India Surfactants Market Size, Share, Trends and Forecast by Type, Functionality, End-User, and Region, 2025-2033

India Surfactants Market Overview:

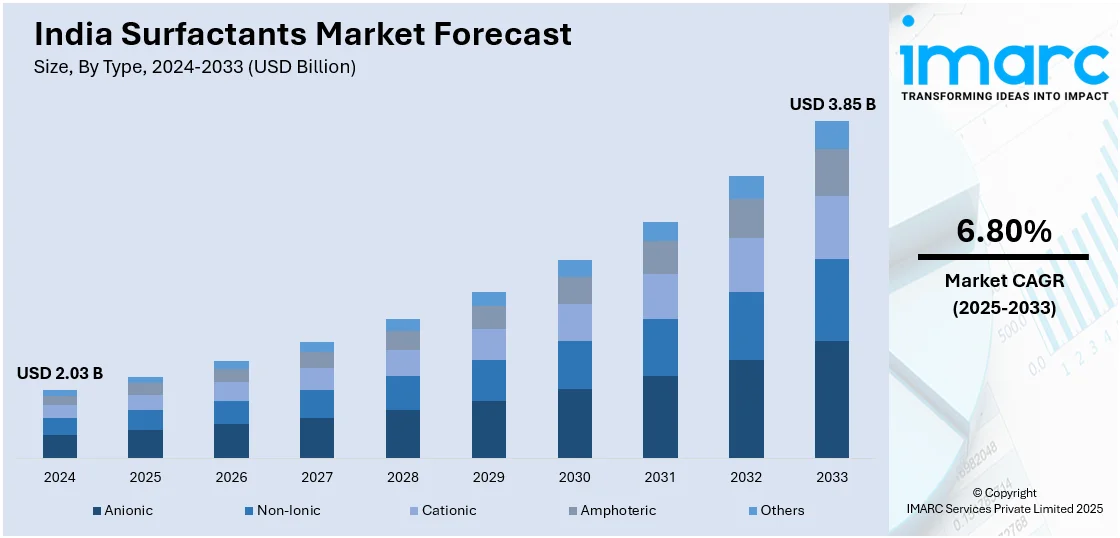

The India surfactants market size reached USD 2.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.85 Billion by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The market is driven by rapid industrialization, expanding agrochemical and textile sectors, escalating demand for personal and home care products, rising preference for bio-based ingredients, and increased government focus on sanitation and hygiene initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.03 Billion |

| Market Forecast in 2033 | USD 3.85 Billion |

| Market Growth Rate 2025-2033 | 6.80% |

India Surfactants Market Trends:

Expansion of the Indian Personal Care and Cosmetics Industry

One of the primary drivers of the Indian surfactants market is the rapid growth in the personal care and cosmetics sector. The India beauty and personal care market is projected to reach USD 48.5 billion by 2033 exhibiting a growth rate (CAGR) of 5.35% during 2025-2033. There has been a considerable shift in consumer culture towards grooming, hygiene, and skincare, fueled mainly by increasing disposable incomes, urbanization, and significant social media influence. Surfactants are typical components in large varieties of consumer personal care items, including shampoos, facial washes, body cleansers, lotions, and shaving creams, wherein they serve to be emulsifiers, foam producers, as well as cleaners. India's young, aspirational population is an intrinsic consumer group that continuously looks for innovative, functional, and premium cosmetics. This trend is also augmented by the progress of home-grown beauty companies and growing penetration of foreign brands. The elevating demand for natural and organic ingredients has further helped in the birth of bio-based and mild surfactants, giving rise to new sub-segments in the surfactants market.

To get more information on this market, Request Sample

Industrial and Institutional Cleaning Sector Growth

Another driver is the strong growth of India's industrial and institutional (I&I) cleaning industry. This is owing to the expanding hospitality, healthcare, manufacturing, transportation, and education sectors, all of which necessitate specialized cleaning and sanitation products. Post-COVID, there has also been a shift in paradigms regarding hygiene and sanitization standards, particularly in commercial and public environments. This has increased significantly demand for industrial-grade cleaning products, which depend to a great extent on surfactants to emulsify grease and disinfect. Surfactants in I&I applications, unlike in personal care products, are required to have high performance under severe conditions and compatibility with various chemicals and materials. This part is also marked by substantial innovation in green and biodegradable cleaning chemicals for environmentally aware institutions, thus increasing the range of surfactants being embraced. As the I&I industry further professionalizes and expands, it is a stable and long-term demand channel for the Indian surfactants market.

India Surfactants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, functionality, and end-user.

Type Insights:

- Anionic

- Non-Ionic

- Cationic

- Amphoteric

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes anionic, non-ionic, cationic, amphoteric, and others.

Functionality Insights:

- Surface Modification

- Emulsification

- Foaming

- Dispersion

- Others

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes surface modification, emulsification, foaming, dispersion, and others.

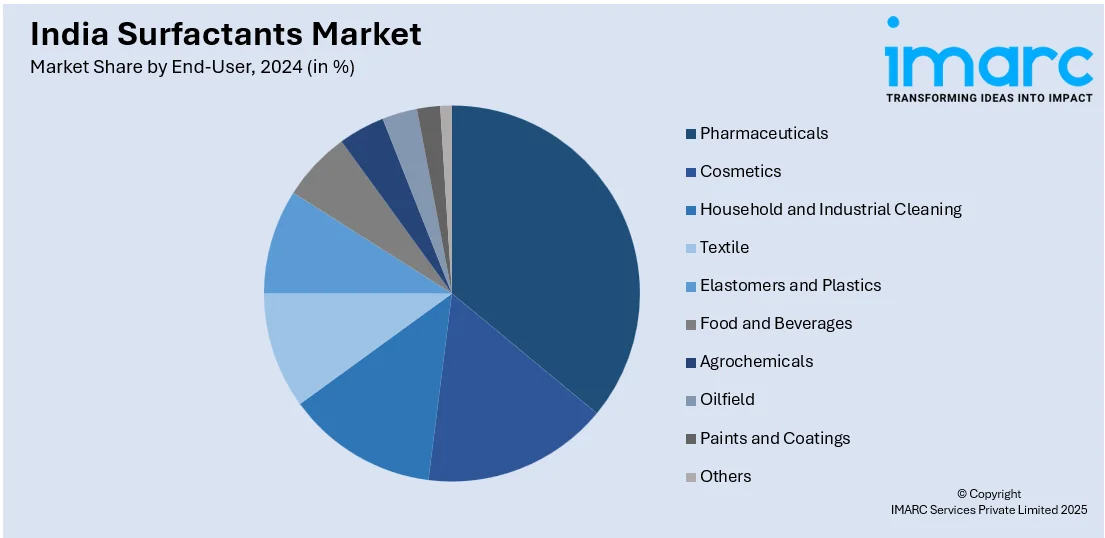

End-User Insights:

- Pharmaceuticals

- Cosmetics

- Household and Industrial Cleaning

- Textile

- Elastomers and Plastics

- Food and Beverages

- Agrochemicals

- Oilfield

- Paints and Coatings

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes pharmaceuticals, cosmetics, household and industrial cleaning, textile, elastomers and plastics, food and beverages, agrochemicals, oilfield, paints and coatings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surfactants Market News:

- April 2025: Godrej Industries (Chemicals) completed the acquisition of Savannah Surfactants' Food Ester and Emulsifier business, enhancing its surfactant and specialty chemicals portfolio. The Goa-based facility adds a 5,200 MTPA production capacity and aligns with the company's strategy to expand its global presence in the oleochemicals, surfactants, and biotech segments.

- August 2024: Researchers at the Indian Institute of Science (IISc) developed CNSL-1000-M, a sustainable surfactant derived from cashew nutshell liquid, enabling water-based chemical reactions and reducing reliance on toxic organic solvents. This innovation enhances product yields and lowers costs in industrial processes, particularly in the synthesis of anticancer drugs and organic LEDs.

India Surfactants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Anionic, Non-Ionic, Cationic, Amphoteric, Others |

| Functionalities Covered | Surface Modification, Emulsification, Foaming, Dispersion, Others |

| End-Users Covered | Pharmaceuticals, Cosmetics, Household and Industrial Cleaning, Textile, Elastomers and Plastics, Food and Beverages, Agrochemicals, Oilfield, Paints and Coatings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surfactants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surfactants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surfactants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surfactants market in India was valued at USD 2.03 Billion in 2024.

The India surfactants market is projected to exhibit a CAGR of 6.80% during 2025-2033, reaching a value of USD 3.85 Billion by 2033.

The India surfactants market is driven by increasing demand in personal care, household cleaning, and industrial applications. The rise in disposable income, urbanization, and awareness about hygiene and sustainability also contribute to market expansion. Additionally, the shift towards eco-friendly and biodegradable surfactants, as well as advancements in formulation technology, are key factors driving the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)