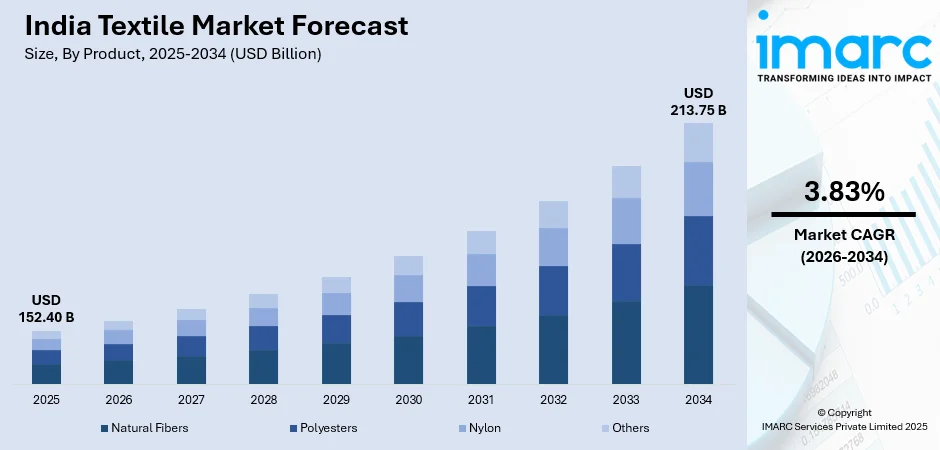

India Textile Market Size, Share, Trends and Forecast by Product, Raw Material, Application, and Region, 2026-2034

India Textile Market Summary:

The India textile market size was valued at USD 152.40 Billion in 2025 and is projected to reach USD 213.75 Billion by 2034, growing at a compound annual growth rate of 3.83% from 2026-2034.

The market is propelled by growing consumer demand for different varieties of fabrics, increasing favor towards eco-friendly and green fabrics, and government support through initiatives that aim for excellence in manufacturing in India. Urbanization and increasing spending capacity, including in rural areas, are increasing consumption trends significantly. The growth of e-commerce has widened market reach, and technology advancements in manufacturing processes are improving efficiency. All these points make India one of the major textile giants in the world and thus significantly contributing to the India textile market share.

Key Takeaways and Insights:

-

By Product: Polyesters dominate the market with a share of 61.8% in 2025, driven by exceptional durability, wrinkle resistance, cost-effectiveness, and versatile applications across fashion, sportswear, and home textile segments.

-

By Raw Material: Cotton leads the market with a share of 54.7% in 2025, owing to India's leading global production status, natural breathability, biodegradability, and rising consumer preference for sustainable fabrics.

-

By Application: Fashion and clothing represent the largest segment with a market share of 67.06% in 2025, driven by rising fashion consciousness, expanding organized retail networks, fast fashion growth, and increasing demand for diverse apparel categories.

-

By Region: North India dominates the market with a share of 32% in 2025, owing to established textile manufacturing clusters, robust infrastructure, proximity to major consumption centers, and integrated textile park presence.

-

Key Players: The India textile market exhibits a highly competitive landscape characterized by the coexistence of large-scale integrated manufacturers and numerous small-to-medium enterprises operating across various value chain segments. Market participants compete on product quality, pricing strategies, and manufacturing capabilities.

To get more information on this market Request Sample

The India textile market is experiencing robust expansion propelled by multifaceted growth catalysts spanning consumer, industrial, and policy dimensions. Rising disposable incomes and an expanding middle-class population are generating unprecedented demand for diverse textile products ranging from everyday apparel to premium fashion segments. Government initiatives aimed at strengthening domestic manufacturing capabilities, enhancing export competitiveness, and developing integrated textile parks are creating favorable conditions for industry expansion. In November 2025, India’s textile exports to 111 countries recorded 10 percent year-on-year growth during April–September 2025, highlighting export resilience and stronger demand across key global markets despite external challenges. Moreover, increasing urbanization and evolving lifestyle preferences are driving consumption of branded and organized retail textiles. Furthermore, the growing global preference for Indian textiles, supported by the country's rich heritage in fabric production and competitive labor costs, positions India as a preferred sourcing destination for international buyers seeking quality textile products.

India Textile Market Trends:

Sustainable and Eco-Friendly Textile Adoption

The Indian textile industry is witnessing a transformative shift towards sustainable manufacturing practices and eco-conscious product development. Manufacturers are increasingly investing in organic cotton cultivation, recycled fiber processing, and water-efficient dyeing technologies to meet growing consumer demand for environmentally responsible products. As per sources, in July 2025, Rudra Ecovation showcased it upcycled fabric Anaura at Textile Fair India 2025, highlighting large-scale PET recycling capabilities and India’s advancing adoption of circular, eco-friendly textile manufacturing practices. This sustainability movement extends across the value chain, encompassing raw material sourcing, production processes, and end-product development. Consumers are demonstrating heightened awareness regarding environmental impact, preferring textiles with lower carbon footprints and biodegradable properties. Industry participants are adopting circular economy principles, focusing on waste reduction and resource optimization while meeting international sustainability standards for export markets.

Digital Transformation and Smart Manufacturing

Technological advancement is revolutionizing India's textile manufacturing landscape through automation, digitalization, and smart production systems. Manufacturers are deploying artificial intelligence-powered quality control mechanisms, predictive maintenance systems, and robotic-assisted assembly processes to enhance operational efficiency. As per sources, in June 2025, India’s textile hubs, including Tiruppur, adopted AI across manufacturing value chains, improving production efficiency by 10% and strengthening smart manufacturing adoption, according to the Tiruppur Exporters’ Association. Further, digital integration across spinning, weaving, and processing operations enables real-time monitoring and optimization of production parameters. The adoption of advanced enterprise resource planning systems facilitates streamlined inventory management and supply chain coordination. These technological interventions are improving product consistency, reducing production waste, and enhancing overall competitiveness in both domestic and international markets.

Technical Textiles Segment Emergence

India's textile industry is experiencing significant diversification towards technical textiles catering to specialized industrial applications beyond traditional apparel and home furnishings. Growing demand from automotive, healthcare, construction, and agricultural sectors is driving investment in high-performance fabric development. Manufacturers are developing specialized products including geotextiles, medical textiles, protective clothing, and automotive interior fabrics with enhanced functional properties. Government support through dedicated policies and incentive programs is accelerating technical textile capacity expansion. According to sources, in November 2025, Techtextil India 2025 opened in Mumbai, featuring 215 exhibitors across 12 technical textile segments, highlighting innovations in functional fabrics, nonwovens, and composites. Further, this segment diversification reduces dependence on conventional textile applications while opening lucrative opportunities in value-added product categories with higher margin potential.

Market Outlook 2026-2034:

The India textile market is positioned for sustained revenue expansion throughout the forecast period, supported by favorable demographic trends, policy incentives, and increasing global sourcing preferences. Market revenue is projected to demonstrate consistent growth driven by domestic consumption strength and export competitiveness enhancement. Strategic government initiatives promoting manufacturing modernization and cluster development will accelerate capacity expansion. Rising demand for value-added products, technical textiles, and sustainable fabrics will create diversified revenue streams, positioning India as an increasingly significant contributor to global textile commerce. The market generated a revenue of USD 152.40 Billion in 2025 and is projected to reach a revenue of USD 213.75 Billion by 2034, growing at a compound annual growth rate of 3.83% from 2026-2034.

India Textile Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Polyesters |

61.8% |

|

Raw Material |

Cotton |

54.7% |

|

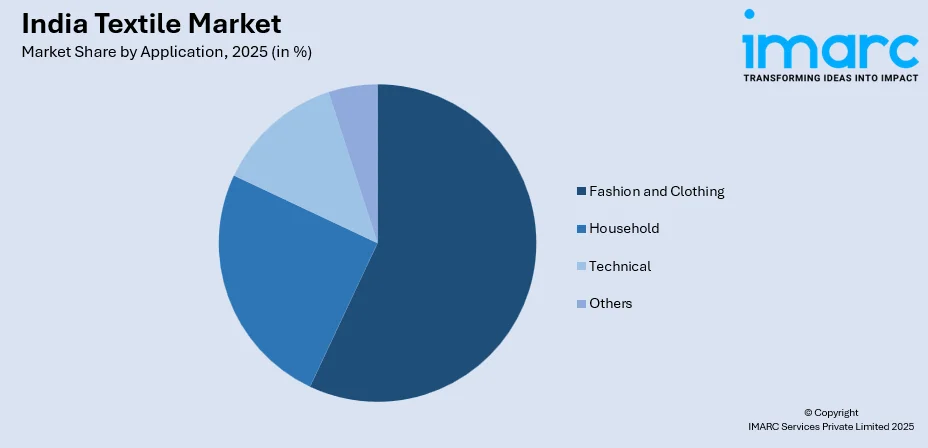

Application |

Fashion and Clothing |

67.06% |

|

Region |

North India |

32% |

Product Insights:

- Natural Fibers

- Polyesters

- Nylon

- Others

Polyesters dominate with a market share of 61.8% of the total India textile market in 2025.

Polyesters command the dominant position in India's textile product landscape, representing approximately three-fifths of total market revenue. This synthetic fiber's exceptional durability, wrinkle resistance, and dimensional stability make it indispensable across multiple application categories including fashion apparel, sportswear, and home furnishings. The material's versatility enables seamless blending with natural fibers, creating fabric compositions that combine superior performance characteristics with comfort properties desired by contemporary consumers seeking value-driven textile solutions.

The segment's continued leadership reflects polyester's cost-effectiveness compared to alternative synthetic and natural fibers, making it accessible across diverse consumer income segments. Manufacturing scalability and established domestic production capacity ensure consistent supply availability throughout the year. Growing demand from fast fashion retailers, ready-to-wear segments, and technical textile applications further reinforces polyester's market dominance, with manufacturers continuously expanding production capabilities to meet rising consumption requirements. In February 2025, Reliance Industries showcased advanced polyester technologies, including R|Elan SuPer and HEXaREL Quanta, at Bharat Tex 2025, emphasizing sustainability, circularity, and high-performance textile innovations.

Raw Material Insights:

- Cotton

- Chemical

- Wool

- Silk

- Others

Cotton leads with a share of 54.7% of the total India textile market in 2025.

Cotton maintains its position as the predominant raw material in India's textile industry, leveraging the nation's extensive cotton cultivation heritage and integrated processing infrastructure. India's status as a leading global cotton producer ensures abundant domestic raw material availability, reducing import dependency and supporting cost competitiveness. The fiber's natural breathability, hypoallergenic properties, and biodegradability align perfectly with increasing consumer preferences for sustainable, comfortable, and environmentally responsible fabric choices.

Traditional expertise in cotton textile manufacturing, spanning spinning, weaving, and processing operations, provides Indian manufacturers with significant competitive advantages in quality and production efficiency. Government support through minimum support pricing mechanisms for cotton farmers and technology mission initiatives strengthens raw material supply chains. According to sources, in October 2025, the Ministry of Textiles celebrated World Cotton Day, launching the Kasturi Cotton Bharat initiative to promote sustainable, high-quality Indian cotton through technology, collaboration, and industry partnerships. Moreover, growing international demand for Indian cotton textiles, particularly handloom products and specialty ethnic fabrics, continues reinforcing this segment's market leadership.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Technical

- Fashion and Clothing

- Others

Fashion and clothing exhibit a clear dominance with a 67.06% share of the total India textile market in 2025.

Fashion and clothing constitute the largest consumption segment within India textile market, reflecting the nation's massive population base and rapidly evolving fashion consciousness among consumers. Rising disposable incomes, accelerating urbanization, and increased exposure to global fashion trends are driving unprecedented demand for diverse apparel categories ranging from casual everyday wear to premium designer collections. The expansion of organized retail networks and branded fashion outlets has fundamentally transformed consumer purchasing behaviors nationwide. As per sources, in 2025, Myntra launched its ‘Myntra Fashion Forward 2025’ campaign, featuring various emerging and established Indian designers, expanding accessibility to premium and trend-driven apparel across e-commerce platforms.

This segment's dominance is further strengthened by India's vibrant occasion-wear culture, generating consistent demand for ceremonial, festive, and wedding attire throughout the year. E-commerce platform proliferation has democratized fashion accessibility, enabling consumers across geographic locations to access diverse apparel options conveniently. Fast fashion adoption and shorter fashion cycles are accelerating consumption patterns, with consumers increasingly seeking variety, trend alignment, and personalized styling options in their clothing purchases.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India dominates with a market share of 32% of the total India textile market in 2025.

North India leads regional textile consumption and production, supported by established manufacturing clusters, robust infrastructure networks, and strategic proximity to major consumption centers across the country. States including Punjab, Haryana, and Uttar Pradesh host significant textile production facilities spanning spinning, weaving, and garment manufacturing operations. The region's substantial demographic concentration and higher urbanization rates drive considerable domestic consumption demand, creating integrated production-consumption ecosystems benefiting local manufacturers significantly.

Historical textile trading centers and well-developed supply chain ecosystems provide operational advantages for manufacturers serving both domestic and international export markets effectively. Government-developed textile parks and special economic zones have attracted substantial investments in modern manufacturing facilities with advanced technologies. The region's established logistics networks facilitate efficient distribution to pan-India markets while enabling seamless connectivity to export channels and ports, reinforcing North India's leadership position.

Market Dynamics:

Growth Drivers:

Why is the India Textile Market Growing?

Rising Consumer Spending and Middle-Class Expansion

India's expanding middle-class population, characterized by rising disposable incomes and evolving lifestyle aspirations, constitutes a fundamental growth catalyst for the textile market. Urbanization trends are reshaping consumption patterns, with consumers demonstrating increasing willingness to spend on quality apparel and home textile products. The demographic dividend, with a significant youth population entering prime consumption years, creates sustained demand momentum across diverse textile categories. Consumers are transitioning from basic functional purchases towards aspirational and brand-conscious buying behaviours, driving premiumization across market segments. E-commerce penetration has further democratized access to diverse textile products, enabling consumers across tier-two and tier-three cities to participate in organized textile consumption. As per sources, Tata Cliq Luxury announced plans to expand product categories and reach Tier 2 and 3 cities, reflecting rising middle-class demand and e-commerce penetration across non-metro India.

Government Policy Support and Manufacturing Initiatives

Strategic government interventions through dedicated textile policies, incentive schemes, and infrastructure development programs are creating favorable conditions for industry expansion. Initiatives promoting integrated textile parks, technology modernization, and export competitiveness enhancement provide manufacturers with operational advantages. Schemes supporting handloom and power loom sectors ensure inclusive growth across organized and unorganized segments. Foreign direct investment facilitation and single-window clearance mechanisms are attracting domestic and international investments in manufacturing capacity expansion. Policy measures addressing infrastructure bottlenecks, skill development requirements, and raw material availability strengthen the industry's foundational capabilities, enabling sustained growth trajectories.

Export Market Expansion and Global Sourcing Shifts

India textile market is benefiting from favorable global sourcing dynamics as international buyers diversify supply chains beyond traditional manufacturing destinations. The country's comprehensive value chain capabilities, spanning fiber production through finished garment manufacturing, position it as a preferred sourcing destination. Competitive labor costs combined with improving quality standards enhance export attractiveness across apparel and home textile categories. Free trade agreements and preferential market access arrangements are opening new export opportunities in key consumption markets. According to sources, India and Oman signed a Free Trade Agreement, opening new export opportunities across textiles, food processing, and other sectors, enhancing market access and strengthening bilateral trade ties. India's established reputation in specialty textiles, including handloom products and ethnic wear, creates differentiated export propositions beyond commodity fabric categories.

Market Restraints:

What Challenges the India Textile Market is Facing?

Infrastructure and Logistics Constraints

Despite significant improvements, infrastructure deficiencies continue constraining operational efficiency across India's textile value chain. Inadequate transportation networks, power supply inconsistencies, and limited warehousing facilities increase production costs and delivery timelines. These bottlenecks particularly impact export competitiveness, where time-sensitive delivery requirements demand seamless logistics coordination, limiting geographic diversification of production capacity across emerging manufacturing locations.

Fragmented Industry Structure

The Indian textile industry's fragmented nature, characterized by numerous small-scale and unorganized players alongside larger integrated manufacturers, creates competitive and operational complexities. This fragmentation limits economies of scale, technology adoption, and quality standardization across the value chain. Coordination challenges between spinning, weaving, processing, and garment manufacturing segments impact overall supply chain efficiency and industry reputation significantly.

Raw Material Price Volatility

Fluctuations in cotton, synthetic fiber, and chemical input prices create margin pressures and planning uncertainties for textile manufacturers across segments. Dependency on agricultural production cycles exposes cotton availability to weather-related risks and yield variations. International price movements in petroleum-derived synthetic fibers impact polyester production costs, while limited hedging mechanisms restrict manufacturers' ability to manage input cost volatility effectively.

Competitive Landscape:

The India textile market features a dynamic competitive environment characterized by the coexistence of large-scale integrated manufacturers, specialized segment players, and numerous small-to-medium enterprises across value chain stages. Competition intensity varies across segments, with organized players dominating synthetic fiber production and branded apparel while unorganized participants maintain significant presence in cotton textiles and basic garment manufacturing. Market participants differentiate through product quality, manufacturing capabilities, supply chain integration, and geographic reach. Strategic investments in technology modernization, capacity expansion, and sustainable production practices define competitive positioning among leading players. Export-oriented manufacturers emphasize quality certifications and compliance capabilities, while domestic-focused players leverage distribution networks and brand recognition.

Recent Developments:

-

In June 2025, Cedaar Textile Limited opened its IPO to raise ₹60.90 Crore, aiming to modernize machinery, implement a solar rooftop system, and expand into technical textiles and branded apparel, strengthening its presence in India’s evolving textile sector while supporting sustainable and value-added product offerings.

-

In June 2025, UNIQLO announced its first store in Bengaluru, Southern India, scheduled to open in August. The 16th Indian outlet will offer LifeWear for men, women, and children, expanding UNIQLO’s footprint and catering to the city’s growing demand for high-quality, versatile apparel.

India Textile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India textile market size was valued at USD 152.40 Billion in 2025.

The India textile market is expected to grow at a compound annual growth rate of 3.83% from 2026-2034 to reach USD 213.75 Billion by 2034.

Polyesters held the largest market share driven by exceptional durability, cost-effectiveness, and versatile applications across fashion, sportswear, home textiles, and industrial segments, making it the preferred choice among manufacturers and consumers.

Key factors driving the India textile market include rising consumer spending, expanding middle-class population, government manufacturing initiatives, export market expansion, sustainable textile demand, technological modernization, organized retail growth, and favorable global sourcing dynamics.

Major challenges include infrastructure and logistics constraints, fragmented industry structure limiting economies of scale, raw material price volatility, competition from lower-cost manufacturing destinations, technology adoption gaps, environmental compliance requirements, and skilled workforce availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)