India Stabilizers Market Size, Share, Trends and Forecast by Type, Application, Controller Type, End User, and Region, 2025-2033

India Stabilizers Market Overview:

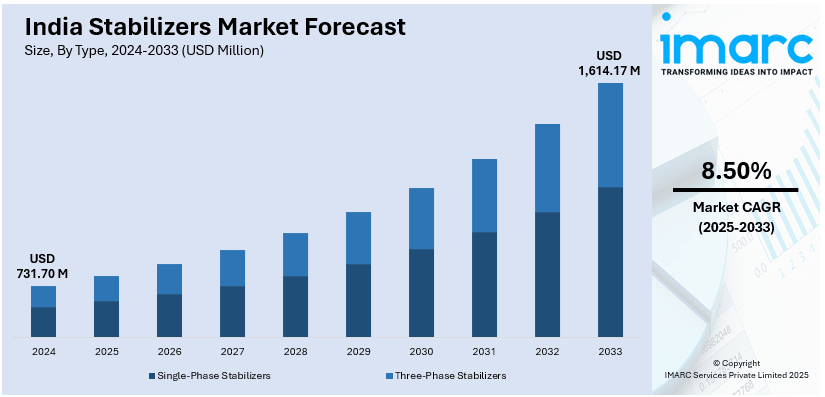

The India stabilizers market size reached USD 731.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,614.17 Million by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market is driven by increasing demand for lead-free alternatives due to stringent environmental regulations, rapid urbanization fueling infrastructure projects, and expanding applications in packaging and consumer goods. Rising poly vinyl chloride (PVC) consumption, advancements in stabilizer formulations, and the growing emphasis on sustainability further bolstering the market growth across diverse industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 731.70 Million |

| Market Forecast in 2033 | USD 1,614.17 Million |

| Market Growth Rate 2025-2033 | 8.50% |

India Stabilizers Market Trends:

Rising Demand for Lead-Free and Calcium-Based Stabilizers

The India stabilizers market is shifting toward lead-free alternatives amid rising environmental concerns and stricter regulations. Calcium-based stabilizers are gaining momentum as PVC manufacturers seek eco-friendly options to meet government mandates. In 2023, Platinum Industries reported that over 70% of its PVC stabilizer sales were lead-free, highlighting this industry-wide transition. The ban on lead stabilizers in various applications and growing demand for non-toxic materials are accelerating adoption. Advancements in stabilizer formulations are also improving the performance of calcium-based solutions, making them suitable for pipes, cables, and packaging. Sustainability efforts by end-users and producers are also coming to this transition, as the emphasis grows stronger on minimizing the environmental footprint of plastic goods while maintaining cost-effectiveness and regulatory compliance. The trend marks a long-term transition towards safer and greener PVC manufacturing in India.

To get more information on this market, Request Sample

Expanding Usage in the Construction and Infrastructure Sectors

India's thriving construction sector is one of the major drivers for stabilizers, particularly in the manufacturing of PVC-based products like pipes, window profiles, and flooring. Urbanization and government-initiated infrastructure projects like smart cities and affordable housing schemes are strongly driving the demand for stabilizers. The demand for long-lasting, weather-resistant, and economical materials has compelled manufacturers to come up with advanced stabilizers that improve PVC lifespan and performance. Moreover, the implementation of high-performance stabilizers is guaranteeing conformity to fire protection and durability standards in the building industry. Such increased use in infrastructure is boosting stabilizer demand, as all stakeholders ensure they use high-quality materials that resist extreme environmental factors and long-term structural demands.

Growth of the Packaging and Consumer Goods Industries

India’s packaging market, valued at USD 75 billion in FY20, is projected to reach nearly USD 200 billion by FY25, growing at a CAGR of 18–20%. This rapid expansion, driven by packaged foods, personal care, and e-commerce shipments, is fueling demand for stabilizers in flexible and rigid plastic applications. High-performance stabilizers are essential in films, containers, and laminates to ensure durability and product protection. Regulatory focus on recyclability has also encouraged the development of stabilizers that improve processing and performance in recycled PVC. Brand owners are increasingly prioritizing advanced stabilizers to extend shelf life and meet sustainability goals. Additionally, the shift toward bio-based and non-toxic stabilizers is aligning with consumer demand for environmentally responsible packaging, reinforcing their role in the evolving packaging and consumer goods sectors.

India Stabilizers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, controller type, and end user.

Type Insights:

- Single-Phase Stabilizers

- Three-Phase Stabilizers

The report has provided a detailed breakup and analysis of the market based on the type. This includes single-phase stabilizers, and three-phase stabilizers.

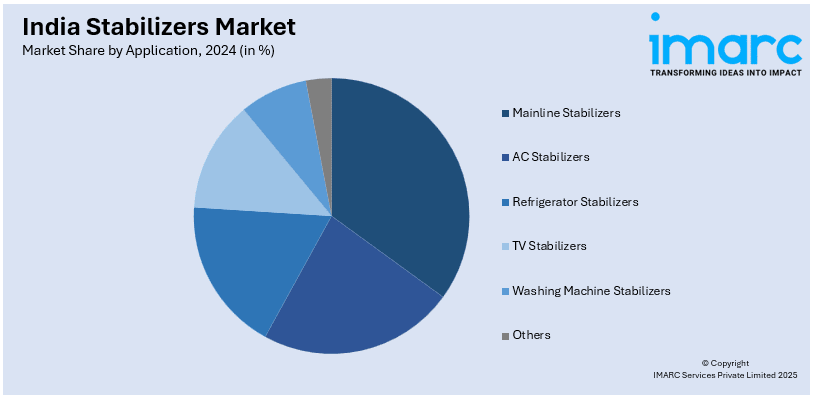

Application Insights:

- Mainline Stabilizers

- AC Stabilizers

- Refrigerator Stabilizers

- TV Stabilizers

- Washing Machine Stabilizers

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mainline stabilizers, AC stabilizers, refrigerator stabilizers, tv stabilizers, washing machine stabilizers, and others.

Controller Type Insights:

- Servo-Controlled Stabilizers

- Static Stabilizers

The report has provided a detailed breakup and analysis of the market based on the controller type. This includes servo-controlled stabilizers, and static stabilizers.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Stabilizers Market News:

- In February 2025, ELGi Equipments Ltd launched the STABILISOR system, an innovative technology for industrial air compressors. Using the "Recirculate and Recover" principle, it optimizes compressor performance by adjusting capacity to plant air demand. This reduces load/unload cycles, enhances energy efficiency by up to 15%, and extends equipment lifespan. Available in two versions—Light Version for field fitment and Heavy Version factory-fitted—it minimizes inefficiencies and improves operational stability.

India Stabilizers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single-Phase Stabilizers, Three-Phase Stabilizers |

| Applications Covered | Mainline Stabilizers, AC Stabilizers, Refrigerator Stabilizers, TV Stabilizers, Washing Machine Stabilizers, Others |

| Controller Types Covered | Servo-Controlled Stabilizers, Static Stabilizers |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India stabilizers market performed so far and how will it perform in the coming years?

- What is the breakup of the India stabilizers market on the basis of type?

- What is the breakup of the India stabilizers market on the basis of application?

- What is the breakup of the India stabilizers market on the basis of controller type?

- What is the breakup of the India stabilizers market on the basis of end user?

- What is the breakup of the India stabilizers market on the basis of region?

- What are the various stages in the value chain of the India stabilizers market?

- What are the key driving factors and challenges in the India stabilizers market?

- What is the structure of the India stabilizers market and who are the key players?

- What is the degree of competition in the India stabilizers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India stabilizers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India stabilizers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India stabilizers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)