India Test and Measurement Equipment Market Size, Share, Trends, and Forecast by Product, Service Type, End Use Industry, and Region, 2025-2033

India Test and Measurement Equipment Market Overview:

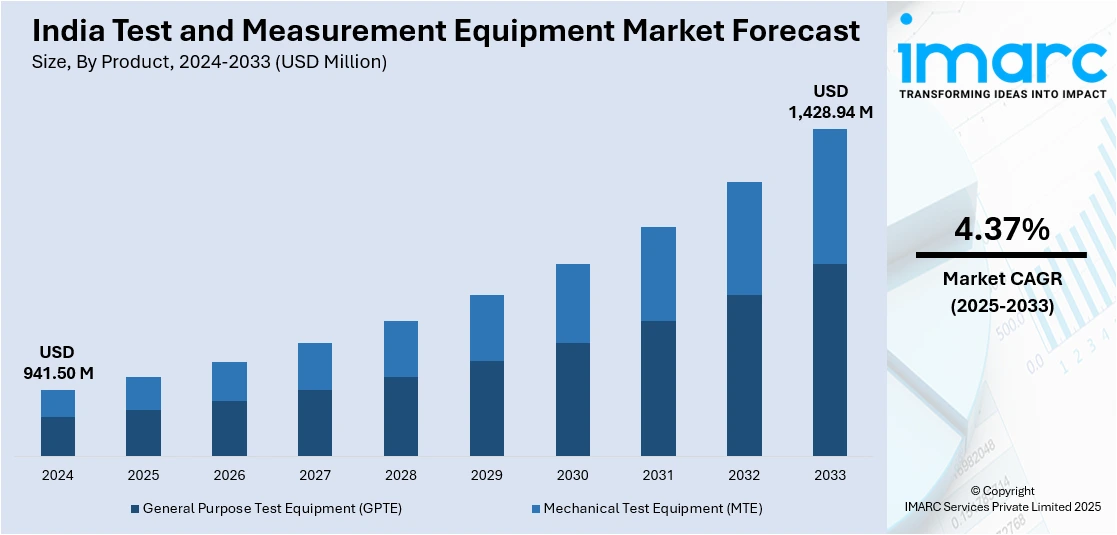

The India test and measurement equipment market size reached USD 941.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,428.94 Million by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The market is rapidly expanding, due to electronics manufacturing, semiconductor production, and 5G deployment. An increasing demand for high-precision testing in sectors such as electric vehicles, IoT devices, and industrial automation is driving this evolution. Furthermore, government incentives and rising exports are further strengthening investments in advanced, AI-driven testing solutions across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 941.50 Million |

| Market Forecast in 2033 | USD 1,428.94 Million |

| Market Growth Rate 2025-2033 | 4.37% |

India Test and Measurement Equipment Market Trends:

Growth in Automotive and Electric Vehicle Testing Solutions

India's automotive and electric vehicle (EV) sector is fueling an upsurge in demand for specialized test and measurement equipment. As EVs, hybrid vehicles, and autonomous driving technologies grow rapidly, automakers need high-voltage testing, battery testing, and powertrain testing solutions to validate performance, safety, and regulatory compliance. For instance, as per industry reports, in the first 11 months of 2024, EV sales in India surpassed 1.8 Million units, reflecting a nearly 45% year-on-year increase. The shift toward electrification and more stringent emissions norms has increased the need for automotive diagnostic tools, durability testing systems, and advanced telematics testing. Connected vehicles and Advanced Driver Assistance Systems (ADAS) are additionally fueling the demand for RF testing, sensor calibration, and real-time data acquisition systems. Meanwhile, India's push for localized EV production and automotive R&D will further drive growth for advanced test and measurement solutions for vehicle safety and performance validation.

To get more information on this market, Request Sample

Rising Demand for High-Precision Testing in Electronics and Semiconductor Manufacturing

India’s growing electronics and semiconductor manufacturing sector is driving the demand for advanced test and measurement equipment. As the country expands domestic production of smartphones, consumer electronics, automotive electronics, and semiconductor chips, manufacturers require high-precision testing solutions to ensure product quality and compliance with global standards. For instance, in September 2024, Analog Devices (ADI) announced a partnership with Tata Group to explore semiconductor manufacturing in India. Tata Electronics is investing USD 14 billion in a Gujarat fabrication plant and Assam chip testing facility to strengthen India’s semiconductor industry under government-backed initiatives. Moreover, 5G deployment and the rise of IoT-enabled devices further necessitate sophisticated testing tools for RF measurements, signal integrity analysis, and power testing. Additionally, increasing export opportunities demand stringent adherence to international testing protocols, compelling Indian manufacturers to adopt cutting-edge measurement technologies. As product miniaturization and complexity increase, the industry is witnessing a strong shift toward high-accuracy, real-time, and AI-powered testing solutions to meet evolving market requirements.

India Test and Measurement Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, service type, and end use industry.

Product Insights:

- General Purpose Test Equipment (GPTE)

- Oscilloscopes

- Signal Generators

- Multimeters

- Logic Analyzers

- Spectrum Analyzers

- Bert (Bit Error Rate Test)

- Network Analyzers

- Others

- Mechanical Test Equipment (MTE)

- Non-Destructive Test Equipment

- Machine Vision Inspection

- Machine Condition Monitoring

The report has provided a detailed breakup and analysis of the market based on the product. This includes general purpose test equipment (GPTE) (oscilloscopes, signal generators, multimeters, logic analyzers, spectrum analyzers, bert (bit error rate test), network analyzers, and others) and mechanical test equipment (MTE) (non-destructive test equipment, machine vision inspection, and machine condition monitoring).

Service Type Insights:

- Calibration Services

- Repair Services/After-Sales Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes calibration services and repair services/after-sales services.

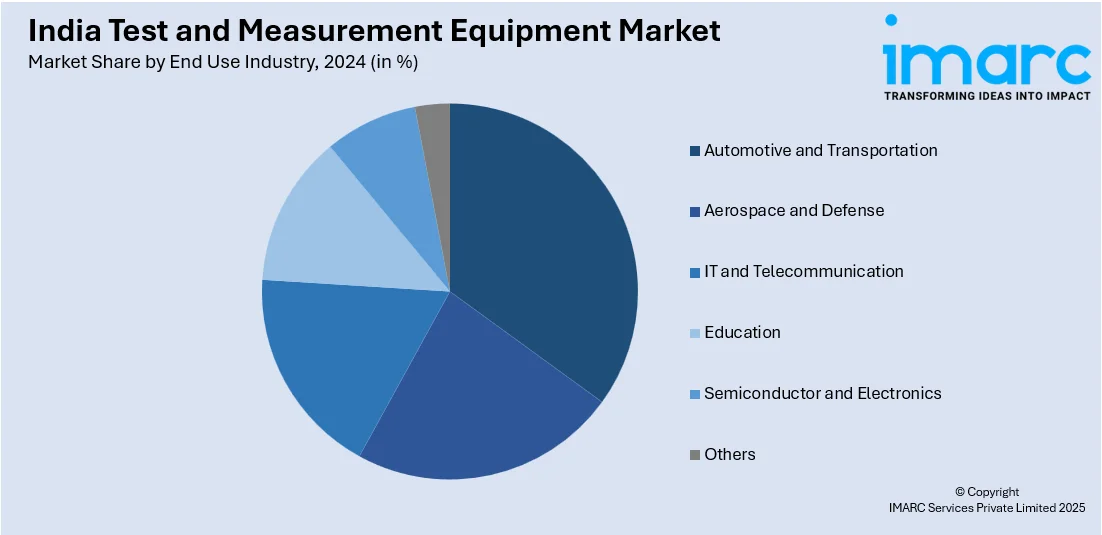

End Use Industry Insights:

- Automotive and Transportation

- Aerospace and Defense

- IT and Telecommunication

- Education

- Semiconductor and Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive and transportation, aerospace and defense, IT and telecommunication, education, semiconductor and electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Test and Measurement Equipment Market News:

- In May 2024, Italy’s Texa announced the launch of the TXT Bharat, a multi-brand vehicle diagnostic tool, in partnership with Madhus Garage Equipment in India. It supports BS-III to BS-VI standards and is designed for commercial vehicles, offering faster processing, Bluetooth connectivity, USB-C, and interactive software that enables precise diagnostics and real-time maintenance guidance.

India Test and Measurement Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Service Types Covered | Calibration Services, Repair Services/After-Sales Services |

| End Use Industries Covered | Automotive and Transportation, Aerospace and Defense, IT and Telecommunication, Education, Semiconductor and Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India test and measurement equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India test and measurement equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India test and measurement equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The test and measurement equipment market in India was valued at USD 941.50 Million in 2024.

The India test and measurement equipment market is projected to exhibit a CAGR of 4.37% during 2025-2033, reaching a value of USD 1,428.94 Million by 2033.

The India test and measurement equipment market is driven by rising demand from the electronics and semiconductor industries, rapid growth in electric vehicles requiring advanced testing solutions, and expanding telecom and smart infrastructure projects. Government initiatives like 'Make in India' further boost adoption across industrial and research and development (R&D) sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)