIIT training centers has created a substantial consumer base seeking specialized nutritional support. The Indian government’s Khelo Bharat Niti, approved by the cabinet in 2025 to strengthen the national sports ecosystem and boost grassroots participation, aims to elevate India’s global sporting competitiveness. The market landscape is characterized by continuous product innovation, with manufacturers introducing plant-based alternatives, clean-label formulations, and region-specific flavor profiles to cater to evolving consumer preferences and dietary requirements.

India Sports Nutrition Market Trends:

Rising Adoption of Plant-Based and Vegan Protein Formulations

The Indian sports nutrition market is increasingly shifting toward plant‑based proteins, fueled by changing diets and sustainability awareness. In July 2025, Mumbai’s Prot launched Prot Block, a pea protein ingredient targeting protein deficiency and versatile clean‑label use. Manufacturers are broadening offerings with pea, soy, and innovative blends for vegan and lactose-intolerant consumers. This aligns with the wellness trend for transparent, ethical, and environmentally conscious supplementation, appealing to fitness enthusiasts seeking sustainable nutrition solutions.

Digital Integration and E-Commerce Expansion

The sports nutrition sector is undergoing rapid digital transformation, with e‑commerce emerging as a key distribution channel for urban consumers. In September 2025, Ronnie Coleman Signature Series partnered with Bright Lifecare’s HealthKart to produce, distribute, and retail its fitness nutrition range across India, enhancing online accessibility. Online marketplaces, detailed product information, reviews, and social media marketing are reshaping brand engagement, allowing manufacturers to effectively reach tier‑two and tier‑three cities with limited traditional retail presence.

Personalization and Functional Ingredient Innovation

The sports nutrition market is shifting toward personalized solutions featuring functional ingredients like probiotics, digestive enzymes, and adaptogens. Companies are launching blends that support gut health, performance, and recovery, reflecting growing consumer demand. India’s probiotics market nearly doubled to ₹2,070 crore in 2025, highlighting their rising importance in sports formulations. Manufacturers are also creating goal-specific, gender-focused, immunity-boosting, and ready-to-drink products to cater to diverse dietary needs and busy lifestyles, enhancing convenience and effectiveness.

Market Outlook 2026-2034:

The India sports nutrition market is poised for strong growth, driven by favorable demographics, rising disposable incomes, and expanding fitness infrastructure in major and emerging cities. Increasing fitness participation among millennials and Gen Z, along with heightened awareness of protein deficiency and the benefits of nutritional supplements, is fueling demand. These factors collectively create a supportive environment for sustained market expansion, positioning sports nutrition as a key segment in India’s health and wellness industry. The market generated a revenue of USD 1.91 Billion in 2025 and is projected to reach a revenue of USD 3.35 Billion by 2034, growing at a compound annual growth rate of 6.45% from 2026-2034.

India Sports Nutrition Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Sports Drinks |

66.32% |

|

Raw Material |

Animal Derived |

72.15% |

|

Distribution Channel |

Hypermarkets and Supermarkets |

52.18% |

|

Region |

North India |

34% |

Product Type Insights:

- Sports Food

- Sports Drinks

- Sports Supplements

The sports drinks dominates with a market share of 66.32% of the total India sports nutrition market in 2025.

Sports drinks are gaining popularity in India as convenient hydration and energy solutions. In February 2025, Reliance Consumer Products launched Spinner, co-created with cricket legend Muttiah Muralitharan, priced at ₹10 to broaden market accessibility. The segment thrives due to the widespread availability of isotonic and electrolyte-enhanced beverages and aggressive marketing by multinational brands. These drinks effectively meet the hydration needs of fitness enthusiasts, recreational athletes, and outdoor-active individuals in India’s warm climate.

The sports drinks category continues to evolve with manufacturers introducing low-sugar variants, natural ingredient formulations, and functional beverages incorporating vitamins and minerals. The convenience factor associated with ready-to-drink formats appeals to time-constrained urban consumers, while flavor innovations targeting Indian palate preferences have expanded consumer acceptance beyond traditional fitness demographics to mainstream consumption occasions.

Raw Material Insights:

- Animal Derived

- Plant-Based

- Mixed

The animal derived leads with a share of 72.15% of the total India sports nutrition market in 2025.

Animal‑derived proteins, especially whey concentrates and isolates, retain market dominance due to superior amino acid profiles and proven muscle protein synthesis benefits. In March 2025, MuscleBlaze’s Biozyme Whey earned a US patent for its enzyme blend enhancing amino acid bioavailability, reflecting ongoing innovation and global recognition. Supported by extensive clinical research on absorption and bioavailability, these proteins remain the preferred choice for athletes and bodybuilders aiming for optimal performance and effective, science-backed nutrition.

Animal-derived proteins lead the market not only due to performance benefits but also because of their integration into functional and fortified products. Beyond muscle building, these proteins are increasingly used in weight management, immunity support, and recovery formulations. Advances in processing have enabled the development of hydrolyzed and peptide-based products, offering faster absorption and targeted health benefits, further solidifying their dominance across sports nutrition and general wellness segments.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Convenience Stores

- Drug and Specialty Stores

- Online

- Others

The hypermarkets and supermarkets dominates with a market share of 52.18% of the total India sports nutrition market in 2025.

Hypermarkets and supermarkets act as prime destination stores for sport supplements, allowing consumers to access complete product offerings and engage in comparisons for brands, compositions, and pricing for different products in the same environment. The development in the organized sector for retail stores in major and tier two cities has greatly improved access to products, and the health and wellness segments in these facilities allow for consumers to experience an organized shopping environment, professional advice, and incentives for consumption.

These retail models have the advantage of consumer trust, promotional activity, and loyalty programs that provide incentives for repeat business. The retail experience allows consumers to check packaging, confirm authenticity markings, consult store staff about products suited to their personal fitness goals, and compare various products side by side, thereby addressing issues of counterfeit products, which are common in the unorganized retailing segment, besides improving overall consumer confidence in buying products.

Regional Insights:

- North India

- West and Central India

- East India

- South India

North India exhibits a clear dominance with a 34% share of the total India sports nutrition market in 2025.

North India's market leadership stems from the concentration of fitness infrastructure, higher disposable incomes, and pronounced health consciousness among urban populations in Delhi-NCR, Punjab, Haryana, and Uttar Pradesh. The region hosts numerous national-level sports academies, premium fitness chains, and bodybuilding communities that drive consistent demand for performance nutrition products across various price segments, while increasing awareness of personalized nutrition, emerging fitness trends, and influencer-led promotions further stimulates consumption among both amateur and professional fitness enthusiasts.

The northern region benefits from established distribution networks, strong organized retail presence, and early adoption of international sports nutrition brands. Additionally, the region's climatic conditions necessitating hydration solutions and the cultural emphasis on physical fitness contribute to sustained market expansion, with manufacturers increasingly tailoring product offerings to regional taste preferences, dietary considerations, and emerging consumer trends, while leveraging targeted marketing campaigns and influencer partnerships to strengthen brand visibility and consumer loyalty.

Market Dynamics:

Growth Drivers:

Why is the India Sports Nutrition Market Growing?

Expanding Fitness Infrastructure and Rising Health Consciousness

The proliferation of gyms, fitness centers, and specialized training facilities across urban and semi‑urban India is reshaping consumer attitudes toward fitness and nutrition. For example, in March, global fitness chain Crunch Fitness signed a master franchise agreement to enter India, planning to open at least 75 gyms nationwide, reflecting growing confidence in organized fitness infrastructure. Traditional gyms, boutique studios, CrossFit boxes, and MMA centers create multiple touchpoints for sports nutrition products. Rising health consciousness and preventive wellness measures position these products as essential for overall well‑being, beyond purely athletic performance.

Government Initiatives and Sports Development Programs

Government led initiatives promoting sports participation and physical fitness have created favorable conditions for market growth. Programs such as Fit India Movement, Khelo India, and state level sports development schemes have increased grassroots engagement in organized sports, while campaigns like Fit India Sundays on Cycle have mobilized citizens of all ages to adopt active lifestyles. These efforts include infrastructure development, athlete support programs, and public awareness campaigns, elevating the national profile of fitness. With schools integrating fitness education and the government emphasizing elite sports development, a broader consumer base is emerging, driving demand for nutritional support products.

Social Media Influence and Digital Marketing Effectiveness

The pervasive influence of social media platforms has transformed sports nutrition marketing and consumer engagement in India. Fitness influencers, athletes, and wellness advocates use Instagram, YouTube, and short‑form video apps to demonstrate product usage, share transformation stories, and provide nutritional guidance. For example, in February 2025, Herbalife India partnered with rising cricket star Yashasvi Jaiswal to promote sports nutrition products, leveraging his social presence to inspire young consumers. This digital ecosystem fosters authentic peer recommendations, user‑generated content, and interactive campaigns, democratizing fitness knowledge and enabling consumers in smaller cities to access information once limited to metropolitan audiences.

Market Restraints:

What Challenges the India Sports Nutrition Market is Facing?

Prevalence of Counterfeit and Substandard Products

The Indian sports nutrition market confronts significant challenges from counterfeit products and substandard formulations circulating through unorganized retail channels and unauthorized online sellers. These counterfeit products undermine consumer trust, pose potential health risks, and create pricing pressures for legitimate manufacturers. The absence of stringent enforcement mechanisms and limited consumer awareness regarding product authentication enables the proliferation of fake supplements, particularly in price-sensitive market segments.

Premium Pricing and Affordability Constraints

The premium pricing of quality sports nutrition products presents accessibility challenges for price-conscious Indian consumers, particularly in smaller cities and rural areas. Import duties, distribution costs, and quality certifications contribute to elevated retail prices that limit market penetration among middle-income households. This pricing barrier creates market bifurcation where aspirational consumers may defer purchases or opt for lower-quality alternatives that deliver suboptimal results.

Limited Awareness in Semi-Urban and Rural Markets

Despite significant urban market development, sports nutrition awareness remains limited in semi-urban and rural India where traditional dietary practices and skepticism toward supplementation persist. The lack of specialized retail channels, fitness infrastructure, and nutritional education in these regions constrains market expansion beyond metropolitan boundaries. Addressing this awareness gap requires sustained educational initiatives and distribution network development.

Competitive Landscape:

The India sports nutrition market demonstrates a moderately consolidated competitive structure characterized by the presence of established multinational corporations alongside rapidly growing domestic brands. International players leverage global research capabilities, brand recognition, and premium positioning, while Indian companies compete through localized product development, competitive pricing, and extensive distribution networks. The market witnesses continuous product innovation, strategic partnerships with fitness chains, and aggressive digital marketing investments as companies vie for consumer attention. Private label offerings from e-commerce platforms and retail chains are emerging as competitive alternatives, introducing pricing pressure across market segments while expanding overall category accessibility.

Some of the key players include:

- Avid Nutrilabs

- Glanbia Performance Nutrition India Pvt. Ltd.

- Guardian Healthcare Services Pvt. Ltd.

- Herbalife India

- MuscleBlaze

- Nutramarc Sports Nutrition & Company

- Olympia Nutrition

- PepsiCo Inc.

- QNTSPORT.in, Inc.

- Scitron

- Steadfast Nutrition

- The Coca-Cola Company

Recent Developments:

-

In December 2025, One Science Nutrition (OSN) appointed actor Tiger Shroff as its brand ambassador, reinforcing its presence in India’s sports nutrition market. The brand also launched limited‑edition Tiger Combo Packs, featuring whey protein and creatine, aimed at promoting high-quality, verified nutrition and educating consumers on performance-focused supplementation.

India Sports Nutrition Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Type Covered | Sports Food, Sports Drinks, Sports Supplements |

| Raw Material Covered | Animal Derived, Plant-Based, Mixed |

| Distribution Channel Covered | Hypermarkets and Supermarkets, Convenience Stores, Drug and Specialty Stores, Online, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Avid Nutrilabs, Glanbia Performance Nutrition India Pvt. Ltd., Guardian Healthcare Services Pvt. Ltd., Herbalife India, MuscleBlaze, Nutramarc Sports Nutrition & Company, Olympia Nutrition, PepsiCo Inc., QNTSPORT.in, Inc., Scitron, Steadfast Nutrition, The Coca-Cola Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India sports nutrition market size was valued at USD 1.91 Billion in 2025.

The India sports nutrition market is expected to grow at a compound annual growth rate of 6.45% from 2026-2034 to reach USD 3.35 Billion by 2034.

Sports drinks dominated the market with a 66.32% share, driven by widespread availability, convenient consumption formats, and effectiveness in providing rapid hydration and energy replenishment during physical activities across diverse consumer segments.

Key factors driving the India sports nutrition market include expanding fitness infrastructure and gymnasiums, rising health consciousness among urban populations, government initiatives promoting sports participation, increasing disposable incomes, social media influence, and growing awareness about protein supplementation benefits.

Major challenges include prevalence of counterfeit products in unorganized retail channels, premium pricing limiting accessibility for price-conscious consumers, limited awareness in semi-urban and rural areas, regulatory compliance requirements, and intense competition among established players.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)