India Surface Treatment Market Size, Share, Trends and Forecast by Chemical Type, Material, End User, and Region, 2025-2033

India Surface Treatment Market Overview:

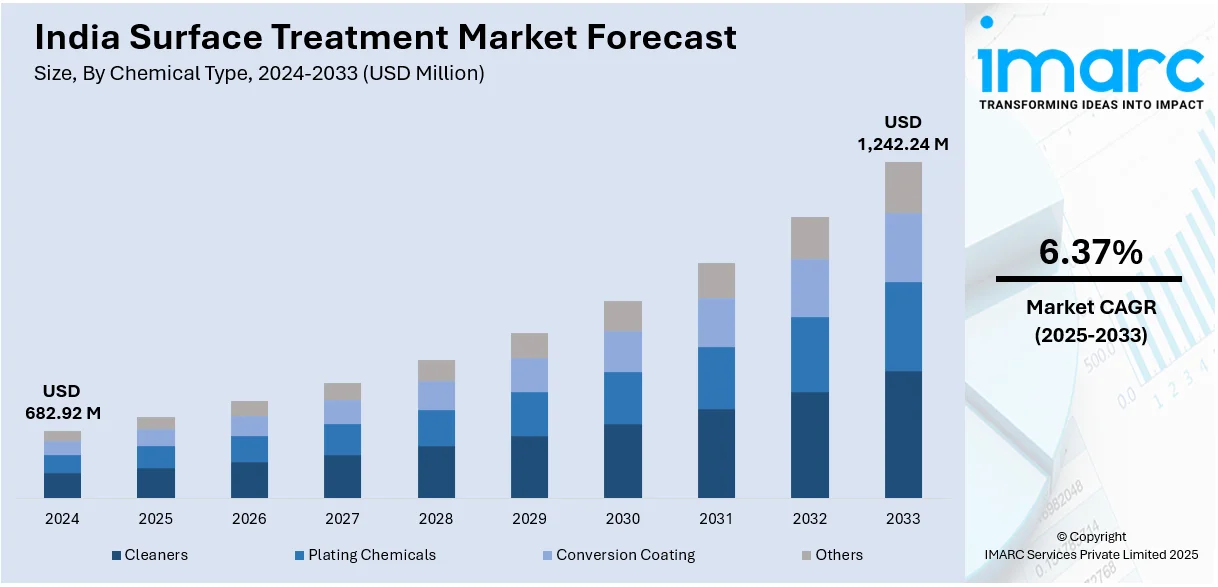

The India surface treatment market size reached USD 682.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,242.24 Million by 2033, exhibiting a growth rate (CAGR) of 6.37% during 2025-2033. The India surface treatment market is growing because of the rising demand for high-quality, durable products driven by increased user awareness, along with manufacturers adopting advanced, eco-friendly technologies to enhance product performance, aesthetics, and longevity across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 682.92 Million |

| Market Forecast in 2033 | USD 1,242.24 Million |

| Market Growth Rate 2025-2033 | 6.37% |

India Surface Treatment Market Trends:

Rising Awareness and Demand for High-Quality Products

People in India are becoming more quality-conscious and aware about the long-term benefits of durable, well-designed products, the demand for high-quality goods is rising across various sectors. This change in user preferences is especially apparent in sectors such as automotive, electronics, and consumer products, where the demand for items to both appear attractive and have a longer lifespan is becoming standard. Surface treatments are crucial for fulfilling these expectations, as they significantly contribute to improving product performance, aesthetics, and overall durability. Regardless of whether it involves corrosion resistance in domestic devices, scratch-resistant layers for mobile phones, or long-lasting finishes for cars, buyers now expect products to provide both visual attractiveness and practical durability. To satisfy this growing demand, manufacturers are progressively concentrating on enhancing the surface attributes of their goods using advanced surface treatment technologies. As a result, the adoption of cutting-edge surface treatments is becoming more widespread across industries. In November 2024, the India Surface Treatment & Finishing Expo 2024 was held at Yashobhoomi, Dwarka, New Delhi. This event showcased advancements in surface preparation and finishing technologies, offering a platform for networking and technological exchange. It aimed to help manufacturers and finishers optimize processes and meet precise product specifications. This event highlights the increasing significance of surface treatments in fulfilling the changing needs of users.

To get more information on this market, Request Sample

Technological Advancements

Improvements in surface treatment technologies are revolutionizing the industry, marked by a significant move towards environment-friendly options and automated systems. Advancements like nanocoating, laser surface treatment, and plasma technology are enhancing production efficiency, accuracy, and ecological sustainability. As sectors place greater emphasis on minimizing their ecological footprint and improving product standards, these innovative technologies are gaining traction. Automation and robotics are enhancing surface treatment procedures by reducing human involvement and increasing production rates. This also results in improved consistency and enhanced quality outcomes, further supporting the growth of the market. Moreover, the development of new materials and coatings is meeting the evolving demands of various industries, driving continuous interest in cutting-edge solutions. A notable example of these innovations is MKS' Atotech participated in the CII India Surface Coating Show 2024, held at the India Habitat Centre, New Delhi, from November 28-29, 2024. The company showcased its sustainable, high-performance coating solutions, including non-PFAS zinc flake coatings and innovative cleaning systems like UniClean® A101 / B201. Atotech also presented its eco-friendly products, such as UniPrep® cleaners, to enhance sustainability in the surface coating industry.

India Surface Treatment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on chemical type, material, and end user.

Chemical Type Insights:

- Cleaners

- Plating Chemicals

- Conversion Coating

- Others

A detailed breakup and analysis of the market based on the chemical type have also been provided in the report. This includes cleaner, plating chemicals, conversion coating, and others.

Material Insights:

- Metals

- Plastics

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes metals, plastics, and others.

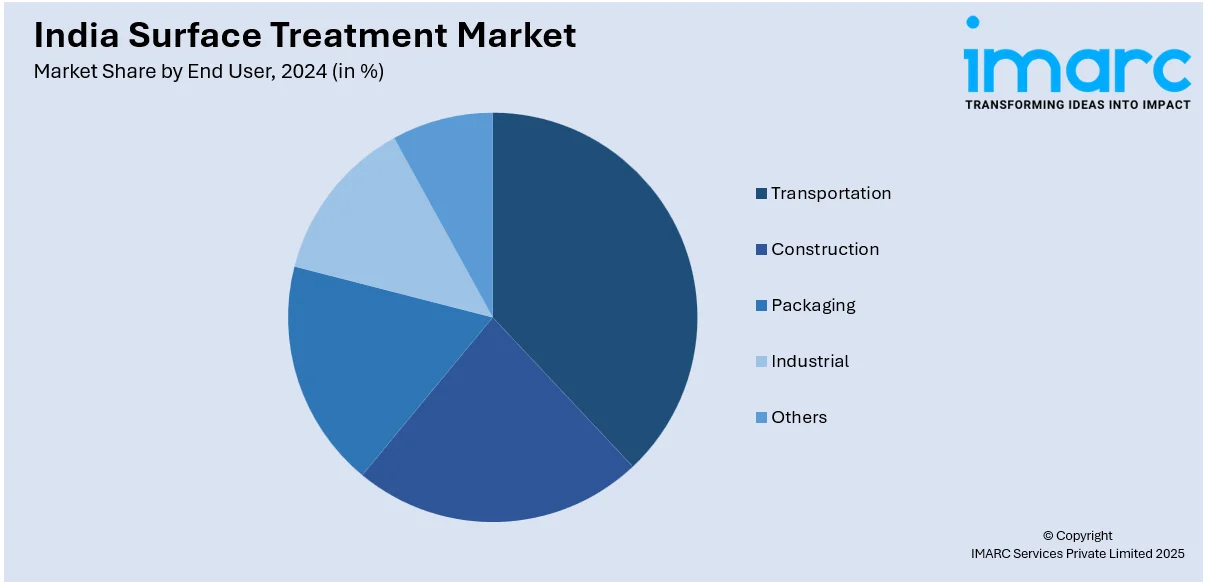

End User Insights:

- Transportation

- Construction

- Packaging

- Industrial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes transportation, construction, packaging, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surface Treatment Market News:

- In February 2025, MKS' Atotech will exhibit at the MachAuto Expo 2025 in Ludhiana, India, from February 21–24, 2025. The company will showcase its sustainable, Cr(VI)-free, non-PFAS surface finishing solutions, including the TriChrome® and BluCr® plating technologies.

- In July 2024, Henkel India completed Phase III of its largest manufacturing facility in Kurkumbh, Maharashtra. The plant aimed to localize production, reduce reliance on imports, and meet the growing demand for adhesives, sealants, and surface treatment solutions in sectors like automotive and MRO. Henkel also set a goal for carbon neutrality by 2030 and committed to sustainable, efficient operations with advanced technologies.

India Surface Treatment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chemical Types Covered | Cleaner, Plating Chemicals, Conversion Coating, Others |

| Materials Covered | Metals, Plastics, Others |

| End Users Covered | Transportation, Construction, Packaging, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India surface treatment market performed so far and how will it perform in the coming years?

- What is the breakup of the India surface treatment market on the basis of chemical type?

- What is the breakup of the India surface treatment market on the basis of material?

- What is the breakup of the India surface treatment market on the basis of end user?

- What is the breakup of the India surface treatment market on the basis of region?

- What are the various stages in the value chain of the India surface treatment market?

- What are the key driving factors and challenges in the India surface treatment market?

- What is the structure of the India surface treatment market and who are the key players?

- What is the degree of competition in the India surface treatment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surface treatment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surface treatment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surface treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)