India Steam Trap Market Size, Share, Trends and Forecast by Product Type, Application, Material Type, Distribution Channel, End-Use Industry, and Region, 2025-2033

India Steam Trap Market Overview:

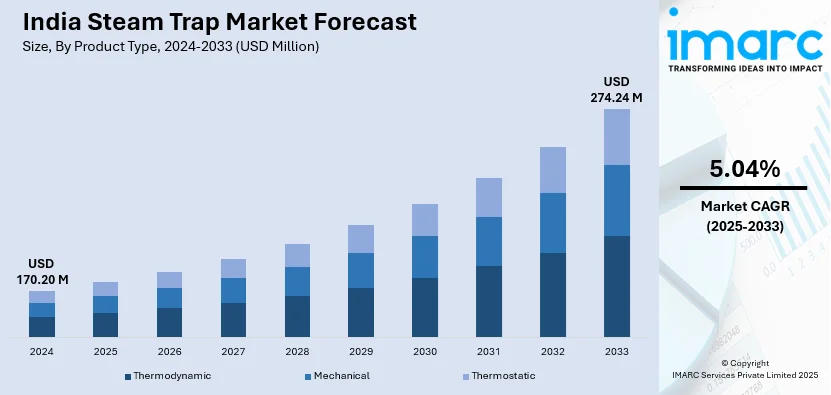

The India steam trap market size reached USD 170.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 274.24 Million by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. The rising demand for energy efficiency, stringent government regulations on steam management, growth in the power generation, chemical, and food processing industries, and significant advancements in smart steam trap monitoring technologies are aiding market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 170.20 Million |

| Market Forecast in 2033 | USD 274.24 Million |

| Market Growth Rate 2025-2033 | 5.04% |

India Steam Trap Market Trends:

Adoption of Smart and IoT-Enabled Steam Traps

The India steam trap market is witnessing a rapid shift towards smart and IoT-enabled steam traps that improve efficiency, reduce maintenance costs, and prevent energy losses. IoT-based steam traps provide continuous monitoring of steam systems, allowing industries to detect failures instantly. According to a 2023 report by the Confederation of Indian Industry (CII), Indian industries lose up to 15-20% of steam energy due to faulty traps. The adoption of smart traps can reduce this loss by up to 80%, significantly improving energy efficiency. Traditional steam traps often fail unnoticed, leading to higher operational costs. Smart steam traps use AI-driven analytics to predict failures before they occur. By 2025, over 40% of industrial plants in India are expected to implement predictive maintenance systems for steam traps. This transition helps industries minimize downtime and reduce steam wastage. Moreover, the Indian government’s push for Industry 4.0 and digital transformation in manufacturing is accelerating smart steam trap adoption. The National Manufacturing Policy emphasizes on automation and energy efficiency, making smart steam traps an essential part of future industrial infrastructure.

To get more information on this market, Request Sample

Rising Demand for Energy Efficiency and Sustainability Initiatives

The increasing focus on energy conservation and sustainability is a major trend driving the growth of the India steam trap market. With industries aiming to reduce carbon emissions and enhance steam system efficiency, the demand for high-performance steam traps is rising significantly. Energy costs in India have surged by 15% between 2023 and 2025. Steam traps play a critical role in reducing energy wastage by ensuring proper condensate discharge and steam retention. The Bureau of Energy Efficiency (BEE) estimates that optimized steam trap systems can improve energy efficiency by 25-30% in industrial plants. In addition to this, with India targeting net-zero emissions by 2070, industries are adopting sustainable manufacturing solutions. According to the Indian Energy Conservation Building Code (ECBC) 2023, industries using energy-efficient steam traps can receive incentives and tax benefits. The food processing and pharmaceutical industries are leading this shift, with over 60% of new plants expected to adopt energy-efficient steam management systems by 2025. Furthermore, government-backed initiatives like the Perform, Achieve & Trade (PAT) Scheme are promoting energy efficiency in steam systems. Additionally, companies such as Tata Steel and Reliance Industries have announced carbon reduction strategies, increasing investments in steam efficiency technologies, including advanced steam traps.

India Steam Trap Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, application, material type, distribution channel, and end-use industry.

Product Type Insights:

- Thermodynamic

- Mechanical

- Thermostatic

The report has provided a detailed breakup and analysis of the market based on the product type. This includes thermodynamic, mechanical, and thermostatic.

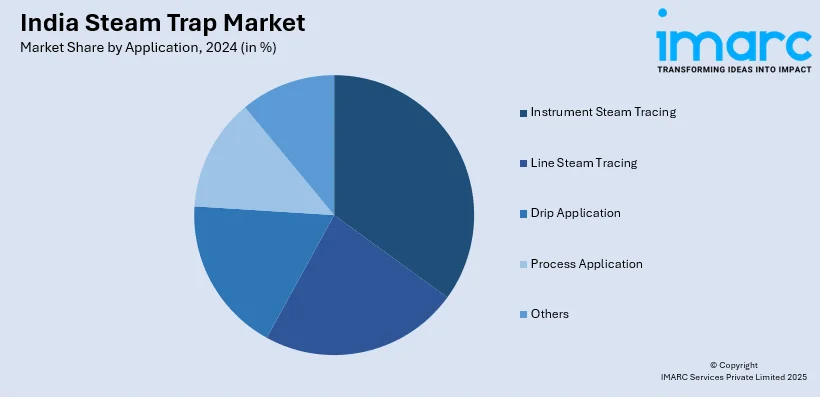

Application Insights:

- Instrument Steam Tracing

- Line Steam Tracing

- Drip Application

- Process Application

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes instrument steam tracing, line steam tracing, drip application, process application, and others.

Material Type Insights:

- Steel

- Iron

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes steel, iron, and others.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End-Use Industry Insights:

- Oil and Gas

- Power Generation

- Pharmaceuticals

- Food and Beverages

- Pulp and Paper

- Chemical

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes oil and gas, power generation, pharmaceuticals, food and beverages, pulp and paper, chemical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Steam Trap Market News:

- July 2024: TLV International launched a new subsidiary, TLV India Private Limited (TLV India Pvt. Ltd.), in New Delhi to strengthen its presence in the Indian market. The subsidiary will collaborate with existing distributors and expand operations, offering localized support and services for steam users.

- January 2023: Armstrong International secured ISA100 Wireless™ certification for its AIM® ST6700 Wireless Steam Trap Monitor. This advanced monitoring technology continuously assesses steam trap performance, detecting potential issues that could disrupt operations. The AIM® ST6700 accurately identifies problems such as plugged or blow-through steam traps, helping prevent equipment failures, product losses, safety hazards, and excessive energy waste.

India Steam Trap Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Thermodynamic, Mechanical, Thermostatic |

| Applications Covered | Instrument Steam Tracing, Line Steam Tracing, Drip Application, Process Application, Others |

| Material Types Covered | Steel, Iron, Others |

| Distribution Channels Covered | Online, Offline |

| End-Use Industries Covered | Oil and Gas, Power Generation, Pharmaceuticals, Food and Beverages, Pulp and Paper, Chemical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India steam trap market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India steam trap market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India steam trap industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India steam trap market was valued at USD 170.20 Million in 2024.

The India steam trap market is projected to exhibit a CAGR of 5.04% during 2025-2033, reaching a value of USD 274.24 Million by 2033.

The India steam trap market is driven by growing industrialization, increased focus on energy efficiency, and rising demand in sectors like chemicals, pharmaceuticals, and food processing. Government support for sustainable manufacturing and the need to reduce steam loss in thermal systems also fuel adoption of advanced steam trap technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)