India Telecom Market Size, Share, Trends and Forecast by Services, and Region, 2026-2034

India Telecom Market Summary:

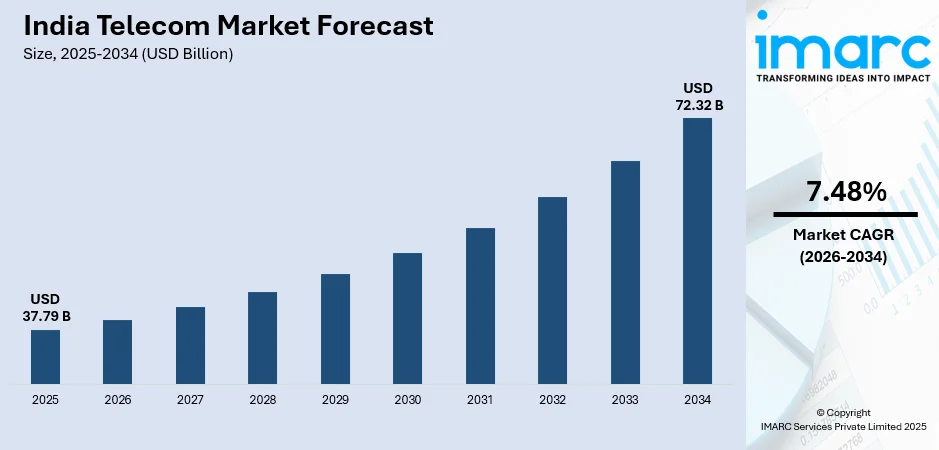

The India telecom market size was valued at USD 37.79 Billion in 2025 and is projected to reach USD 72.32 Billion by 2034, growing at a compound annual growth rate of 7.48% from 2026-2034.

In India, the market expansion is driven by widespread smartphone adoption, affordable data plans, and transformative government initiatives. The rapid deployment of 5G infrastructure, expanding rural connectivity through BharatNet, and rising demand for digital content are catalyzing robust growth across the sector. Cloud computing solutions, video streaming services, and mobile payment platforms are accelerating consumer engagement, while enterprise adoption of advanced connectivity solutions continues to broaden. The proliferation of Internet of Things (IoT) applications across manufacturing, healthcare, and agriculture further strengthens the market share.

Key Takeaways and Insights:

-

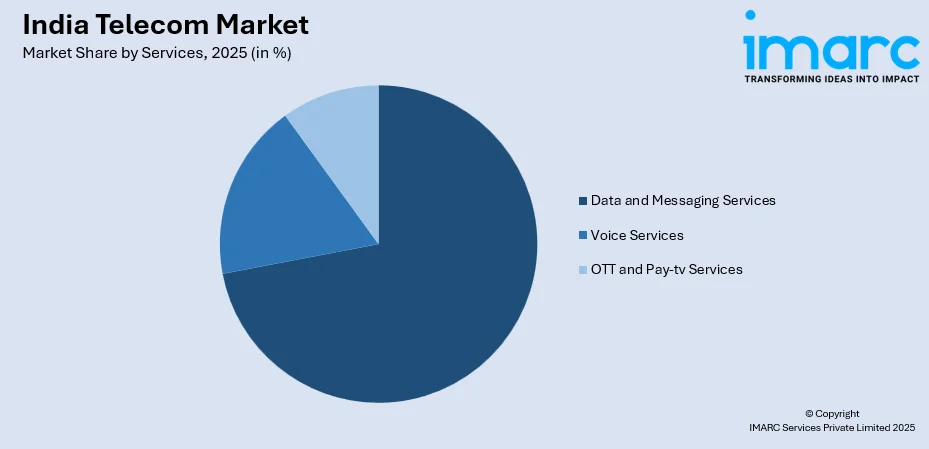

By Services: Data and messaging services dominate the market with a share of 72% in 2025, owing to exponential growth in mobile internet consumption, proliferation of video streaming platforms, and widespread adoption of digital payment solutions. Affordable data tariffs and expanding 4G/5G coverage continue to fuel subscriber acquisition across urban and rural demographics.

-

By Region: North India leads the market with a share of 28% in 2025, driven by the concentration of population in major metropolitan areas like Delhi-NCR, substantial enterprise connectivity requirements, and robust infrastructure investments by leading telecom operators seeking to capture the high-density subscriber base.

-

Key Players: Key players drive the India telecom market by expanding network infrastructure, investing in 5G rollouts, and developing bundled service offerings. Their strategic focus on rural connectivity, enterprise solutions, and digital ecosystem integration strengthens market penetration and subscriber retention.

To get more information on this market Request Sample

The India telecom industry is experiencing transformative growth, underpinned by supportive government policies, massive infrastructure investments, and evolving consumer preferences towards digital services. The Digital India initiative has significantly enhanced connectivity across underserved regions, attracting substantial investments in domestic telecom equipment manufacturing. The sector has witnessed remarkable expansion in broadband penetration, with subscriptions increasing from 6.1 Crore in March 2014 to 99.56 Crore in 2025, a growth of 1,532.13%. The accelerated rollout of 5G services across metropolitan areas and tier-two cities is creating new opportunities for enterprise applications, fixed wireless access services, and immersive digital experiences that are reshaping consumer engagement patterns. Additionally, rising adoption of cloud services, IoT solutions, and digital payments is strengthening data traffic growth across networks. Telecom operators are increasingly focusing on network modernization and service innovation to capture value from India’s expanding digital economy.

India Telecom Market Trends:

Accelerated 5G Network Expansion and Monetization

The rapid deployment of 5G infrastructure across India represents a pivotal trend reshaping the telecommunications landscape. As per IMARC Group, the India 5G services market size reached USD 663.87 Million in 2024. Major service providers have aggressively expanded network coverage, targeting population-dense metropolitan areas and progressively extending services to smaller cities. Fixed wireless access solutions are emerging as viable alternatives for broadband connectivity in underserved regions, while enterprise adoption of private 5G networks continues to gain momentum across the manufacturing and healthcare sectors.

Rising Satellite Communication Integration

Satellite-based connectivity solutions are gaining prominence as transformative enablers for bridging the digital divide across remote and geographically challenging terrains. The government's administrative allocation of satcom spectrum has attracted multiple international players seeking market entry, while domestic operators are forging strategic partnerships to integrate satellite backhaul capabilities. These collaborations are positioning satellite connectivity as a complementary technology to terrestrial networks, expanding addressable markets.

Digital Infrastructure and Data Center Expansion

The proliferation of cloud services, artificial intelligence (AI) applications, and streaming platforms is driving substantial investments in data center infrastructure across India, fueling the telecom market expansion. In October 2025, Adani Enterprises, in collaboration with its joint venture AdaniConneX, and Google unveiled a significant partnership to create India's largest AI data center campus and new renewable energy facilities in Visakhapatnam, Andhra Pradesh. Google's AI center in Visakhapatnam represents a diverse investment of around USD 15 Billion over five years (2026-2030), including gigawatt-scale data center activities. Hyperscale facilities are being developed in major metropolitan areas to support the escalating demand for low-latency computing and storage solutions. The convergence of telecom and cloud services is creating integrated digital platforms that offer comprehensive connectivity, computing, and content delivery capabilities to enterprise and consumer segments alike.

Market Outlook 2026-2034:

The India telecom market outlook remains robustly positive, supported by favorable demographic trends, accelerating digitalization across industries, and sustained government commitment to infrastructure development. The market generated a revenue of USD 37.79 Billion in 2025 and is projected to reach a revenue of USD 72.32 Billion by 2034, growing at a compound annual growth rate of 7.48% from 2026-2034. The proliferation of enterprise connectivity solutions, rising average revenue per user (ARPU) from premium service adoption, and expanding rural penetration through BharatNet are anticipated to drive sustained revenue growth throughout the forecast period.

India Telecom Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Services | Data and Messaging Services | 72% |

| Region | North India | 28% |

Services Insights:

Access the comprehensive market breakdown Request Sample

- Voice Services

- Wired

- Wireless

- Data and Messaging Services

- OTT and Pay-tv Services

Data and messaging services dominate with a market share of 72% of the total India telecom market in 2025.

The data and messaging services segment commands market leadership, driven by the exponential growth in mobile internet consumption across all demographic segments. Mobile data consumption surged dramatically, with India leading globally at 32 GB per smartphone per month, according to the June 2025 edition of the Ericsson Mobility Report. The proliferation of affordable smartphones and competitive data tariffs has democratized digital access, enabling hundreds of millions of users to consume streaming content, utilize digital payment platforms, and engage with social media applications.

The segment's dominance reflects evolving consumer preferences towards bandwidth-intensive applications, including video streaming, online gaming, and cloud-based productivity tools. Enterprise adoption of cloud computing solutions, unified communications platforms, and IoT applications has further accelerated demand for high-capacity data services. The introduction of 5G networks has enhanced the value proposition for premium data offerings, enabling operators to monetize advanced capabilities through differentiated pricing strategies.

Regional Insights:

- North India

- South India

- West and Central India

- East and Northeast India

North India leads with a share of 28% of the total India telecom market in 2025.

North India maintains market leadership, underpinned by the concentration of population and economic activities in Delhi-NCR and surrounding states. As per macrotrends, in 2024, the population of the Delhi metro area reached 33,807,000, reflecting a 2.63% rise compared to 2023. The region benefits from extensive network infrastructure investments by leading telecom operators, with high-density urban areas enabling efficient network deployment and rapid subscriber acquisition. Enterprise connectivity requirements from corporate headquarters, government institutions, and emerging technology startups contribute significantly to regional revenue generation.

The expansion of broadband connectivity across tier-two and tier-three cities in North India is accelerating digital adoption among previously underserved populations. Government initiatives targeting rural connectivity have enhanced network availability across agricultural regions, enabling farmers and small businesses to access digital services and e-commerce platforms. Rural tele-density across northern states has improved substantially, reflecting the success of infrastructure deployment programs and affordable service offerings. The convergence of improving affordability and expanding coverage continues to strengthen regional market penetration.

Market Dynamics:

Growth Drivers:

Why is the India Telecom Market Growing?

Accelerated 5G Infrastructure Deployment

The rapid nationwide rollout of 5G services constitutes a transformative growth driver, enabling advanced applications and premium service monetization. India has achieved one of the fastest 5G deployments globally, with services becoming available across all states and union territories. The 5G infrastructure market demonstrates exceptional growth potential, with major operators having deployed over 500,000 base transceiver stations by late 2025. The subscriber base for 5G services is projected to expand substantially, driven by increasing smartphone affordability and the proliferation of 5G-enabled devices in the market. Fixed wireless access offerings built on 5G infrastructure are creating new revenue streams while providing broadband alternatives in areas lacking fiber connectivity. Additionally, 5G is enabling enterprise-focused use cases, such as private networks, smart factories, and real-time analytics applications. These capabilities are strengthening operator revenue diversification and accelerating India’s transition towards a digitally connected economy.

Rising Digital Services Consumption

The explosive growth in digital services consumption across entertainment, commerce, and financial applications continues to drive telecom infrastructure demand. India's app usage recorded substantial rise, with time spent surging to 1.12 Trillion hours in 2024, reflecting deepening digital engagement across the population. The proliferation of streaming platforms, mobile gaming applications, and social media services has generated unprecedented data traffic, requiring continuous network capacity expansion. Enterprise digitalization is simultaneously accelerating demand for high-speed connectivity, with organizations increasingly adopting cloud-based applications, unified communications platforms, and IoT solutions. Digital payment adoption has reached remarkable scale, compelling telecom operators to invest in fiberization, data centers, and advanced network optimization technologies. Sustained digital consumption growth is also encouraging service innovations, including bundled data plans and enterprise connectivity solutions.

Supportive Government Policies and Digital Initiatives

Supportive government policies strongly drive the India telecom market by encouraging investments, expansion, and innovations. National digital initiatives promote broadband access, rural connectivity, and technology adoption across public services. Policy focus on domestic manufacturing strengthens telecom equipment supply chains and reduces import dependence. Infrastructure sharing reforms and streamlined approvals help lower deployment costs and accelerate rollout timelines. Government-backed digitization of governance, healthcare, education, and financial services stimulates sustained connectivity demand. Spectrum policy reforms and long-term payment options improve financial viability for operators. Emphasis on digital inclusion ensures telecom services reach remote and underserved regions. By aligning telecom development with broader economic growth and digital transformation goals, government support enhances investor confidence and accelerates market expansion. This policy-driven ecosystem remains a critical enabler of long-term growth in the India telecom sector.

Market Restraints:

What Challenges the India Telecom Market is Facing?

Infrastructure Deployment Challenges in Remote Regions

There are major operational and financial obstacles to network expansion in geographically difficult terrain, including hilly regions, deep forests, and sparsely populated places. Improvements in connectivity in these underserved areas are nevertheless hampered by limited power infrastructure, challenging terrain access, and reduced return on investment (ROI) considerations. These difficulties exacerbate the connectivity divide between urban and rural residents and impede efforts to promote digital inclusion in rural areas.

Spectrum Costs and Regulatory Compliance

Reinvestment capacity is impacted by large amounts of operator revenue being absorbed by regulatory levies and substantial spectrum purchase expenses. Smaller operators are more affected by these financial burdens, which may have an impact on decisions about network growth, particularly in financially marginal areas where payback periods are longer. High compliance costs can limit the flexibility of long-term network planning methods and postpone technological advancements.

Cybersecurity and Data Privacy Risks

Telecom networks are more vulnerable to cybersecurity threats and data privacy hazards as a result of increased digitization. Operators have to make significant investments in fraud prevention, network security, and data protection compliance. Cyber events can increase the complexity and expense of telecom operations in India by disrupting services, undermining consumer trust, and resulting in regulatory penalties. The intricacy of cloud-based network architectures and 5G security makes them even more susceptible to sophisticated intrusions. Inadequate handling of these risks may lead to long-term client attrition, service interruptions, and reputational harm.

Competitive Landscape:

The India telecom market exhibits an oligopolistic structure, with multiple private operators collectively commanding substantial market share. Competitive dynamics have shifted from price-based differentiation towards network quality, ecosystem integration, and value-added service offerings. Operators are investing aggressively in infrastructure expansion, digital platform development, and strategic partnerships to strengthen market positioning. The state-owned operator has undertaken significant network modernization through indigenous technology deployment, introducing competitive dynamics in previously underserved segments. Enterprise connectivity solutions, private 5G networks, and satellite integration are emerging as key battlegrounds for differentiation.

Recent Developments:

-

In December 2025, the National Highways Authority of India (NHAI) signed a memorandum of understanding with Reliance Jio to deploy a telecom-based highway safety alert system across national highways. The collaboration will leverage Jio’s 4G/5G networks to deliver real-time safety warnings to travelers, enhancing road safety through intelligent communication infrastructure.

India Telecom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India telecom market size was valued at USD 37.79 Billion in 2025.

The India telecom market is expected to grow at a compound annual growth rate of 7.48% from 2026-2034 to reach USD 72.32 Billion by 2034.

Data and messaging services dominated the market with a share of 72%, driven by exponential mobile data consumption, proliferation of streaming platforms, and widespread digital payment adoption.

Key factors driving the India telecom market include expanding urban connectivity, accelerated 5G infrastructure deployment, rising digital services consumption, supportive government policies, and increasing enterprise digitalization. Growing smartphone penetration and affordable data plans are further amplifying subscriber engagement and data usage.

Major challenges include infrastructure deployment difficulties in remote regions, substantial spectrum acquisition costs, regulatory compliance burdens, and the need for continuous network modernization investments. Intense price competition further strains operator profitability and funding capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)