India Thermal Paper Market Size, Share, Trends and Forecast by Application, Width, Technology, and Region, 2025-2033

India Thermal Paper Market Overview:

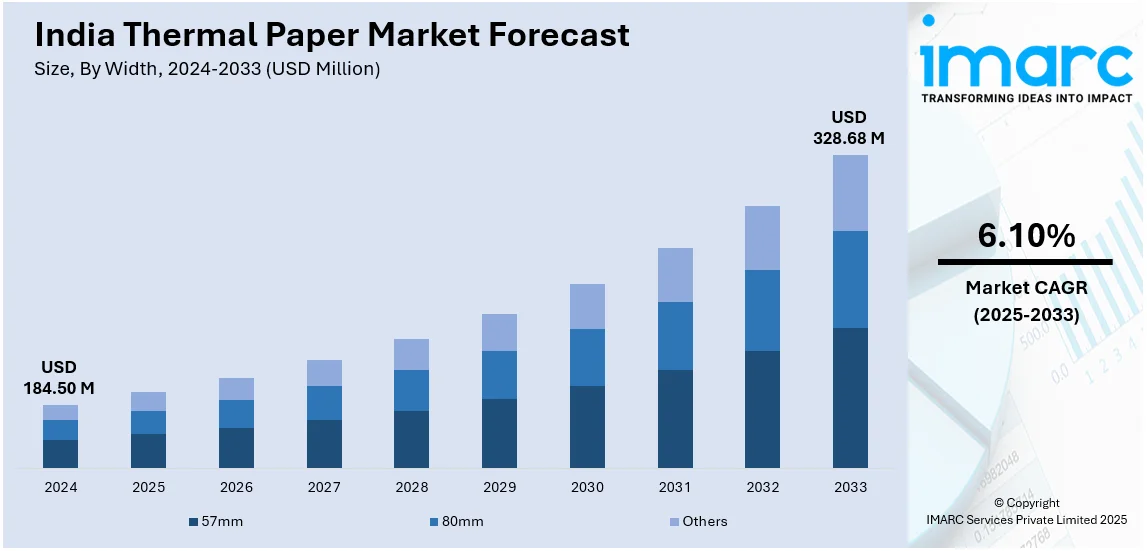

The India thermal paper market size reached USD 184.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 328.68 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The market is driven by increasing digital transactions, widespread adoption of point-of-sale (POS), increasing e-commerce growth, expanding retail and logistics sectors, rising healthcare applications, and ongoing innovations in eco-friendly alternatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 184.50 Million |

| Market Forecast in 2033 | USD 328.68 Million |

| Market Growth Rate (2025-2033) | 6.10% |

India Thermal Paper Market Trends:

Growing Demand Due to Digital Payments and POS Expansion

The India thermal paper market growth benefits from rapid digital transformation because retail outlets banking institutions and hospitality services adopt point-of-sale (POS) systems. For instance, in 2023, the Indian government announced plans to install 5 million POS devices in rural areas by 2025, aiming to promote digital payments, thereby increasing the demand for thermal paper in these regions. In addition to this, the government-backed UPI, Aadhaar-enabled payment systems, and e-wallet initiatives encourage businesses to invest in innovative billing and receipt solutions. Moreover, the retail industry and its sub-sectors of supermarkets and convenience stores as well as e-commerce depend on thermal paper for bill generation and order management. Besides this, the logistics and transportation industries depend on thermal receipts to create shipping labels which helps expand their market demand. Also, the growth of the bank automation market through ATM receipts and transaction record management drives a significant market expansion. Furthermore, thermal printing remains integrated into business operations by companies that want to provide convenient and efficient services to customers through mobile and contactless payment options. As a result, the expanding usage of digital transactions creates ongoing market demand for thermal paper despite the development of paperless solutions in specific fields, which is enhancing the India thermal paper market outlook.

To get more information on this market, Request Sample

Rising Focus on Sustainability and Eco-Friendly Alternatives

The India thermal paper market is moving toward environmentally friendly and BPA-free thermal paper products as environmental concerns grow stronger. In line with this, the traditional thermal paper incorporates the chemical bisphenol A (BPA) which faces health and environmental challenges that prompted worldwide regulatory actions. Concurrently, the market demands have prompted manufacturers to create BPA-free and phenol-free alternatives that both satisfy global sustainability requirements and respond to consumers seeking eco-friendly products. Additionally, the growing market interest includes thermal paper that can be both recycled and compostable because it helps businesses meet their sustainability targets. Furthermore, electronic receipts combined with QR code transactions represent a business strategy to reduce paper usage. Also, sustainable manufacturing practices and waste management policies from the government lead to new innovative developments across the industry. For example, at PaperTech 2024, the Indian Paper Manufacturers Association (IPMA) highlighted the industry's dedication to reducing its carbon footprint through clean technologies. Integrated mills have significantly reduced water usage, from 200 cubic meters to under 50 cubic meters per tonne of paper, showcasing a strong commitment to environmental sustainability. Apart from this, the expanding market demand for eco-friendly thermal paper technologies is giving companies a competitive advantage in India's developing business arena, thus boosting the India thermal paper market share.

India Thermal Paper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application, width and technology.

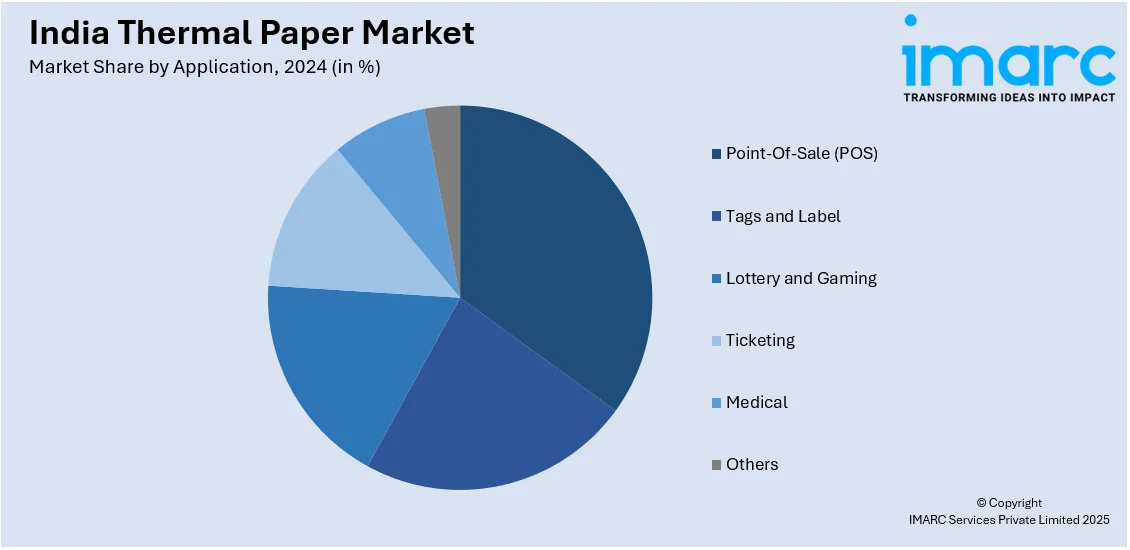

Application Insights:

- Point-Of-Sale (POS)

- Tags and Label

- Lottery and Gaming

- Ticketing

- Medical

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes point-of-sale (POS), tags and label, lottery and gaming, ticketing, medical and others.

Width Insights:

- 57mm

- 80mm

- Others

A detailed breakup and analysis of the market based on the width have also been provided in the report. This includes 57mm, 80mm, and others.

Technology Insights:

- Direct Thermal

- Thermal Transfer

The report has provided a detailed breakup and analysis of the market based on the technology. This includes direct thermal and thermal transfer.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Thermal Paper Market News:

- In November 2024, Monotech Systems partnered with Alliance Printech at Labelexpo India to integrate JETSCI® inkjet systems with flexographic presses. This collaboration enhances print quality, cost-efficiency, and flexibility, boosting thermal paper market growth by meeting evolving label and packaging demands.

- In October 2024, Durst Group collaborated with Newgen Printronics at Labelexpo India 2024, unveiling the Tau RSC E 7-color low-migration printer. It is designed for food and pharmaceutical labeling, and this innovation enhances printing solutions, driving thermal paper market growth by meeting specialized industry needs.

India Thermal Paper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Point-Of-Sale (POS), Tags and Label, Lottery and Gaming, Ticketing, Medical, Others |

| Widths Covered | 57mm, 80mm, Others |

| Technologies Covered | Direct Thermal, Thermal Transfer |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India thermal paper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India thermal paper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India thermal paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The thermal paper market in India was valued at USD 184.50 Million in 2024.

The India thermal paper market is projected to exhibit a CAGR of 6.10% during 2025-2033, reaching a value of USD 328.68 Million by 2033.

Key factors driving the India thermal paper market include the growing demand for receipts in retail and banking sectors, increasing adoption of point-of-sale (POS) systems, rising use of thermal printers in logistics and transportation, and a surge in the e-commerce industry, which requires efficient labeling and packaging solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)