India Tetracycline Market Size, Share, Trends and Forecast by Product Type, Type, Source, Form, Distribution Channel, Application, Route of Administration, and Region, 2025-2033

India Tetracycline Market Overview:

The India tetracycline market size reached USD 81.32 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 114.66 Million by 2033, exhibiting a growth rate (CAGR) of 3.6% during 2025-2033. The rising incidence of bacterial infections, increasing livestock farming, and growing demand for affordable antibiotics are some of the factors propelling the growth of the market. Government support for animal healthcare and expanding pharmaceutical manufacturing capacity further fuel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 81.32 Million |

| Market Forecast in 2033 | USD 114.66 Million |

| Market Growth Rate 2025-2033 | 3.6% |

India Tetracycline Market Trends:

Rising Incidence of Infectious Diseases Driving Tetracycline Demand

In India, infectious disorders such as respiratory tract infections, urinary tract infections, and skin infections are on the rise. This spike has resulted in an increased need for effective antibiotic therapies, particularly tetracyclines, which are recognized for their broad-spectrum effectiveness against a variety of bacteria. As these diseases spread, healthcare doctors are increasingly prescribing tetracyclines to treat them. Furthermore, the rising problem of antibiotic resistance has rendered tetracyclines an essential component of the treatment arsenal, as they are still effective against certain resistant bacterial strains. The post-pandemic environment has also boosted health awareness, leading to early detection and treatment of bacterial illnesses, driving up tetracycline usage. Moreover, the surge in hospital-acquired infections and community-wide bacterial diseases has increased the need for dependable antibiotic therapies. India's enormous population, along with insufficient sanitation in some areas, has accelerated the spread of infectious illnesses, making tetracycline-based therapies the preferred option. Government actions encouraging access to vital medications, as well as increased antibiotic availability through online and offline pharmacy channels, have fueled market expansion. Tetracyclines are an important answer in India's healthcare environment since there is still a demand for inexpensive, effective antibiotics in both urban and rural settings.

.webp)

To get more information on this market, Request Sample

Expansion of the Veterinary Sector Boosting Tetracycline Usage

India's veterinary sector has been witnessing substantial growth, driven by the increasing demand for livestock and poultry products. As the consumption of animal protein rises, maintaining animal health becomes paramount, leading to a greater reliance on antibiotics like tetracyclines. These antibiotics are extensively used in veterinary medicine to manage infections, improve growth rates, and ensure the productivity of livestock. Additionally, tetracyclines are widely used to prevent and treat bacterial diseases in cattle, poultry, and aquaculture, supporting the safety and quality of animal-based food products. The growth of the dairy and poultry sectors, driven by urbanization and changing dietary preferences, has intensified the need for efficient animal health management. Farmers and livestock owners frequently rely on tetracyclines due to their affordability, ease of administration, and broad-spectrum activity against various pathogens. Furthermore, the rising prevalence of zoonotic diseases, which can transfer from animals to humans, underscores the importance of effective antibiotic treatments in animals. Government regulations promoting responsible antibiotic use, along with awareness campaigns on antimicrobial resistance, are also influencing the veterinary antibiotic market. Despite efforts to minimize misuse, the expansion of livestock farming and increasing veterinary healthcare infrastructure continue to drive the demand for tetracyclines in India.

India Tetracycline Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, type, source, form, distribution channel, application, and route of administration.

Product Type Insights:

- OTC

- Prescription

The report has provided a detailed breakup and analysis of the market based on the product type. This includes OTC and prescription.

Type Insights:

- Tetracycline Hydrochloride

- Tetracycline Phosphate

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes tetracycline hydrochloride and tetracycline phosphate.

Source Insights:

- In-house

- Contract Manufacturing Organizations

The report has provided a detailed breakup and analysis of the market based on the source. This includes in-house and contract manufacturing organizations.

Form Insights:

- Tablet

- Capsule

- Powder

- Ointments

- Injection

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes tablet, capsule, powder, ointments, injection, and others.

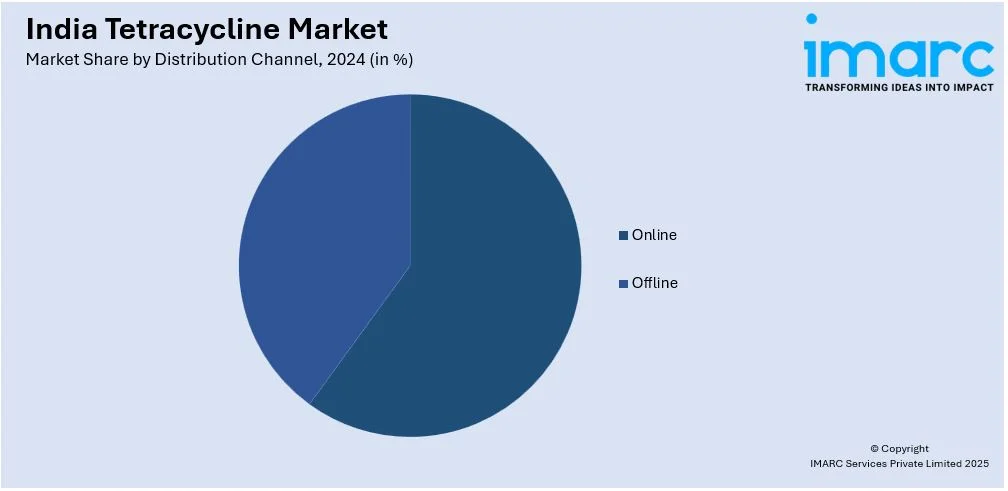

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Application Insights:

- Respiratory

- Bowel

- Genital

- Systemic Infections

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes respiratory, bowel, genital, systemic infections, and others.

Route of Administration Insights:

- Oral

- Topical

- Ophthalmic

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes oral, topical, and ophthalmic.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tetracycline Market News:

- In July 2024, Paratek Pharmaceuticals' Phase III study demonstrated that Nuzyra (omadacycline), a next-generation tetracycline, met non-inferiority benchmarks against moxifloxacin in treating community-acquired bacterial pneumonia. This success supports its potential application across various bacterial infections.

India Tetracycline Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | OTC, Prescription |

| Types Covered | Tetracycline Hydrochloride, Tetracycline Phosphate |

| Sources Covered | In-house, Contract Manufacturing Organizations |

| Forms Covered | Tablet, Capsule, Powder, Ointments, Injection, Others |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Respiratory, Bowel, Genital, Systemic Infections, Others |

| Route of Administrations Covered | Oral, Topical, Ophthalmic |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India tetracycline market performed so far and how will it perform in the coming years?

- What is the breakup of the India tetracycline market on the basis of product type?

- What is the breakup of the India tetracycline market on the basis of type?

- What is the breakup of the India tetracycline market on the basis of source?

- What is the breakup of the India tetracycline market on the basis of form?

- What is the breakup of the India tetracycline market on the basis of distribution channel?

- What is the breakup of the India tetracycline market on the basis of application?

- What is the breakup of the India tetracycline market on the basis of route of administration?

- What are the various stages in the value chain of the India tetracycline market?

- What are the key driving factors and challenges in the India tetracycline market?

- What is the structure of the India tetracycline market and who are the key players?

- What is the degree of competition in the India tetracycline market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tetracycline market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tetracycline market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tetracycline industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)