India Surface Cleaner Market Size, Share, Trends and Forecast by Type, Form, Product, Composition, Distribution Channel, and Region, 2025-2033

India Surface Cleaner Market Overview:

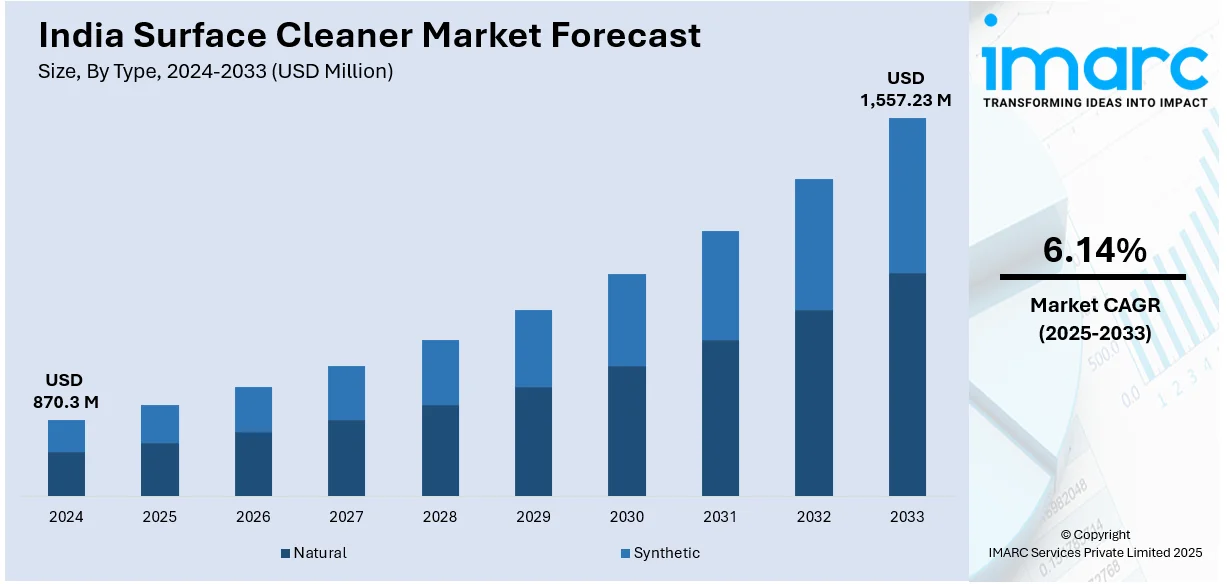

The India surface cleaner market size reached USD 870.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,557.23 Million by 2033, exhibiting a growth rate (CAGR) of 6.14% during 2025-2033. The rising hygiene awareness, urbanization, increasing disposable income, growing demand for eco-friendly products, expanding retail networks, and government sanitation initiatives are some of the factors propelling the growth of the market. Innovation in disinfectant formulations, product diversification, and advanced marketing strategies further boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 870.3 Million |

| Market Forecast in 2033 | USD 1,557.23 Million |

| Market Growth Rate (2025-2033) | 6.14% |

India Surface Cleaner Market Trends:

Consumer Shift toward Scientific Validation in Household Cleaning

Consumers are increasingly prioritizing scientifically backed claims when selecting household cleaning products. The demand for rigorous efficacy testing is rising as buyers seek evidence of germ elimination and superior performance over traditional alternatives. Independent laboratory validation is becoming a key differentiator, influencing purchasing decisions. This shift reflects a growing awareness of hygiene standards and a preference for products with proven disinfecting capabilities rather than relying on conventional solutions. Social media-driven engagement initiatives are further accelerating this behavior, encouraging consumers to challenge their existing choices. As more individuals seek transparency, brands that emphasize laboratory-certified effectiveness and engage in direct product comparisons are gaining trust and market share. This movement underscores a larger push toward data-backed decision-making in everyday consumer goods. For example, in April 2024, Lizol launched the #TestWhatYouTrust challenge, inviting consumers to test their preferred phenyl brands against Lizol's disinfectant. Over 200,000 entries were received. Independent ISO-certified lab results showed Lizol eliminated 99.9% of germs and provided ten times better cleaning than commonly used phenyls.

To get more information on this market, Request Sample

Growing Demand for Smart and Cordless Cleaning Solutions

Consumers are increasingly opting for automated and cordless cleaning devices to enhance convenience and efficiency in household maintenance. The rising preference for robotic vacuums reflects a shift toward hands-free solutions that integrate advanced navigation, AI-driven cleaning, and self-emptying features. Cordless stick models are also gaining traction due to their portability and ease of use. Competitive pricing and online availability are making these devices more accessible, catering to a broad range of consumers. As urban dwellers seek time-saving and high-performance cleaning solutions, the market is witnessing an expansion of product offerings with varied features and price points. This shift highlights a growing reliance on smart technology for daily cleaning, reinforcing the demand for innovation in home hygiene solutions. For instance, in August 2024, Dreame Technology introduced a new lineup of robotic and cordless stick vacuum cleaners in India. The range includes robot vacuums such as the D10 Plus Gen 2, D9 Max Gen 2, and L10 Prime, along with cordless stick models Mova J10, J20, and J30. Prices start at INR 7,999 for the Mova J10 and go up to INR 45,999 for the L10 Prime. These products are now available on Amazon India.

India Surface Cleaner Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, form, product, composition, and distribution channel.

Type Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the type. This includes natural and synthetic.

Form Insights:

- Liquid

- Powder

- Wipes

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid, powder, wipes, and others.

Product Insights:

- Floor Cleaner

- Specialised Cleaner

- Multi-Purpose Cleaner

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes floor cleaner, specialised cleaner, multi-purpose cleaner, and others.

Composition Insights:

- Quaternary Ammonium

- Alcohols

- Chlorine

- Hydrogen Peroxide

- Others

A detailed breakup and analysis of the market based on the composition have also been provided in the report. This includes quaternary ammonium, alcohols, chlorine, hydrogen peroxide, and others.

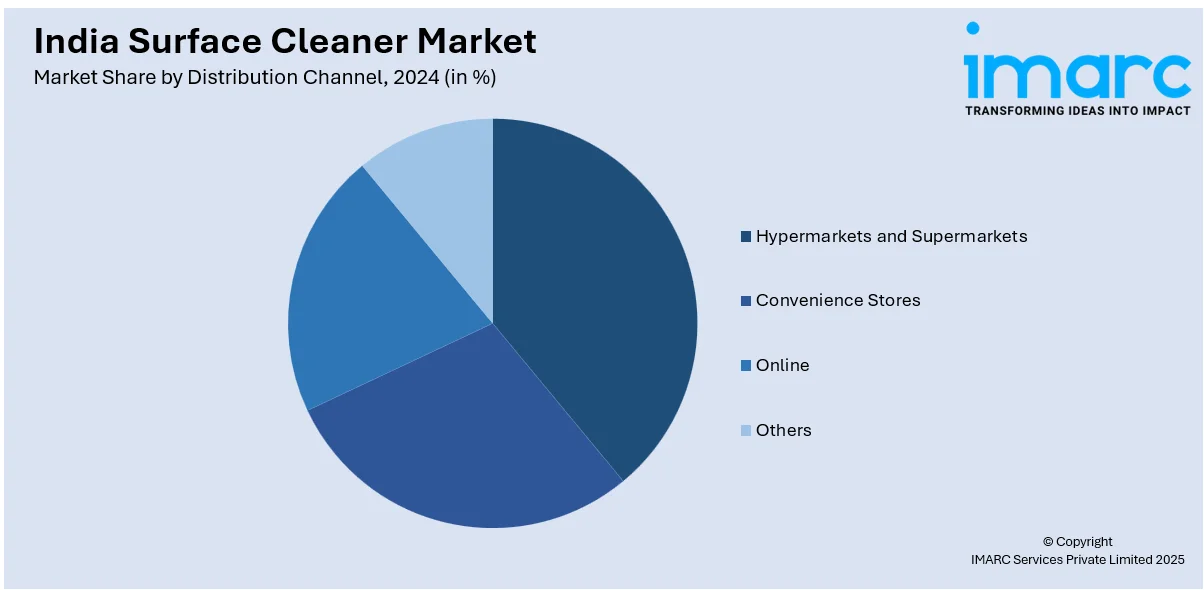

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surface Cleaner Market News:

- In December 2024, Hindustan Unilever’s Vim launched Vim UltraPro Floor Cleaner in India, featuring ultrapro technology for superior stain removal and long-lasting freshness. The brand introduced an interactive, tech-driven in-store display at a Bengaluru retail outlet to engage consumers.

- In October 2024, Dyson introduced the WashG1, a cordless wet floor cleaner, to the Indian market. This device addresses both wet and dry debris, featuring dual counter-rotating microfibre rollers and a hydration system for efficient cleaning. Equipped with a 1-litre clean-water tank, it can cover up to 3,100 square feet per charge.

India Surface Cleaner Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Synthetic |

| Forms Covered | Liquid, Powder, Wipes, Others |

| Products Covered | Floor Cleaner, Specialised Cleaner, Multi-Purpose Cleaner, Others |

| Compositions Covered | Quaternary Ammonium, Alcohols, Chlorine, Hydrogen Peroxide, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surface cleaner market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surface cleaner market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surface cleaner industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India surface cleaner market was valued at USD 870.3 Million in 2024.

The India surface cleaner market is projected to exhibit a CAGR of 6.14% during 2025-2033, reaching a value of USD 1,557.23 Million by 2033.

Urbanization, shifting consumer lifestyles, and growing hygiene awareness are the main factors propelling the surface cleaning market in India. Increased demand for convenient and effective cleaning solutions, along with aggressive marketing by FMCG brands and heightened focus on cleanliness post-pandemic, continues to boost the adoption of surface cleaners across households and commercial spaces.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)