India Sugar Substitutes Market Size, Share, Trends and Forecast by Product Type, Application, Origin, and Region, 2025-2033

Market Overview:

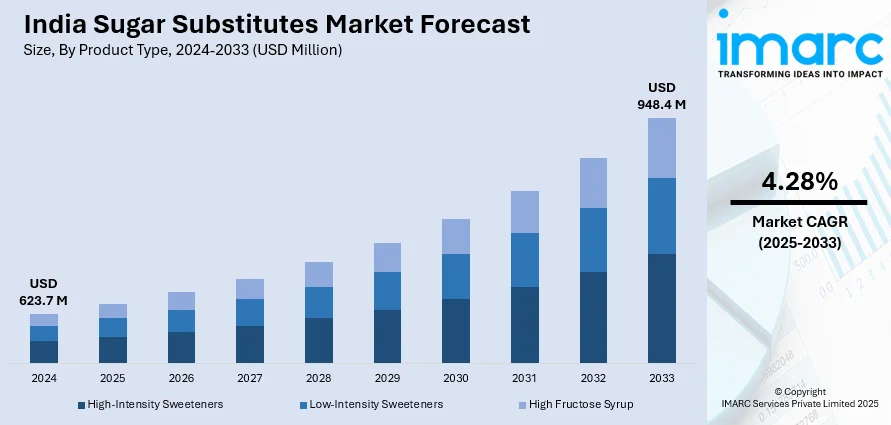

The India sugar substitutes market size reached USD 623.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 948.4 Million by 2033, exhibiting a growth rate (CAGR) of 4.28% during 2025-2033. The increasing innovation in the food and beverage industry, including the development of new products with reduced sugar content, which has increased the use of sugar substitutes, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 623.7 Million |

| Market Forecast in 2033 | USD 948.4 Million |

| Market Growth Rate (2025-2033) | 4.28% |

Sugar substitutes are artificial or natural sweeteners that are used as alternatives to traditional sugar. These substitutes are designed to provide sweetness without the calories associated with sucrose, making them popular among individuals aiming to reduce their calorie intake or manage conditions like diabetes. Common sugar substitutes include artificial sweeteners like aspartame, saccharin, and sucralose, as well as natural options such as stevia and monk fruit. Artificial sweeteners are often much sweeter than sugar, requiring smaller amounts to achieve the same level of sweetness. They are low or calorie-free because the body either doesn't metabolize them or does so inefficiently. Natural sweeteners, like stevia, are derived from plants and offer sweetness with minimal impact on blood sugar levels. While sugar substitutes can be beneficial for certain health goals, it's essential to use them in moderation and consider individual preferences and sensitivities. Always consult with healthcare professionals for personalized advice, especially for individuals with specific health conditions.

To get more information of this market, Request Sample

India Sugar Substitutes Market Trends:

The sugar substitutes market in India has experienced significant growth in recent years, driven by various factors. Firstly, the increasing prevalence of health-conscious consumer trends has fueled the demand for alternatives to traditional sugar. As more individuals seek to manage their weight and reduce their calorie intake, the market for sugar substitutes has expanded exponentially. Moreover, the rising incidence of lifestyle-related diseases such as diabetes has propelled the adoption of sugar substitutes, as they offer a sweetening solution without the adverse effects associated with excessive sugar consumption. Furthermore, technological advancements in the food and beverage industry have played a pivotal role in the expansion of the sugar substitutes market. Continuous R&D efforts have led to the creation of innovative and improved sugar substitutes that closely mimic the taste and texture of natural sugar, satisfying consumer preferences without compromising on flavor. Additionally, the growing awareness of the detrimental effects of excessive sugar consumption on oral health, which has encouraged consumers to opt for sugar substitutes in various food and beverage products, is expected to drive the market in India during the forecast period.

India Sugar Substitutes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, application, and origin.

Product Type Insights:

- High-Intensity Sweeteners

- Stevia

- Aspartame

- Cyclamate

- Sucralose

- Saccharin

- Others

- Low-Intensity Sweeteners

- D-Tagatose

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Others

- High Fructose Syrup

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high-intensity sweeteners (stevia, aspartame, cyclamate, sucralose, saccharin, and others), low-intensity sweeteners (D-tagatose, sorbitol, maltitol, xylitol, mannitol, and others), and high fructose syrup.

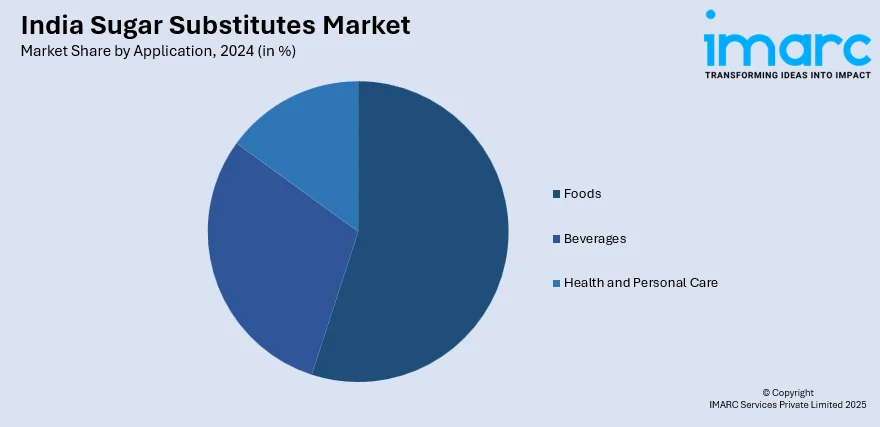

Application Insights:

- Foods

- Beverages

- Health and Personal Care

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes foods, beverages, and health and personal care.

Origin Insights:

- Artificial

- Natural

The report has provided a detailed breakup and analysis of the market based on the origin. This includes artificial and natural.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sugar Substitutes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Foods, Beverages, Health and Personal Care |

| Origins Covered | Artificial, Natural |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sugar substitutes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sugar substitutes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sugar substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sugar substitutes market in India was valued at USD 623.7 Million in 2024.

The India sugar substitutes market is projected to exhibit a (CAGR) of 4.28% during 2025-2033, reaching a value of USD 948.4 Million by 2033.

The market is driven by heightening awareness for health, increased cases of diabetes and obesity, and growing demand for low-calorie sweeteners. Consumers in urban areas are opting for healthier living, which is forcing food and beverage manufacturers to switch to natural and synthetic sugar substitutes. Government encouragement of preventive healthcare adds to the usage of sugar substitutes in different product segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)