India Surgical Lights Market Size, Share, Trends and Forecast by Type, Technology, Application, End User, and Region, 2025-2033

India Surgical Lights Market Size and Share:

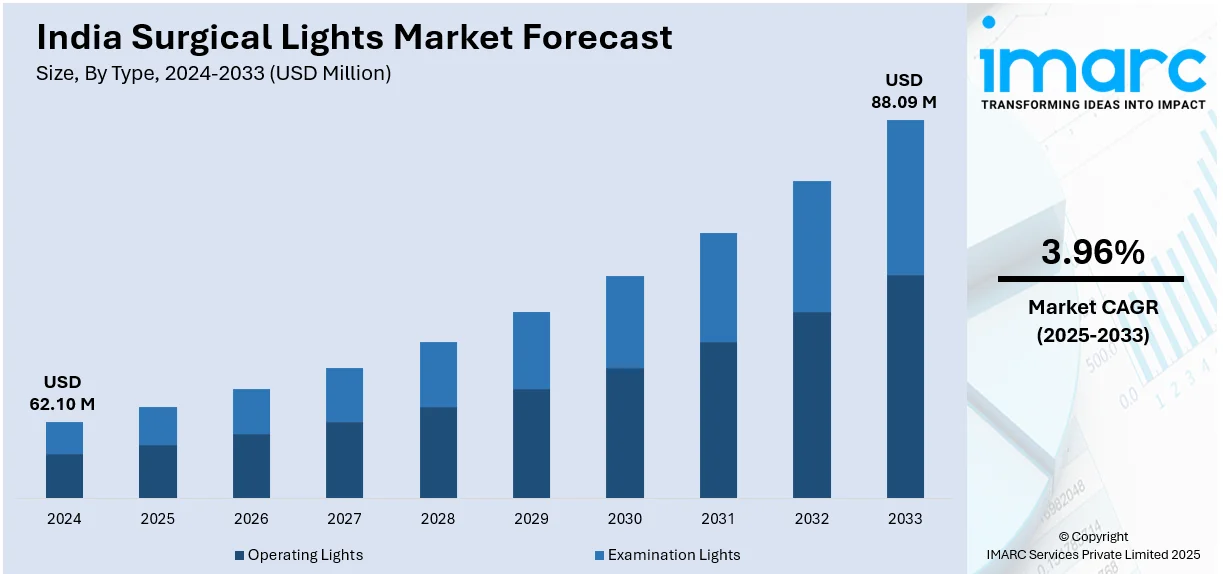

The India surgical lights market size reached USD 62.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 88.09 Million by 2033, exhibiting a growth rate (CAGR) of 3.96% during 2025-2033. The market is driven by rising healthcare infrastructure development, increasing demand for energy-efficient light-emitting diode (LED) lighting, and growing adoption of hybrid operating rooms. Technological advancements, including smart lighting systems with wireless controls and real-time adjustments, further boost market growth, alongside expanding medical tourism and higher surgical procedure volumes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 62.10 Million |

| Market Forecast in 2033 | USD 88.09 Million |

| Market Growth Rate 2025-2033 | 3.96% |

India Surgical Lights Market Trends:

Increasing Demand for Hybrid Operating Rooms

The integration of advanced surgical lighting in hybrid operating rooms (ORs) is a key trend in India's surgical lights market. Hospitals are upgrading surgical suites with high-performance lighting systems compatible with imaging and robotic-assisted surgery technologies. Hybrid ORs demand shadow-free illumination for procedures like cardiac, neurosurgery, and orthopedic interventions. The increase in the medical tourism business, whereby in 2023 6.9% of the visitors in India pursued treatments, is catalyzing growth in state-of-the-art medical facilities. Meeting international specifications necessitates top-flight surgical light devices. Additionally, infection control measures have led to the use of touchless control systems and antimicrobial-coated lighting solutions, improving efficiency and patient safety in modern surgical environments, aligning with India's evolving healthcare infrastructure.

To get more information on this market, Request Sample

Rising Adoption of LED Surgical Lights

The India surgical lights market is heading towards Light-emitting diode (LED)-based lighting systems due to their efficiency in energy usage, improved light, and lower heat output. LED lights are preferred by hospitals and surgical suites due to their longer lifespan and ability to provide shadow-free illumination, improving the accuracy of the surgery. The rise in the number of minimally invasive procedures and healthcare infrastructure expansion in tier-2 and tier-3 cities adds further to the application of LEDs. Demand is also being fueled by regulatory pressure for energy-efficient medical devices and growing knowledge of the benefits of LED lighting. Manufacturers are offering advanced features like adjustable intensity levels and color temperatures to enhance visibility and reduce eye strain for surgeons, rendering LED lights as the choice of preference in present operating rooms.

Technological Advancements in Smart Surgical Lights

India’s market for surgical lights is changing with the advent of technological advancements, with manufacturers incorporating smart features such as wireless control, real-time light adjustment, and hospital automation compatibility. Automatic brightness adjustment sensors and color temperature modulation sensors improve surgical efficiency. New models today incorporate camera integration to facilitate live streaming and documentation, which is beneficial for medical education and telemedicine. There is growing demand for ergonomic, flexible arm designs for better maneuverability during intricate procedures. These developments are in line with India's digital healthcare revolution, where connectivity and automation are streamlining hospital operations. The National Medical Devices Policy 2023 estimates India's medical devices market at $11 billion in 2020, holding a 1.5% global share. With government initiatives like Atmanirbhar Bharat and Make in India, domestic medtech innovation is driving growth in surgical lighting solutions.

India Surgical Lights Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033 Our report has categorized the market based on type, technology, application, and end user.

Type Insights:

- Operating Lights

- Examination Lights

The report has provided a detailed breakup and analysis of the market based on the type. This includes operating lights and examination lights.

Technology Insights:

- Light Emitting Diode (LED)

- Halogen Lights

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes light emitting diode (LED) and halogen lights.

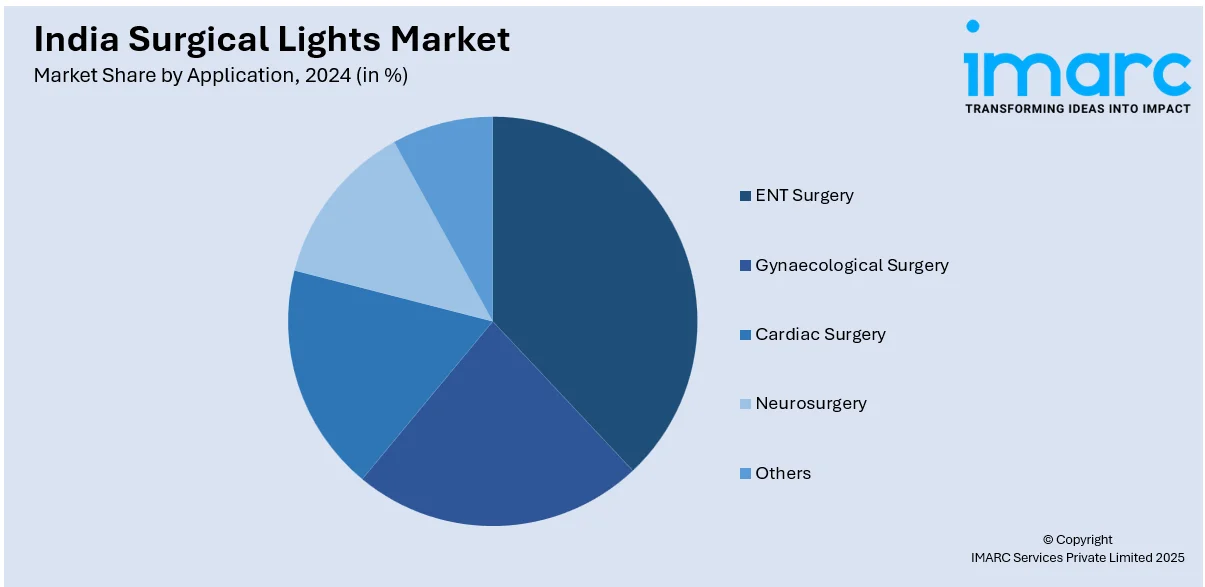

Application Insights:

- ENT Surgery

- Gynaecological Surgery

- Cardiac Surgery

- Neurosurgery

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes ENT surgery, gynaecological surgery, cardiac surgery, neurosurgery, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers (ASCS), and specialty clinics.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surgical Lights Market News:

- In August 2024, Swedish medtech firm Getinge launched Maquet Corin, a connected operating room table, and Maquet Ezea, a durable surgical light, in India. Designed for efficiency and safety, these innovations enhance workflow and risk management in surgical settings. Maquet Corin offers real-time service data access, ensuring readiness for procedures. Getinge India’s Managing Director, Aruna Nayak, emphasized the company’s commitment to advancing healthcare technology and improving patient outcomes.

India Surgical Lights Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Operating Lights, Examination Lights |

| Technologies Covered | Light Emitting Diode (LED), Halogen Lights |

| Applications Covered | ENT Surgery, Gynaecological Surgery, Cardiac Surgery, Neurosurgery, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Specialty Clinics |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India surgical lights market performed so far and how will it perform in the coming years?

- What is the breakup of the India surgical lights market on the basis of type?

- What is the breakup of the India surgical lights market on the basis of technology?

- What is the breakup of the India surgical lights market on the basis of application?

- What is the breakup of the India surgical lights market on the basis of end user?

- What is the breakup of the India surgical lights market on the basis of region?

- What are the various stages in the value chain of the India surgical lights market?

- What are the key driving factors and challenges in the India surgical lights market?

- What is the structure of the India surgical lights market and who are the key players?

- What is the degree of competition in the India surgical lights market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surgical lights market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surgical lights market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surgical lights industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)