India Testing and Commissioning Market Size, Share, Trends and Forecast by Service Type, Commissioning Type, Sourcing Type, End Use Sector, and Region, 2025-2033

India Testing and Commissioning Market Overview:

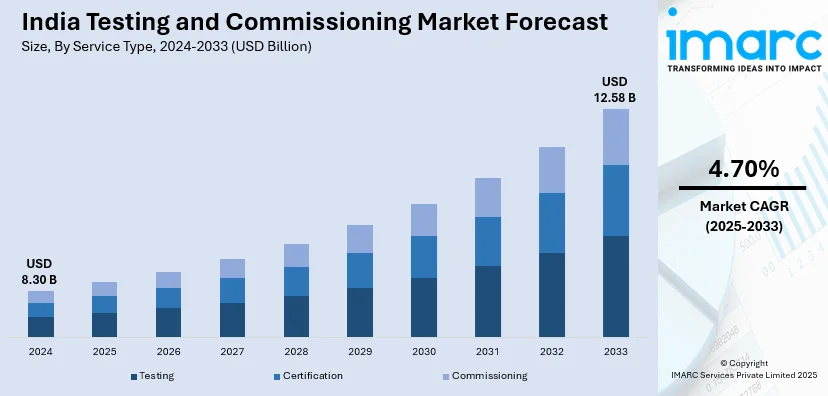

The India testing and commissioning market size reached USD 8.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.58 Billion by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The market is expanding due to stringent regulatory compliance, increasing infrastructure projects, rapid industrialization, growing exports, and rising demand for quality assurance across industries. Adoption of automation, IoT integration, and advancements in testing technologies further accelerate growth, ensuring operational efficiency, safety, and adherence to global standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.30 Billion |

| Market Forecast in 2033 | USD 12.58 Billion |

| Market Growth Rate (2025-2033) | 4.70% |

India Testing and Commissioning Market Trends:

Expansion of Electrical Testing and Commissioning Services

The growing demand for dependable power infrastructure is creating the need for sophisticated electrical testing and commissioning services in India. With accelerating urbanization and government-initiated electrification projects, power distribution networks need to be rigorously tested for transformers, switchgear, substations, and smart grid equipment. The integration of renewable energy resources, such as solar and wind power, also creates the need for comprehensive testing procedures to make the grid stable and energy-efficient. A notable example is Bharti Airtel’s recent acquisition of a 26% stake in AMP Energy Green Three, a special purpose vehicle (SPV) for renewable energy projects. This move highlights the growing corporate commitment to clean energy integration, which, in turn, escalates demand for high-level testing and commissioning services to support renewable infrastructure and seamless grid synchronization.

To get more information on this market, Request Sample

Growth in Building Safety and Environmental Compliance Testing

Rising concerns over structural safety and environmental sustainability are fueling the demand for specialized testing and commissioning services in India's construction sector. Stricter regulations and energy efficiency mandates are driving the need for material testing, seismic assessments, fire safety inspections, and air quality monitoring. Green building certifications are further promoting comprehensive commissioning practices to ensure adherence to environmental standards. The push for smart cities and sustainable urban development is also accelerating the adoption of sensor-based monitoring systems that assess structural integrity and energy consumption in real-time. With increasing emphasis on long-term durability and safety, the market for testing and commissioning services in building infrastructure continues to expand. For instance, in November 2024, it was released that the New Pamban Bridge, connecting Mandapam and Rameswaram in Tamil Nadu, is nearing commissioning after a successful Overhead Maintenance System (OMS) engine test by Indian Railways. The test confirmed its robust construction and efficiency, achieving 121 kmph on land and 80 kmph on the bridge. Designed as an advanced replacement for the 108-year-old Pamban Bridge, it will enhance connectivity for passengers and goods. The milestone brings the bridge closer to operational status, ensuring faster, safer rail transport.

India Testing and Commissioning Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service type, commissioning type, sourcing type, and end use sector.

Service Type Insights:

- Testing

- Certification

- Commissioning

The report has provided a detailed breakup and analysis of the market based on the service type. This includes testing, certification, and commissioning.

Commissioning Type Insights:

- Initial Commissioning

- Retro Commissioning

- Monitor-Based Commissioning

A detailed breakup and analysis of the market based on the commissioning type have also been provided in the report. This includes initial, retro, and monitor-based commissioning.

Sourcing Type Insights:

- Inhouse

- Outsourced

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes inhouse and outsourced.

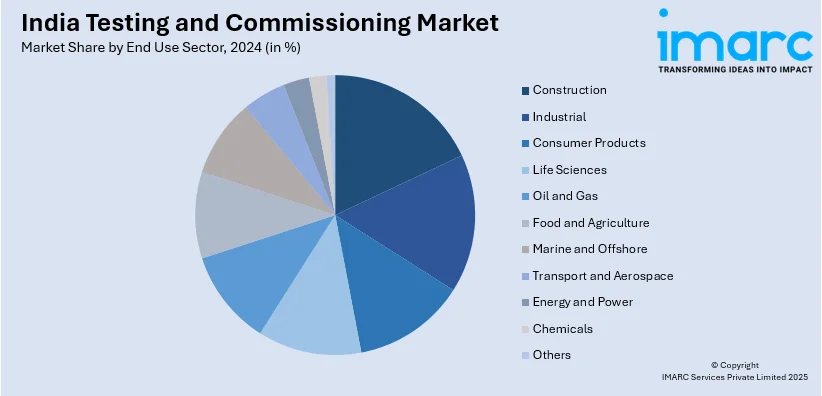

End Use Sector Insights:

- Construction

- Industrial

- Consumer Products

- Life Sciences

- Oil and Gas

- Food and Agriculture

- Marine and Offshore

- Transport and Aerospace

- Energy and Power

- Chemicals

- Others

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes construction, industrial, consumer products, life sciences, oil and gas, food and agriculture, marine and offshore, transport and aerospace, energy and power, chemicals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Testing and Commissioning Market News:

- In March 2024, India’s Voltech Group, a leader in testing, commissioning, and maintenance of electrical systems, announced plans to expand into the nuclear sector. The company has been involved in nuclear power projects, including Kudankulam in Tamil Nadu.

- In January 2025, Suzlon Group's Blade Test Center Gujarat (BTCG) successfully conducted full-scale blade testing for We4Ce, a Netherlands-based wind energy company. The facility specializes in natural frequency determination, static testing, and fatigue testing, ensuring compliance with international standards such as IEC 61400-5. This highlights India's growing role in testing and commissioning services for renewable energy equipment, reinforcing its position as a global hub for wind turbine validation and certification.

India Testing and Commissioning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Testing, Certification, Commissioning |

| Commissioning Types Covered | Initial Commissioning, Retro Commissioning, Monitor-Based Commissioning |

| Sourcing Types Covered | Inhouse, Outsourced |

| End Use Sectors Covered | Construction, Industrial, Consumer Products, Life Sciences, Oil and Gas, Food and Agriculture, Marine and Offshore, Transport and Aerospace, Energy and Power, Chemicals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India testing and commissioning market performed so far and how will it perform in the coming years?

- What is the breakup of the India testing and commissioning market on the basis of service type?

- What is the breakup of the India testing and commissioning market on the basis of commissioning type?

- What is the breakup of the India testing and commissioning market on the basis of sourcing type?

- What is the breakup of the India testing and commissioning market on the basis of end use sector?

- What are the various stages in the value chain of the India testing and commissioning market?

- What are the key driving factors and challenges in the India testing and commissioning market?

- What is the structure of the India testing and commissioning market and who are the key players?

- What is the degree of competition in the India testing and commissioning market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India testing and commissioning market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India testing and commissioning market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India testing and commissioning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)