India Spreads Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Income Group, and Region, 2026-2034

India Spreads Market Summary:

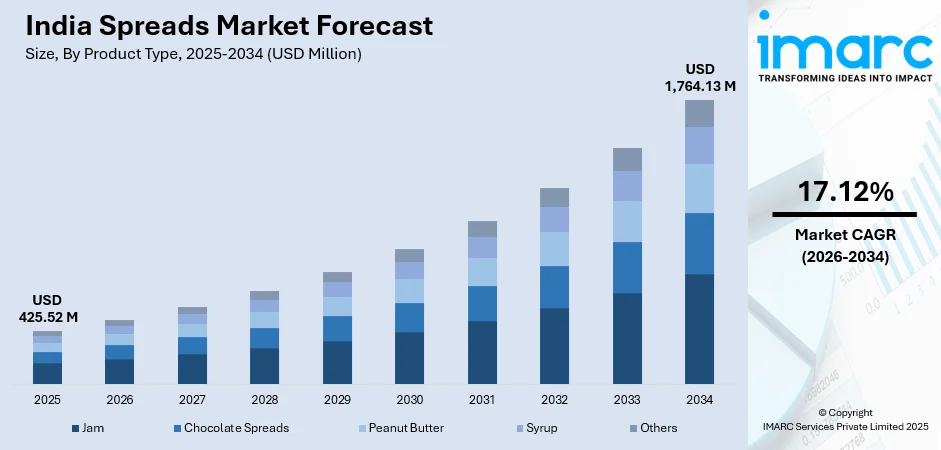

The India spreads market size was valued at USD 425.52 Million in 2025 and is projected to reach USD 1,764.13 Million by 2034, growing at a compound annual growth rate of 17.12% from 2026-2034.

The market is experiencing robust growth driven by rising health consciousness among consumers, rapid urbanization, and increasing disposable incomes across income segments. The heightened innovations in the FMCG sector, coupled with expanding organized retail infrastructure and e-commerce penetration, has transformed consumer purchasing behaviors. Quick commerce platforms have emerged as significant distribution channels, offering ultra-fast delivery services that cater to convenience-seeking urban consumers. The growing preference for protein-rich, organic, and functional food products is reshaping product development strategies across manufacturers. Government initiatives supporting the food processing sector through production-linked incentives and infrastructure development are expanding the India spreads market share.

Key Takeaways and Insights:

-

By Product Type: Jam dominates the market with a share of 24% in 2025, driven by traditional breakfast consumption patterns, cultural preferences for fruit-based spreads, and extensive distribution across urban and rural markets.

-

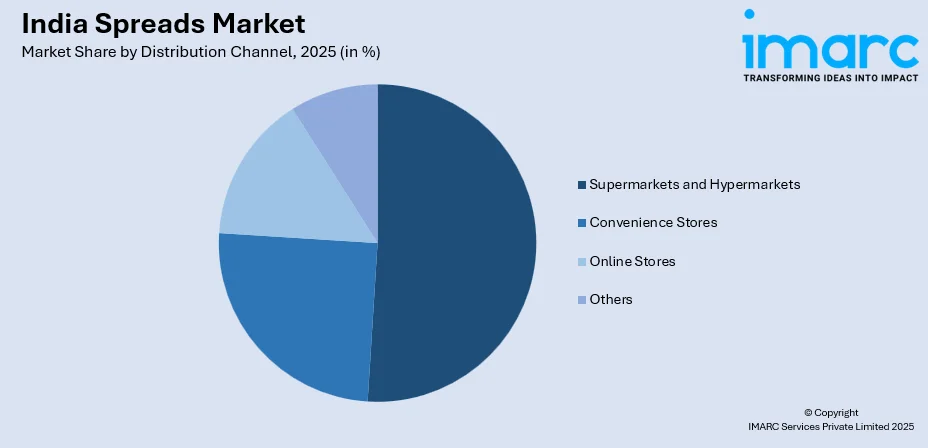

By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 51% in 2025, benefiting from extensive product assortments, promotional activities, and rapid quick commerce platform growth enabling ultra-fast delivery services across metropolitan areas.

-

By Income Group: Upper-middle (INR 5.5 lacs - 27.5 lacs) represents the largest segment with a market share of 34% in 2025, reflecting growing purchasing power, increasing brand affinity, and willingness to pay premium prices for quality and health-focused spread variants.

-

By Region: West and central India leads the market with a share of 28% in 2025, anchored by Mumbai and Pune's strong organized retail presence, high per capita incomes, and sophisticated consumer preferences driving premiumization trends.

-

Key Players: Leading manufacturers are competing through product innovation, distribution network expansion, and premiumization strategies. Some of the companies covered include Agro Tech Foods Ltd, Dr. Oetker India Pvt. Ltd. (Dr. August Oetker), Ferrero India Pvt. Ltd., G.D. Foods Manufacturing India Pvt. Ltd., Hershey India Pvt. Ltd. (The Hershey Company), Hindustan Unilever Limited (Unilever), and Mapro Garden LLP.

To get more information on this market Request Sample

The India spreads market is witnessing a fundamental transformation in consumption patterns as traditional jam and chocolate spread categories expand to include health-focused variants such as nut butters, low-sugar formulations, and plant-based alternatives. Consumer preferences are shifting toward products offering functional benefits including high protein content, organic certification, and clean-label ingredients free from artificial preservatives and additives. The proliferation of quick commerce platforms and acquisitions among key market players has revolutionized distribution dynamics, with ultra-fast delivery services now accounting for the majority of e-grocery orders in metropolitan areas. For instance, in 2025, Tata Consumer Products Ltd (TCPL) is in advanced talks to purchase Danone SA’s nutraceuticals and specialized nutrition business in India, a potential step that could greatly enhance its position in the thriving health and protein sector, according to sources close to the negotiations. The convergence of digital commerce infrastructure, rising health awareness, and increasing purchasing power among middle-income households positions the market for sustained expansion across both urban centers and emerging semi-urban consumption pockets.

India Spreads Market Trends:

Health and Wellness Revolution Driving Product Innovation

The India spreads market is experiencing a significant transformation as health-conscious consumers increasingly prioritize nutritional value and clean-label ingredients in their purchase decisions. Manufacturers are responding by introducing fortified variants enriched with vitamins, minerals, and functional ingredients that address specific dietary requirements including protein supplementation, sugar reduction, and organic certification. Consumer awareness regarding lifestyle-related health conditions such as diabetes, obesity, and cardiovascular diseases has accelerated demand for low-sugar, high-fiber, and antioxidant-rich spreads that align with preventive healthcare approaches. In 2025, The Ministry of Health and Family Welfare instructed all Central and State government offices to prominently exhibit ‘Sugar and Fat Boards’, which are visual aids showing the sugar and fat content of food items available on the premises, along with suggested daily intake levels. This wellness-oriented shift is particularly pronounced among urban millennials and fitness enthusiasts who actively seek products supporting their active lifestyles.

Plant-Based and Vegan Alternatives Gaining Market Traction

The adoption of plant-based diets and vegan lifestyles is reshaping product development strategies across the India spreads market as consumers increasingly seek alternatives to dairy-based formulations. Manufacturers are investing in research and development to create plant-based spreads that deliver comparable taste profiles, nutritional benefits, and textural experiences to conventional products while appealing to ethical and environmental considerations. The vegan spreads segment is attracting diverse consumer groups including health enthusiasts, environmental advocates, and individuals with lactose intolerance or dietary restrictions, thereby expanding the addressable market beyond traditional boundaries. Product innovation in this space focuses on incorporating alternative protein sources such as chickpeas, rice syrup, and various legumes that provide nutritional density while eliminating animal-derived ingredients. This addresses the growing vegan diet adoption, signaling sustained demand for plant-based spread alternatives in both domestic and international markets. IMARC Group predicts that the India vegan food market is projected to attain USD 3,822.3 Million by 2033.

Quick Commerce and Digital Distribution Transformation

The rapid proliferation of quick commerce platforms is fundamentally transforming distribution dynamics within the India spreads market, offering consumers ultra-fast delivery services that have become the dominant channel for online grocery purchases. These platforms operate through dense networks of dark stores strategically positioned in urban centers, enabling delivery timelines of 10 to 30 minutes that cater to convenience-seeking consumers with time-constrained lifestyles. The shift toward digital commerce infrastructure has democratized access to premium and specialty spreads previously available only in select retail outlets, thereby expanding market reach across metropolitan and emerging urban centers. Quick commerce platforms have achieved remarkable scale, with major players collectively processing millions of daily orders and maintaining robust contribution margins through operational efficiencies, technology optimization, and strategic category expansion beyond staple groceries. In 2024, Amazon unveiled its plans of launching its quick commerce service in India as early as the first quarter of 2025. To back this strategy, Amazon's Indian branch has designated leaders to oversee the advancement of its quick commerce initiative. This strategy aims to reinforce Amazon's top status in the Indian market by targeting ultra-fast delivery in 20-30 minutes.

Market Outlook 2026-2034:

The India spreads market is poised for sustained expansion through the forecast period, propelled by demographic tailwinds including rising middle-class population and increasing consumer sophistication in food preferences. The market generated a revenue of USD 425.52 Million in 2025 and is projected to reach a revenue of USD 1,764.13 Million by 2034, growing at a compound annual growth rate of 17.12% from 2026-2034. The proliferation of organized retail channels and quick commerce platforms will further enhance distribution efficiency and market accessibility, particularly in tier-2 and tier-3 cities where consumption patterns are increasingly mirroring metropolitan trends.

India Spreads Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Jam |

24% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

51% |

|

Income Group |

Upper-Middle (INR 5.5 lacs - 27.5 lacs) |

34% |

|

Region |

West and Central India |

28% |

Product Type Insights:

- Jam

- Chocolate Spreads

- Peanut Butter

- Syrup

- Others

Jam dominates with a market share of 24% of the total India spreads market in 2025.

Jam represents the dominant product category within the India spreads market, reflecting deep-rooted consumption traditions where fruit-based spreads have been integral to breakfast and snacking occasions for generations. The segment benefits from strong brand recognition established by legacy manufacturers who have cultivated consumer loyalty through consistent quality, diverse flavor portfolios, and strategic pricing across multiple pack sizes catering to different household needs. Traditional jam varieties including mixed fruit, strawberry, and mango continue commanding substantial market share, though premiumization trends are evident with growing demand for organic, reduced-sugar, and exotic fruit formulations.

These products appeal to health-conscious consumers willing to pay premium prices for perceived superior quality and nutritional profiles. Manufacturers are innovating within the segment by introducing fortified variants enriched with vitamins, fiber, and natural sweeteners that position jam as a functional food product rather than merely an indulgent spread. The segment also benefits from extensive distribution penetration spanning urban hypermarkets, neighborhood stores, and emerging online channels, ensuring consistent availability and accessibility across diverse consumer touchpoints throughout metropolitan and semi-urban markets.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Convenience Stores

- Supermarkets and Hypermarkets

- Online Stores

- Others

Supermarkets and hypermarkets lead with a share of 51% of the total India spreads market in 2025.

Supermarkets and hypermarkets represent the predominant distribution channel for spreads in India, reflecting the channel's inherent advantages including comprehensive product assortments spanning multiple brands and price points, strategic shelf placement that drives impulse purchases, and promotional activities that enhance trial and repeat purchase behaviors. The organized retail sector has experienced substantial expansion across metropolitan cities and emerging urban centers, with major chains establishing large-format stores offering superior shopping experiences characterized by air-conditioned environments, hygienic conditions, and convenient parking facilities that appeal to middle-class and affluent consumers.

These modern retail formats enable manufacturers to implement sophisticated merchandising strategies including eye-level shelf placement, end-cap displays, and combo offers that significantly influence purchase decisions. The channel's growth trajectory is further strengthened by the proliferation of quick commerce platforms operating through dark store networks that deliver products within 10 to 30 minutes, fundamentally transforming consumer expectations around convenience and accessibility. In 2025, More Retail, a prominent food and grocery retailer in India, revealed the grand launch of its newest supermarket in Kazipara, situated on Taki Road, Barasat, Kolkata (West Bengal). The new shop will officially welcome customers on 20th June 2025. The launch signifies another important achievement in More Retail’s ongoing growth and dedication to providing an enhanced, community-oriented shopping experience.

Income Group Insights:

- Upper-Middle (INR 5.5 lacs - 27.5 lacs)

- High-Income (Greater than INR 27.5 lacs)

- Lower-Middle (INR 2.5 lacs - INR 5.5 lacs)

- Low-Income (Less than INR 2.5 Lacs)

Upper-middle (INR 5.5 lacs - 27.5 lacs) exhibits a clear dominance with a 34% share of the total India spreads market in 2025.

The upper-middle income segment, encompassing households earning between INR 5.5 lacs and 27.5 lacs annually, represents the largest and most dynamic consumer cohort driving spreads market growth in India, accounting for 34% market share. This demographic exhibits strong affinity for branded products, premium variants, and innovative formulations that offer perceived superior quality, health benefits, and lifestyle alignment compared to traditional alternatives. The segment benefits from rising disposable incomes, dual-income household structures, and evolving consumption patterns.

Moreover, the heightened need for fresh products is influenced by exposure to global food trends through digital media, international travel, and urban lifestyles that prioritize convenience and nutritional quality. Upper-middle income consumers demonstrate willingness to experiment with new product categories including plant-based spreads, organic variants, and functional foods fortified with proteins, vitamins, and other beneficial ingredients that command premium price points. In 2025, rural India overtook cities in affordable premium FMCG consumption, demonstrating the segment's geographic expansion beyond traditional metropolitan concentrations into emerging semi-urban and prosperous rural markets.

Regional Insights:

- North India

- West and Central India

- South India

- East India

West and central India leads with a share of 28% of the total India spreads market in 2025.

West and Central India emerges as the dominant regional market for spreads, commanding 28% share, anchored by Maharashtra's metropolitan cities including Mumbai and Pune that serve as consumption hubs characterized by high purchasing power, sophisticated consumer preferences, and extensive modern retail infrastructure. The region benefits from the presence of major FMCG companies including Hindustan Unilever and ITC that maintain robust distribution networks, strong brand visibility, and continuous product innovation capabilities. Mumbai tops India in shopping frequency with 233 trips per year, reflecting active consumer engagement with retail channels, while West Delhi records the highest FMCG spend at Rs. 39,325 annually, more than double the national average.

West India accounted for a major share of the quick commerce market in 2024, demonstrating the region's leadership in adopting digital commerce infrastructure and ultra-fast delivery services. The region's cosmopolitan consumer base exhibits openness to international food trends, willingness to experiment with new product categories, and preference for premium and health-focused variants that drive market premiumization. Manufacturing concentration in Maharashtra and Gujarat provides supply chain efficiencies that support competitive pricing while maintaining quality standards. Regional festivals and gift-giving traditions create seasonal demand spikes that manufacturers leverage through limited-edition launches and attractive packaging formats.

Market Dynamics:

Growth Drivers:

Why is the India Spreads Market Growing?

Rising Disposable Incomes and Rapid Urban Developments

The India spreads market is experiencing robust growth propelled by fundamental macroeconomic tailwinds including rising disposable incomes and accelerating urbanization that are reshaping consumption patterns across demographic segments. India's nominal GDP per capita is projected to be approximately $2,878 in 2025 according to the IMF World Economic Outlook (April - 2025), reflecting sustained economic growth that has expanded middle-class purchasing power and consumption capacity for branded food products. By the year 2035, the urban population of India is projected to grow to 675 million individuals, rising from 483 million in 2020, as per UN-Habitat's World. This is driven by rural-to-urban migration and expanding urban boundaries that expose growing consumer cohorts to modern retail infrastructure, international food brands, and convenience-oriented lifestyles that prioritize ready-to-eat and packaged food solutions.

Expanding Organized Retail and E-Commerce Penetration

The proliferation of organized retail infrastructure and explosive growth of e-commerce channels, particularly quick commerce platforms, are fundamentally transforming distribution dynamics and market accessibility for spreads across India's urban landscape. The organized retail sector has experienced substantial expansion through hypermarket chains, supermarkets, and convenience store formats that offer comprehensive product assortments, hygienic shopping environments, and promotional activities that enhance consumer engagement and trial behaviors. E-commerce penetration, already accounting for 17% of FMCG consumption among affluent buyers in 2024, providing manufacturers with efficient channels to reach consumers across geographic markets without extensive physical distribution investments. Quick commerce platforms have emerged as category disruptors, offering ultra-fast delivery services within 10 to 30 minutes through dense dark store networks strategically positioned in metropolitan areas. The digital commerce ecosystem benefits from ubiquitous smartphone penetration, widespread acceptance of digital payment systems, and sophisticated logistics infrastructure that enables efficient last-mile delivery even in congested urban environments, thereby lowering barriers to market entry for innovative brands and expanding addressable markets for established manufacturers seeking to reach digitally-savvy consumer segments.

Government Support and Production-Linked Incentive Schemes

Government initiatives aimed at strengthening the food processing sector through production-linked incentive schemes, infrastructure development, and policy reforms are creating a conducive environment for market expansion by encouraging manufacturing investments, promoting exports, and enhancing supply chain efficiencies. The Union Government approved the Production Linked Incentive scheme for the food processing sector with a budget outlay of Rs. 10,900 crore (USD 1.46 billion), designed to incentivize capacity expansion, technology adoption, and value addition across the food processing value chain. As of September 2025, the scheme had approved 170 applicants, demonstrating the program's effectiveness in catalyzing private sector investments and strengthening domestic manufacturing capabilities.

Market Restraints:

What Challenges the India Spreads Market is Facing?

Raw Material Price Volatility and Supply Chain Complexity

The India spreads market faces significant challenges from volatile raw material costs including edible oils, nuts, fruits, cocoa, sugar, and packaging materials that experience price fluctuations driven by global commodity markets, weather conditions, and supply-demand imbalances. Rising ingredient costs compress manufacturer margins, particularly for companies lacking vertical integration or long-term procurement contracts that provide price stability. Transportation cost volatility driven by diesel price fluctuations and logistics constraints further impacts delivered costs, while supply chain complexity spanning multiple intermediaries from farm gate to manufacturing facilities introduces inefficiencies that elevate operational expenses and reduce responsiveness to demand signals.

Intense Competition from Regional and D2C Brands

The market experiences intense competitive pressures from proliferating regional brands and direct-to-consumer startups leveraging digital channels to establish brand presence without extensive distribution investments required for traditional retail penetration. FMCG new product launches rose 1.8 times in the year ending May 2025, though only 4% reached 1% market penetration due to intense competition and consumer inertia around established brands. Private label expansion by major retailers has grown in sales volume as organized retail chains introduce competitive store brands that offer attractive price-value propositions compared to established brands, thereby fragmenting market share and intensifying price competition that pressures margins.

Distribution Infrastructure Gaps and Last-Mile Challenges

Despite rapid organized retail expansion and e-commerce growth, significant distribution infrastructure gaps persist across semi-urban and rural markets where traditional stores remain dominant retail formats with limited shelf space for premium or niche spread variants. Last-mile delivery challenges including poor road infrastructure, traffic congestion in urban centers, and dispersed rural settlements elevate logistics costs and limit market accessibility. Even in 2025, efficient rural distribution remains a significant hurdle for both large FMCG companies and smaller brands seeking to penetrate beyond metropolitan concentrations, constraining market expansion potential and limiting consumption growth in demographically significant rural markets.

Competitive Landscape:

The India spreads market exhibits a competitive landscape characterized by the presence of established multinational corporations, legacy Indian brands, and emerging health-focused startups competing across product categories, price segments, and distribution channels. Market leadership is maintained by international players including Ferrero India, Hershey India, and Hindustan Unilever that leverage strong brand equity, extensive distribution networks, and continuous product innovation capabilities to command premium pricing and high market shares in their respective categories. Domestic manufacturers compete through regional brand strength, localized flavor profiles, and value pricing strategies that appeal to price-conscious consumers while maintaining quality standards. The competitive environment is intensifying with entry of health and wellness-focused brands that capitalize on growing consumer preference for organic, high-protein, and functional food products that address specific dietary requirements and lifestyle choices. Quick commerce platforms are emerging as important gatekeepers influencing market access and consumer visibility through search algorithms, promotional placements, and private label introductions that compete directly with established brands. Manufacturers are investing in premiumization strategies, digital marketing capabilities, and portfolio diversification to defend market positions and capture growth opportunities across evolving consumer segments.

Recent Developments:

-

In December 2025, Nutrica, the wellness and lifestyle brand associated with BN Agritech Limited, has entered the peanut butter market by introducing Nutrica Peanut Butter. The collection signifies the brand's next move in developing a comprehensive wellness portfolio that merges flavor, quality, and effectiveness to enhance daily health objectives. Nutrica Peanut Butter is now accessible in general trade shops in 14 cities, including Delhi, Mumbai, Pune, and Chandigarh.

-

In December 2025, Reliance Consumer Products Limited (RCPL), the FMCG division of Reliance Industries Limited (RIL), has revealed a major expansion into the packaged foods sector by relaunching the 75-year-old legacy foods brand SIL as its leading product in this category. This signifies RCPL’s extensive entry into the foods sector, starting with SIL’s new range of noodles, jams, ketchups, sauces, and spreads.

India Spreads Market Report Coverage:

| Report Features | Details | |

|---|---|---|

| Base Year of the Analysis | 2025 | |

| Historical Period | 2020-2025 | |

| Forecast Period | 2026-2034 | |

| Units | Million USD | |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

| Product Types Covered | Jam, Chocolate Spreads, Peanut Butter, Syrup, Others | |

| Distribution Channels Covered | Convenience Stores, Supermarkets and Hypermarkets, Online Stores, Others | |

| Income Groups Covered | Upper-Middle (INR 5.5 lacs - 27.5 lacs), High-Income (Greater than INR 27.5 lacs), Lower-Middle (INR 2.5 lacs - INR 5.5 lacs), Low-Income (Less than INR 2.5 Lacs) | |

| Region Covered | North India, South India, West and Central India, East India | |

| Companies Covered | Agro Tech Foods Ltd, Dr. Oetker India Pvt. Ltd. (Dr. August Oetker), Ferrero India Pvt. Ltd., G.D. Foods Manufacturing India Pvt. Ltd., Hershey India Pvt. Ltd. (The Hershey Company), Hindustan Unilever Limited (Unilever) and Mapro Garden LLP | |

| Customization Scope | 10% Free Customization | |

| Post-Sale Analyst Support | 10-12 Weeks | |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India spreads market size was valued at USD 425.52 Million in 2025.

The India spreads market is expected to grow at a compound annual growth rate of 17.12% from 2026-2034 to reach USD 1,764.13 Million by 2034.

Jam represents the largest segment with 24% market share, driven by traditional consumption patterns and cultural preferences for fruit-based breakfast spreads. Moreover, the heightened availability of high-quality, organic, and sugar-free jams is driving its need among health-conscious consumers in the country.

The primary growth drivers include rising disposable incomes and rapid urbanization, expanding organized retail and e-commerce penetration especially through quick commerce platforms, increasing health consciousness driving demand for nutritious and functional food products, government support through production-linked incentive schemes for the food processing sector, and the proliferation of modern distribution channels that enhance market accessibility across urban and semi-urban areas.

Major challenges include volatile raw material costs impacting profit margins, intense competition from regional brands and private labels fragmenting market share, distribution infrastructure gaps limiting rural penetration, and supply chain complexities that elevate operational costs and reduce efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)