India Textile Recycling Market Size, Share, Trends and Forecast by Product Type, Textile Waste, Distribution Channel, End Use, and Region, 2026-2034

India Textile Recycling Market Summary:

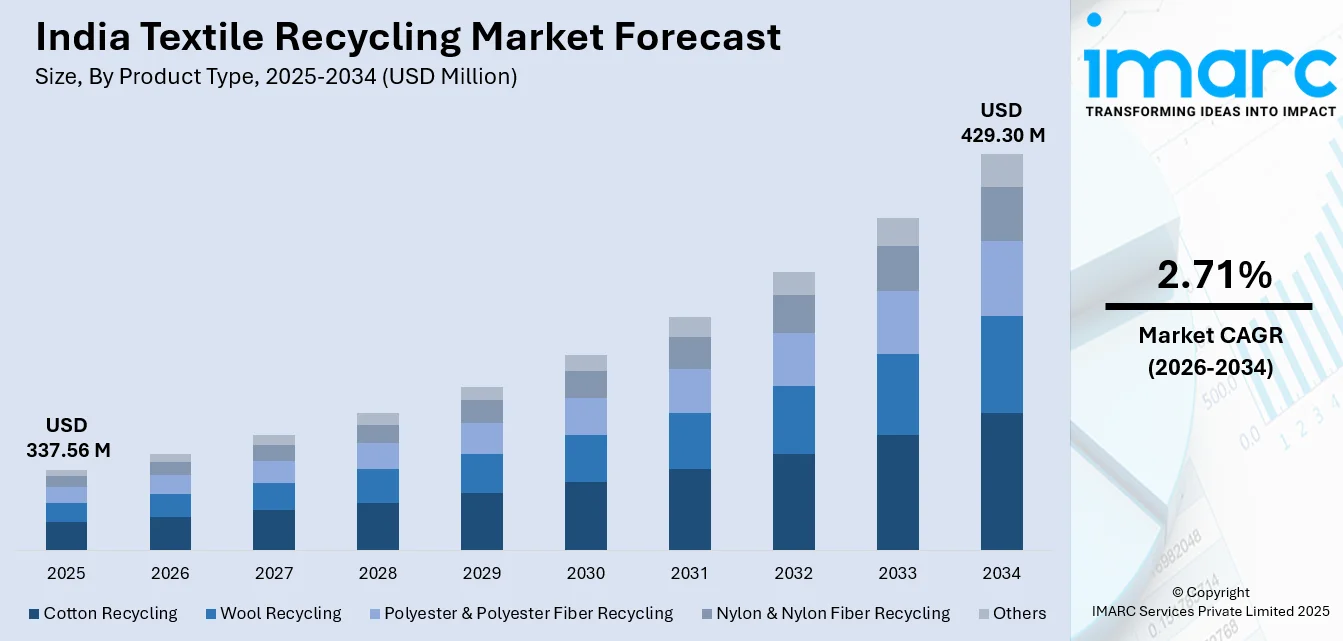

The India textile recycling market size was valued at USD 337.56 Million in 2025 and is projected to reach USD 429.30 Million by 2034, growing at a compound annual growth rate of 2.71% from 2026-2034.

The India textile recycling market is growing significantly because of rising awareness about the environment and the large amount of textile waste being generated in the country. The Indian textile recycling market is benefiting from favorable governmental policies being adopted to promote eco-friendly approaches and the circular economy concept in the fashion and apparel sector. Increasing demand for eco-friendly items and technological advancements are supplementing the Indian textile recycling market’s growth.

Key Takeaways and Insights:

-

By Product Type: Cotton recycling dominates the market with a share of 32% in 2025, driven by the widespread availability of cotton textile waste and established mechanical recycling infrastructure across traditional textile hubs.

- By Textile Waste: Pre-consumer textile leads the market with a share of 55% in 2025, owing to the homogeneous composition and ease of processing manufacturing waste from textile mills and garment factories.

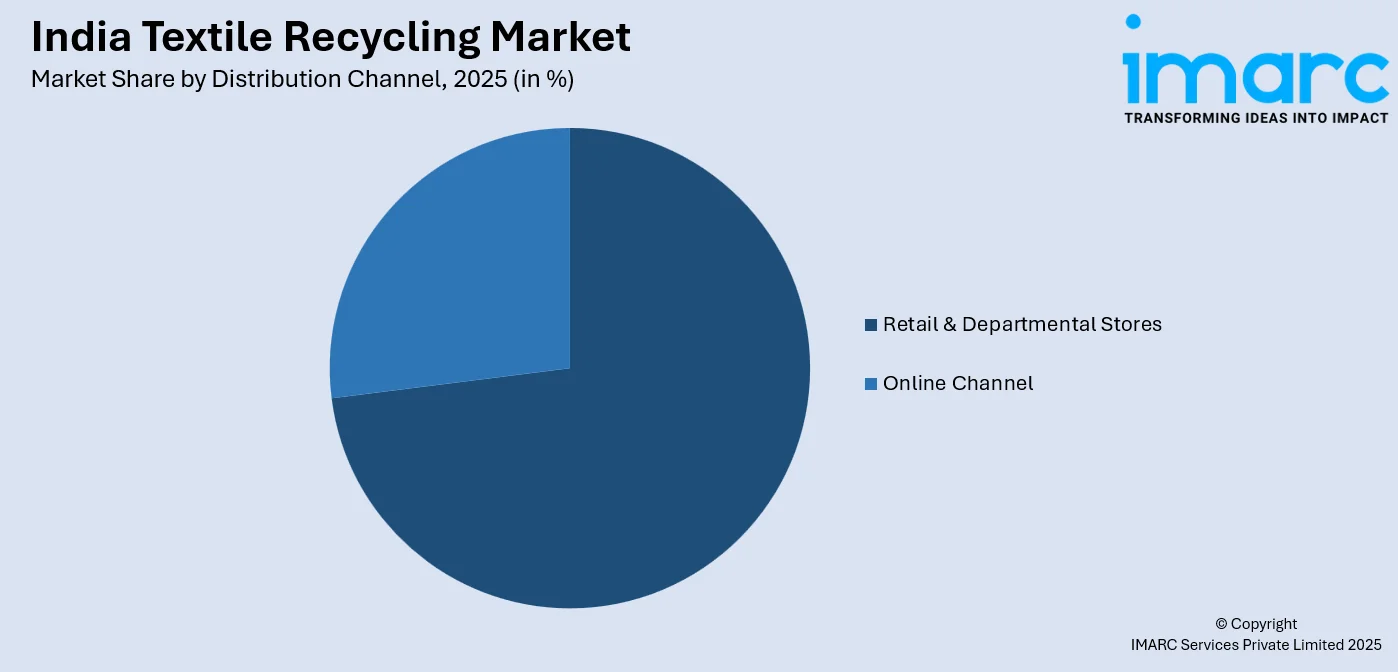

- By Distribution Channel: Retail & departmental stores represent the largest segment with a market share of 73% in 2025, fueled by established collection networks and growing consumer participation in textile take-back programs.

- By End Use: Apparel dominates with a share of 52% in 2025, reflecting the strong demand for recycled fibers in sustainable fashion and the growth of circular economy practices within garment manufacturing.

- By Region: North India leads with a market share of 30% in 2025, supported by the concentration of major textile recycling clusters in Panipat and Ludhiana along with proximity to raw material sources.

- Key Players: The India textile recycling market exhibits a moderately fragmented competitive landscape, characterized by the presence of established recyclers alongside emerging startups investing in advanced recycling technologies and fiber-to-fiber solutions.

To get more information on this market Request Sample

The textile recycling ecosystem in India is evolving with increasing integration of technology-driven solutions for fiber sorting and processing. The market benefits from the country’s position as a leading global textile producer with extensive manufacturing infrastructure and skilled workforce. Rising environmental consciousness among consumers and brands is accelerating the adoption of recycled materials across the value chain. In November 2025, the Government of India, under the Ministry of Textiles’ National Technical Textiles Mission, has launched focused recycling programmes including scientific textile recycling models and the Atal Centre of Textile Recycling and Sustainability to drive circular innovation. Government-led circular economy initiatives and policy support are creating favorable conditions for market expansion, while collaborative efforts between recyclers, manufacturers, and international brands are strengthening supply chain connectivity and driving innovation in sustainable textile production.

India Textile Recycling Market Trends:

Integration of AI-Driven Fiber Sorting Technologies

The adoption of advanced sorting technologies is transforming India’s textile recycling landscape. Hyperspectral imaging and near-infrared spectroscopy combined with machine learning algorithms are enabling more accurate identification and separation of different fiber types during the recycling process. In 2025, India‑founded startup Refiberd was recognised with the Global Fashion Agenda Trailblazer Award for its AI‑driven textile detection technology that uses hyperspectral imaging to optimise and scale textile recycling by analysing garment composition. These technological advancements are particularly crucial for handling blended fabrics, which traditionally posed challenges for mechanical recycling facilities.

Cluster-Based Recycling Infrastructure Development

The textile recycling industry is witnessing a strategic shift toward cluster-based infrastructure development across major textile hubs. This approach connects aggregators, recyclers, and manufacturers within geographic clusters, enabling shared infrastructure investments and stronger market linkages. In August 2025, Techtextil India announced a strategic tie‑up to launch the dedicated “ReCycle Zone” at its annual event in Mumbai, creating a platform that brings recyclers, solution providers, and technology innovators together to accelerate scalable recycling solutions across textile clusters. Key clusters in Panipat, Ludhiana, Tirupur, and Surat are emerging as focal points for coordinated recycling activities, benefiting from existing textile manufacturing expertise and established supply chain networks. The cluster model is improving traceability and creating long-term value for all stakeholders.

Rising Demand for Textile-to-Textile Recycling Solutions

The market is experiencing growing interest in textile-to-textile recycling technologies that convert post-consumer waste into virgin-quality fibers. Both mechanical and chemical recycling processes are being scaled to address the increasing demand for circular materials from global fashion brands. In April 2025, Ester Industries and Loop Industries announced a 50:50 joint venture to establish what will be the world’s first textile‑to‑textile waste recycling plant in India, aimed at transforming discarded textiles into high‑quality reusable materials using patented chemical recycling technology. Strategic partnerships and joint ventures are facilitating technology transfer and investment in advanced recycling facilities. This trend is particularly significant as extended producer responsibility regulations and circularity requirements gain momentum in key export markets.

Market Outlook 2026-2034:

The Indian textile recycling market is poised to witness growth over the coming years, led by the increasing textile waste, government regulations, as well as the demand for sustainable textiles. The textile recycling market is also being driven by significant developments, such as the establishment of advanced recycling facilities, innovations, as well as collaborative efforts by the government, associations, and enterprises, thus resolving the long-standing issues of disorganization within the sector. The market generated a revenue of USD 337.56 Million in 2025 and is projected to reach a revenue of USD 429.30 Million by 2034, growing at a compound annual growth rate of 2.71% from 2026-2034.

India Textile Recycling Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Cotton Recycling |

32% |

|

Textile Waste |

Pre-consumer Textile |

55% |

|

Distribution Channel |

Retail & Departmental Stores |

73% |

|

End Use |

Apparel |

52% |

|

Region |

North India |

30% |

Product Type Insights:

- Cotton Recycling

- Wool Recycling

- Polyester & Polyester Fiber Recycling

- Nylon & Nylon Fiber Recycling

- Others

The cotton recycling dominates with a market share of 32% of the total India textile recycling market in 2025.

Cotton recycling maintains its leading position in the India textile recycling market due to the abundant availability of cotton-based textile waste from both manufacturing processes and consumer disposal. According to reports, several Indian mills expanded installations of Trützschler’s TRUECYCLED technology to transform cotton and other textile waste into high‑quality recycled yarn, reinforcing India’s capacity to produce premium circular cotton fibers. The well-established mechanical recycling infrastructure in traditional textile hubs such as Panipat enables efficient processing of cotton waste into recycled fibers. The familiarity of processors with cotton fiber characteristics and the relatively straightforward recycling process compared to synthetic materials contribute to its dominance. Growing demand from sustainable fashion brands for recycled cotton fibers is further strengthening this segment.

The cotton recycling segment benefits from India’s position as one of the world’s largest cotton producers, ensuring consistent supply of raw material for recycling operations. Investment in quality improvement technologies is enhancing the grade of recycled cotton fibers, expanding their application possibilities in higher-value textile products. Collaborative initiatives between recyclers and spinning mills are improving the integration of recycled cotton into mainstream textile supply chains. The segment is also benefiting from increasing brand commitments to incorporate recycled cotton content in their product ranges.

Textile Waste Insights:

- Pre-consumer Textile

- Post-consumer Textile

The pre-consumer textile leads with a share of 55% of the total India textile recycling market in 2025.

Pre-consumer textile waste dominates the market owing to its relatively homogeneous composition and predictable quality characteristics compared to post-consumer waste. Manufacturing scraps, cutting waste, and production rejects from textile and garment factories provide a consistent and clean feedstock for recycling operations. The direct sourcing relationships between recyclers and manufacturing facilities ensure reliable supply chains and enable better quality control throughout the recycling process.

The pre-consumer segment benefits from established collection networks within industrial clusters and the economic incentive for manufacturers to monetize their production waste. The lower contamination levels and known fiber compositions of pre-consumer waste result in higher-quality recycled output and better yields from recycling processes. However, growing attention is being directed toward post-consumer textile recycling as brands and regulators increasingly focus on end-of-life solutions for consumer products and extended producer responsibility frameworks.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Channel

- Retail & Departmental Stores

The retail & departmental stores dominate with a market share of 73% of the total India textile recycling market in 2025.

The retail and departmental stores channel maintains its dominant position due to the established physical presence and consumer touchpoints that facilitate textile collection and recycling awareness programs. Major retail chains are increasingly implementing take-back schemes and collection bins for used textiles, leveraging their store networks to aggregate post-consumer waste. The trust and convenience associated with established retail brands encourage greater consumer participation in textile recycling initiatives.

This distribution channel benefits from the ability to combine recycling collection with regular shopping activities, reducing friction for consumers participating in textile recovery programs. Retail partnerships with recycling organizations and sustainable fashion brands are creating integrated systems for collecting, processing, and reintroducing recycled materials into product lines. The visibility of in-store recycling programs also serves an important educational function, raising consumer awareness about sustainable disposal options and circular fashion concepts.

End Use Insights:

- Apparel

- Industrial

- Home Furnishings

- Non-woven

- Others

The apparel leads with a share of 52% of the total India textile recycling market in 2025.

The apparel segment leads the end-use market driven by the substantial volume of clothing waste generated annually and the growing adoption of circular economy principles within the fashion industry. In 2025, global fashion brand Mango partnered with Circulose to incorporate recycled cotton‑based fibres, produced from cotton waste, into its collections as part of its long‑term sustainability and circularity strategy. Global and domestic fashion brands are increasingly incorporating recycled fibers into their collections to meet sustainability targets and consumer demand for environmentally responsible products. The versatility of recycled textile fibers for various apparel applications supports the segment’s dominant position.

The apparel segment benefits from heightened consumer awareness regarding fast fashion’s environmental impact and the growing preference for sustainable clothing options. Brand commitments to recycled content targets and transparent supply chain practices are driving consistent demand for recycled fibers in garment manufacturing. Investment in quality improvement technologies is enabling recycled fibers to meet the performance standards required for a broader range of apparel categories, expanding market opportunities beyond basic applications.

Region Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India textile recycling market in 2025.

North India maintains its leading position in the textile recycling market due to the concentration of established recycling clusters, particularly in Panipat which is recognized as one of the world’s largest textile recycling hubs. The region benefits from proximity to major textile manufacturing centers and raw material sources, enabling efficient supply chain operations. The presence of experienced recyclers with decades of operational expertise and established domestic and international buyer networks strengthens the region’s competitive position.

The region is witnessing increased investment in modernizing recycling infrastructure and adopting advanced processing technologies. Government initiatives and cluster-based development programs are supporting capacity expansion and technology upgradation across existing facilities. The strategic location provides access to both domestic consumption markets and export channels, while the skilled workforce familiar with textile recycling processes ensures operational efficiency and quality consistency.

Market Dynamics:

Growth Drivers:

Why is the India Textile Recycling Market Growing?

Rising Environmental Awareness and Sustainability Consciousness

The growing environmental consciousness among consumers, manufacturers, and policymakers is significantly driving the textile recycling market in India. Increasing awareness regarding the environmental impact of textile waste, including landfill burden and pollution from incineration, is motivating stakeholders across the value chain to adopt sustainable practices. In November 2025, the Closing the Loop programme, supported by the H&M Foundation and IKEA Foundation, reported diverting over 4,000 metric tonnes of textile waste from landfills in India while improving livelihoods for waste workers through inclusive circular supply chain initiatives. The fashion industry’s contribution to greenhouse gas emissions and water pollution has prompted brands to incorporate recycled materials into their supply chains. Consumer preference for sustainably produced garments is influencing purchasing decisions and creating market pull for recycled textile products. Educational campaigns and media coverage highlighting environmental issues are further accelerating this shift toward circular fashion models.

Government Policy Support and Regulatory Framework Development

The Indian government’s commitment to promoting sustainable practices and circular economy principles is creating a favorable policy environment for textile recycling. According to reports, the InTex India programme, a joint initiative by the Ministry of Textiles and UNEP, was launched to help small and medium enterprises adopt circular practices and eco‑innovation across textile clusters. Initiatives under the National Resource Efficiency Policy encourage recycling across textile clusters, while schemes supporting small and medium enterprises provide financial assistance for establishing recycling infrastructure. The Swachh Bharat Mission promotes improved waste segregation, enhancing the availability of quality textile waste for recyclers. Task forces focused on cluster-based development approaches are coordinating efforts between government agencies and industry stakeholders. The policy momentum is expected to strengthen further with potential implementation of extended producer responsibility frameworks aligned with international regulatory trends.

Technological Advancements in Recycling Processes and Automation

Continuous technological innovation is transforming the capabilities and economics of textile recycling operations in India. Advanced fiber sorting technologies utilizing artificial intelligence, hyperspectral imaging, and near-infrared spectroscopy are improving the accuracy and efficiency of material identification and separation. Investment in both mechanical and chemical recycling processes is expanding the range of textile waste that can be effectively processed. Automation is enhancing throughput and consistency while reducing labor dependence and processing costs. Research and development activities focused on fiber-to-fiber recycling technologies are enabling the production of higher-quality recycled fibers suitable for premium applications. These technological improvements are attracting investment and enabling the industry to meet growing demand for recycled materials.

Market Restraints:

What Challenges the India Textile Recycling Market is Facing?

Fragmented and Unorganized Waste Collection Infrastructure

The textile recycling industry faces significant challenges due to the fragmented nature of waste collection systems across India. The largely informal and unorganized collection networks result in inconsistent supply quality and unpredictable material availability for recycling facilities. The lack of standardized collection and sorting processes leads to contamination and mixed textile waste that is difficult to process efficiently.

Quality Limitations and Blended Fabric Processing Challenges

The processing of blended fabrics containing multiple fiber types remains a significant technical challenge for the recycling industry. Mechanical recycling processes typically result in fiber degradation, limiting the quality and application range of recycled output. The prevalence of complex fabric compositions in modern textiles complicates separation and recycling, while achieving virgin-quality recycled fibers requires expensive chemical recycling technologies.

High Capital Investment Requirements for Advanced Technologies

The substantial capital investment required for establishing advanced recycling facilities presents a barrier to industry modernization and expansion. Chemical recycling technologies capable of producing high-quality fibers demand significant upfront investment and operational expertise. Many existing recyclers, particularly small and medium enterprises, face financial constraints in adopting new technologies, limiting the industry’s ability to scale and meet growing demand for premium recycled materials.

Competitive Landscape:

The Indian textile recycling industry is represented by a fairly fragmented level of competition, with the integration of both established recycling facilities and relatively new technology-based startups. The India textile recycling market comprises conventional mechanical recycling facilities, which are geographically dispersed in already established clusters, and relatively new players investing in the latest fiber-to-fiber recycling technology. Competitive intensity in the recycling industry is influenced by capacity, technology, web of relationships, and access to high-quality feedstocks, among others. Increasing collaboration between local recycling companies and foreign technology developers is being observed to improve processing capacity in the industry, which is experiencing signs of industry concentration, with larger players adding capacity and small players being forced to advance technology or play an important role in a specific segment.

Recent Developments:

- In December 2025, The Re-START Alliance has launched its first flagship programme in India, Cluster Collective, to scale textile-to-textile (T2T) recycling nationwide. The four-year initiative will enhance recycling infrastructure, improve sorting and collection systems, and unite stakeholders to strengthen India’s textile recycling ecosystem.

India Textile Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Cotton Recycling, Wool Recycling, Polyester & Polyester Fiber Recycling, Nylon & Nylon Fiber Recycling, Others |

| Textile Wastes Covered | Pre-consumer Textile, Post-consumer Textile |

| Distribution Channels Covered | Online Channel , Retail & Departmental Stores |

| End Uses Covered | Apparel, Industrial, Home Furnishings, Non-woven, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India textile recycling market size was valued at USD 337.56 Million in 2025.

The India textile recycling market is expected to grow at a compound annual growth rate of 2.71% from 2026-2034 to reach USD 429.30 Million by 2034.

Cotton recycling dominated the market with a share of 32%, driven by the abundant availability of cotton textile waste and well-established mechanical recycling infrastructure in traditional textile hubs across India.

Key factors driving the India textile recycling market include rising environmental awareness and sustainability consciousness, supportive government policies promoting circular economy models, technological advancements in recycling processes, increasing textile waste generation, and growing demand for eco-friendly products from consumers and fashion brands.

Major challenges include fragmented and unorganized waste collection infrastructure, quality limitations from processing blended fabrics, high capital investment requirements for advanced recycling technologies, contamination in mixed textile waste, dependency on manual sorting processes, and erratic supply of high-quality feedstock.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)