India Syngas Market Size, Share, Trends and Forecast by Production Technology, Application, and Region, 2025-2033

India Syngas Market Overview:

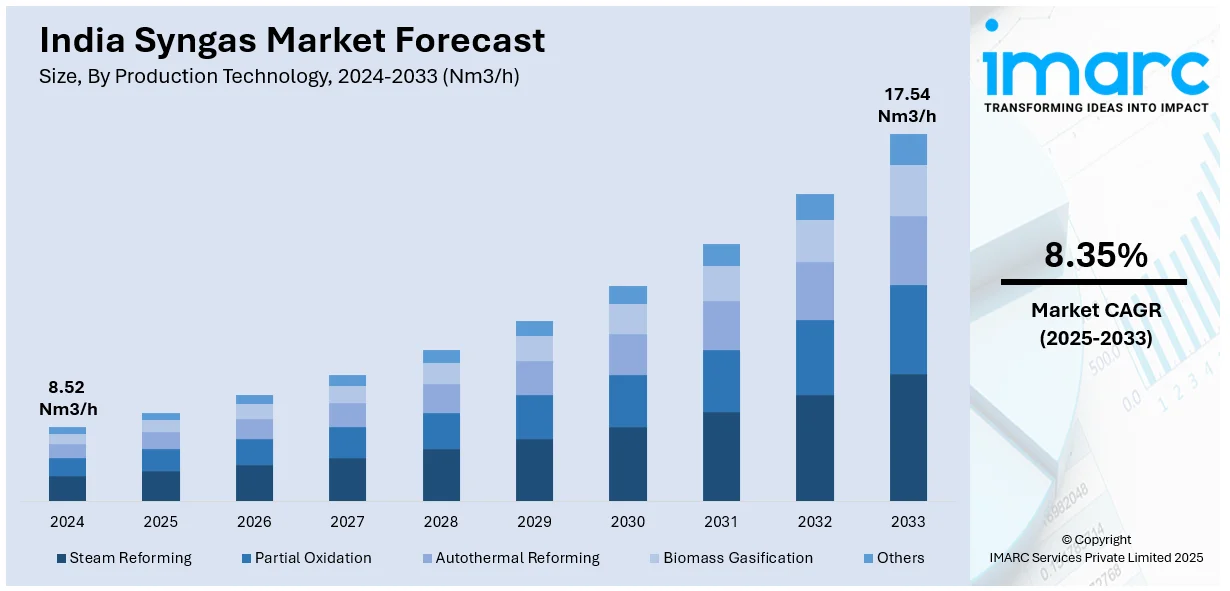

The India syngas market size reached 8.52 Nm3/h in 2024. Looking forward, IMARC Group expects the market to reach 17.54 Nm3/h by 2033, exhibiting a growth rate (CAGR) of 8.35% during 2025-2033. The India syngas market share is expanding, driven by for the rising demand for alternative fuel sources to reduce dependence on conventional fossil fuels, along with the growing reliance on syngas as a key feedstock for various chemical production processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 8.52 Nm3/h |

| Market Forecast in 2033 | 17.54 Nm3/h |

| Market Growth Rate (2025-2033) | 8.35% |

India Syngas Market Trends:

Growing demand for clean energy

The rising demand for clean energy is impelling the India syngas market growth. Government agencies are investing in clean energy projects to lower dependence on fuel fuels, which is positively influencing the market. In June 2024, the Government of India sanctioned a budget of USD 5.6 Million (INR 50 Crore) for every one of the four forthcoming green hydrogen valley initiatives in the nation. This monetary assistance was intended to encourage the advancement and utilization of clean energy technologies in India. Syngas, which can be produced from biomass and natural gas, is gaining popularity, as it provides a sustainable way to generate energy while minimizing emissions. With India focusing on reducing carbon footprints and achieving sustainability goals, syngas is becoming an important solution for power generation, fuel production, and hydrogen extraction. Industries are using it as a replacement for natural gas in industrial processes, and the growing adoption of gasification technologies is making production more efficient. Additionally, syngas is being explored as a potential feedstock for manufacturing synthetic natural gas, decreasing reliance on imported fuels. As energy demand continues to rise across industries, transportation, and households, syngas is emerging as a flexible solution to meet the need for cleaner energy in India.

To get more information on this market, Request Sample

Increasing applications in chemical industry

The rising applications in the chemical industry are offering a favorable India syngas market outlook. Syngas, a mixture of carbon monoxide, hydrogen, and carbon dioxide, is widely used in producing methanol, ammonia, and synthetic fuels, which are essential for fertilizers, plastics, and industrial chemicals. The growing demand for fertilizers in India’s agricultural sector is encouraging chemical companies to expand ammonia production, leading to a higher need for syngas. Methanol, another major derivative, is gaining importance in fuel blending and formaldehyde manufacturing. As industries look for cost-effective and reliable raw materials, syngas offers flexibility in utilizing various feedstocks like coal and biomass. The Indian government's initiatives to boost domestic chemical production and reduce reliance on imports further strengthen the demand for syngas. Additionally, advancements in gasification technologies are making syngas production more efficient and economically viable. With the chemical industry burgeoning and diversifying, syngas is being employed to meet the increasing demand for essential industrial chemicals, ensuring steady market growth in India. According to the IBEF, the Indian chemical market was valued at USD 220 Billion in 2024 and is set to grow to USD 300 Billion by 2030 and USD 1 Trillion by 2040.

India Syngas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on production technology and application.

Production Technology Insights:

- Steam Reforming

- Partial Oxidation

- Autothermal Reforming

- Biomass Gasification

- Others

The report has provided a detailed breakup and analysis of the market based on the production technology. This includes steam reforming, partial oxidation, autothermal reforming, biomass gasification, and others.

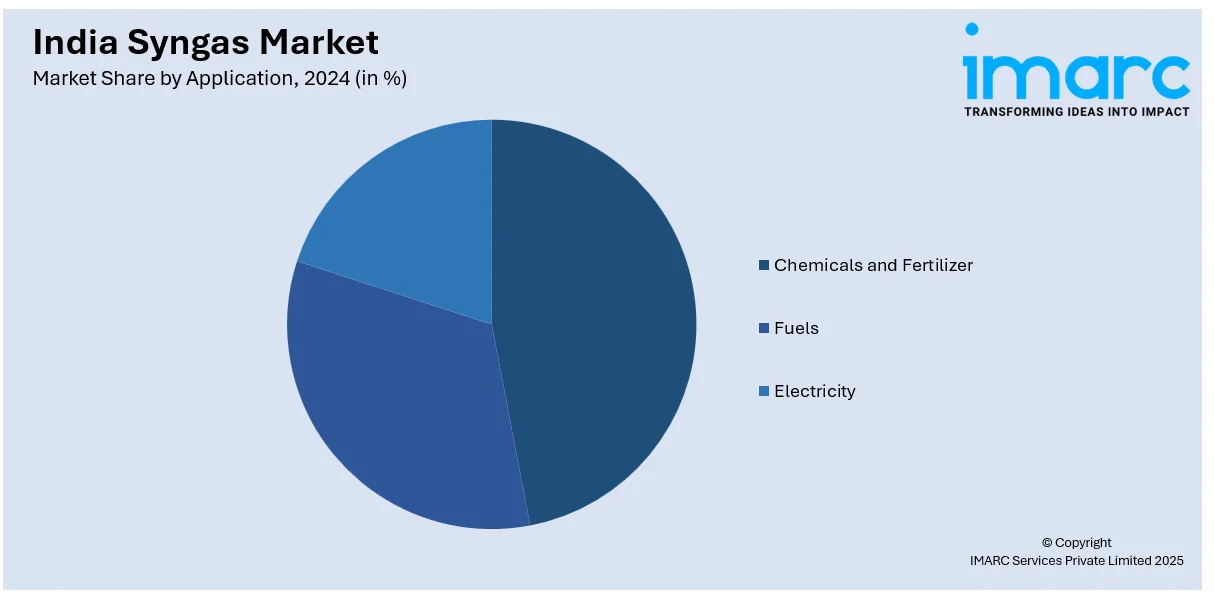

Application Insights:

- Chemicals and Fertilizer

- Fuels

- Electricity

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chemicals and fertilizer, fuels, and electricity.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Syngas Market News:

- In June 2024, Bharat Coal Gasification & Chemicals Limited (BCGCL) released a tender document to choose the LSTK-2 contractor for their ‘Coal to Ammonium Nitrate Project’ located in Odisha, India. The tender was related to the syngas purification plant and the ammonia synthesis gas plant, which were essential for refining syngas derived from coal gasification for ammonia manufacturing.

- In January 2024, the Cabinet Committee on Economic Affairs sanctioned Coal India Limited's (CIL) equity investments to establish joint venture firms with BHEL and GAIL, exceeding a 30% equity threshold. This initiative sought to showcase the economic and technical feasibility of gasification projects, encouraging markets for downstream products, and creating new economic value chains. To encourage coal gasification, the Ministry also provided a 50% revenue share rebate within commercial auction policies for gasification coal, formed a new sub-sector dedicated to syngas production, and granted long-term coal allocations to gasification facilities.

India Syngas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Nm3/h |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Technologies Covered | Steam Reforming, Partial Oxidation, Autothermal Reforming, Biomass Gasification, Others |

| Applications Covered | Chemicals and Fertilizer, Fuels, Electricity |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India syngas market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India syngas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India syngas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The syngas market in India reached 8.52 Nm3/h in 2024.

The India syngas market is projected to exhibit a CAGR of 8.35% during 2025-2033, reaching 17.54 Nm3/h by 2033.

The India syngas market is driven by rising demand for clean energy, increasing use of syngas in chemical production, and its role in reducing reliance on crude oil. Industrial expansion, coal gasification initiatives, and growth in power generation are also supporting market development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)