India Telecom Cloud Market Size, Share, Trends and Forecast by Type, Computing Services, Application, End User, and Region, 2026-2034

India Telecom Cloud Market Size and Share:

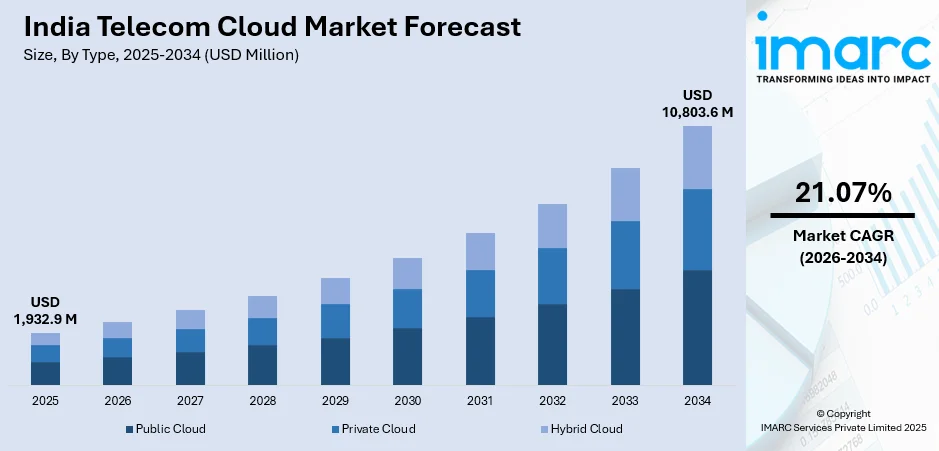

The India telecom cloud market size reached USD 1,932.9 Million in 2025. The market is expected to reach USD 10,803.6 Million by 2034, exhibiting a growth rate (CAGR) of 21.07% during 2026-2034. The market growth is driven in large part by demand for telecom cloud solutions that allow communications service providers to deliver innovative services and applications that improve overall customer experience. The faster proliferation of 5G with cloud technologies, growing virtualization and NFV (network function virtualization) adoption, cost-saving drivers, and the growth of the IoT ecosystem are also among the factors supporting market growth.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of type, the market has been divided into public cloud, private cloud, and hybrid cloud.

- On the basis of computing services, the market has been divided into SaaS, IaaS, and PaaS.

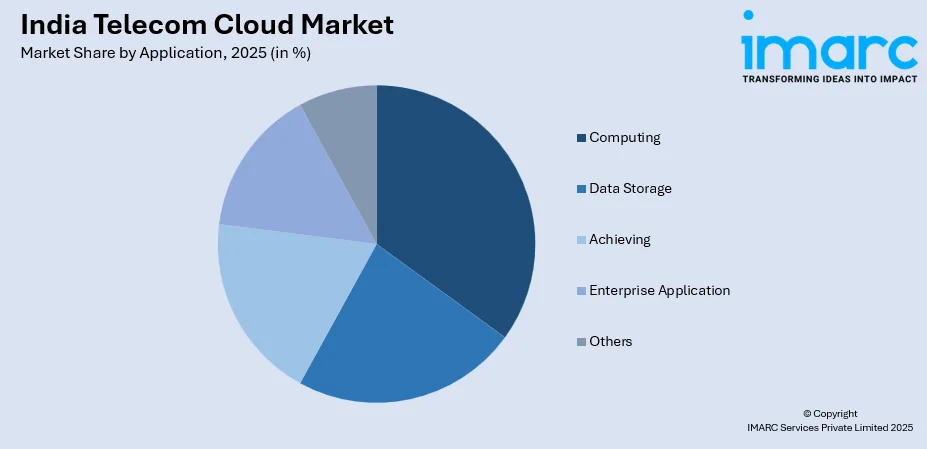

- On the basis of application, the market has been divided into computing, data storage, achieving, enterprise application, and others.

- On the basis of end user, the market has been divided into BFSI, retail, manufacturing, transportation and distribution, healthcare, government, media and entertainment, and others.

Market Size and Forecast:

- 2025 Market Size: USD 1,932.9 Million

- 2034 Projected Market Size: USD 10,803.6 Million

- CAGR (2026-2034): 21.07%

Telecom cloud refers to the virtualized and scalable infrastructure that enables telecommunications services to be delivered over the internet. It leverages cloud computing technologies to provide on-demand access to a shared pool of resources, such as computing power, storage, and networking, allowing telecom operators to optimize their operations and services. The telecom cloud facilitates the deployment of network functions and services in a more flexible and cost-effective manner, promoting agility and innovation within the telecommunications industry. This cloud-based approach enhances scalability, allowing operators to dynamically adjust resources based on demand. It also supports the transition to 5G and the implementation of network functions virtualization (NFV) and software-defined networking (SDN), enabling more efficient and responsive telecommunications infrastructure. In essence, the telecom cloud represents a transformative paradigm for delivering and managing telecommunications services in a highly dynamic and adaptable manner.

To get more information on this market, Request Sample

India Telecom Cloud Market Trends:

The telecom cloud market in India is experiencing robust growth, primarily driven by a confluence of factors that underscore the transformative nature of the telecommunications industry. Firstly, the escalating demand for high-speed connectivity and seamless communication across diverse devices propels telecom operators to adopt cloud-based solutions. Consequently, the integration of 5G networks, a pivotal driver in itself, synergizes with cloud technologies to unlock unprecedented levels of speed and efficiency. Moreover, the increasing trend towards virtualization and network function virtualization (NFV) within the telecom sector reinforces the ascendancy of cloud solutions. This transition towards virtualized infrastructure enables telecom operators to enhance their network agility, scalability, and resource optimization. Furthermore, the imperative to reduce operational expenditures and enhance overall cost-efficiency serves as an intrinsic driver, compelling telecom companies to leverage the cost advantages offered by cloud-based services. In parallel, the burgeoning Internet of Things (IoT) ecosystem further amplifies the demand for robust and flexible cloud infrastructure. As IoT devices increase, the need for scalable, secure, and latency-sensitive networks becomes paramount, positioning the telecom cloud market as a linchpin for facilitating seamless IoT connectivity. In essence, the interplay of these multifaceted drivers underscores the telecom cloud market's trajectory as an indispensable force shaping the future of telecommunications.

Hybrid Cloud Adoption, Enhanced Cybersecurity Focus, and Edge Computing-5G Synergy

The telecom cloud market size in India is witnessing accelerated adoption of hybrid cloud architectures as telecom operators seek to balance the cost-effectiveness of public cloud services with the security and control advantages of private cloud infrastructure, creating flexible deployment models that optimize both performance and compliance requirements. This hybrid approach enables telecommunications companies to maintain sensitive data and critical operations on private infrastructure while leveraging public cloud resources for scalable applications and non-critical workloads, resulting in enhanced operational efficiency and reduced capital expenditure, which is further expanding the India telecom cloud market share. Cybersecurity has emerged as a paramount concern driving significant investments in advanced security frameworks, multi-factor authentication systems, and real-time threat monitoring capabilities that protect against increasingly sophisticated cyber threats targeting telecommunications infrastructure and customer data. The convergence of edge computing and 5G technologies is creating unprecedented opportunities for ultra-low latency applications, autonomous systems, and real-time data processing capabilities that require distributed cloud architectures positioned closer to end users. This edge-5G synergy is particularly transformative for applications including autonomous vehicles, industrial IoT, augmented reality, and smart city implementations that demand instantaneous response times and massive data processing capabilities at the network edge.

Government Initiatives Accelerating Digital Infrastructure Development and Market Growth

The Indian government's comprehensive digital transformation initiatives are playing a pivotal role in accelerating the India telecom cloud market growth through strategic policy frameworks and substantial financial investments in digital infrastructure development. The BharatNet program, aimed at connecting all gram panchayats with high-speed broadband connectivity, is creating massive demand for scalable cloud infrastructure that can support rural connectivity and digital services across India's vast geographic landscape. The Production Linked Incentive (PLI) Scheme for Telecom is providing substantial financial incentives for domestic manufacturing of telecommunications equipment and infrastructure components, encouraging local production capabilities while reducing dependency on imports and fostering innovation in cloud-based telecommunications solutions. The National Broadband Mission, with its ambitious targets for broadband penetration and digital inclusion, is driving telecommunications operators to invest heavily in cloud infrastructure that can support the scaling requirements of nationwide connectivity initiatives. These government programs are complemented by regulatory frameworks that encourage private sector participation, foreign direct investment in telecommunications infrastructure, and the development of indigenous technologies that align with India's vision of becoming a global leader in digital communications and cloud-based telecommunications services.

Growth, Opportunities, and Challenges in the India Telecom Cloud Market:

Growth Drivers of the India Telecom Cloud Market

As per the India telecom cloud market analysis , the market is primarily driven by increasing demand for telecom cloud solutions that enable innovative services and enhanced customer experiences through scalable, virtualized infrastructure. The integration of 5G networks with cloud technologies creates unprecedented speed and efficiency opportunities, while the transition toward network function virtualization (NFV) and software-defined networking (SDN) enhances network agility and resource optimization. The burgeoning IoT ecosystem and imperative to reduce operational expenditures compel telecom companies to leverage cost-effective cloud-based services.

Opportunities in the India Telecom Cloud Market

Significant opportunities exist in hybrid cloud adoption that balances public cloud cost-effectiveness with private cloud security and control advantages, creating flexible deployment models for telecommunications operators. The convergence of edge computing and 5G technologies presents lucrative prospects for ultra-low latency applications, autonomous systems, and real-time data processing capabilities. Government initiatives including BharatNet, PLI Scheme for Telecom, and National Broadband Mission create substantial infrastructure development opportunities and policy support for market expansion.

Challenges in the India Telecom Cloud Market

The India telecom cloud market forecast indicates the industry facing challenges in managing enhanced cybersecurity requirements, including investments in advanced security frameworks and real-time threat monitoring capabilities to protect against sophisticated cyber threats. Also, the complexity of integrating legacy telecommunications infrastructure with modern cloud technologies requires significant technical expertise and capital investment. Regulatory compliance across diverse applications and the need to balance innovation with data privacy and security standards pose ongoing challenges for market participants.

India Telecom Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, computing services, application, and end user.

Type Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

The report has provided a detailed breakup and analysis of the market based on the type. This includes public cloud, private cloud, and hybrid cloud.

Computing Services Insights:

- SaaS

- IaaS

- PaaS

A detailed breakup and analysis of the market based on the computing services have also been provided in the report. This includes SaaS, IaaS, and PaaS.

Application Insights:

- Computing

- Data Storage

- Achieving

- Enterprise Application

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes computing, data storage, achieving, enterprise application, and others.

End User Insights:

- BFSI

- Retail

- Manufacturing

- Transportation and Distribution

- Healthcare

- Government

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes BFSI, retail, manufacturing, transportation and distribution, healthcare, government, media and entertainment, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- August 2025: Bharti Airtel announced the launch of Airtel Cloud, a new cloud platform and AI-powered software suite aimed at enterprises and telecom operators. The platform offers cloud infrastructure, workforce management, AI-driven customer interaction tools, and supports scalable, secure migration. Airtel partnered with Singtel, Globe Telecom, and Airtel Africa to expand adoption across regions.

- December 2024: The Indian government proposed introducing a new category of Cloud-hosted Telecom Network (CTN) Provider Authorization to foster telecom cloud infrastructure deployment and operator diversity under section 3(1)(b) of the Indian Telegraph Act. This initiative supports the growth of cloud-based telecom architecture in India.

India Telecom Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Computing Services Covered | SaaS, IaaS, PaaS |

| Applications Covered | Computing, Data Storage, Achieving, Enterprise Application, Others |

| End Users Covered | BFSI, Retail, Manufacturing, Transportation and Distribution, Healthcare, Government, Media and Entertainment, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India telecom cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the India telecom cloud market on the basis of type?

- What is the breakup of the India telecom cloud market on the basis of computing Services?

- What is the breakup of the India telecom cloud market on the basis of application?

- What is the breakup of the India telecom cloud market on the basis of end user?

- What are the various stages in the value chain of the India telecom cloud market?

- What are the key driving factors and challenges in the India telecom cloud?

- What is the structure of the India telecom cloud market and who are the key players?

- What is the degree of competition in the India telecom cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India telecom cloud market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India telecom cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India telecom cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)