India Surrogacy Market Size, Share, Trends and Forecast by Type, Technology, Service Provider, and Region, 2025-2033

India Surrogacy Market Size and Share:

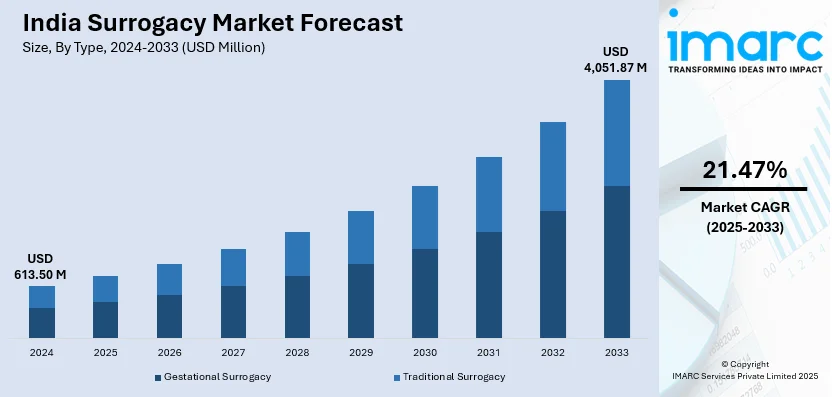

The India surrogacy market size reached USD 613.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,051.87 Million by 2033, exhibiting a growth rate (CAGR) of 21.47% during 2025-2033. Rising infertility rates, advancements in assisted reproductive technologies, increasing awareness about surrogacy, favorable government regulations, growing medical tourism, higher disposable incomes, improved healthcare infrastructure, delayed pregnancies due to career priorities, rising demand from non-traditional families, and increasing success rates of in-vitro fertilization (IVF) procedures are expanding the India surrogacy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 613.50 Million |

| Market Forecast in 2033 | USD 4,051.87 Million |

| Market Growth Rate 2025-2033 | 21.47% |

India Surrogacy Market Trends:

Rising Demand for Commercial Surrogacy Amidst Regulatory Changes

The India surrogacy market growth is driven by a changing legal framework and increasing demand for assisted reproductive technologies. While the Surrogacy (Regulation) Act, 2021, permits only altruistic surrogacy, many intended parents seek solutions within regulated clinics. In 2024, the Central government of India then amended the Surrogacy (Regulation) Rules, 2022, allowing couples to use at least one gamete from the intending couple for surrogacy, even if they are medically certified to suffer from a condition that necessitates the use of a donor gamete. On the other hand, single women (widow or divorcee) undergoing surrogacy must use self-eggs and donor sperm to avail surrogacy procedures, according to the latest notification. Apart from this, the growing prevalence of infertility, lifestyle disorders, and delayed pregnancies among urban couples is further driving the market. Additionally, advancements in in-vitro fertilization (IVF) and embryo transfer techniques are improving success rates. Despite regulatory restrictions, India remains a hub for surrogacy-related medical tourism, with domestic and international patients seeking fertility treatments under legally permissible conditions.

To get more information on this market, Request Sample

Technological Advancements Enhancing Success Rates in Surrogacy

The integration of cutting-edge reproductive technologies is revolutionizing the Indian surrogacy market. Innovations such as preimplantation genetic testing (PGT), embryo freezing, and AI-assisted embryo selection are improving pregnancy success rates. Fertility clinics are adopting personalized treatment approaches, utilizing data analytics to optimize surrogacy outcomes. The affordability of fertility treatments in India, compared to Western countries, continues to attract medical tourists. Notably, Alka IVF Shree Kanak Hospital, under the direction of Dr. Alka, stated on December 23, 2024, that it was expanding throughout India, with planned facilities in Jodhpur, Kota, Jhansi, and Udaipur. The facility offers individualized care to couples dealing with infertility issues by specializing in cutting-edge reproductive therapies like intracytoplasmic sperm injection (ICSI), pre-implantation genetic screening (PGS), and in-vitro fertilization (IVF). Additionally, the rise of fertility preservation services, such as egg and sperm freezing, allows intended parents to plan surrogacy at their convenience. As technology advances, India’s surrogacy market is expected to see improved efficiency and higher patient trust, which, in turn, is positively impacting the India surrogacy market outlook.

India Surrogacy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, technology, and service provider.

Type Insights:

- Gestational Surrogacy

- Traditional Surrogacy

The report has provided a detailed breakup and analysis of the market based on the type. This includes gestational surrogacy and traditional surrogacy.

Technology Insights:

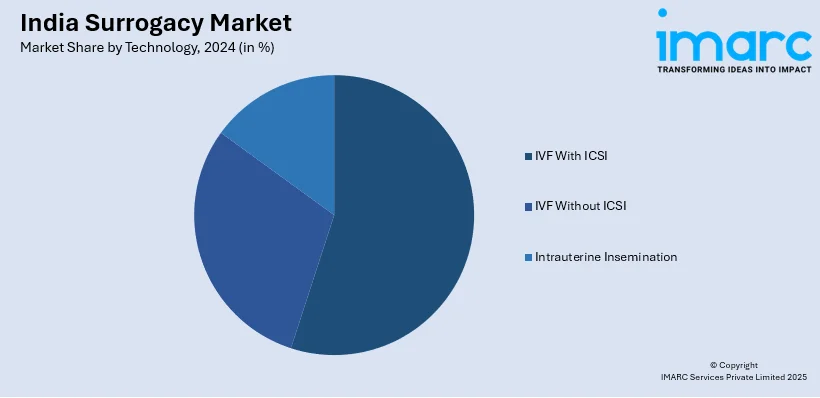

- IVF With ICSI

- IVF Without ICSI

- Intrauterine Insemination

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes IVF with ICSI, IVF without ICSI, and intrauterine insemination.

Service Provider Insights:

- Hospitals

- Fertility Clinics

- Others

A detailed breakup and analysis of the market based on the service provider have also been provided in the report. This includes hospitals, fertility clinic, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Surrogacy Market News:

- On January 7, 2025, the Supreme Court of India decided to consider age restrictions in India's surrogacy legislation, and the hearing was set for February 11. According to the Surrogacy (Regulation) Act, 2021, intended fathers and mothers must be between the ages of 26 and 55 and 23 and 50, respectively. Additionally, surrogate moms must be married, between the ages of 25 and 35, have a biological child, and be able to serve as surrogates only once. The Court underlined the need for a database to make sure that the same woman isn't used for surrogacy more than once and stressed the need to set up a system to stop surrogate mother exploitation.

India Surrogacy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gestational Surrogacy, Traditional Surrogacy |

| Technologies Covered | IVF With ICSI, IVF Without ICSI, Intrauterine Insemination |

| Service Providers Covered | Hospitals, Fertility Clinics, Others |

| Regions Covered | North India, South India, East India, and West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India surrogacy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India surrogacy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India surrogacy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surrogacy market in India was valued at USD 613.50 Million in 2024.

The India surrogacy market is projected to exhibit a CAGR of 21.47% during 2025-2033, reaching a value of USD 4,051.87 Million by 2033.

Key factors driving India’s surrogacy market include increasing infertility rates due to lifestyle changes, delayed parenthood, and medical conditions; advancements in ART technologies like IVF; supportive altruistic surrogacy laws; rising awareness; improved healthcare infrastructure; growing acceptance of non-traditional families; and increasing demand from both domestic and international intended parents.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)