India Telehandler Market Size, Share, Trends and Forecast by Product, Type, Ownership, Height, Capacity, Application, and Region, 2025-2033

India Telehandler Market Size and Share:

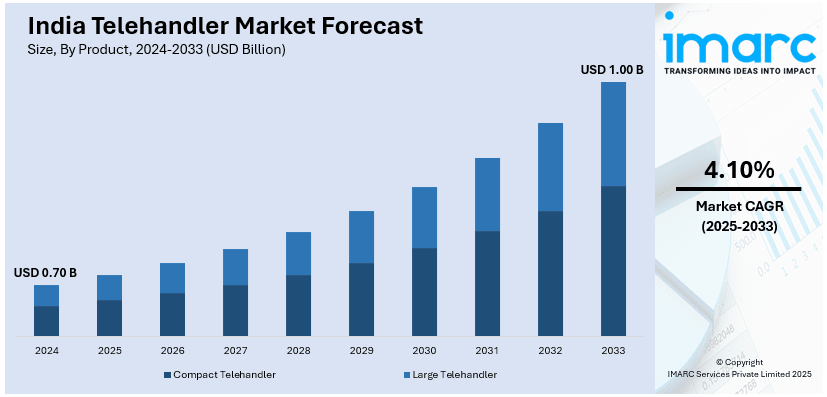

The India telehandler market size reached USD 0.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.00 Billion by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is driven by rapid infrastructure development, government initiatives including smart cities, and increased construction activities. The demand for versatile, cost-effective material-handling equipment, coupled with the trend of mechanization, fuels the India telehandler share. Additionally, the rising preference for rental services among SMEs due to high ownership costs further propels market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.70 Billion |

| Market Forecast in 2033 | USD 1.00 Billion |

| Market Growth Rate (2025-2033) | 4.10% |

India Telehandler Market Trends:

Increasing Adoption in Construction and Infrastructure Development

The increasing adoption of telehandlers in the construction and infrastructure sectors is creating a positive India telehandler market outlook. With the Indian government’s focus on infrastructure development, including projects such as smart cities, highways, and affordable housing, the demand for versatile and efficient material-handling equipment has accelerated. For instance, the Indian government allocated ₹11 Lakh Crore (approximately USD 134.15 Billion) for infrastructure in 2024. These steps include the laying of 2,031 km of fresh railway lines, the construction of 6,000 km of national highways, and the expansion of telecommunications services to 10,700 villages, improving connectivity and manufacturing capabilities. The Union Minister states that India is emerging as an economic powerhouse with the highest growth rate of 6.5 percent in the world against the global average of 3.2 percent. Additionally, telehandlers, known for their ability to lift, move, and place materials with precision, are becoming a preferred choice for contractors and builders. Their multifunctionality, which allows them to replace multiple pieces of equipment, reduces operational costs and enhances productivity. Additionally, the growing trend of mechanization in construction activities to meet tight project deadlines is further enhancing the market. Manufacturers are also introducing advanced telehandlers with improved load capacity, reach, and fuel efficiency, catering to the changing needs of the industry. This trend is expected to continue as infrastructure projects expand across the country.

To get more information on this market, Request Sample

Rising Demand for Rental Telehandlers

The increasing demand for rental services is significantly supporting the India telehandler market growth. Small and medium-sized enterprises (SMEs) and contractors are increasingly opting to rent telehandlers rather than purchase them outright, primarily due to the high initial investment and maintenance costs associated with ownership. Renting provides flexibility, allowing businesses to access the latest models and technologies without incurring significant capital expenditure. This trend is particularly prominent in regions with sporadic construction activities or short-term projects. Rental companies are expanding their fleets to include telehandlers with varying specifications to cater to diverse customer requirements. Furthermore, the growing awareness of the benefits of renting, such as reduced downtime and access to well-maintained equipment, is driving this trend. As the construction industry continues to grow, the rental market for telehandlers is expected to witness robust growth, making it a key segment in the overall market landscape. According to a research report by IMARC Group, the market size of construction equipment in India was USD 14.3 Billion in 2024. The market is anticipated to reach USD 29.5 Billion by 2033, at a CAGR of 7.6% during the forecast period 2025-2033.

India Telehandler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, type, ownership, height, capacity, and application.

Product Insights:

- Compact Telehandler

- Large Telehandler

The report has provided a detailed breakup and analysis of the market based on the product. This includes compact telehandler and large telehandler.

Type Insights:

- Rotating

- Non-rotating

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes rotating and non-rotating.

Ownership Insights:

- Rental

- Personal

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes rental and personal.

Height Insights:

- Less Than 50 ft

- 50 ft and Above

A detailed breakup and analysis of the market based on the height have also been provided in the report. This includes less than 50 ft and 50 ft and above.

Capacity Insights:

- Below 3 Tons

- 3-10 Tons

- Above 10 Tons

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes below 3 tons, 3-10 tons, and above 10 tons.

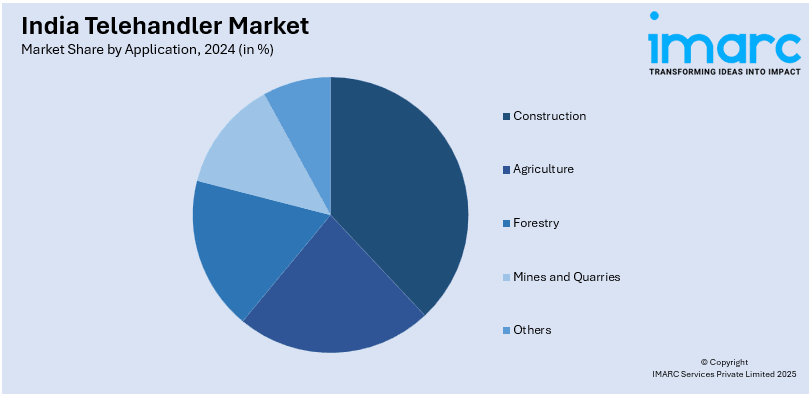

Application Insights:

- Construction

- Agriculture

- Forestry

- Mines and Quarries

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction, agriculture, forestry, mines and quarries, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Telehandler Market News:

- 18 January 2024: A leading construction equipment manufacturer, SANY India, has achieved a significant milestone by exporting over 1,000 telehandlers to the United States. This accomplishment aligns with the Indian government's 'Make in India' initiative and solidifies India's role as a key manufacturing hub in the company's global strategy.

India Telehandler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Compact Telehandler, Large Telehandler |

| Types Covered | Rotating, Non-rotating |

| Ownerships Covered | Rental, Personal |

| Heights Covered | Less Than 50 ft, 50 ft and Above |

| Capacities Covered | Below 3 Tons, 3-10 Tons, Above 10 Tons |

| Applications Covered | Construction, Agriculture, Forestry, Mines and Quarries, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India telehandler market performed so far and how will it perform in the coming years?

- What is the breakup of the India telehandler market on the basis of product?

- What is the breakup of the India telehandler market on the basis of type?

- What is the breakup of the India telehandler market on the basis of ownership?

- What is the breakup of the India telehandler market on the basis of height?

- What is the breakup of the India telehandler market on the basis of capacity?

- What is the breakup of the India telehandler market on the basis of application?

- What is the breakup of the India telehandler market on the basis of region?

- What are the various stages in the value chain of the India telehandler market?

- What are the key driving factors and challenges in the India telehandler market?

- What is the structure of the India telehandler market and who are the key players?

- What is the degree of competition in the India telehandler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India telehandler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India telehandler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India telehandler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)