India Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

India Steel Tubes Market Overview:

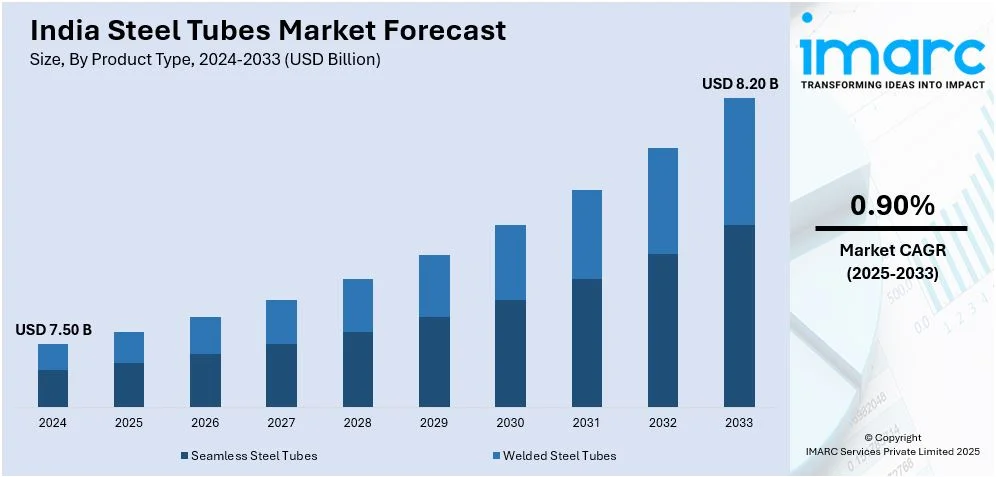

The India steel tubes market size reached USD 7.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.20 Billion by 2033, exhibiting a growth rate (CAGR) of 0.90% during 2025-2033. The market is driven by rapid infrastructure development, expanding construction activities, rising automotive production, increasing oil and gas exploration, growing demand for water and sewage systems, government initiatives like "Make in India," and ongoing advancements in manufacturing technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.50 Billion |

| Market Forecast in 2033 | USD 8.20 Billion |

| Market Growth Rate 2025-2033 | 0.90% |

India Steel Tubes Market Trends:

Rising Demand from Infrastructure and Construction Sectors

The India steel tube market share is witnessing significant growth due to increasing infrastructure development and booming construction activities. Large-scale government programs like Smart Cities Mission along with Bharatmala and Pradhan Mantri Awas Yojana (PMAY) create a widespread requirement for steel tubes in structural applications, bridges, and high-rise building projects. According to reports, in August 2024, India approved 12 industrial smart cities across 10 states with ₹28,602 crore investment, attracting ₹1.52 lakh crore and creating 9.39 lakh jobs, driving steel tube demand in construction. Moreover, the rapid process of urban development and growing foreign direct investments (FDI) in real estate have created a need for robust materials that offer cost efficiency. Architects and engineers are selecting steel tubes as their preferred material because of their strength properties combined with corrosion resistance and recyclable nature. Manufacturers have also enhanced the quality and lifetime potential of steel tubes through high-frequency induction welding (HFIW) and galvanization technologies, making them well-suited for extended infrastructure development. As a result, the demand for steel tubes in the construction sector is growing steadily further driven by the rising public expenditure and expanding private industry activity.

To get more information on this market, Request Sample

Expansion of Oil & Gas and Water Pipeline Networks

The expansion of India's oil & gas and water pipeline networks is a key trend influencing the India steel tube market outlook. The Indian government along with private entities invest in pipeline infrastructure because of rising energy needs to improve transportation, and distribution of oil, natural gas, and refined petroleum products. In line with this, high-quality steel tubes specifically seamless and welded varieties experience rising demand from two major natural gas pipeline projects, Jagdishpur-Haldia & Bokaro-Dhamra Natural Gas Pipeline (JHBDPL) and Pradhan Mantri Urja Ganga. Furthermore, the market expansion gains momentum through natural gas adoption initiatives, especially City Gas Distribution (CGD). For instance, in October 2024, GAIL (India) Ltd announced its intention to secure long-term import agreements for an additional 5.5 million tons of LNG annually, aiming to increase its total capacity to 21 million tons per year by 2030. This move supports the expansion of its pipeline network and enhances petrochemical capacities. Additionally, the water supply and sewage sectors require increasing amounts of steel tubes because the Jal Jeevan Mission along with other government programs aims to establish piped water systems throughout rural communities. Apart from this, the advancing development of steel tubes puts them at the core of the ongoing expansion of the India steel tubes market growth.

India Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Other

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

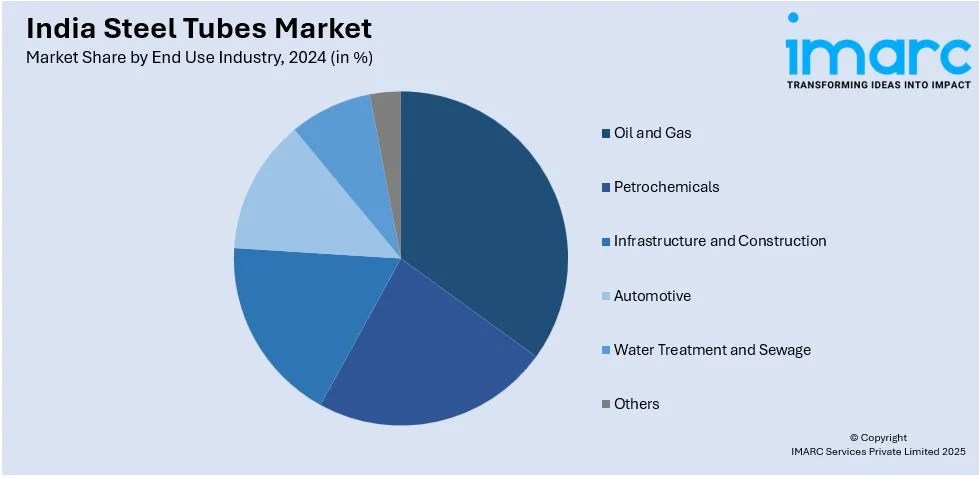

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Steel Tubes Market News:

- In October 2024, JSW Steel, through its joint venture Jsquare Electrical Steel Nashik, agreed to acquire thyssenkrupp Electrical Steel India for $482.1 million. This acquisition enables JSW to produce grain-oriented electrical steel domestically, reducing reliance on imports and enhancing its product portfolio.

- In February 2024, Tata Steel signed a Memorandum of Understanding with IIT Bhubaneswar Research and Entrepreneurship Park to collaborate on projects focusing on materials processing, energy, and low-carbon steel production. This partnership fosters innovation and research in sustainable steel manufacturing.

India Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Type Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The steel tubes market in India was valued at USD 7.50 Billion in 2024.

The steel tubes market in India is projected to exhibit a (CAGR) of 0.90% during 2025-2033, reaching a value of USD 8.20 Billion by 2033.

The India steel tubes market is spurred on by construction, automotive, oil & gas, and infrastructure work. Increasing industrialization, urbanization, and demand for corrosion-resistant, high-strength, and durable steel tubes drive growth. Advances in seamless and welded tubes, growth of pipeline networks, and government investment in infrastructure projects also fuel the rising demand for steel tubes in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)