India Stevia Market Size, Share, Trends and Forecast by Extract Type, End Use, and Region, 2025-2033

India Stevia Market Size and Share:

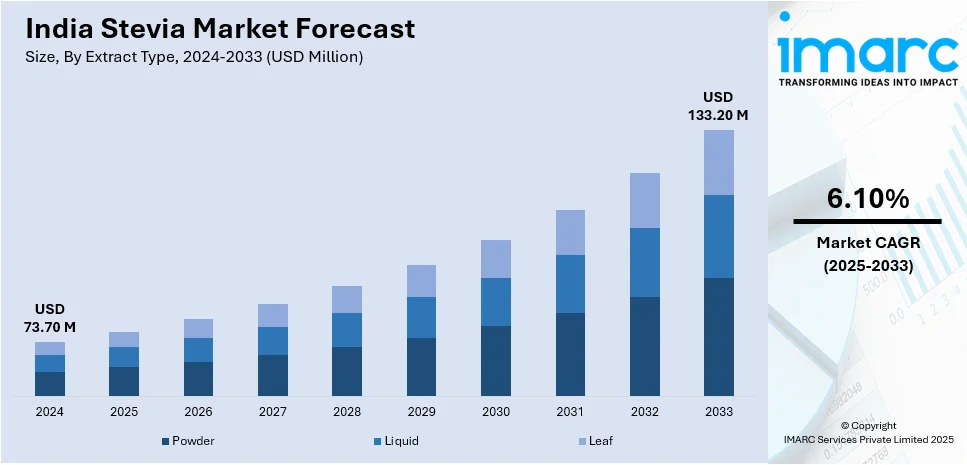

The India stevia market size reached USD 73.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 133.20 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The market is driven by rising health consciousness, increasing diabetes and obesity rates, and demand for natural, low-calorie sweeteners. Government support, FSSAI approvals, and clean-label trends further improve adoption. Expanding product offerings in food, beverages, and pharmaceuticals, along with e-commerce growth, are key factors propelling the India stevia market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 73.70 Million |

| Market Forecast in 2033 | USD 133.20 Million |

| Market Growth Rate (2025-2033) | 6.10% |

India Stevia Market Trends:

Increasing Demand for Natural Sweeteners in India

The rising demand for natural sweeteners is significantly expanding the India stevia market share. As consumers become more health-conscious, there is a growing preference for sugar alternatives that are low-calorie and do not spike blood sugar levels. Stevia, derived from the leaves of the Stevia rebaudiana plant, is gaining popularity as a zero-calorie, plant-based sweetener. This trend is further fueled by the increasing prevalence of diabetes and obesity in India, prompting individuals to adopt healthier lifestyles. The World Diabetes Day 2024 was observed under the theme "Breaking Barriers, Bridging Gaps," as making diabetes care more accessible was the need of the hour. According to a latest study, India is home to an estimated 10.1 crore (around 101 million) cases of diabetes. Reacting to the epidemic, the Indian government has opened over 6,200 health centers where, as part of an NP-NCD (National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Disease, and Stroke), diabetes screening and prevention are performed with lifestyle modifications and affordable insulin access. With increasing diabetes awareness and rising demand for natural sugar substitutes, including stevia, the market in India is set for significant growth. Additionally, the food and beverage industry is incorporating stevia into products including beverages, dairy, and confectionery to cater to this demand. Government initiatives promoting healthier eating habits and the FSSAI’s approval of stevia as a food additive have also contributed to its market expansion. With the shift towards clean-label and natural products, stevia is poised to become a key player in India’s sweetener market.

To get more information on this market, Request Sample

Expansion of Stevia-Based Product Offerings

The rise in product innovations and diversification is creating a positive India stevia market outlook. Manufacturers are introducing stevia in various forms, such as liquid extracts, powders, and tablets, to meet diverse consumer needs. The growing popularity of stevia in the food and beverage sector has led to its inclusion in products, including health drinks, baked goods, and snacks. On 7th August 2024, ORSL launched a range of hydration products in India under the name Advanz Care, including ORSL® Rehydrate+, a low-calorie beverage sweetened with stevia, which caters to the needs of diabetics and the elderly. With demand for sugar-free beverages continuing to rise, the launch of ORSL marks the immense potential within India's stevia market. Moreover, the pharmaceutical industry is leveraging stevia’s natural properties to develop sugar-free medications and supplements. E-commerce platforms are also playing a pivotal role in making stevia-based products accessible to a wider audience, especially in urban areas. As consumer awareness about the benefits of stevia increases, companies are investing in marketing campaigns to highlight its natural origin and health advantages. This trend is expected to drive further growth in the Indian stevia market, making it a competitive segment in the global sweetener industry.

India Stevia Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on extract type and end use.

Extract Type Insights:

- Powder

- Liquid

- Leaf

The report has provided a detailed breakup and analysis of the market based on the extract type. This includes powder, liquid, and leaf.

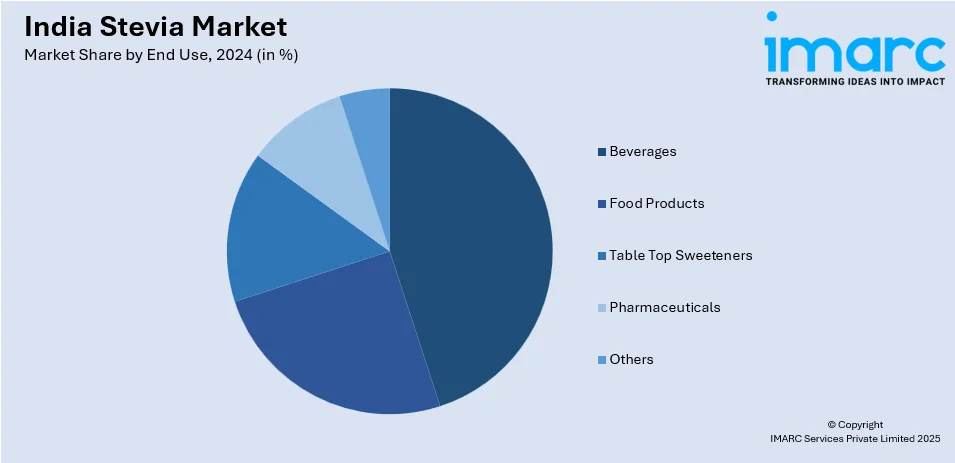

End Use Insights:

- Beverages

- Food Products

- Table Top Sweeteners

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes beverages, food products, table top sweeteners, pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Stevia Market News:

- March 6, 2025: Mumbai-based Healthy Mithai Co. raised INR 1.33 Crore (approximately USD 152,86.44) in a seed round of funding led by Singapore-based BeyondSeed. The organization manufactures mithai that is fit for individuals with diabetes, featuring zero-calorie stevia. They include low glycemic index sweets with 50% fewer calories to meet the growing demand in India for healthier desserts. With the packaged sweets market likely to reach INR 11,000 Crore (approximately USD 1,341.46 Million) by 2031, the startup aims to expand its footprint in urban areas and modern trade stores.

- December 10, 2024: Sugar Free Green, a brand by Zydus Wellness, collaborated with Bollywood actress Malaika Arora to promote its new sweetener made out of stevia in a pack of 3 in India targeting the rising demand for natural substitutes to sugar. With a significant 95% market share in the sweetener sector, Sugar Free has been the trusted go-to option for consumers for over three rich decades. With more health-conscious consumers seeking organic options, this collaboration highlights the brand's commitment to delivering guilt-free indulgence.

India Stevia Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Extract Types Covered | Powder, Liquid, Leaf |

| End Uses Covered | Beverages, Food Products, Table Top Sweeteners, Pharmaceuticals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India stevia market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India stevia market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India stevia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The stevia market in India was valued at USD 73.70 Million in 2024.

The India stevia market is projected to exhibit a CAGR of 6.10% during 2025-2033, reaching a value of USD 133.20 Million by 2033.

The India stevia market is fueled by increasing health consciousness, growing demand for natural and low-calorie sweeteners, and increasing cases of diabetes and obesity. Expanding applications in food and beverages, government support for natural alternatives, and consumer preference for plant-based products further propel market adoption and growth nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)