India Telesurgery Market Size, Share, Trends and Forecast by Component, Application, End Use, and Region, 2025-2033

India Telesurgery Market Overview:

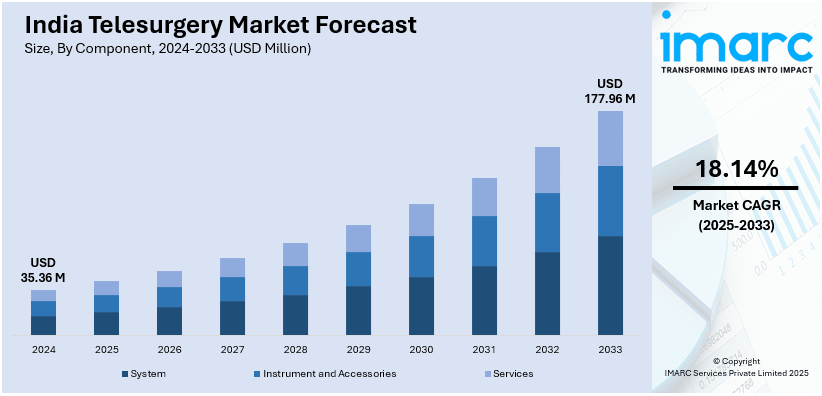

The India telesurgery market size reached USD 35.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 177.96 Million by 2033, exhibiting a growth rate (CAGR) of 18.14% during 2025-2033. Significant advancements in surgical robotics and telecommunications, exemplified by the indigenous SSI Mantra system's regulatory approval and successful remote procedures, and the launch of supportive government initiatives to improve digital infrastructure and enhance access to specialized surgical care in remote areas are primarily propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35.36 Million |

| Market Forecast in 2033 | USD 177.96 Million |

| Market Growth Rate 2025-2033 | 18.14% |

India Telesurgery Market Trends:

Indigenous Development and Adoption of Robotic Surgical Systems

India’s telesurgery market is undergoing a significant transformation, driven by the emergence of indigenous robotic systems like the SSI Mantra, developed by SS Innovations. The regulatory approval of this system by the Central Drugs Standard Control Organization (CDSCO) represents a significant milestone in expanding remote surgical capabilities nationwide. Designed to be cost-effective and efficient, such systems are making advanced surgical care accessible in underserved and rural regions, addressing long-standing disparities in healthcare delivery. A landmark achievement came in 2025 when India successfully performed its first robotic cardiac telesurgery over a distance of 2,000 km using the SSI Mantra platform. SS Innovations plans to deploy over 1,000 robotic systems in Indian hospitals in the near-term, accelerating adoption across the healthcare landscape. Crucially, these homegrown systems are priced lower than their international counterparts, significantly improving market penetration. This shift not only boosts India’s self-reliance in med-tech innovation but also positions the country as a competitive global exporter of advanced surgical robotics.

To get more information on this market, Request Sample

Digital Infrastructure Expansion Enabling Remote Surgeries

The rapid expansion of India’s digital and healthcare infrastructure, driven by flagship initiatives like the Ayushman Bharat Digital Mission and BharatNet, is creating a robust foundation for the widespread adoption of telesurgery. These initiatives are enhancing high-speed, low-latency connectivity, which is vital for seamless real-time video streaming and precision synchronization of surgical devices across vast distances. With over 214,000 gram panchayats connected via optical fiber under BharatNet as of October 2024, rural healthcare systems are gaining digital muscle to support remote interventions. Simultaneously, the rollout of 5G technology is expected to be a game-changer, enabling ultra-reliable, low-latency communication required for complex telesurgical procedures. India’s 5G subscriber base is projected to cross 770 million by 2028, laying the groundwork for real-time, high-definition medical data transfer. As connectivity and digital health systems mature, telesurgery is poised to evolve from sporadic pilot projects to routine, dependable medical interventions, especially in remote and underserved areas, fundamentally reshaping equitable access to specialized care across India.

India Telesurgery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, application, and end use.

Component Insights:

- System

- Instrument and Accessories

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes system, instrument and accessories, and services.

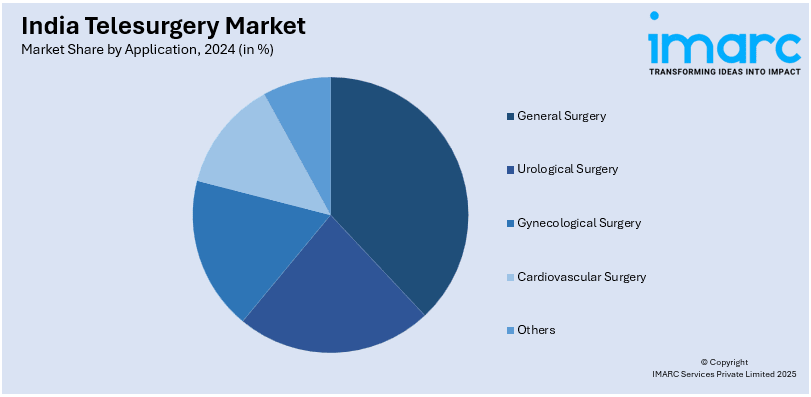

Application Insights:

- General Surgery

- Urological Surgery

- Gynecological Surgery

- Cardiovascular Surgery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes general surgery, urological surgery, gynecological surgery, cardiovascular surgery, and others.

End Use Insights:

- Hospitals

- Outpatient Facilities

- Research and Academic Institutions

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals, outpatient facilities, and research and academic institutions.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Telesurgery Market News:

- March 2025: SS Innovations unveiled India's first mobile tele-surgical unit, SSI MantraM. The unit aims to improve remote surgical access, integrating the SSi Mantra 3 Surgical Robotic System for real-time collaboration between surgical teams. Equipped with high-speed connectivity, SSI MantraM facilitates robotic-assisted procedures in underserved regions and serves as a platform for surgical education and data analytics.

- June 2024: The Rajiv Gandhi Cancer Institute and Research Centre (RGCIRC) completed India's first telesurgery in cancer care. The surgery was a Radical Cysto-Prostatectomy with Bilateral Lymph Nodes Removal.

India Telesurgery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | System, Instrument and Accessories, Services |

| Applications Covered | General Surgery, Urological Surgery, Gynecological Surgery, Cardiovascular Surgery, Others |

| End Uses Covered | Hospitals, Outpatient Facilities, Research and Academic Institutions |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India telesurgery market performed so far and how will it perform in the coming years?

- What is the breakup of the India telesurgery market on the basis of component?

- What is the breakup of the India telesurgery market on the basis of application?

- What is the breakup of the India telesurgery market on the basis of end use?

- What are the various stages in the value chain of the India telesurgery market?

- What are the key driving factors and challenges in the India telesurgery?

- What is the structure of the India telesurgery market and who are the key players?

- What is the degree of competition in the India telesurgery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India telesurgery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India telesurgery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India telesurgery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)