India Surgical Navigation Systems Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

Market Overview:

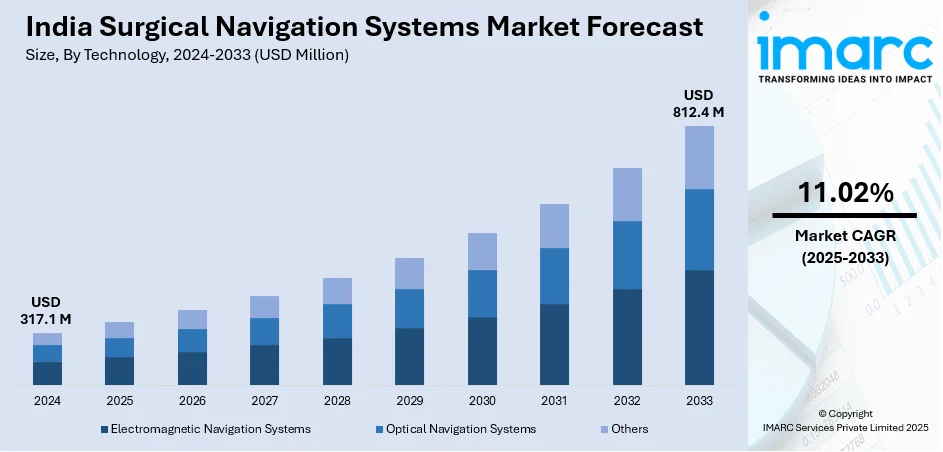

India surgical navigation systems market size reached USD 317.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 812.4 Million by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025-2033. The continuous advancements in technology, such as improved imaging modalities, robotics, and augmented reality, which enhance the accuracy and efficiency of surgical navigation systems, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 317.1 Million |

|

Market Forecast in 2033

|

USD 812.4 Million |

| Market Growth Rate 2025-2033 | 11.02% |

Surgical navigation systems are advanced technologies designed to enhance precision and accuracy in medical procedures. These systems integrate real-time imaging with computerized mapping to provide surgeons with detailed, three-dimensional guidance during surgery. By utilizing preoperative imaging data and tracking the position of surgical instruments in relation to the patient's anatomy, navigation systems enable surgeons to navigate through complex structures with greater confidence. This technology is particularly beneficial in minimally invasive surgeries, neurosurgery, and orthopedic procedures. Surgical navigation systems contribute to improved surgical outcomes, reduced invasiveness, and shorter recovery times for patients. The integration of these systems assists surgeons in making more informed decisions, enhancing their ability to navigate delicate anatomical structures and perform intricate procedures with greater precision.

To get more information on this market, Request Sample

India Surgical Navigation Systems Market Trends:

The surgical navigation systems market in India has experienced a surge in demand, primarily driven by technological advancements and the increasing complexity of medical procedures. Moreover, the growing prevalence of minimally invasive surgeries has propelled the market forward. To begin with, the integration of advanced imaging modalities, such as magnetic resonance imaging (MRI) and computed tomography (CT), into navigation systems has significantly enhanced the precision and accuracy of surgical interventions. Additionally, the rising incidence of chronic diseases and the aging population have contributed to the expansion of the market, as these factors often necessitate intricate surgical procedures that benefit from navigation assistance. Furthermore, the shift toward value-based healthcare models has prompted healthcare providers to adopt cutting-edge technologies to improve patient outcomes and reduce healthcare costs. Consequently, surgical navigation systems have become indispensable tools in achieving these objectives, fostering market growth. Moreover, the increasing awareness among surgeons about the benefits of navigation-guided surgeries and the positive patient outcomes associated with such procedures has further fueled the market's momentum. In conclusion, a confluence of technological innovation, changing healthcare paradigms, and a growing understanding of the advantages of surgical navigation systems collectively propel the regional market forward, positioning it as a pivotal component of modern healthcare.

India Surgical Navigation Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Electromagnetic Navigation Systems

- Optical Navigation Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes electromagnetic navigation systems, optical navigation systems, and others.

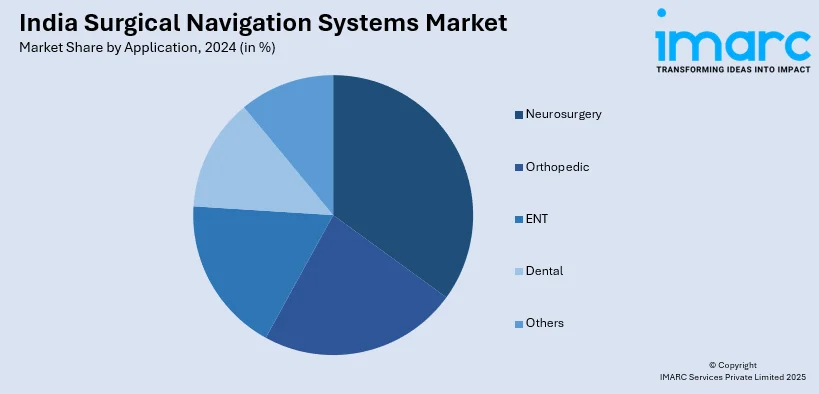

Application Insights:

- Neurosurgery

- Orthopedic

- ENT

- Dental

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes neurosurgery, orthopedic, ENT, dental, and others.

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and ambulatory surgical centers.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surgical Navigation Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electromagnetic Navigation Systems, Optical Navigation Systems, Others |

| Applications Covered | Neurosurgery, Orthopedic, ENT, Dental, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surgical navigation systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surgical navigation systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surgical navigation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surgical navigation systems market in India was valued at USD 317.1 Million in 2024.

The India surgical navigation systems market is projected to exhibit a (CAGR) of 11.02% during 2025-2033, reaching a value of USD 812.4 Million by 2033.

The market is propelled by mounting incidence of complex procedures, surging demand for minimally invasive treatments, and advancements in 3D imaging and navigation technology. Increased healthcare infrastructure, mounting geriatric population, and growth in medical tourism also underpin uptake, with improved precision, results, and patient safety in surgery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)