India Statin Market Size, Share, Trends and Forecast by Type, Therapeutic Area, Drug Class, Application, Distribution, and Region, 2026-2034

India Statin Market Overview:

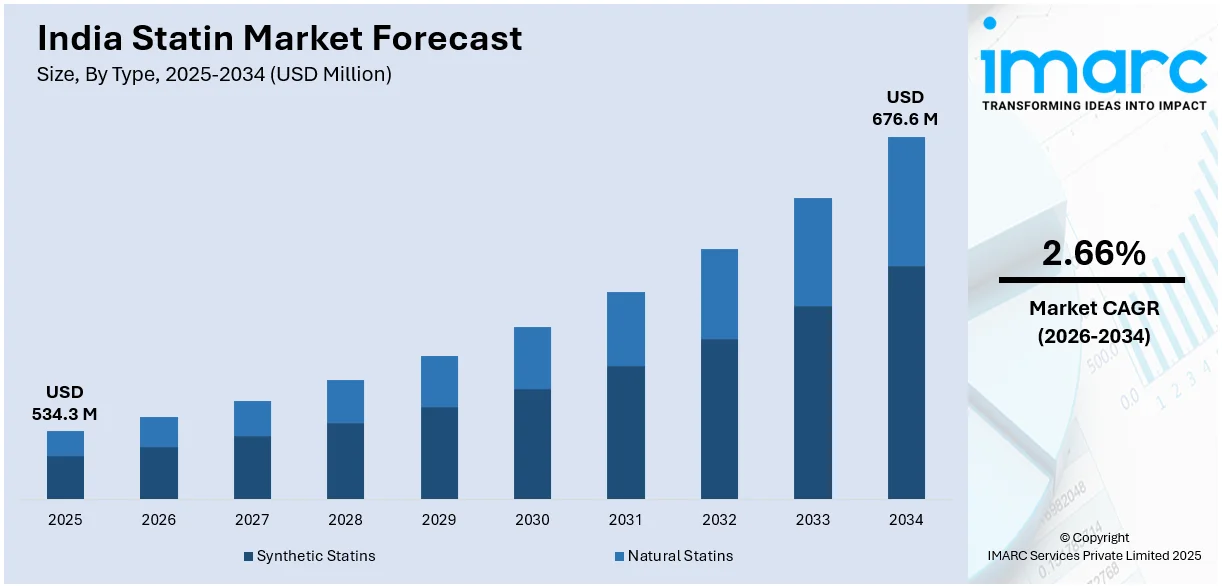

The India statin market size reached USD 534.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 676.6 Million by 2034, exhibiting a growth rate (CAGR) of 2.66% during 2026-2034. The India statin market is expanding due to the increasing prevalence of cardiovascular diseases, growing adoption of generic drugs, and government initiatives promoting affordable treatments. Rising healthcare awareness, improved accessibility through digital pharmacies, and advancements in sustained-release formulations are further driving market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 534.3 Million |

| Market Forecast in 2034 | USD 676.6 Million |

| Market Growth Rate (2026-2034) | 2.66% |

India Statin Market Trends:

Growing Prevalence of Heart Diseases Driving Statin Demand

The rising prevalence of heart diseases in India is significantly influencing the demand for cholesterol-lowering medications like statins. Heart disease, including conditions such as coronary artery disease and stroke, remains a major cause of mortality in India, particularly in urban areas where lifestyle changes and dietary habits are contributing to increased cholesterol levels. The growing number of individuals affected by these conditions has created a strong need for effective treatments to manage dyslipidemia and reduce associated cardiovascular risks. In July 2024, the Cardiological Society of India (CSI) addressed this growing concern by releasing the country’s first-ever guidelines for managing high cholesterol. The guidelines focus on the importance of maintaining proper LDL (bad cholesterol) and HDL (good cholesterol) levels, which directly ties into the management of heart diseases. The guidelines underscore statins as the primary treatment for dyslipidemia, recommending their use as the first line of defense against high cholesterol. This targeted approach is expected to drive significant demand for statins, as these medications have long been established as an effective method for reducing LDL cholesterol and lowering the risk of heart diseases. As the guidelines are adopted, healthcare providers will be more likely to prescribe statins, accelerating their presence in the Indian market and contributing to a growing need for cholesterol management solutions.

To get more information on this market Request Sample

Rising Awareness of Cholesterol Management Alternatives

As awareness about high cholesterol and its associated health risks rises, new treatment options are gaining attention. Inclisiran, a novel cholesterol-lowering injection, is a key player in this shift. Expected to debut in India in January 2024, inclisiran presents an alternative to statins, particularly for patients who are intolerant to statins or have not responded well to them. The introduction of this drug will significantly expand the treatment landscape for high cholesterol, offering physicians a new tool to manage patients with complex cases. This increased awareness of available treatment alternatives will likely stimulate interest in cholesterol management, driving further adoption of both statins and newer therapies like inclisiran. Statins remain the primary treatment for high cholesterol in India, but inclisiran’s introduction will lead to a more nuanced approach to managing cholesterol, allowing patients who face side effects with statins to find relief with this new option. This growing recognition of cholesterol management, coupled with the introduction of inclisiran, will likely drive a shift in the Indian statin market. As more patients become aware of cholesterol’s dangers and seek solutions, demand for cholesterol-lowering treatments will rise, benefiting not only statins but also the broader category of lipid-lowering therapies, including newer innovations like inclisiran. This trend towards expanding treatment options will likely impact both the statin market and the overall heart disease market in India.

India Statin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, therapeutic area, drug class, application, and distribution.

Type Insights:

- Synthetic Statins

- Natural Statins

The report has provided a detailed breakup and analysis of the market based on the type. This includes synthetic statins and natural statins.

Therapeutic Area Insights:

- Cardiovascular Disorders

- Obesity

- Inflammatory Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes cardiovascular disorders, obesity, inflammatory disorders, and others.

Drug Class Insights:

- Atorvastatin

- Fluvastatin

- Lovastatin

- Pravastatin

- Simvastatin

- Others

A detailed breakup and analysis of the market based on the drug class have also been provided in the report. This includes atorvastatin, fluvastatin, lovastatin, pravastatin, simvastatin, and others.

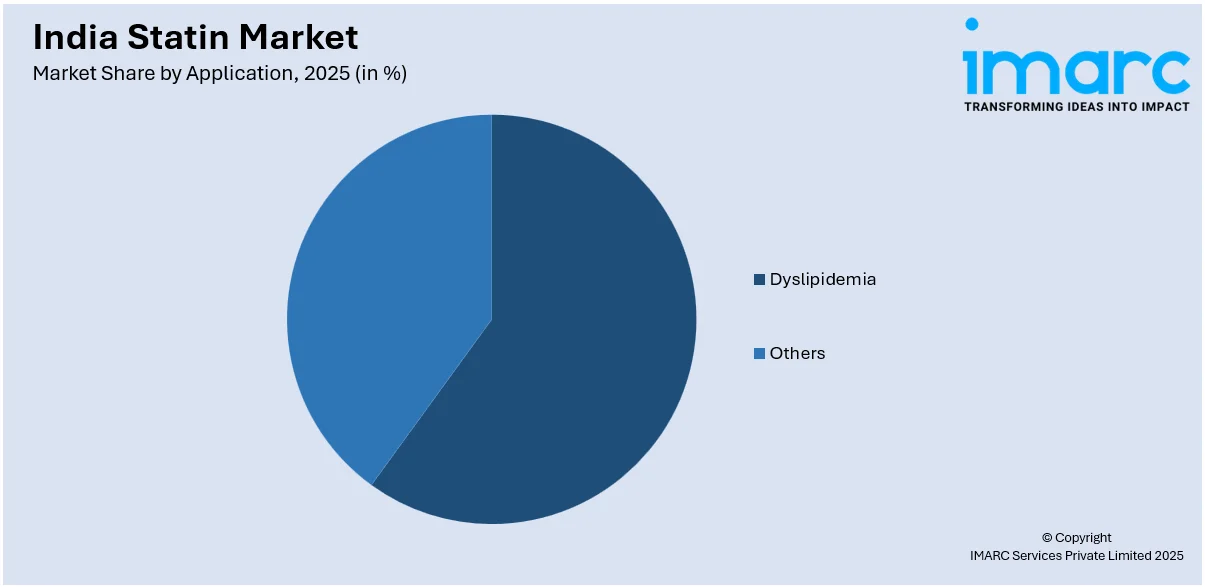

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Dyslipidemia

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes dyslipidemia and others.

Distribution Insights:

- Hospitals

- Clinics

A detailed breakup and analysis of the market based on the distribution have also been provided in the report. This includes hospitals and clinics.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Statin Market News:

- April 2024: Novartis unveiled data showing that early addition of Leqvio (inclisiran) to statin therapy significantly reduced LDL-C levels in ASCVD patients, surpassing usual care. This breakthrough underscores the potential for improved statin therapy adherence, likely driving market growth in India for advanced lipid-lowering treatments.

- July 2024: The Cardiological Society of India (CSI) introduced new dyslipidemia management guidelines emphasizing aggressive LDL-C targets, particularly for high-risk patients. This push for early detection and treatment, including statin use, is set to drive significant growth in India's statin industry, promoting broader adoption and higher demand.

India Statin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic Statins, Natural Statins |

| Therapeutic Areas Covered | Cardiovascular Disorders, Obesity, Inflammatory Disorders, Others |

| Drug Classes Covered | Atorvastatin, Fluvastatin, Lovastatin, Pravastatin, Simvastatin, Others |

| Applications Covered | Dyslipidemia, Others |

| Distributions Covered | Hospitals, Clinics |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India statin market performed so far and how will it perform in the coming years?

- What is the breakup of the India statin market on the basis of type?

- What is the breakup of the India statin market on the basis of lease type?

- What is the breakup of the India statin market on the basis of service provider type?

- What is the breakup of the India statin market on the basis of tenure?

- What are the various stages in the value chain of the India statin market?

- What are the key driving factors and challenges in the India statin?

- What is the structure of the India statin market and who are the key players?

- What is the degree of competition in the India statin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India statin market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India statin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India statin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)