India System Integration Market Size, Share, Trends and Forecast by Service, End Use Industry, and Region, 2025-2033

India System Integration Market Overview:

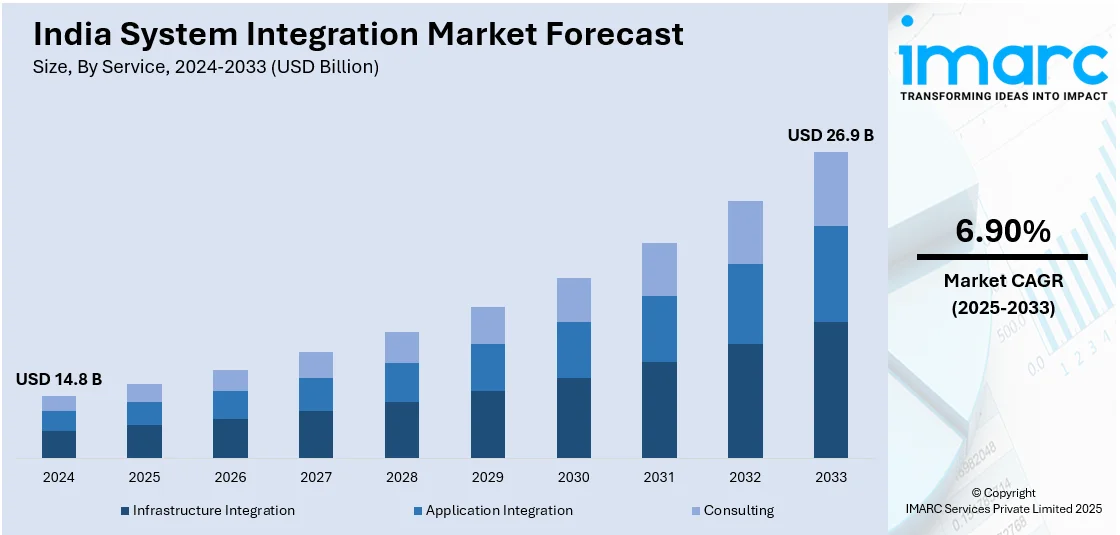

The India system integration market size reached USD 14.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. Rapid digital transformation initiatives, government-led infrastructure projects, growing cloud adoption, advancements in automation, increasing demand for seamless enterprise IT solutions, and the expansion of smart cities are key factors driving India's system integration market, fostering innovation, operational efficiency, and enhanced connectivity across industries, ultimately boosting economic growth and technological advancement.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.8 Billion |

| Market Forecast in 2033 | USD 26.9 Billion |

| Market Growth Rate 2025-2033 | 6.90% |

India System Integration Market Trends:

Digital Transformation Initiatives

India's collective push toward digitalization has been instrumental in fueling the expansion of the system integration market. The government's flagship initiative, Digital India, initiated in 2015, seeks to convert the nation into a digitally empowered society and knowledge economy. The program has contributed to an upsurge in the uptake of digital technologies across sectors, requiring strong system integration solutions to provide seamless interoperability between heterogeneous digital platforms. One of the keystone elements of this digital change is the Unified Payments Interface (UPI), designed by the National Payments Corporation of India (NPCI). UPI has changed the payment process by allowing for real-time transfer of money from one bank account to another via mobile phones. The usage of UPI has been phenomenal; in October 2021 itself, UPI registered transactions totaling INR 7.71 trillion, an elevation of 56% from the earlier month. Such geometric expansion highlights the indispensable necessity for system integration solutions in order to organize and normalize the enormous list of financial exchanges every day. In addition, the introduction of India Stack, an open API suite of comprehensive nature, has enabled the creation of a single software platform to bring India's population into the digital world. India Stack is composed of multiple layers, such as the Presenceless Layer (concerning the storage of biometric information), the Paperless Layer (linking individuals' records to digital identities), the Cashless Layer (meshing national banks and online accounts), and the Consent Layer (governing the protection and ownership of information). This infrastructure has provided governments, corporates, start-ups, and developers with a platform to create presence-less, paperless, and cashless solutions, thereby fueling demand for advanced system integration services in order to seamlessly integrate these myriad applications.

To get more information on this market, Request Sample

Development of Economic Corridors

The economic corridor development strategically has played a key role in expanding the system integration market in India. One of the examples is the East Coast Economic Corridor (ECEC), which is India's first coastal economic corridor and stretches about 2,500 kilometers along the east coast from Kolkata to Kanyakumari. Backed by the Asian Development Bank (ADB) with a $500 million investment, the ECEC seeks to integrate the domestic market and link the Indian economy with the dynamic value chains of Southeast and East Asia. The ECEC is composed of a number of centers of economic activity, connecting areas of resource abundance with new industrial clusters. This integration calls for the creation of effective multi-modal transport networks, strong information and communication technology (ICT) infrastructures, and streamlined regulatory regimes—all of which demand sophisticated system integration solutions. For example, the existence of a robust ICT sector in urban areas such as Kolkata, Visakhapatnam, Hyderabad, and Chennai helps support the communications infrastructure of the ECEC, offering a platform for developing skills and allowing the deployment of e-governance systems. In addition, the ECEC supports the government's Sagarmala project, which aims to enhance India's economic prowess along its seacoast by redeveloping ports, industrial parks along the coast, and inland logistics hubs. The effective implementation of these projects depends to a large extent on the integration of diverse systems such as transportation, logistics, urban development, and industrial operations, thus propelling the need for end-to-end system integration services.

India System Integration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service and end use industry.

Service Insights:

- Infrastructure Integration

- Application Integration

- Consulting

The report has provided a detailed breakup and analysis of the market based on the service. This includes infrastructure integration, application integration, and consulting.

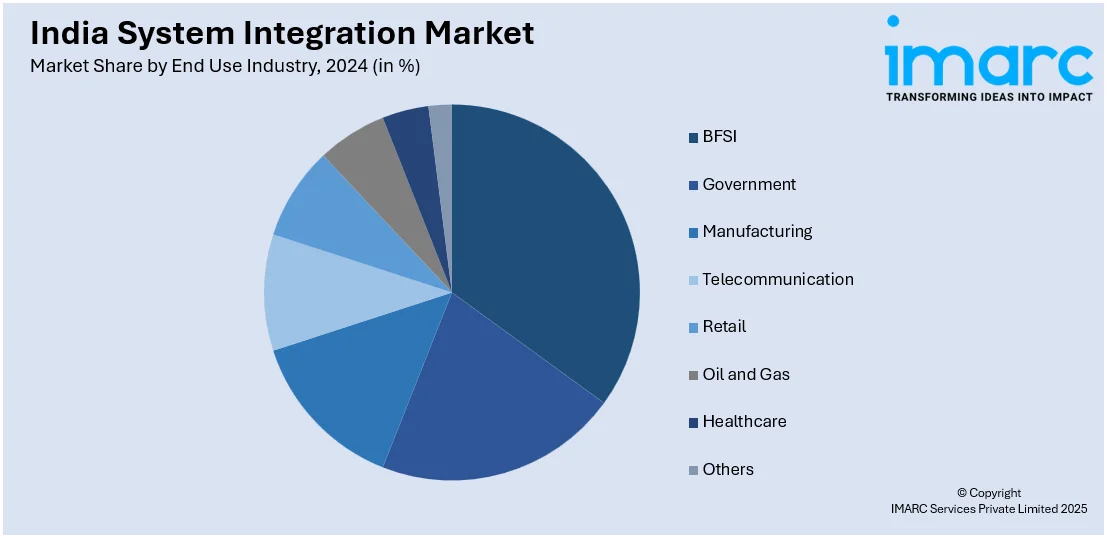

End Use Industry Insights:

- BFSI

- Government

- Manufacturing

- Telecommunication

- Retail

- Oil and Gas

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, government, manufacturing, telecommunication, retail, oil and gas, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India System Integration Market News:

- December 2024: ABB's System Integration Unit in Bengaluru exported 85% of its integrated analytical systems to overseas customers, including Argentina and the UAE. This success highlights India's expanding competence in system integration, further boosting its global image and encouraging additional investments. Such progress energizes the domestic system integration market by driving innovation and broadening service portfolios.

- October 2024: The Vistara-Air India merger is poised for system integration before its November deadline, ensuring smooth operational synchronization. This massive integration includes IT, customer service, and operational systems, fueling the need for sophisticated system integration solutions. The merger consolidates India's aviation infrastructure, stimulating the system integration market with higher technology investments.

India System Integration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure Integration, Application Integration, Consulting |

| End Use Industries Covered | BFSI, Government, Manufacturing, Telecommunication, Retail, Oil and Gas, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India system integration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India system integration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India system integration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The system integration market in the India was valued at USD 14.8 Billion in 2024.

The India system integration market is projected to exhibit a CAGR of 6.90% during 2025-2033, reaching a value of USD 26.9 Billion by 2033.

Rapid digital transformation, government-led infrastructure projects, expanding cloud adoption, advancements in automation, increasing demand for seamless enterprise IT systems, and the development of smart cities are the primary factors driving the India system integration market forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)