India Sulphuric Acid Market Size, Share, Trends and Forecast by Raw Material, Application, and Region, 2025-2033

India Sulphuric Acid Market Size and Share:

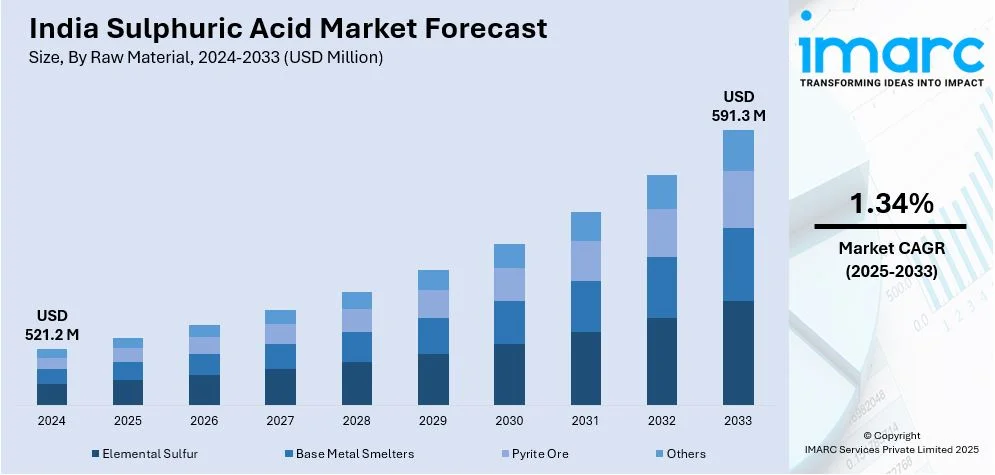

The India sulphuric acid market size reached USD 521.2 Million in 2024. The market is expected to reach USD 591.3 Million by 2033, exhibiting a growth rate (CAGR) of 1.34% during 2025-2033. The market growth is attributed to increasing demand from fertilizers, chemicals, and petroleum refining industries, rising agricultural activities, growing investments in wastewater treatment, expanding automotive and battery production, rapid industrialization, implementation of stringent environmental regulations, surging mining operations, and technological advancements in manufacturing processes.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of raw material, the market has been divided into elemental sulfur, base metal smelters, pyrite ore, and others.

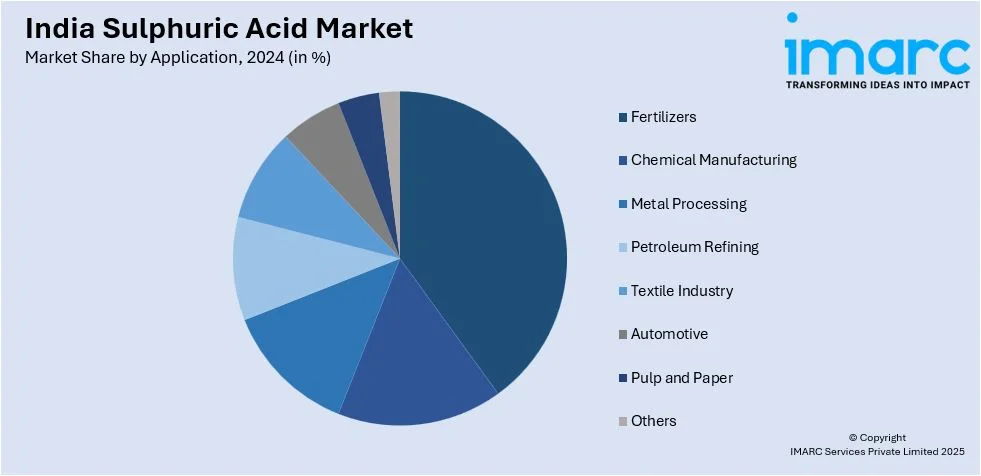

- On the basis of application, the market has been divided into fertilizers, chemical manufacturing, metal processing, petroleum refining, textile industry, automotive, pulp and paper, and others.

Market Size and Forecast:

- 2024 Market Size: USD 521.2 Million

- 2033 Projected Market Size: USD 591.3 Million

- CAGR (2025-2033): 1.34%

India Sulphuric Acid Market Trends:

Rising Demand from the Fertilizer Industry

Sulphuric acid is a crucial raw material in the production of phosphate fertilizers, particularly diammonium phosphate (DAP) and single super phosphate (SSP). India is a significant contributor to the global agriculture sector. Agriculture is the main source of income for approximately 55% of its population. According to an industry report, kharif foodgrain production for 2024 is expected to hit 1647.05 Lakh Metric Tonnes (LMT), marking an increase of 89.37 LMT from 2024. Additionally, agricultural income has grown at an annual rate of 5.23 percent over the last ten years. Therefore, the sulphuric acid demand in India is steadily increasing to support high crop yields. The Indian government's emphasis on food security and increasing farm productivity leads to subsidies and incentives for fertilizers, which is driving the need for sulphuric acid. Additionally, soil degradation and nutrient depletion in arable land necessitate the use of phosphate-based fertilizers. The expansion of fertilizer manufacturing facilities across the country, particularly in states like Gujarat, Maharashtra, and Tamil Nadu, is contributing to increased sulphuric acid consumption. Moreover, imports of raw materials such as phosphate rock and sulphur further impact local sulphuric acid production. It also leads to greater investments in domestic manufacturing capacities. In addition to this, the government's push for balanced fertilization and precision farming techniques is expected to sustain the demand for sulphuric acid. Also, private sector investments in fertilizer plants, along with advancements in production technologies, are positively influencing the India sulphuric acid market outlook.

To get more information on this market, Request Sample

Expansion of Industrial Applications and Infrastructure Development

Sulphuric acid is extensively used in various industrial sectors, including chemicals, petroleum refining, and wastewater treatment. The growing production of specialty chemicals, such as detergents, synthetic fibers, and pharmaceuticals, significantly increases the consumption of sulphuric acid in India. Its role in metal processing, particularly in the leaching of non-ferrous metals like zinc and copper, is also gaining traction due to increased mining activities. Additionally, India's rapid industrialization and infrastructure development projects further contribute to rising sulphuric acid demand. According to an industry report, India is experiencing swift urbanization. By 2036, approximately 600 million people, approximately 40% of the population, will reside in its towns and cities, an increase from 31 percent in 2011. Urban regions are expected to account for nearly 70 percent of the country's GDP. With the government's push for urbanization, smart city initiatives, and the expansion of industrial corridors, the need for sulphuric acid in steel manufacturing, cement production, and water treatment is growing. The sulphuric acid industry India faces stringent environmental regulations on effluent treatment and pollution control result in a higher demand, as sulphuric acid is widely used in wastewater treatment plants to neutralize contaminants. Additionally, the rise of the electric vehicle (EV) sector also leads to a surge in battery manufacturing, where sulphuric acid plays a key role in lead-acid battery production. As India continues to promote clean energy and industrial self-reliance, the diverse applications of sulphuric acid are expected to keep growing, which is facilitating the India sulphuric acid market growth.

Technology Integration and Environmental Compliance

The Indian sulphuric acid market is undergoing significant transformation through the integration of advanced automation, energy-efficient processes, and comprehensive environmental compliance measures. Modern contact process plants are incorporating sophisticated process control systems, automated catalyst management, and real-time monitoring technologies that optimize conversion efficiency while minimizing environmental impact. Digital twin technologies and artificial intelligence are enhancing operational efficiency and predictive maintenance capabilities. Environmental regulations are driving the implementation of advanced scrubbing technologies, zero liquid discharge systems, and continuous emissions monitoring to ensure compliance with stringent standards. Companies are investing in closed-loop systems, heat recovery mechanisms, and improved catalyst formulations that achieve substantial energy savings while reducing sulfur dioxide emissions and acid mist release. The adoption of Industry 4.0 principles, combined with ISO 14001 environmental management systems, is setting new benchmarks for operational excellence. As the sulphuric acid price trend in India becomes increasingly competitive, these technological and environmental advancements provide manufacturers with crucial competitive advantages while meeting regulatory requirements and creating opportunities for environmentally responsible India Sulphuric Acid Market Analysis providers.

Supply Chain Resilience and Global Market Dynamics

The industry is strengthening its market position through enhanced supply chain resilience strategies and adaptive responses to global market dynamics. Manufacturers are establishing diversified sourcing relationships for key raw materials like elemental sulfur and pyrite ore, while implementing advanced logistics management systems that include GPS tracking, route optimization, and real-time cargo monitoring. Strategic partnerships with international suppliers and freight forwarders are improving access to global markets and raw materials. The industry is increasingly influenced by international pricing dynamics, trade policies, and geopolitical factors that affect both raw material imports and finished product exports. Currency fluctuations and changes in international sulfur pricing directly impact production costs and market competitiveness. Companies are implementing sophisticated demand forecasting systems and risk management strategies, including force majeure insurance and alternative supply arrangements. Regional trade agreements and anti-dumping regulations are reshaping competitive landscapes while creating new export opportunities. The development of dedicated rail corridors, port facilities, and regional distribution hubs is improving overall logistics efficiency throughout the supply chain while reducing environmental impact, as per the India sulphuric acid market analysis.

Sustainability Innovation and Market Diversification

The Indian sulphuric acid market is embracing sustainability through circular economy practices, enhanced safety protocols, and diversification into emerging applications that create new growth opportunities. Spent acid regeneration technologies and by-product utilization programs are enabling resource efficiency improvements while reducing waste generation. Companies are implementing comprehensive health and safety enhancement programs featuring automated handling systems, advanced worker protection protocols, and state-of-the-art safety technologies including real-time gas detection and emergency response capabilities. The growing renewable energy sector is driving demand for high-purity sulphuric acid in advanced battery manufacturing, energy storage systems, and hydrogen economy applications. Water treatment applications are expanding beyond traditional industrial uses to include municipal purification, desalination projects, and environmental remediation. The pharmaceutical, biotechnology, and advanced materials manufacturing sectors are increasing consumption of specialized sulphuric acid grades. Life cycle assessment methodologies and green chemistry principles are being integrated into production processes to optimize environmental performance. These sustainability initiatives and application diversifications are creating competitive advantages, new revenue streams, and reduced dependence on traditional fertilizer demand patterns in the evolving Sulphuric Acid demand in India market landscape.

Growth, Opportunities, and Challenges in the India Sulphuric Acid Market:

- Growth Drivers of the India Sulphuric Acid Market: The expanding fertilizer industry, driven by government subsidies and increasing agricultural productivity demands, continues to be the primary growth driver for sulphuric acid consumption. Rising industrial applications across chemicals, petroleum refining, and metal processing sectors are creating sustained demand growth. Government infrastructure development initiatives and urbanization projects are generating increased requirements for sulphuric acid in construction and water treatment applications.

- Opportunities in the India Sulphuric Acid Market: The growing electric vehicle market presents significant opportunities for sulphuric acid demand in battery manufacturing and recycling applications. Emerging applications in renewable energy storage systems and advanced water treatment technologies offer new market expansion possibilities. Export potential to neighboring countries and strategic partnerships with global chemical companies provide avenues for market growth and technological advancement.

- Challenges in the India Sulphuric Acid Market: Fluctuating raw material prices, particularly for elemental sulfur and energy costs, create margin pressure and pricing volatility for manufacturers. Stringent environmental regulations require continuous investments in emission control and waste management systems, increasing operational costs. Intense competition from imports and the need for continuous technological upgrades present ongoing challenges for domestic producers.

India Sulphuric Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on raw material and application.

Raw Material Insights:

- Elemental Sulfur

- Base Metal Smelters

- Pyrite Ore

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes elemental sulfur, base metal smelters, pyrite ore, and others.

Application Insights:

- Fertilizers

- Chemical Manufacturing

- Metal Processing

- Petroleum Refining

- Textile Industry

- Automotive

- Pulp and Paper

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fertilizers, chemical manufacturing, metal processing, petroleum refining, textile industry, automotive, pulp and paper, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sulphuric Acid Market News:

- June 2025: Arya Engineers partnered with Austria's P&P Industries to deliver integrated sulphuric acid plant solutions, combining advanced catalyst-based wet process technology with local manufacturing expertise. This strategic alliance will provide comprehensive turnkey solutions from concept development to commissioning, enhancing India's domestic sulphuric acid production capabilities and technological advancement.

- May 2025: Caitlyn India Private Limited announced a INR 400 Crore investment for establishing a 50,000 TPA phosphoric acid plant in southern India, featuring a captive sulphuric acid unit. The facility will utilize hemihydrate-dihydrate technology for high-purity production and aims to reduce India's dependence on chemical imports while supporting domestic fertilizer manufacturing.

- March 2025: Coromandel International Limited inaugurated its second sulfur plant at Visakhapatnam, doubling production capacity to 50,000 metric tonnes annually and enhancing bentonite sulphur fertilizer supply for Indian farmers. The facility incorporates advanced German technology for high-quality production and supports research into specialized sulphur variants for specific regional agricultural requirements.

- August 2024: DMCC Speciality Chemicals Limited successfully commissioned a 500 TPD sulphuric acid plant for Andhra Sugars Ltd. in Saggonda, Andhra Pradesh, marking another milestone in India's expanding sulphuric acid production capacity. This project demonstrates DMCC's growing expertise in designing and delivering turnkey sulphuric acid solutions across India.

India Sulphuric Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Material Covered | Elemental Sulfur, Base Metal Smelters, Pyrite Ore, Others |

| Applications Covered | Fertilizers, Chemical Manufacturing, Metal Processing, Petroleum Refining, Textile Industry, Automotive, Pulp and Paper, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sulphuric acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sulphuric acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sulphuric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India sulphuric acid market was valued at USD 521.2 Million in 2024.

The India sulphuric acid market is projected to exhibit a CAGR of 1.34% during 2025-2033, reaching a value of USD 591.3 Million by 2033.

The market is driven by increasing demand from fertilizers, chemicals, and petroleum refining industries, rising agricultural activities, growing investments in wastewater treatment, expanding automotive and battery production, rapid industrialization, implementation of stringent environmental regulations, surging mining operations, and technological advancements in manufacturing processes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)