India Sports Technology Market Size, Share, Trends and Forecast by Component, Technology, Sports, Application, End User, and Region, 2025-2033

India Sports Technology Market Size and Share:

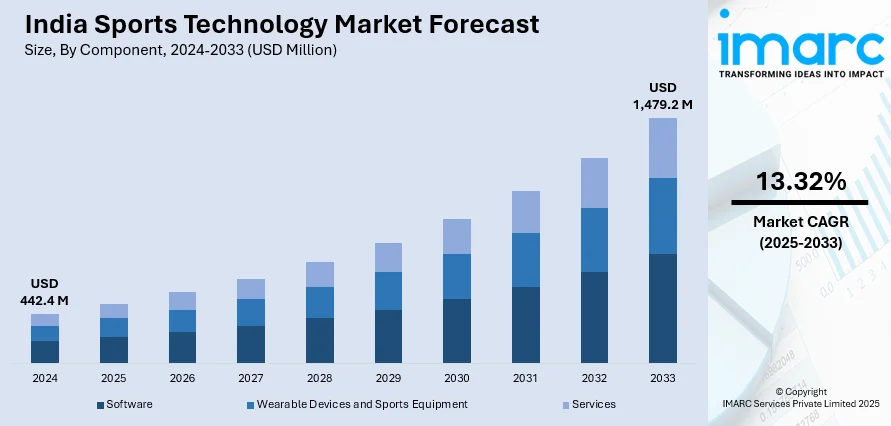

The India sports technology market size reached USD 442.4 Million in 2024. The market is expected to reach USD 1,479.2 Million by 2033, exhibiting a growth rate (CAGR) of 13.32% during 2025-2033. The market growth is attributed to the growing investments in sports infrastructure, rising adoption of data analytics and wearable devices, increasing popularity of e-sports, expanding fan engagement platforms, technological advancements in performance tracking, and supportive government initiatives aimed at promoting sports development and professional training across the country.

Market Insights:

- Based on region, the market is divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of component, the market is segmented into software, wearable devices and sports equipment, and services.

- Based on the technology, the market is categorized as artificial intelligence/machine learning (AI/ML), internet of things (IoT), and augmented reality/virtuality (AR/VR).

- On the basis of sports, the market is segmented into soccer, baseball, basketball, ice hockey, American football/rugby, tennis, cricket, golf, esports, and others.

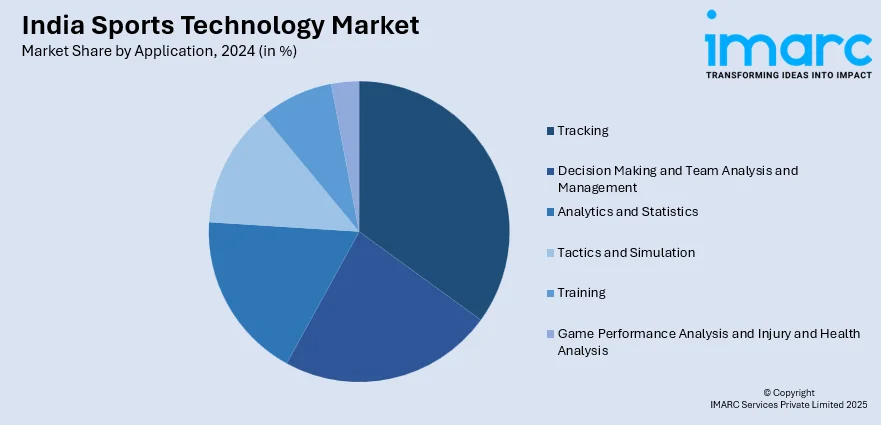

- Based on the application, the market is categorized as tracking, decision making and team analysis and management, analytics and statistics, tactics and simulation, training, and game performance analysis and injury and health analysis.

- On the basis of end user, the market is segmented into coaches, clubs, leagues, sports associations, and others.

Market Size and Forecast:

- 2024 Market Size: USD 442.4 Million

- 2033 Projected Market Size: USD 1,479.2 Million

- CAGR (2025-2033): 13.32%

Sports technology refers to the application of scientific and technological advancements in the field of sports to enhance performance, safety, and overall athlete experience. It encompasses a wide range of innovations, including wearable devices, biomechanics analysis, virtual reality, and data analytics. Athletes and teams utilize these technologies to monitor and improve physical fitness, track performance metrics, prevent injuries, and optimize training regimens. For instance, smart wearables can provide real-time data on heart rate, motion, and other vital signs, enabling personalized training programs. Biomechanics technologies help analyze body movements for better technique and injury prevention. Overall, sports technology plays a pivotal role in pushing the boundaries of human performance and shaping the future of sports by merging athleticism with cutting-edge scientific and engineering solutions.

To get more information of this market, Request Sample

The sports technology market in India is experiencing unprecedented growth, primarily propelled by advancements in wearables, data analytics, and virtual reality. These innovative technologies have seamlessly integrated into the sports landscape, fostering a new era of performance enhancement and fan engagement. Firstly, the surge in wearable devices, such as smartwatches and fitness trackers, has empowered athletes to monitor and optimize their training regimens, leading to improved overall performance. Moreover, these wearables contribute to the burgeoning field of sports analytics, generating a wealth of data that teams and coaches can leverage for strategic decision-making. Furthermore, the adoption of virtual reality (VR) in sports training and fan experiences has been a significant driver augmenting the India sports technology market share. VR not only provides athletes with immersive training simulations but also enhances the fan experience through virtual stadium tours and immersive broadcasts. The demand for enhanced viewer engagement has spurred investments in augmented reality (AR) applications, creating interactive and personalized experiences for sports enthusiasts. In addition to enhancing performance and fan interactions, the sports technology market in India is also driven by the increasing emphasis on injury prevention and player safety. Cutting-edge technologies, such as biomechanics analysis and injury prediction algorithms, are now integral components of sports medicine, ensuring athletes can perform at their best while minimizing the risk of injuries.

India Sports Technology Market Trends:

Integration of Wearable Technology and Performance Analytics

The use of wearable technology, including smartwatches, GPS locators, and biometric sensors, is revolutionizing sports training and performance analysis in India. These devices gather real-time data on the heart rate, oxygen saturation, movement, and fatigue levels of athletes, allowing coaches and sports scientists to create customized training programs. Moreover, advanced analytics platforms in professional sports apply artificial intelligence (AI) and machine learning (ML) to analyze this data and offer insights to enhance speed, endurance, and the prevention of injury. The Indian cricket league, football league, and kabaddi league are now extensively using these facilities to optimize player performance and retain a competitive edge. Furthermore, wearable technology is increasingly being used beyond elite sports as well, with fitness enthusiasts and recreational athletes using affordable products to self-monitor and track progress. This emerging environment of interconnected sports solutions is also driving demand for cloud-based data analysis and storage platforms, thus providing opportunities for technology vendors to create localized, sport-oriented applications suited to Indian requirements.

Virtual and Augmented Reality in Training and Fan Engagement

Virtual reality (VR) and augmented reality (AR) technologies are transforming both the sports fan experience and athlete training in India. For training, VR simulations allow players to rehearse game situations in immersive settings without causing physical stress, improving tactical decision-making and skill mastery. This, in turn, is enhancing the India sports technology market outlook. Cricket schools and football training facilities increasingly use VR-supported drills to fine-tune reaction times and strategic reactions. Among fans, AR apps are enhancing live sports viewing with interactive overlays, player data, and real-time game information, providing more immersive viewing experiences. Sports organizations are also trying out VR-fueled virtual stadium tours and virtual interactive fan zones to extend digital engagement past physical grounds. The proliferation of low-cost VR headsets and smartphone-based augmented reality apps is bringing these technologies into the hands of more people in India, thus encouraging a tech-oriented sports culture that combines physical performance improvement with immersive entertainment.

Challenges of India Sports Technology Market:

The market faces tremendous challenges such as the high cost of implementation, lack of infrastructure, and inconsistent adoption of technology. Sophisticated systems like AI-based analytics, VR-based training platforms, and advanced wearable devices are expensive and may demand a lot of money to implement, which becomes unaffordable for small-sized sports academies. Also, low penetration of broadband and lack of uniform internet speeds in some areas hamper the seamless integration of cloud-based sports solutions. There is also a scarcity of trained personnel who can handle and read data from advanced sports technologies, and hence, underutilization of available technology. Besides, resistance to embracing technology in conventional training practices still exists in some sporting communities. Security of data issues, especially regarding player health and performance data, introduces another dimension of complication. These factors hinder the deployment of advanced sports technologies, thereby influencing the market development.

Market Dynamics of India Sports Technology Market:

The sports technology industry in India is evolving under the influence of rapid digitalization, rising sports investments, and the growing popularity of both mainstream and emerging sports. Professional leagues in cricket, football, and kabaddi are driving demand for performance analytics, fan engagement platforms, and immersive media solutions. Technological advancements in AI, IoT, and cloud computing are enabling real-time data tracking, predictive analytics, and personalized training modules. Consumer behavior is shifting toward digital-first sports experiences, with streaming platforms, interactive mobile apps, and AR/VR tools gaining traction. At the same time, government initiatives to promote sports at grassroots levels are expanding opportunities for tech-enabled infrastructure. However, market growth is moderated by the high costs of adoption and uneven access to advanced technologies across regions. The competitive landscape is increasingly dynamic, with both global technology firms and domestic startups offering sport-specific solutions tailored to Indian conditions and audience preferences.

Growth Drivers of India Sports Technology Market:

The market is propelled by the high level of investment in professional leagues, increased corporate sponsorship, and growing demand for data-based sports strategies. In addition to this, the growth of sports other than cricket, including football, badminton, and kabaddi, is opening up new spaces for technology adoption. Moreover, wearable technology and AI-driven analytics are becoming a part of athlete performance tracking, injury prevention, and strategic planning. According to the India sports technology market statistics, government-sponsored initiatives, including the development of sports infrastructure and talent identification programs, are driving the growth of the tech-enabled sports ecosystem. The increasing fitness culture among city dwellers is also increasing demand for consumer-led sports technologies, including fitness bands and smartphone training apps. Furthermore, the increase in online sports consumption is motivating the inclusion of AR/VR capabilities, interactive facts, and gamification to capture fan interest. This convergence of athletic performance needs, audience expectations, and digital capabilities is driving sustained growth in the sector.

Opportunities of India Sports Technology Market:

The market offers substantial opportunities fueled by growing digital adoption, higher disposable incomes, and growth in organized sports. Grassroots sports initiatives offer immense potential for bringing in low-cost, scalable tech solutions for training and talent hunting. As per the India sports technology market forecast, startups have opportunities to develop localized apps for sports such as cricket, kabaddi, and hockey, incorporating AI, video analysis, and IoT-based performance tracking, which is expected to attract and engage a wider audience. The eSports market is also becoming a growth market, with the potential for VR/AR-based gaming platforms, streaming technology, and competitive analytics. Apart from that, collaboration among sports institutions, technology firms, and schools of education can help bring about skill-building in the domains of sports science and analytics. The advancement of 5G networks will also support more advanced real-time applications, ranging from remote coaching to live immersive broadcasts. All these factors create a favorable environment for innovation, investment, and cross-industry collaborations that can further accelerate the adoption of sports technologies in India.

India Sports Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, technology, sports, application, and end user.

Component Insights:

- Software

- Wearable Devices and Sports Equipment

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software, wearable devices and sports equipment, and services.

Technology Insights:

- Artificial Intelligence/Machine Learning (AI/ML)

- Internet of Things (IoT)

- Augmented Reality/Virtuality (AR/VR)

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes artificial intelligence/machine learning (AI/ML), internet of things (IoT), and augmented reality/virtuality (AR/VR).

Sports Insights:

- Soccer

- Baseball

- Basketball

- Ice Hockey

- American Football/Rugby

- Tennis

- Cricket

- Golf

- Esports

- Others

The report has provided a detailed breakup and analysis of the market based on the sports. This includes soccer, baseball, basketball, ice hockey, american football/rugby, tennis, cricket, golf, esports, and others.

Application Insights:

- Tracking

- Decision Making and Team Analysis and Management

- Analytics and Statistics

- Tactics and Simulation

- Training

- Game Performance Analysis and Injury and Health Analysis

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes tracking, decision making and team analysis and management, analytics and statistics, tactics and simulation, training, and game performance analysis and injury and health analysis.

End User Insights:

- Coaches

- Clubs

- Leagues

- Sports Associations

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes coaches, clubs, leagues, sports associations, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- June 2025: Colab Cloud Platforms Ltd. announced its strategic foray into the sports management and sports technology sectors, aiming to transform how sports are played, managed, and experienced through its Sports Ecosystem Marketplace: "Learn, Play & Shop". The platform will serve as an all-in-one hub where athletes and sports enthusiasts can book top coaches and academies ("Learn"), reserve turf, stadiums, and other infrastructure ("Play"), and purchase high-quality sports gear, accessories, and nutrition ("Shop"). Leveraging technologies such as VR/AR, AI personalization, and data analytics, Colab Cloud plans to offer comprehensive solutions including athlete management, sponsorship and marketing tools, and fan-engagement platforms.

- December 2024: Garmin India launched a diverse range of wearable products, including the Forerunner 935, the Fenix 5 series of premium multisport GPS smartwatches, and two new activity trackers—the Vívofit Jr and VivoSmart 3, designed to cater to both fitness enthusiasts and younger users. The new offerings are powered by Garmin's latest software, promising an enhanced user experience, and Garmin India also appointed NexG Devices Pvt. Ltd. as its national distributor to expand its fitness and wellness product distribution across the country.

- September 2024: WHOOP announced its entry into the Indian market with the launch of its advanced wearable fitness and health-tracking technology. The device provides real-time insights into key health metrics, supported by features including WHOOP Coach, Any-Wear™ capability, Sleep Coach, and continuous data capture with a rechargeable 5.5-day battery. In partnership with Flipkart, WHOOP aims to deliver data-driven, personalized fitness coaching across metro and tier-2 cities.

- July 2024: During the two-day "Sports Tech Startup Conclave" in New Delhi, IIT Madras announced plans to invest up to INR 5 Crore in Indian sports-tech startups over the next five years, aiming to support at least 200 ventures focused on AI- and IoT-driven innovations, including sensors, networks, and controllers, under the aegis of its Pravartak Technologies Foundation and the Centre of Excellence in Sports Science and Analytics (CESSA). The initiative not only targets deep-tech applications for athletic performance and fan engagement but also offers incubation support, advanced infrastructure, and technical assistance to both early-stage and incorporated startups.

India Sports Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Wearable Devices and Sports Equipment, Services |

| Technologies Covered | Artificial Intelligence/Machine Learning (AI/ML), Internet of Things (IoT), Augmented Reality/Virtuality (AR/VR) |

| Sports Covered | Soccer, Baseball, Basketball, Ice Hockey, American Football/Rugby, Tennis, Cricket, Golf, Esports, Others |

| Applications Covered | Tracking, Decision Making and Team Analysis and Management, Analytics and Statistics, Tactics and Simulation, Training, Game Performance Analysis And Injury and Health Analysis |

| End Users Covered | Coaches, Clubs, Leagues, Sports Associations, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sports technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sports technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sports technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sports technology market in India was valued at USD 442.4 Million in 2024.

The sports technology market in India is projected to exhibit a (CAGR) of 13.32% during 2025-2033, reaching a value of USD 1,479.2 Million by 2033.

The market in India is expanding as a result of rising adoption of analytics-driven performance monitoring, fitness wearables, and technology-facilitated training. Government initiatives like Khelo India and private investments are developing sports infrastructure. Advances in fan engagement, broadcast, and athlete monitoring technologies also drive expansion, especially across professional leagues, academies, and recreational sporting.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)