India Structural Steel Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

India Structural Steel Market Summary:

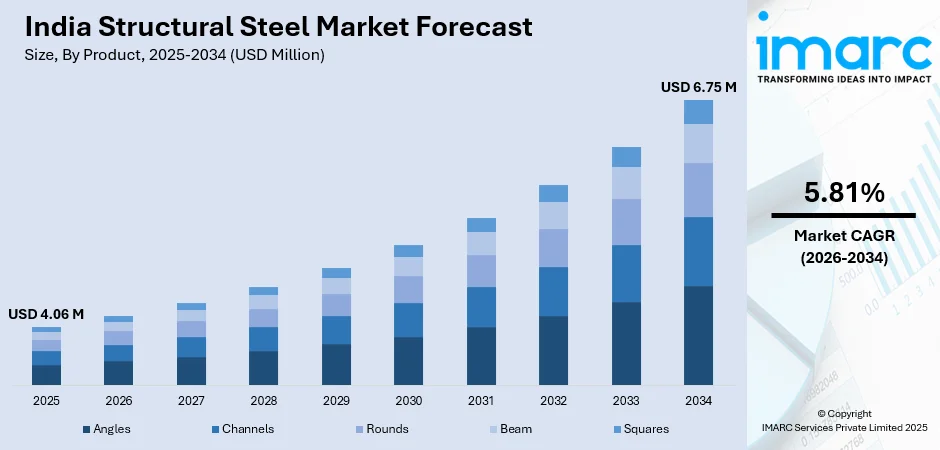

The India structural steel market size was valued at USD 4.06 Million in 2025 and is projected to reach USD 6.75 Million by 2034, growing at a compound annual growth rate of 5.81% from 2026-2034.

The market is driven by accelerated government infrastructure investment through the National Infrastructure Pipeline, rising adoption of pre-engineered buildings offering superior cost and time efficiency, and rapid urbanization across tier-two and tier-three cities. Additionally, the integration of artificial intelligence and smart manufacturing technologies is transforming production processes while the growing emphasis on sustainable construction practices continues to strengthen the India structural steel market share.

Key Takeaways and Insights:

- By Product: Beam dominate the market with a share of 37.5% in 2025, driven by their extensive utilization in large-scale infrastructure projects requiring superior load-bearing capacity, widespread application in commercial and industrial construction, and compatibility with pre-engineered building systems.

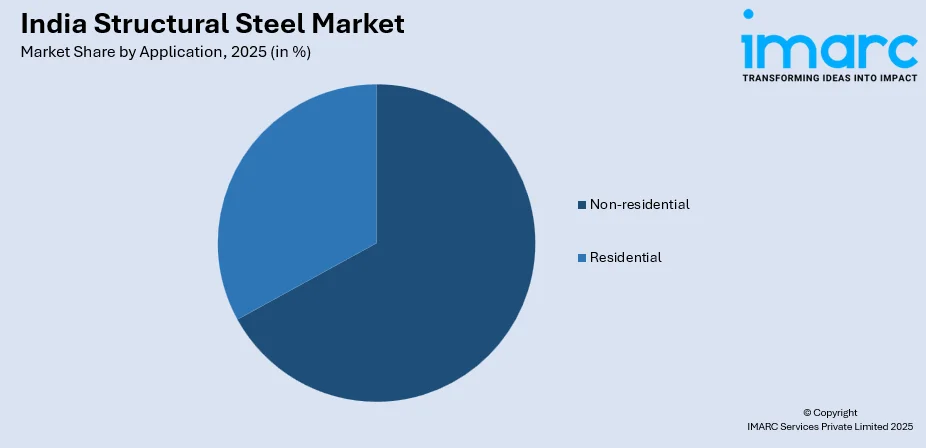

- By Application: Non-residential leads the market with a share of 67.2% in 2025, owing to massive government investment in commercial complexes, institutional buildings, industrial warehouses, and office spaces under flagship schemes like Smart Cities Mission and National Infrastructure Pipeline.

- By Region: West India dominates the market with a share of 35.0% in 2025, driven by the concentration of industrial hubs in Maharashtra and Gujarat, rapid commercial construction activity in Mumbai and Ahmedabad metropolitan areas, and robust port infrastructure development along the western coastline.

- Key Players: The market exhibits moderate fragmentation, with large integrated steel manufacturers competing alongside specialized structural steel fabricators and regional players serving local markets across diverse price segments and application categories.

To get more information on this market Request Sample

The India structural steel market is experiencing robust expansion fueled by the government's unprecedented infrastructure development initiatives and the rapid pace of urbanization across the nation. The National Infrastructure Pipeline has created substantial demand for structural steel products across highways, metro networks, airports, ports, and smart city developments. According to sources, in September 2025, Jindal Stainless supplied 1,031 metric tonnes of premium 301N stainless steel for Bangalore Metro Phase-2, reinforcing its growing contribution to India’s expanding urban transit infrastructure. Moreover, the construction sector's shift toward pre-engineered buildings, which offer reduced construction timelines and enhanced design flexibility, has further accelerated market growth. Additionally, flagship housing schemes and affordable housing initiatives are driving residential and commercial construction activities nationwide. The integration of advanced manufacturing technologies and automation in steel production facilities is improving product quality and operational efficiency. Growing emphasis on earthquake-resistant construction and sustainable building practices continues to strengthen structural steel adoption across diverse applications.

India Structural Steel Market Trends:

Accelerated Adoption of Pre-Engineered Building Systems

The structural steel market is witnessing significant momentum from the expanding pre-engineered buildings sector, which offers transformative advantages through faster construction timelines and enhanced design flexibility. Factory-built components assembled on-site are reducing construction periods substantially compared to conventional methods while simultaneously lowering overall project costs through standardized designs and optimized material utilization. Government initiatives promoting industrial development have spurred demand for warehouses, logistics hubs, and commercial facilities utilizing PEB technology. In September 2025, Interarch expanded its PEB manufacturing capacity by commissioning Phase-2 of its Uttarakhand facility and adding a new box-column production line, strengthening India’s fast-growing pre-engineered building ecosystem. Further, the commercial segment dominates current applications due to rising business expansion across emerging cities, while adoption of green building standards is further favoring pre-engineered uptake with designs incorporating energy-efficient features and superior insulation properties.

Integration of Smart Manufacturing and Digital Technologies

The structural steel industry is undergoing digital transformation through artificial intelligence and Industry 4.0 technologies, revolutionizing manufacturing processes while enhancing operational efficiency and product quality standards. In July 2025, JSW Steel’s AI-powered predictive maintenance platform, deployed across 10 plants and 2,900 critical assets which helped avoid over 25,000 hours of unplanned downtime through real-time condition-based monitoring. Moreover, smart factories are implementing predictive maintenance systems that analyze real-time sensor data to forecast equipment failures, enabling proactive scheduling that reduces unplanned downtime and extends machinery lifespan. Machine learning algorithms optimize production schedules, raw material allocation, and energy consumption patterns across manufacturing facilities. Digital twin technology enables automated optimization of production operations, improving output while aligning with sustainability objectives. AI-powered quality control systems utilizing high-resolution computer vision detect defects during manufacturing, ensuring consistent product standards throughout production cycles.

Sustainable Construction Practices Driving Material Innovation

Environmental consciousness is reshaping the structural steel market as manufacturers and construction companies increasingly prioritize sustainable practices throughout project lifecycles. The inherent recyclability of steel positions it favorably among construction materials, supporting circular economy principles within the building sector. Producers are developing high-strength, corrosion-resistant, and seismic-compliant structural steel grades catering to evolving building codes and environmental specifications. Green building certifications are encouraging adoption of sustainable steel solutions in commercial and institutional projects. The industry is investing in cleaner production technologies including electric arc furnaces and energy recovery systems. As per sources, in September 2025, the Government of India announced a ₹5,000 crore Green Steel Mission to support clean steel adoption, incentivizing secondary producers and promoting sustainable, low-carbon structural steel production nationwide. Furthermore, advanced coating technologies and surface treatments are extending structural component lifespans while reducing maintenance requirements across diverse applications.

Market Outlook 2026-2034:

The India structural steel market is positioned for steady growth throughout the forecast period, propelled by record infrastructure capital expenditure allocations and the National Steel Policy's ambitious capacity targets. The expanding pre-engineered buildings sector will create substantial revenue opportunities across industrial, commercial, and residential applications. Digital transformation through artificial intelligence and advanced manufacturing technologies will enhance production efficiency and product quality. Additionally, increasing urbanization coupled with affordable housing initiatives will sustain robust structural steel consumption and revenue generation. The market generated a revenue of USD 4.06 Million in 2025 and is projected to reach a revenue of USD 6.75 Million by 2034, growing at a compound annual growth rate of 5.81% from 2026-2034.

India Structural Steel Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Beam | 37.5% |

| Application | Non-residential | 67.2% |

| Region | West India | 35.0% |

Product Insights:

- Angles

- Channels

- Rounds

- Beam

- Squares

Beam dominates with a market share of 37.5% of the total India structural steel market in 2025.

Beam represents the largest product segment within the India structural steel market, commanding substantial market share driven by their fundamental role in construction frameworks requiring superior load-bearing capacity and structural integrity. These essential components form the backbone of large-scale infrastructure projects spanning bridges, commercial complexes, industrial facilities, and institutional buildings where strength and durability remain paramount considerations. In April 2025, GPT Infraprojects commissioned its steel girder and components manufacturing facility in West Bengal with 10,000 MT annual capacity, supporting rail, highway, and bridge infrastructure projects across India.

The dominance of beams is further reinforced by their extensive utilization in pre-engineered building systems, which continue gaining traction across industrial and commercial construction sectors. Their standardized dimensions and predictable performance characteristics make them ideal for modular construction approaches, enabling faster project execution while maintaining structural reliability. Growing investment in metro networks, elevated highways, and multi-story developments continues strengthening beam demand across major urban centers and emerging cities nationwide.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Non-residential

- Institutional

- Commercial

- Offices

- Others

Non-residential leads with a share of 67.2% of the total India structural steel market in 2025.

The non-residential segment holds commanding position within the India structural steel market, driven by massive government investment in commercial, institutional, and industrial construction projects under flagship development initiatives. Commercial complexes, office buildings, warehouses, logistics facilities, and institutional structures constitute primary consumption channels for structural steel products across this dominant application category.

Government initiatives including Smart Cities Mission, industrial corridor development, and special economic zone expansion continue fueling non-residential construction activity nationwide. In August 2024, the Union Cabinet approved 12 industrial smart cities across 10 states with ₹28,602 crore investment, aiming to boost manufacturing, infrastructure, and employment under the National Industrial Corridor Development Programme. Additionally, the segment benefits from growing demand for modern retail spaces, healthcare facilities, educational institutions, and hospitality infrastructure across metropolitan areas and tier-two cities. Industrial warehousing requirements driven by e-commerce expansion and manufacturing sector growth further strengthen non-residential structural steel consumption, while office space development in business districts sustains steady demand throughout the forecast period.

Regional Insights:

- North India

- South India

- East India

- West India

The West India dominates with a market share of 35.0% of the total India structural steel market in 2025.

West India dominates the regional landscape with substantial market share, driven by the concentration of industrial manufacturing hubs, commercial centers, and port infrastructure development across Maharashtra and Gujarat. Major metropolitan areas including Mumbai, Pune, and Ahmedabad serve as primary consumption centers for structural steel products, supported by robust real estate development and industrial expansion activities.

The region benefits from extensive port modernization initiatives under government development programs, creating sustained demand for structural steel in maritime infrastructure construction. According to reports, in October 2025, Gujarat Pipavav Port Limited signed a ₹17,000 crore MoU with the Gujarat Maritime Board to expand and modernize port infrastructure, expected to boost industrial, warehousing, and logistics activities. Moreover, industrial clusters across the western corridor continue attracting manufacturing investments requiring warehouse and factory construction utilizing structural steel frameworks. Commercial real estate development in financial districts and business parks further strengthens regional market leadership, while infrastructure projects including metro networks and elevated corridors ensure consistent structural steel consumption throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the India Structural Steel Market Growing?

Accelerated Government Infrastructure Investment Through National Infrastructure Pipeline

The Indian government has significantly amplified infrastructure spending, creating unprecedented opportunities for structural steel applications across multiple construction sectors. Record budgetary allocations for infrastructure projects spanning highways, ports, urban development, metro stations, airports, and smart cities are driving substantial structural steel demand nationwide. In February 2025, the Indian government allocated ₹11.21 lakh crore for capital expenditure under Union Budget 2025-26, emphasizing infrastructure, urban development, and transportation projects across the nation. Furthermore, flagship development schemes including road network expansion, port modernization programs, dedicated freight corridor projects, and affordable housing initiatives are creating sustained consumption requirements. Building and construction sectors collectively account for the majority of India's total steel consumption, with structural steel forming the backbone of large-scale infrastructure projects requiring high load-bearing capacity and durability. The emphasis on transforming cities through smart city initiatives, combined with unprecedented development pace across transportation infrastructure, ensures steady demand growth.

Rising Adoption of Pre-Engineered Buildings for Construction Efficiency

The structural steel market is experiencing robust growth from the expanding pre-engineered buildings sector, which offers transformative advantages over conventional construction methods through faster timelines, reduced costs, and enhanced design flexibility. Pre-engineered structures, which are factory-built and assembled on-site, significantly reduce construction periods compared to conventional buildings while simultaneously lowering overall construction costs through standardized components and optimized material utilization. Government initiatives promoting industrial development and manufacturing have spurred demand for factories, warehouses, logistics hubs, and commercial facilities utilizing pre-engineered building technology. In August 2025, Tiger Steel Engineering reported that demand for pre‑engineered buildings in India is approaching 1 million tonnes annually, driven by expanding infrastructure across e-commerce, logistics, metro systems, airports, and industrial facilities. Moreover, the commercial segment dominates current applications due to rising consumer spending power and rapid business expansion across emerging cities. Adoption of green building standards and sustainable construction techniques further favors pre-engineered building uptake throughout diverse application categories.

Rapid Urbanization and Smart City Development Initiatives

India's accelerating urbanization rate is creating substantial demand for structural steel across residential, commercial, and infrastructure construction applications nationwide. Growing urban populations require expanded housing stock, commercial facilities, transportation networks, and civic infrastructure, all-consuming significant quantities of structural steel products. Smart Cities Mission implementation across designated urban centers is driving modern infrastructure development utilizing steel-based construction systems. Affordable housing schemes are generating substantial residential construction activity in urban and semi-urban areas, while vertical development trends in land-constrained metropolitan regions favor steel-frame construction systems. In June 2025, the Central Sanctioning and Monitoring Committee approved construction of 2.35 lakh houses under PMAY‑Urban 2.0 across nine states, boosting urban residential construction and steel-frame demand. Furthermore, the expansion of organized retail, hospitality sector growth, and healthcare infrastructure development further strengthen urbanization-driven structural steel demand across major cities and emerging urban centers throughout the forecast period.

Market Restraints:

What Challenges the India Structural Steel Market is Facing?

Raw Material Dependency and Price Volatility

India's structural steel industry confronts significant obstacles stemming from heavy reliance on imported coking coal, exposing manufacturers to global supply chain disruptions and unpredictable price fluctuations impacting production costs. Raw material price volatility extends beyond coking coal to encompass iron ore and ferroalloys, with market prices influenced by global economic uncertainties and supply-demand imbalances. These input cost fluctuations create challenges for manufacturers in maintaining stable pricing and profit margins.

Competition from Cheaper Imported Steel Products

Indian structural steel producers face unprecedented import competition, particularly from manufacturing nations offering lower-priced products that threaten domestic market share and compress profit margins. Downstream industries sometimes favor cheaper imported steel to reduce input costs, creating tensions between domestic producers and traditional customer bases. Sustained import competition could discourage investments in domestic manufacturing capacity expansion and product innovation initiatives.

Environmental Compliance and Decarbonization Requirements

The structural steel industry faces mounting pressure to adopt sustainable production practices and achieve significant carbon emission reductions, necessitating substantial capital investments in cleaner technologies. Transitioning to lower-carbon production routes requires investments in advanced manufacturing equipment and cleaner energy sources. Stringent environmental regulations governing air quality, water usage, and waste management require continuous investment in pollution control equipment adding to operational costs.

Competitive Landscape:

The India structural steel market exhibits moderate fragmentation with a diverse mix of large integrated steel manufacturers, specialized structural steel fabricators, and regional players serving local markets across various application segments. Competition centers on product quality, pricing strategies, delivery timelines, and value-added services including fabrication, customization, and technical support. Major producers leverage vertical integration from raw material procurement through manufacturing to distribution, ensuring quality consistency, cost control, and supply reliability. Established brands dominate infrastructure and commercial construction projects through long-standing relationships with contractors, architects, and government agencies. The market witnesses increased focus on product innovation, with manufacturers developing high-strength, corrosion-resistant, and seismic-compliant structural steel grades catering to evolving building codes.

Recent Developments:

- In December 2025, JSW Steel and Japan’s JFE Steel formed a joint venture to operate Bhushan Power & Steel, with JFE investing ₹15,750 crore for a 50% stake. The partnership aims to expand steel production capacity to 10 million tonnes by 2030, strengthening India’s structural steel supply and value-added products.

- In November 2025, Fabex Steel Structures commissioned its second 40-acre manufacturing unit near Hyderabad, investing ₹120 crore. The facility will produce pre-engineered buildings for industrial, warehouse, and logistics applications, adding 50,000 MT annual capacity, increasing total production to 1 lakh MT, and supporting India’s expanding structural steel market.

India Structural Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Angles, Channels, Rounds, Beam, Squares |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India structural steel market size was valued at USD 4.06 Million in 2025.

The India structural steel market is expected to grow at a compound annual growth rate of 5.81% from 2026-2034 to reach USD 6.75 Million by 2034.

Beam held the largest share in the India structural steel market, driven by their extensive use in infrastructure projects, offering superior load-bearing capacity and compatibility with pre-engineered building systems.

Key factors driving the India structural steel market include accelerated government infrastructure investment, rising adoption of pre-engineered buildings, rapid urbanization across tier-two and tier-three cities, and integration of smart manufacturing technologies.

Major challenges include raw material dependency and price volatility, competition from cheaper imported steel products, environmental compliance costs, decarbonization requirements, supply chain constraints, and limited availability of specialized skilled workforce.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)