India Switchgear Components Market Size, Share, Trends and Forecast by Component Type, Voltage Type, Construction Type, Insulation Type, End User, and Region 2025-2033

India Switchgear Components Market Size and Share:

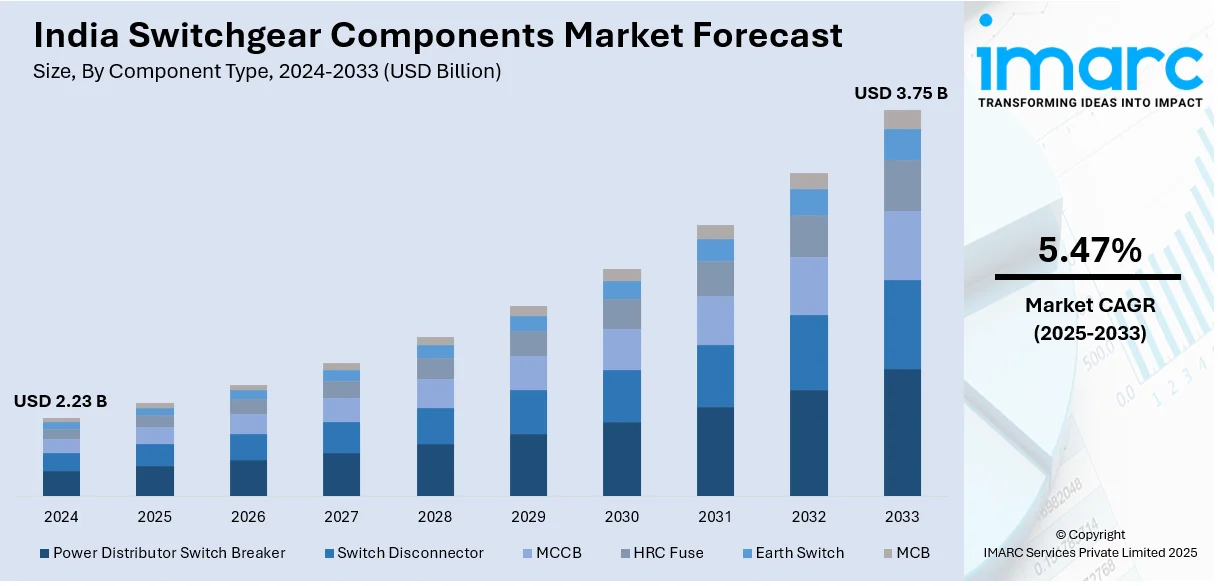

The India switchgear components market size reached USD 2.23 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.75 Billion by 2033, exhibiting a growth rate (CAGR) of 5.47% during 2025-2033. The market is expanding with growing demand for effective power distribution, electrical infrastructure modernization, and rising investments in energy systems led by industrial development, urbanization, and requirements for safe and reliable electrical solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.23 Billion |

| Market Forecast in 2033 | USD 3.75 Billion |

| Market Growth Rate 2025-2033 | 5.47% |

India Switchgear Components Market Trends:

Rising Adoption of Smart and Digital Switchgear

The India switchgear market is fast transforming towards smart and digital solutions to maximize power distribution effectiveness and reliability. The latest switchgear components incorporate built-in sensors, communication modules, and Internet of Things (IoT) connectivity that allow for real-time monitoring, predictive maintenance, and remote management. For instance, in February 2025, Lauritz Knudsen Electrical and Automation unveiled an advanced switchgear and automation portfolio, unveiling smart circuit breakers, industrial automation, home automation, EV solutions, and farm automation, strengthening India's electrical infrastructure development. Moreover, such technologies enhance operational safety and minimize downtime, which are in high demand by industries and utilities. Further, the growth towards smart grids and automation is encouraging the takeoff of digital switchgear that provides seamless interoperation with state-of-the-art energy management systems. Cloud-based computing and artificial intelligence (AI) powered analytics enhance performance through optimization of load allocation and fault identification. Adoption towards intelligent switchgear is further pushed by power networks demanding improved energy efficiency and sustainability. With ongoing modernization initiatives, industries, business centers, and residential areas are intensely turning to smart switchgear to enhance energy reliability, lower operating expenses, and accommodate the boosting demand for intelligent power distribution systems.

To get more information on this market, Request Sample

Expansion of Renewable Energy Driving Switchgear Demand

Renewable energy growth is significantly transforming India's switchgear market, driving demand for high-performance electrical equipment. As the increase in solar and wind power projects continues, switchgear solutions need to manage undulating power loads effectively and provide grid stability. Medium-voltage and high-voltage switchgear are important in integrating renewable energy into the country's power infrastructure to avoid power loss and ensure constant energy delivery. Moreover, new insulation technologies like gas-insulated and vacuum-insulated switchgear improve operating safety and reliability in the renewable power plants. With the trend in the energy industry towards sustainability, sustainable and energy-efficient switchgear solutions are equally in demand. Smart switchgear with automatic controls maximizes energy flow further, minimizing transmission losses. As investment in renewable power generation and grid modernization grows, the deployment of sophisticated switchgear components will increase, allowing for a more efficient and reliable energy transition for India's power sector.

Increased Investment in Urban Electrification and Smart Cities

Urbanization and smart city projects are fueling greater investment in advanced switchgear solutions throughout India. For example, in February 2023, ELMEASURE forayed into the switchgear segment at ELECRAMA 2023 by introducing auto transfer switches (ATS), contactors, MCCBs, and ACBs and enhancing its low-voltage offerings and "Make in India" manufacturing as well as global presence. Furthermore, with cities growing, the demand is escalating for power distribution networks that are efficient yet provide secure access to power for residential, commercial, and industrial segments. Modular and compact switchgear solutions are gaining traction in cities, where infrastructure development needs high-performance yet space-saving electrical products. Smart switchgear with automated and real-time monitoring features is also becoming increasingly popular, enabling better grid stability and fault detection. The inclusion of smart switchgear in metro rail systems, high-rise developments, and business complexes also provides energy efficiency with the facilitation of developing interlinked smart industrial and home systems. With more investment in urban infrastructure and electrification projects, the need for technologically sophisticated switchgear solutions is likely to increase, supporting efficient, safe, and sustainable power delivery in urban areas across the nation.

India Switchgear Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component type, voltage type, construction type, insulation type, and end user.

Component Type Insights:

- Power Distributor Switch Breaker

- Switch Disconnector

- MCCB

- HRC Fuse

- Earth Switch

- MCB

The report has provided a detailed breakup and analysis of the market based on the component type. This includes power distributor switch breaker, switch disconnector, MCCB, HRC fuse, earth switch, and MCB.

Voltage Type Insights:

- Low Voltage (less than 1kV)

- Medium Voltage (1kV to 75kV)

- High Voltage (75kV to 230kV)

- Extra High Voltage (230kV to 500kV)

- Ultra-High Voltage (above 500kV)

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes low voltage (less than 1kV), medium voltage (1kV to 75kV), high voltage (75kV to 230kV), extra high voltage (230kV to 500kV), and ultra-high voltage (above 500kV).

Construction Type Insights:

- Outdoor

- Indoor

- Others

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes outdoor, indoor, and others.

Insulation Type Insights:

- Air Insulated Switchgear

- Gas Insulated Switchgear

- Oil Insulated Switchgear

- Vacuum Insulated Switchgear

A detailed breakup and analysis of the market based on the insulation type have also been provided in the report. This includes air insulated switchgear, gas insulated switchgear, oil insulated switchgear, and vacuum insulated switchgear.

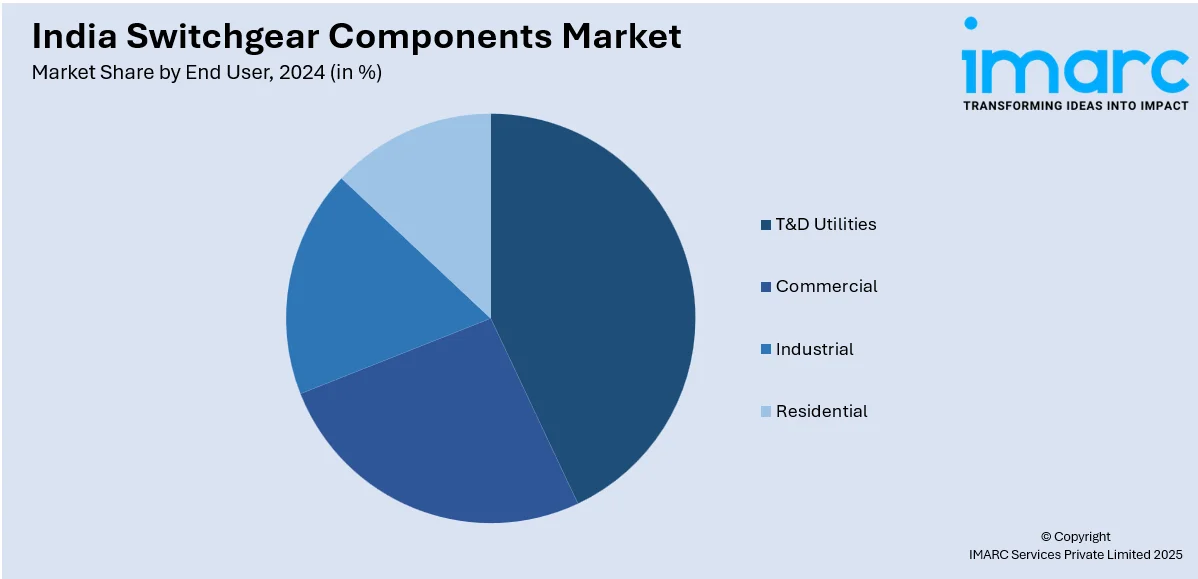

End User Insights:

- T&D Utilities

- Commercial

- Industrial

- Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes T&D utilities, commercial, industrial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Switchgear Components Market News:

- In September 2024, Orient Electric broadened its switchgear range with the introduction of Stella Neo MCBs in the mass premium segment. The MCBs are designed for improved safety, durability, and performance, with advanced technology and high short circuit breaking capacity, further consolidating the company's leadership in India's low-voltage switchgear market.

- In August 2024, Schneider Electric launched eight cutting-edge energy management and automation solutions during its Multi-city Innovation Days 2024 in Mumbai. The launch features new switchgear products, such as the BlokSeT Lean LV Switchboard and MasterPacT MTZ Active Circuit Breaker, promoting safety, efficiency, and sustainability in energy management.

India Switchgear Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Power Distributor Switch Breaker, Switch Disconnector, MCCB, HRC Fuse, Earth Switch, MCB |

| Voltage Types Covered | Low Voltage (Less Than 1kV), Medium Voltage (1kV to 75kV), High Voltage (75kV to 230kV), Extra High Voltage (230kV to 500kV), Ultra-High Voltage (Above 500kV) |

| Construction Types Covered | Outdoor, Indoor, Others |

| Insulation Types Covered | Air Insulated Switchgear, Gas Insulated Switchgear, Oil Insulated Switchgear, Vacuum Insulated Switchgear |

| End Users Covered | T&D Utilities, Commercial, Industrial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India switchgear components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India switchgear components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India switchgear components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The switchgear components market in India was valued at USD 2.23 Billion in 2024.

The India switchgear components market is projected to exhibit a CAGR of 5.47% during 2025-2033, reaching a value of USD 3.75 Billion by 2033.

The India switchgear components market is propelled by rising power infrastructure investments, rapid urbanization, and growing industrial electrification. Government initiatives like grid modernization and renewable energy expansion further boost demand. Increasing focus on energy efficiency and safety standards accelerates adoption across utilities, commercial buildings, and manufacturing sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)