India Textile Dyeing and Printing Market Size, Share, Trends and Forecast by Dye Type, Printing Technique, Fiber Type, Application, Distribution Channel, and Region, 2025-2033

India Textile Dyeing and Printing Market Overview:

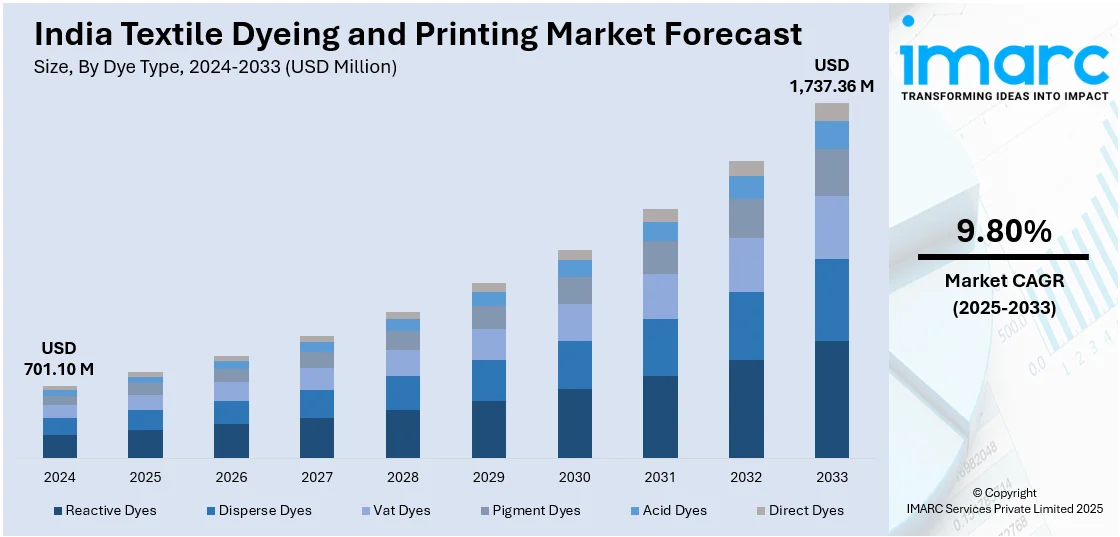

The India textile dyeing and printing market size reached USD 701.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,737.36 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The growing demand for fashionable apparel, inflating disposable incomes, expansion of the organized retail sector, increasing adoption of digital textile printing, implementation of supportive government initiatives, and the shift toward sustainable and eco-friendly dyeing practices are some of the major factors augmenting India textile dyeing and printing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 701.10 Million |

| Market Forecast in 2033 | USD 1,737.36 Million |

| Market Growth Rate 2025-2033 | 9.80% |

India Textile Dyeing and Printing Market Trends:

Rise of Digital Textile Printing Technologies

The increasing adoption of digital textile printing technologies driven by shorter lead times, high design flexibility, and reduced resource consumption is positively impacting the India textile dyeing and printing market outlook. Traditional rotary and flatbed screen printing methods involve multiple pre- and post-treatment steps, high water usage, and labor-intensive operations. According to an industry report, conventional printing requires a minimum of 1,200 meters per color, whereas digital printing allows flexible meterage without production limitations. It also requires less space and minimal labor intervention. Besides this, digital methods like direct-to-fabric (DTF) and direct-to-garment (DTG) allow for faster prototyping, on-demand production, and sharper resolution without compromising fabric quality. This is especially relevant for customized and small-batch fashion lines, which are gaining traction among Indian consumers via online platforms. Additionally, the reduction in water and energy usage aligns with growing regulatory scrutiny over industrial pollution in textile hubs such as Tiruppur and Surat. Moreover, domestic manufacturers are increasingly investing in digital inkjet printers, heat transfer machines, and pigment-based inks to meet both domestic and export-oriented demand, which is supporting market development. Apart from this, major market players are also forming partnerships with global technology providers to integrate advanced digital printing systems, especially those compatible with cotton and blended fabrics widely used in India, further strengthening the market.

To get more information on this market, Request Sample

Shift Toward Sustainable and Low-Impact Dyeing Solutions

The transition toward sustainable dyeing and printing methods is providing a boost to India textile dyeing and printing market growth. India is the largest producer of textiles. According to an industry report, India remains one of the largest textile producers globally, accounting for 4.6% of global trade as of 2024. Therefore, environmental concerns linked to conventional dyeing, such as excessive water usage, synthetic chemicals, and untreated effluent discharge, are prompting a shift in practices. In response, Indian manufacturers are now exploring low-liquor-ratio dyeing machines, supercritical CO₂ dyeing, and waterless dyeing technologies that minimize environmental impact. In addition to this, natural dyes derived from plant-based sources, as well as bio-based synthetic dyes, are gaining traction in product development for eco-conscious apparel collections. Moreover, continual innovations in enzymatic processing and salt-free reactive dyeing are reducing chemical loads and improving wastewater discharge quality. Besides this, textile parks in states like Gujarat and Tamil Nadu are promoting common effluent treatment plants (CETPs) and zero liquid discharge (ZLD) systems to comply with Central Pollution Control Board (CPCB) norms. These developments are reshaping investment priorities in India's dyeing and printing segment, especially among exporters working with international brands committed to sustainable sourcing.

India Textile Dyeing and Printing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on dye type, printing technique, fiber type, application, and distribution channel.

Dye Type Insights:

- Reactive Dyes

- Disperse Dyes

- Vat Dyes

- Pigment Dyes

- Acid Dyes

- Direct Dyes

The report has provided a detailed breakup and analysis of the market based on the dye type. This includes reactive dyes, disperse dyes, vat dyes, pigment dyes, acid dyes, and direct dyes.

Printing Technique Insights:

- Screen Printing

- Digital Printing

- Block Printing

- Heat Transfer Printing

- Rotary Printing

A detailed breakup and analysis of the market based on the printing technique have also been provided in the report. This includes screen printing, digital printing, block printing, heat transfer printing, and rotary printing.

Fiber Type Insights:

- Cotton

- Polyester

- Wool

- Silk

- Nylon

- Viscose

- Blends

The report has provided a detailed breakup and analysis of the market based on the fiber type. This includes cotton, polyester, wool, silk, nylon, viscose, and blends.

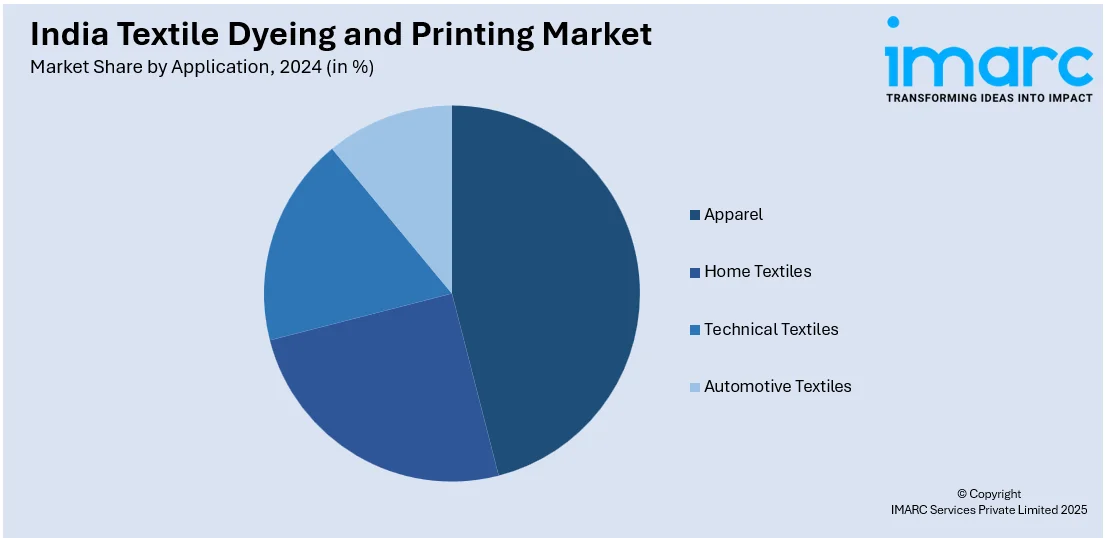

Application Insights:

- Apparel

- Home Textiles

- Technical Textiles

- Automotive Textiles

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes apparel, home textiles, technical textiles, and automotive textiles.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Textile Dyeing and Printing Market News:

- On February 8, 2025, ColorJet India Ltd unveiled the Fab Jet Pro, a high-volume digital textile printer capable of producing up to 13,000 square meters per day. This ultra-wide format printer, with a width of 3.2 meters, features up to 48 print heads and Sticky Belt Technology, ensuring precision and quality across various fabrics. Designed with sustainability in mind, the Fab Jet Pro reduces water and energy consumption, aligning with eco-friendly production practices.

- On February 28, 2025, Epson India showcased its latest advancements in textile printing at the Global Textile Technology & Engineering Show (GTTES), including a live demonstration of the Monna Lisa direct-to-fabric printer and the soft launch of the upcoming SureColor G6030 direct-to-film printer. The Monna Lisa ML-8000 printer has gained significant traction in India, with several clients expanding their fleets due to its efficiency and reliability. Epson's fourth-generation pigment printing technology enhances color brilliance and fabric feel, enabling high-quality printing across a wide variety of fabrics.

India Textile Dyeing and Printing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Dye Types Covered | Reactive Dyes, Disperse Dyes, Vat Dyes, Pigment Dyes, Acid Dyes, Direct Dyes |

| Printing Techniques Covered | Screen Printing, Digital Printing, Block Printing, Heat Transfer Printing, Rotary Printing |

| Fiber Types Covered | Cotton, Polyester, Wool, Silk, Nylon, Viscose, Blends |

| Applications Covered | Apparel, Home Textiles, Technical Textiles, Automotive Textiles |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India textile dyeing and printing market performed so far and how will it perform in the coming years?

- What is the breakup of the India textile dyeing and printing market on the basis of dye type?

- What is the breakup of the India textile dyeing and printing market on the basis of printing technique?

- What is the breakup of the India textile dyeing and printing market on the basis of fiber type?

- What is the breakup of the India textile dyeing and printing market on the basis of application?

- What is the breakup of the India textile dyeing and printing market on the basis of distribution channel?

- What is the breakup of the India textile dyeing and printing market on the basis of region?

- What are the various stages in the value chain of the India textile dyeing and printing market?

- What are the key driving factors and challenges in the India textile dyeing and printing?

- What is the structure of the India textile dyeing and printing market and who are the key players?

- What is the degree of competition in the India textile dyeing and printing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India textile dyeing and printing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India textile dyeing and printing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India textile dyeing and printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)