India Stylus Pen Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, End User, and Region, 2025-2033

India Stylus Pen Market Overview:

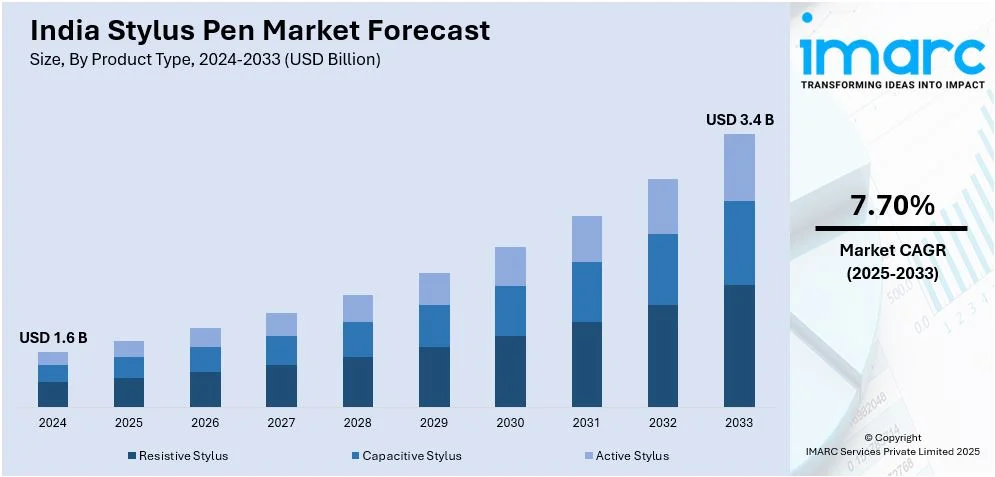

The India stylus pen market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.70% during 2025-2033. The market is expanding due to the increasing use of touchscreen devices, the growing need for digital learning resources, the expansion of design and creative applications, the development of active stylus technology, and the growing digitalization of corporations. Market expansion is further accelerated by the need for precision-based input devices across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Market Growth Rate 2025-2033 | 7.70% |

India Stylus Pen Market Trends:

Rising Integration of AI and Pressure Sensitivity for Enhanced Precision

The India stylus pen market is witnessing increasing adoption of artificial intelligence (AI) and pressure-sensitive technology to improve precision and user experience. AI-powered stylus pens offer features like predictive text, handwriting recognition, and gesture-based inputs, catering to both professional and casual users. Advanced pressure sensitivity mechanisms, integrated into high-end stylus pens, allow users to vary stroke thickness based on applied pressure, making them ideal for digital artists and designers. With the rise in digital illustrations and note-taking applications, AI-driven stylus pens are becoming essential for professionals and students alike. Additionally, manufacturers are introducing customizable buttons and haptic feedback, enhancing user control and productivity. This trend aligns with India’s growing digitization and creative industry expansion, propelling stylus pen adoption. For instance, in November 2023, OnePlus officially confirmed stylus support for its first foldable phone, the OnePlus Open, on both its inner and outer displays. Compatible with the Oppo Pen, the device enhances precision and usability for digital artists and professionals. As a rebranded version of Oppo’s Find N3, it inherits advanced stylus capabilities, aligning with the rising integration of AI and pressure-sensitive technology in the stylus market. This innovation reflects OnePlus’ focus on improving digital productivity and creative user experiences.

To get more information on this market, Request Sample

Expanding Demand for Stylus Pens in Digital Education and E-Learning

The surge in digital education platforms and online learning is significantly driving demand for stylus pens in India. Schools, colleges, and coaching institutes are adopting touchscreen-enabled devices, enabling students to interact with learning materials more effectively. Stylus pens offer enhanced writing precision, making them essential for note-taking, diagram creation, and mathematical problem-solving. With government initiatives like Digital India promoting smart classrooms and e-learning, stylus pens are increasingly being integrated into educational curriculums. Furthermore, affordable tablet-stylus bundles are gaining traction among students and teachers, bridging the gap between traditional writing and digital tools. As educational institutions continue to digitize, stylus pens are becoming indispensable for an engaging and interactive learning experience, ensuring steady market expansion. For instance, in January 2025, Xiaomi launched the Pad 7 in India, featuring stylus pen support with its upgraded Focus Pen, which offers 8,132 pressure sensitivity levels, catering to artists and note-takers. Designed for seamless multitasking, the tablet integrates Snapdragon 7+ Gen 3, a 144Hz Nano Display, and enhanced stylus and keyboard accessories, making it a strong contender in the mid-range segment.

India Stylus Pen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, distribution channel, application, and end user.

Product Type Insights:

- Resistive Stylus

- Capacitive Stylus

- Active Stylus

The report has provided a detailed breakup and analysis of the market based on the product type. This includes resistive, capacitive, and active stylus.

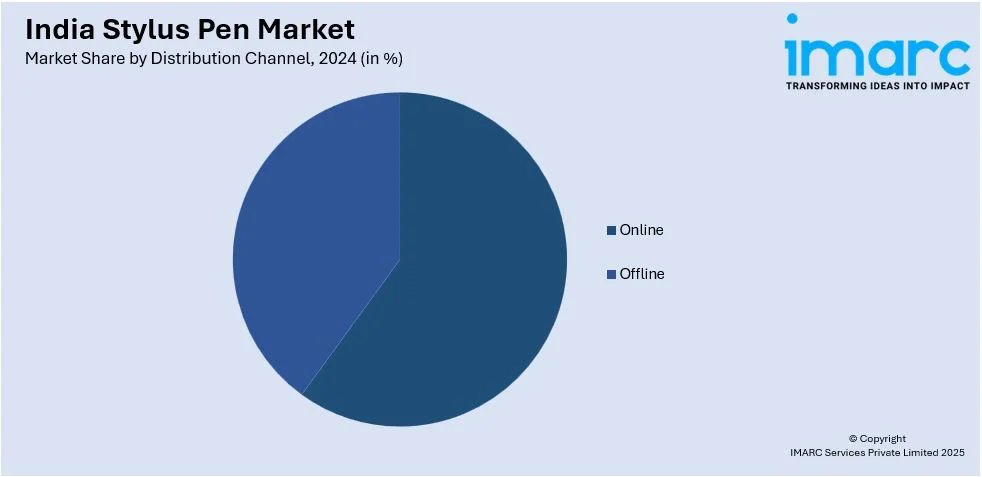

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Application Insights:

- Smart Phones

- Tablets

- Interactive Whiteboards

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes smart phones, tablets, and interactive whiteboards.

End User Insights:

- OEM

- Retail

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes OEM and retail.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Stylus Pen Market News:

- In December 2024, Samsung Display and HiDeep announced the development of battery-free stylus technology that does not require a digitizer. Unlike Samsung's current S Pen, which relies on digitizers, this innovation seeks to reduce device thickness, particularly for foldables. HiDeep is also working on a universal stylus compatible with Apple and Samsung devices.

- In May 2024, Apple unveiled the new iPad Pro with the M4 chip, featuring a thin design, Ultra Retina XDR display, and advanced AI capabilities. Available in 11-inch and 13-inch models, it supports the Apple Pencil Pro, which offers enhanced precision and haptic feedback.

India Stylus Pen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Resistive stylus, capacitive, stylus, active stylus |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Smart Phones, Tablets, Interactive Whiteboards |

| End Users Covered | OEM, Retail |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India stylus pen market performed so far and how will it perform in the coming years?

- What is the breakup of the India stylus pen market on the basis of product type?

- What is the breakup of the India stylus pen market on the basis of distribution channel?

- What is the breakup of the India stylus pen market on the basis of application?

- What is the breakup of the India stylus pen market on the basis of end user?

- What are the various stages in the value chain of the India stylus pen market?

- What are the key driving factors and challenges in the India stylus pen?

- What is the structure of the India stylus pen market and who are the key players?

- What is the degree of competition in the India stylus pen market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India stylus pen market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India stylus pen market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India stylus pen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)