India Tartaric Acid Market Size, Share, Trends and Forecast by Type, Derivative, Application, and Region, 2025-2033

India Tartaric Acid Market Overview:

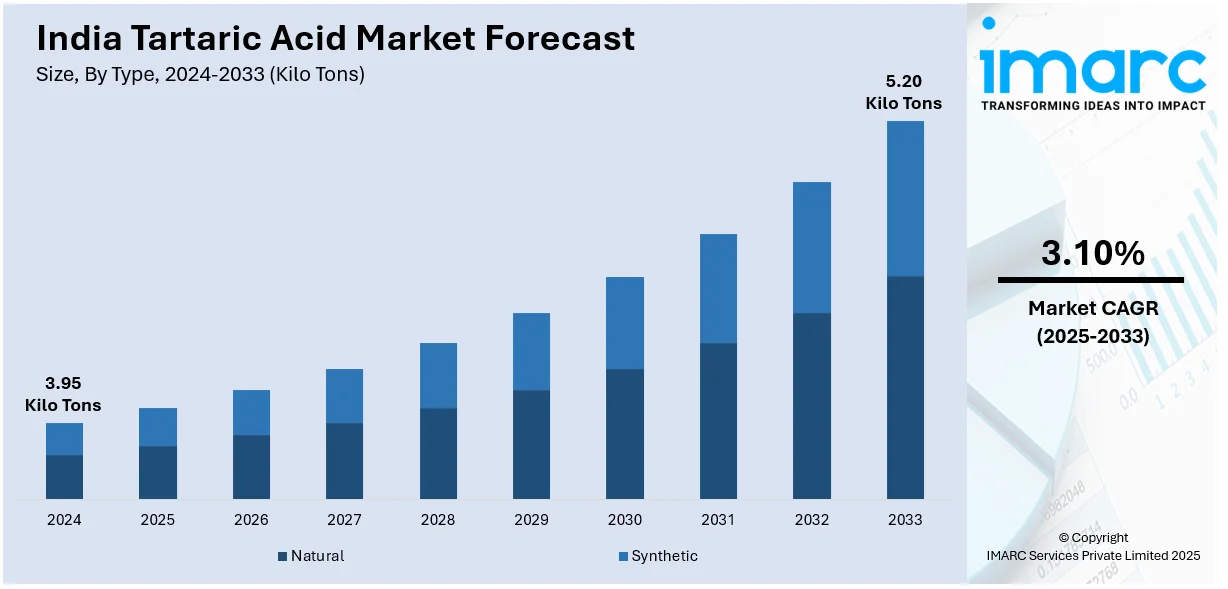

The India tartaric acid market size reached 3.95 Kilo Tons in 2024. Looking forward, IMARC Group expects the market to reach 5.20 Kilo Tons by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The India tartaric acid market share is expanding, driven by the increasing adoption of packaged and convenience food items, along with the rising usage of tartaric acid in the production of effervescent tablets and capsules to improve drug absorption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 3.95 Kilo Tons |

| Market Forecast in 2033 | 5.20 Kilo Tons |

| Market Growth Rate 2025-2033 | 3.10% |

India Tartaric Acid Market Trends:

Growing applications in food processing industry

The rising applications in the food processing industry are offering a favorable India tartaric acid market outlook. Tartaric acid is used by manufacturers as an acid, preservative, and stabilizer in a variety of food products. It improves the texture, flavor, and shelf life of processed food items, making it an essential ingredient in confectionery, bakery, and dairy goods. It is being employed in jams, jellies, and fruit juices to retain acidity and enhance stability, as packaged and convenience food products have become popular. Tartaric acid is utilized in the bakery industry to increase dough quality and leavening in bread and pastries. Another important contributor is the beverage sector, which adds tartaric acid to soft drinks, energy drinks, and flavored drinks for its sour flavor and stabilizing effects. Furthermore, the need for natural and organic food additives is increasing, leading food manufacturers to prefer tartaric acid over synthetic alternatives. As food safety rules have become more stringent, the demand for effective preservatives, such as tartaric acid is high. As India’s food processing industry continues to expand, the requirement for tartaric acid is growing, making it an essential component in various food item applications. As per the IBEF, the food processing industry in India is set to attain USD 735.5 Billion, at a CAGR of 8.8% during 2023-2032.

To get more information on this market, Request Sample

Rising demand in pharmaceuticals

The increasing demand in the pharmaceutical industry is impelling the India tartaric acid market growth. It is widely used in drug formulations for its stabilizing and solubility-enhancing properties. Many pharmaceutical companies employ tartaric acid in the production of effervescent tablets, syrups, and capsules to improve drug absorption and effectiveness. It acts as an excipient in various medications, helping to control pH levels and enhancing the taste of bitter drugs, making them more palatable for patients. With the rising cases of chronic diseases and the growing need for innovative drug formulations, the requirement for tartaric acid in the pharma sector is high. Additionally, its role in the production of antibiotics and certain cardiovascular drugs is driving the demand. The ongoing shift towards natural and organic ingredients in pharmaceutical products is also motivating manufacturers to utilize tartaric acid as a safer alternative to synthetic chemicals. As India’s pharmaceutical industry continues to thrive, the demand for tartaric acid is increasing significantly. According to the IMARC Group, the India pharmaceutical market is anticipated to attain USD 174.31 Billion by 2033, showing a CAGR of 11.32% from 2025-2033.

India Tartaric Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, derivative, and application.

Type Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the type. This includes natural and synthetic.

Derivative Insights:

- Potassium Tartrate (Cream of Tartar)

- Potassium Sodium Tartrate Tetrahydrate (Rochelle Salt)

- Tartar Emetic

- L-Tartaric Acid

- Others

A detailed breakup and analysis of the market based on the derivative have also been provided in the report. This includes potassium tartrate (cream of tartar), potassium sodium tartrate tetrahydrate (rochelle salt), tartar emetic, L-tartaric acid, and others.

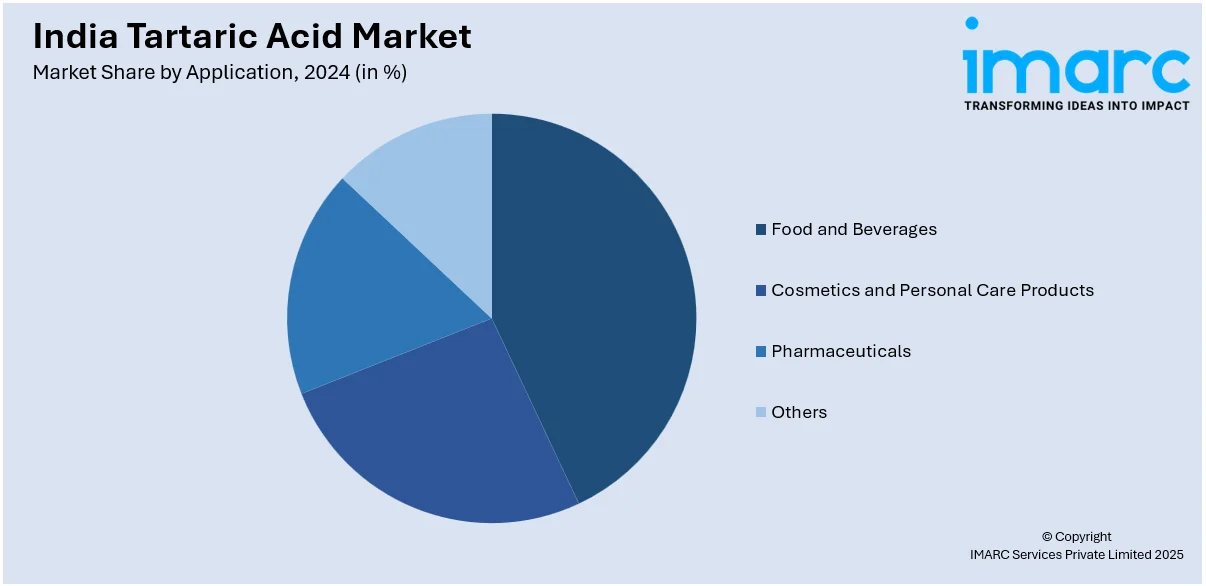

Application Insights:

- Food and Beverages

- Cosmetics and Personal Care Products

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, cosmetics and personal care products, pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tartaric Acid Market News:

- In July 2024, Adani Wilmar, a prominent multinational food and beverage (F&B) conglomerate based in India, purchased a 67% share in the specialty chemical firm, Omkar Chemicals. The latter ran a production facility in Panoli, Gujarat, India, with an output capacity of about 20,000 Tons annually of surfactants. It offered a range of 90 products, featuring inorganic ingredients, organic intermediates, such as tartaric acid derivatives, and numerous organic-inorganic items.

India Tartaric Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Synthetic |

| Derivatives Covered | Potassium Tartrate (Cream of Tartar), Potassium sodium tartrate tetrahydrate (Rochelle Salt), Tartar Emetic, L-Tartaric Acid, Others |

| Applications Covered | Food and Beverages, Cosmetics and Personal Care Products, Pharmaceuticals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India tartaric acid market performed so far and how will it perform in the coming years?

- What is the breakup of the India tartaric acid market on the basis of type?

- What is the breakup of the India tartaric acid market on the basis of derivative?

- What is the breakup of the India tartaric acid market on the basis of application?

- What is the breakup of the India tartaric acid market on the basis of region?

- What are the various stages in the value chain of the India tartaric acid market?

- What are the key driving factors and challenges in the India tartaric acid market?

- What is the structure of the India tartaric acid market and who are the key players?

- What is the degree of competition in the India tartaric acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tartaric acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tartaric acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tartaric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)