India TFT LCD Panel Market Size, Share, Trends and Forecast by Size, Technology, Application, and Region, 2025-2033

India TFT LCD Panel Market Size and Share:

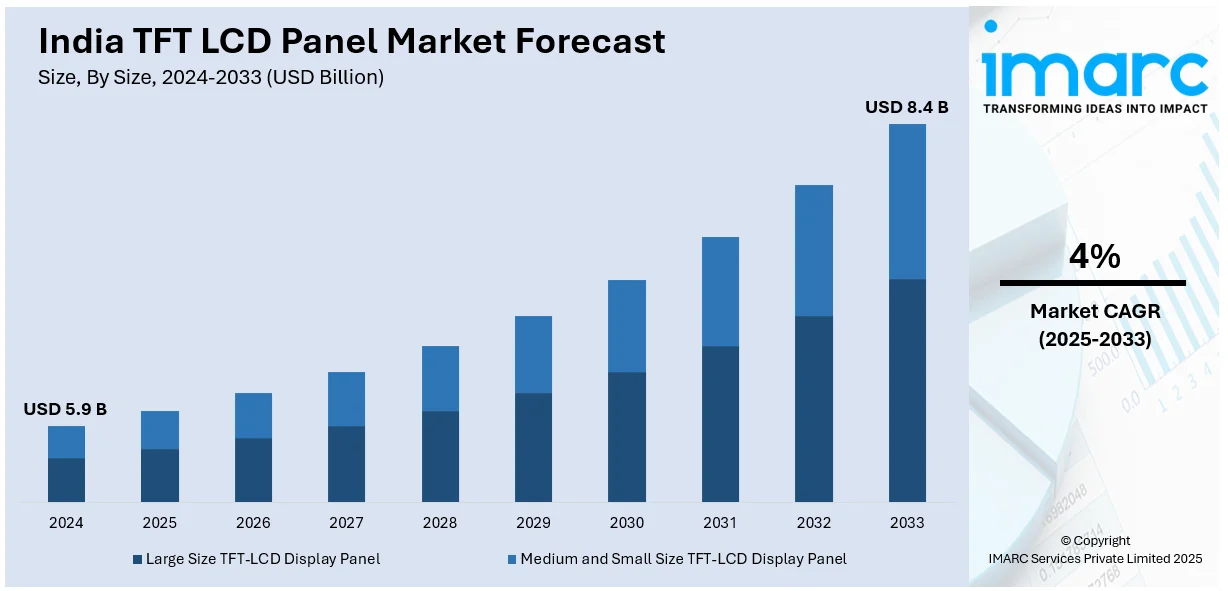

The India TFT LCD panel market size reached USD 5.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4% during 2025-2033. The rising demand for consumer electronics, increased smartphone penetration, expanding automotive and industrial display applications, government initiatives supporting local manufacturing, and the growing adoption of smart TVs and wearables are fueling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.9 Billion |

| Market Forecast in 2033 | USD 8.4 Billion |

| Market Growth Rate 2025-2033 | 4% |

India TFT LCD Panel Market Trends:

Expansion of Consumer Electronics and Mobile Device Markets

The proliferation of consumer electronics, particularly smartphones and televisions, has substantially increased the demand for TFT-LCD panels in India. In 2020, India’s domestic and export demand for flat panel displays exceeded 250 million units, with around 225 million being smartphone displays. By 2025, this demand is expected to surpass 920 million units, growing at a CAGR of 29.5%. This surge is attributed to rising smartphone penetration. As of 2023, smartphone users in India have exceeded 700 million, with expectations to reach 850 million by 2025. The affordability of devices and data plans has made smartphones more accessible, driving the need for high-quality TFT-LCD panels. Moreover, the burgeoning growth of the India TV market is aiding in market expansion, with TFT-LCD panels being the preferred choice due to their cost-effectiveness and superior display quality. Besides this, government programs like 'Digital India' aiming to increase digital connectivity are further boosting the demand for electronic devices that utilize TFT-LCD panels.

To get more information on this market, Request Sample

Development of Domestic Manufacturing Capabilities

Recognizing the strategic importance of display technologies, India is making concerted efforts to establish a robust domestic manufacturing ecosystem for TFT-LCD panels. India’s display market is projected to expand from around USD 7 billion in 2020 to USD 15 billion by 2025, with expectations to triple by 2030. Notably, Vedanta Group plans to establish the country’s first integrated glass and display fabrication facility, leveraging the expertise of its subsidiary, AvanStrate Inc., which holds over 700 patents in LCD glass substrate manufacturing. In addition to this, the Indian government has introduced favorable policies and incentives to attract investments in display manufacturing, aiming to reduce dependence on imports and position India as a global hub for electronics production. Furthermore, ongoing technological developments and investments in research and development (R&D) are fostering innovations in TFT-LCD technology, leading to improved panel quality and cost reductions, thereby enhancing the competitiveness of Indian manufacturers.

India TFT LCD Panel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on size, technology, and application.

Size Insights:

- Large Size TFT-LCD Display Panel

- Medium and Small Size TFT-LCD Display Panel

The report has provided a detailed breakup and analysis of the market based on the size. This includes large size TFT-LCD display panel and medium and small size TFT-LCD display panel.

Technology Insights:

- 8th Generation

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes 8th generation and others.

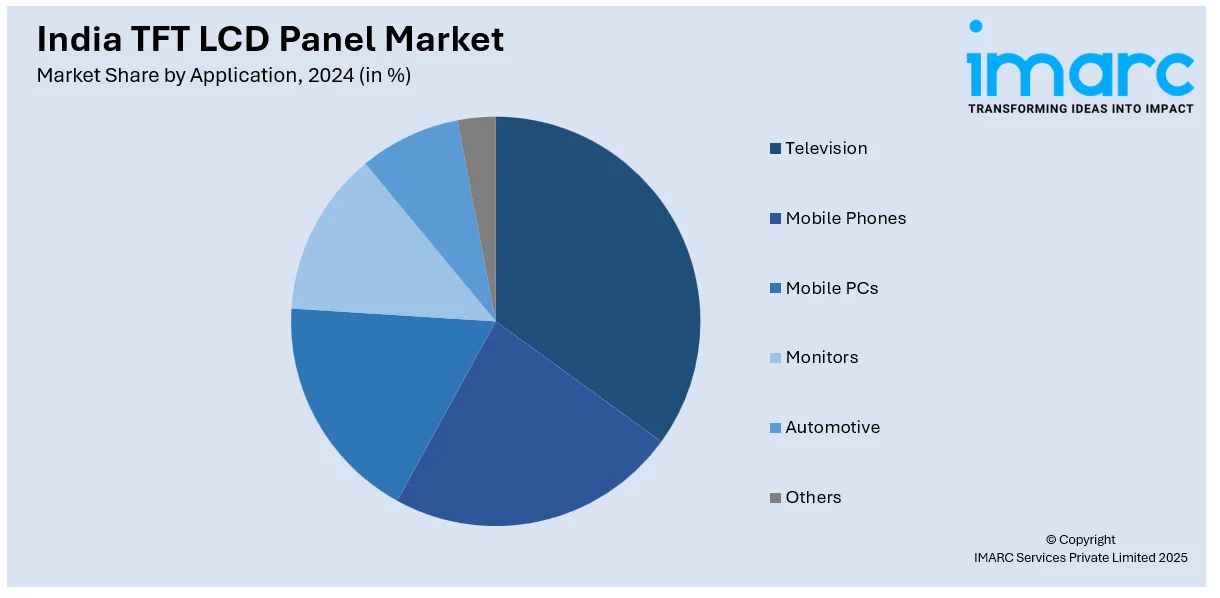

Application Insights:

- Television

- Mobile Phones

- Mobile PCs

- Monitors

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes television, mobile phones, mobile PCs, monitors, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India TFT LCD Panel Market News:

- June 2024: Dixon Technologies (India) Ltd and HKC Corporation Limited formed a joint venture to manufacture LCD and TFT-LCD modules, cellphones, televisions, and other products for the Indian market. The alliance seeks to produce LCD and TFT-LCD modules, assemble final products, and market HKC-branded products in India.

- February 2024: Taiwan-based Innolux, a technology partner of India’s Vedanta, plans to commence mass production of LCD panels in India within two years of receiving approval under the INR 760 billion semiconductor and display manufacturing incentive program. Innolux intends to aid Vedanta by supplying technical know-how for TFT-LCD without involvement in the management of the display fab, which might cost $30-40 billion to create.

India TFT LCD Panel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sizes Covered | Large Size TFT-LCD Display Panel, Medium and Small Size TFT-LCD Display Panel |

| Technologies Covered | 8th Generation, Others |

| Applications Covered | Television, Mobile Phones, Mobile PCs, Monitors, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India TFT LCD panel market performed so far and how will it perform in the coming years?

- What is the breakup of the India TFT LCD panel market on the basis of size?

- What is the breakup of the India TFT LCD panel market on the basis of technology?

- What is the breakup of the India TFT LCD panel market on the basis of application?

- What are the various stages in the value chain of the India TFT LCD panel market?

- What are the key driving factors and challenges in the India TFT LCD panel market?

- What is the structure of the India TFT LCD panel market and who are the key players?

- What is the degree of competition in the India TFT LCD panel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India TFT LCD panel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India TFT LCD panel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India TFT LCD panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)