India Synthetic Leather Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Market Overview:

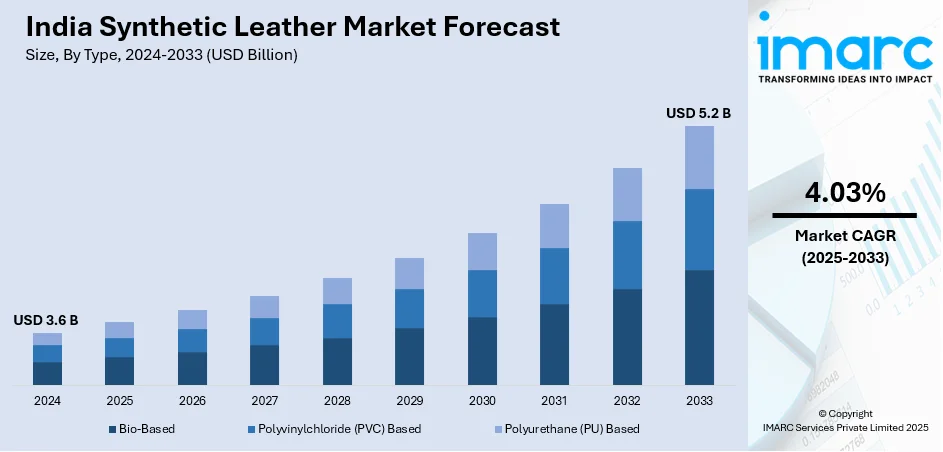

India synthetic leather market size reached USD 3.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The ongoing advancements in manufacturing technologies, which contribute to the improvement of synthetic leather quality, texture, and durability, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.6 Billion |

|

Market Forecast in 2033

|

USD 5.2 Billion |

| Market Growth Rate 2025-2033 | 4.03% |

Synthetic leather, also known as faux leather or artificial leather, is an artificial alternative to traditional animal-derived leather. It is crafted using various synthetic materials, such as polyurethane (PU) or polyvinyl chloride (PVC), to mimic the appearance and texture of genuine leather. Synthetic leather offers a cruelty-free and more sustainable option, reducing dependence on animal products and addressing environmental concerns associated with traditional leather production. This versatile material is used in the manufacturing of clothing, accessories, upholstery, and footwear. It often boasts durability, water resistance, and ease of maintenance. While synthetic leather provides an ethical choice for those seeking alternatives to animal-based products, ongoing efforts in R&D aim to enhance its eco-friendliness and overall sustainability in response to evolving consumer preferences and environmental considerations.

To get more information on this market, Request Sample

India Synthetic Leather Market Trends:

The synthetic leather market in India has witnessed robust growth in recent years, primarily driven by the escalating demand for eco-friendly and cruelty-free alternatives to traditional animal leather. Additionally, advancements in technology and manufacturing processes have significantly improved the quality and durability of synthetic leather, contributing to its expanding market share. Furthermore, the rising awareness of environmental sustainability and the adverse impact of conventional leather production on ecosystems have propelled consumers and industries alike to shift towards synthetic leather. Moreover, the fashion industry's increasing preference for synthetic leather in designing trendy and innovative products has further fueled market growth. The versatility of synthetic leather, allowing for a wide range of textures, colors, and finishes, has made it a favored choice among designers and manufacturers seeking creative flexibility. Furthermore, the cost-effectiveness of synthetic leather compared to genuine leather has attracted budget-conscious consumers, further stimulating market demand. In addition, government regulations promoting sustainable practices and discouraging the use of animal products have played a pivotal role in steering the synthetic leather market. These regulatory initiatives, coupled with the growing emphasis on corporate social responsibility, have prompted businesses to adopt synthetic leather alternatives, driving the market forward. In conclusion, a confluence of factors, including environmental consciousness, technological advancements, design flexibility, cost-effectiveness, and regulatory support, collectively propel the dynamic growth of the synthetic leather market in India.

India Synthetic Leather Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- Bio-Based

- Polyvinylchloride (PVC) Based

- Polyurethane (PU) Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes bio-based, polyvinylchloride (PVC) based, and polyurethane (PU) based.

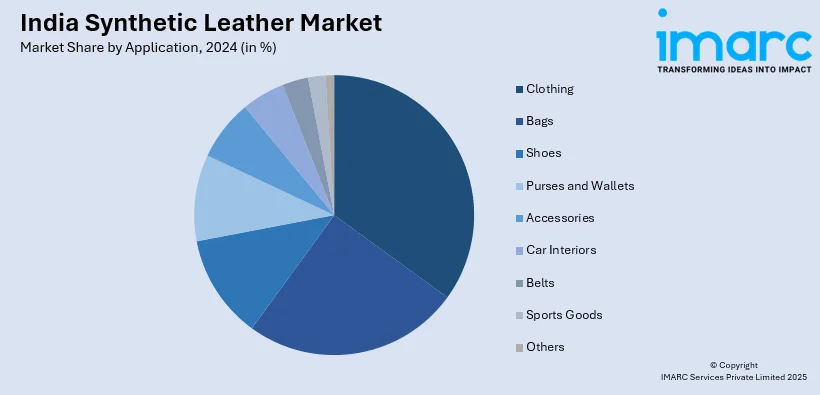

Application Insights:

- Clothing

- Bags

- Shoes

- Purses and Wallets

- Accessories

- Car Interiors

- Belts

- Sports Goods

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes clothing, bags, shoes, purses and wallets, accessories, car interiors, belts, sports goods, and others.

End Use Industry Insights:

- Footwear

- Furniture

- Automotive

- Textile

- Sports

- Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes footwear, furniture, automotive, textile, sports, electronics, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Synthetic Leather Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bio-Based, Polyvinylchloride (PVC) Based, Polyurethane (PU) Based |

| Applications Covered | Clothing, Bags, Shoes, Purses and Wallets, Accessories, Car Interiors, Belts, Sports Goods, Others |

| End Use Industries Covered | Footwear, Furniture, Automotive, Textile, Sports, Electronics, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India synthetic leather market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India synthetic leather market?

- What is the breakup of the India synthetic leather market on the basis of type?

- What is the breakup of the India synthetic leather market on the basis of application?

- What is the breakup of the India synthetic leather market on the basis of end use industry?

- What are the various stages in the value chain of the India synthetic leather market?

- What are the key driving factors and challenges in the India synthetic leather?

- What is the structure of the India synthetic leather market and who are the key players?

- What is the degree of competition in the India synthetic leather market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India synthetic leather market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India synthetic leather market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India synthetic leather industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)