India Telecom Equipment Market Size, Share, Trends and Forecast by Offering Product, Infrastructure, End User, and Region, 2025-2033

India Telecom Equipment Market Overview:

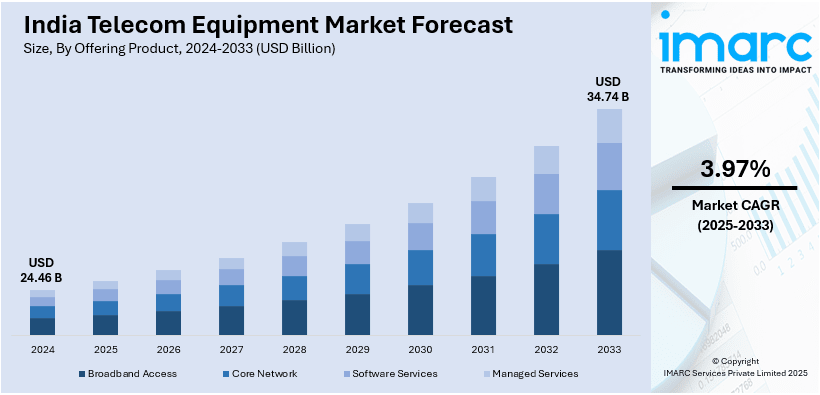

The India telecom equipment market size reached USD 24.46 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 34.74 Billion by 2033, exhibiting a growth rate (CAGR) of 3.97% during 2025-2033. The market is driven by the increasing investments in telecom infrastructure to support faster speeds and higher data capacity, along with the growing concerns about cybersecurity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.46 Billion |

| Market Forecast in 2033 | USD 34.74 Billion |

| Market Growth Rate 2025-2033 | 3.97% |

India Telecom Equipment Market Trends:

Expansion of 5G network

The expansion of the 5G network is fueling the India telecom equipment market growth. With companies rolling out 5G services, the demand for advanced telecom equipment, including fiber optic cables, small cells, routers, and base stations, is rising. The ongoing shift towards 5G requires massive investments in network expansion, encouraging telecom providers to buy new-age equipment that ensures better coverage and low latency. As more individuals and businesses are turning to 5G for seamless streaming, gaming, and cloud computing, telecom companies are being encouraged to scale up their networks, further driving the demand for high-tech telecom equipment. Government initiatives promoting ‘Make in India’ and incentives for local telecom equipment manufacturing are motivating domestic and international firms to wager on production. With industries like artificial intelligence (AI), the Internet of Things (IoT), and smart cities relying on 5G connectivity, the need for robust telecom infrastructure continues to grow, making the telecom equipment market one of the fastest-expanding sectors in India. As per the data released by Nokia, in India, the number of 5G subscribers is projected to increase from 290 Million in 2024 to 770 Million by 2028.

To get more information on this market, Request Sample

Growing cybersecurity concerns

The rising cybersecurity concerns are offering a favorable India telecom equipment market outlook. With the increasing number of cyberattacks, telecom companies are investing in secure network infrastructure to protect against cyber threats, data breaches, and hacking attempts. As per industry reports, in 2024, India experienced an increase in cyber attacks, inculcating BSNL's data breaches, Angel One's personal information leak, and WazirX's hack of USD 235 Million. Around INR 12,000 Crore was lost to fraud, with a significant focus on the hospitality, banking, and healthcare sectors. Tamil Nadu, Telangana, and Bengaluru were the leading locations for attacks. With the rollout of 5G networks, increasing internet penetration, and the rise of IoT devices, telecom providers need advanced security-focused equipment like firewalls, encrypted routers, and AI-based threat detection systems to safeguard their networks. Cyberattacks on telecom infrastructure can disrupt services and compromise user data, making cybersecurity a top priority. The Indian government has also introduced stricter regulations and data protection laws, encouraging telecom companies to upgrade their equipment to adhere to security standards. As businesses and people rely more on digital payments, cloud computing, and smart devices, telecom networks must be resilient against cyber threats, leading to higher demand for next-gen telecom equipment with built-in security features. Additionally, India is focusing on domestic manufacturing of reliable telecom equipment, reducing dependence on foreign suppliers to ensure national security. Enterprises, financial institutions, and small businesses are demanding encrypted communication networks, further impelling the market growth.

India Telecom Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on offering product, infrastructure, and end user.

Offering Product Insights:

- Broadband Access

- Core Network

- Software Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the offering product. This includes broadband access, core network, software services, and managed services.

Infrastructure Insights:

- Wireless Infrastructure

- Wired Infrastructure

A detailed breakup and analysis of the market based on the infrastructure have also been provided in the report. This includes wireless infrastructure and wired infrastructure.

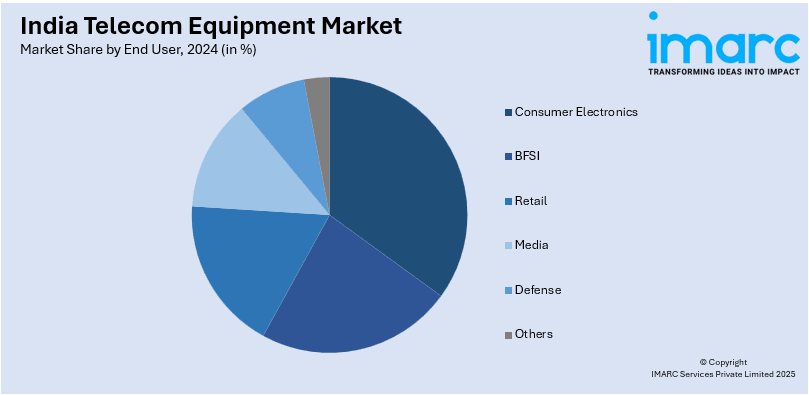

End User Insights:

- Consumer Electronics

- BFSI

- Retail

- Media

- Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes consumer electronics, BFSI, retail, media, defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Telecom Equipment Market News:

- In February 2025, Starlink Internet was set to launch as the government introduced new regulations for satellite devices. The DoT established standards and assessment measures for 14 categories of telecommunication equipment, which included non-geostationary orbit (NGSO) satellite devices, such as integrated gateways and user terminals.

- In January 2025, the Indian Government revealed plans to introduce a new incentive scheme to enhance domestic manufacturing of telecom equipment. The initiative aimed to focus on non-electronic telecom equipment, including antennas, plastic components, fibers, and connected accessories.

India Telecom Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offering Products Covered | Broadband Access, Core Network, Software Services, Managed Services |

| Infrastructures Covered | Wireless Infrastructure, Wired Infrastructure |

| End Users Covered | Consumer Electronics, BFSI, Retail, Media, Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India telecom equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India telecom equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India telecom equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom equipment market in India was valued at USD 24.46 Billion in 2024.

The India telecom equipment market is projected to exhibit a CAGR of 3.97% during 2025-2033, reaching a value of USD 34.74 Billion by 2033.

5G rollout, government production-linked incentives, rising local manufacturing, growing internet users, increased rural network expansion, rising smartphone penetration, cost competitiveness, security concerns driving indigenization, foreign direct investment, and demand for advanced broadband solutions are pushing India’s telecom equipment market upward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)