India Thermal Power Plant Maintenance Market Size, Share, Trends and Forecast by Fuel Type, Capacity, Turbine Type, Service, Equipment, and Region, 2025-2033

India Thermal Power Plant Maintenance Market Overview:

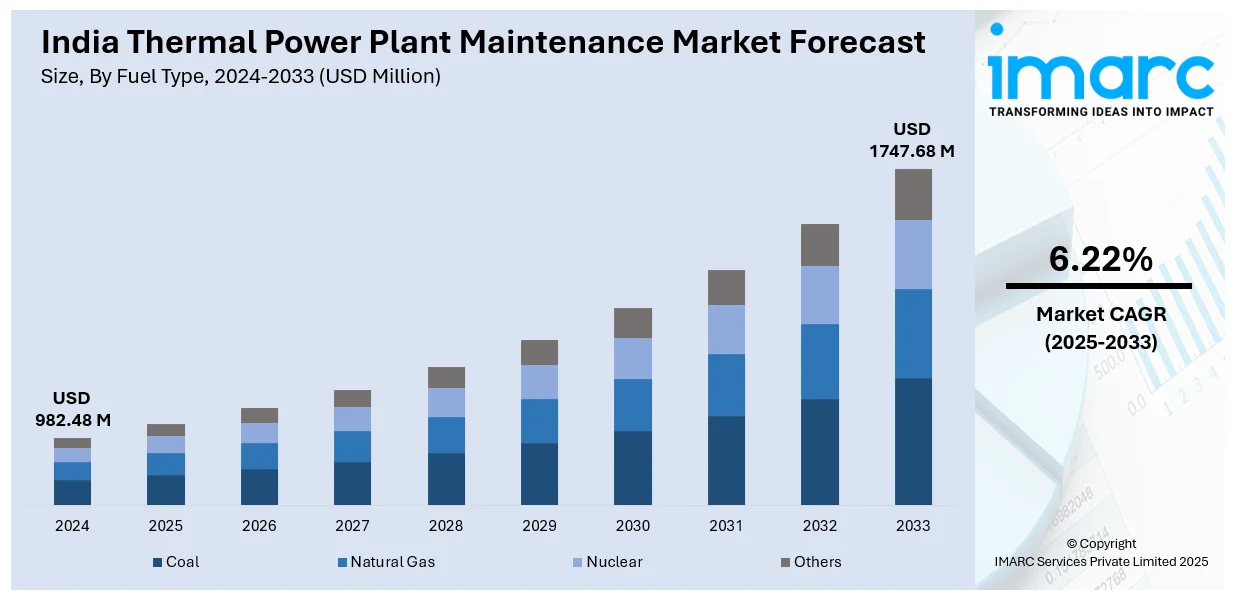

The India thermal power plant maintenance market size reached USD 982.48 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,747.68 Million by 2033, exhibiting a growth rate (CAGR) of 6.22% during 2025-2033. The India thermal power plant maintenance market share is expanding, driven by the rising spending on energy infrastructure, which is enabling the use of innovative maintenance strategies, along with the increasing utilization of artificial intelligence (AI).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 982.48 Million |

| Market Forecast in 2033 | USD 1,747.68 Million |

| Market Growth Rate 2025-2033 | 6.22% |

India Thermal Power Plant Maintenance Market Trends:

Growing investments in energy infrastructure

The rising investments in energy infrastructure are offering a favorable India thermal power plant maintenance market outlook. In the Indian Interim Budget for 2024-2025, the financial allocation for the development of solar power grid infrastructure rose to INR 8,500 Crore (USD 1.02 Billion), a notable increase from INR 4,970 Crore (USD 600 Million) in 2023. As India continues to expand its power generation capacity, government agencies are allocating significant funds to upgrade and modernize existing thermal plants. The expenditure is enabling the adoption of advanced maintenance technologies, which aid in reducing downtime and improving plant efficiency. Many older power plants require extensive refurbishments to comply with stricter environmental regulations, and government funding is supporting retrofitting efforts to enhance their performance and lifespan. Additionally, infrastructure projects like new transmission lines and smart grids are creating the need for well-maintained thermal power plants to ensure a stable electricity supply. With government-backed initiatives promoting cleaner and more efficient energy generation, power plants are focusing on regular maintenance to minimize emissions and improve fuel efficiency. Financial support is also encouraging the use of innovative maintenance strategies, such as drone inspections and remote diagnostics, reducing costs and ensuring safety. As the government continues to work for energy security and sustainability, its spending on energy infrastructure is making thermal power plant maintenance a crucial aspect of the country’s long-term power strategy.

To get more information on this market, Request Sample

Increasing employment of AI

The rising employment of AI is impelling the India thermal power plant maintenance market growth. Power companies look for smarter ways to improve efficiency and reduce downtime. AI-based predictive maintenance helps to detect potential equipment failures before they happen, allowing plant operators to fix issues early and avoid costly breakdowns. With AI-oriented sensors and machine learning (ML) algorithms analyzing real-time data, power plants can optimize maintenance schedules, extend the lifespan of machinery, and minimize unplanned outages. AI also improves energy efficiency by identifying areas where fuel usage can be decreased, ultimately cutting costs and lowering emissions. Additionally, AI-focused automation is reducing the need for manual inspections, making maintenance safer and more accurate. As India’s energy demand keeps rising, power plants are under pressure to operate without disruptions, making AI-based maintenance solutions more valuable. AI-oriented analytics also assist in making informed decisions on equipment upgrades, lowering overall operational risks. With the government’s encouragement for digitalization and smart infrastructure, the adoption of AI in thermal power plant maintenance is growing, ensuring better plant performance, cost savings, and reliability in power generation. According to the IBEF, the market for AI is set to attain USD 7.8 Billion by 2025 in India.

India Thermal Power Plant Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on fuel type, capacity, turbine type, service, and equipment.

Fuel Type Insights:

- Coal

- Natural Gas

- Nuclear

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes coal, natural gas, nuclear, and others.

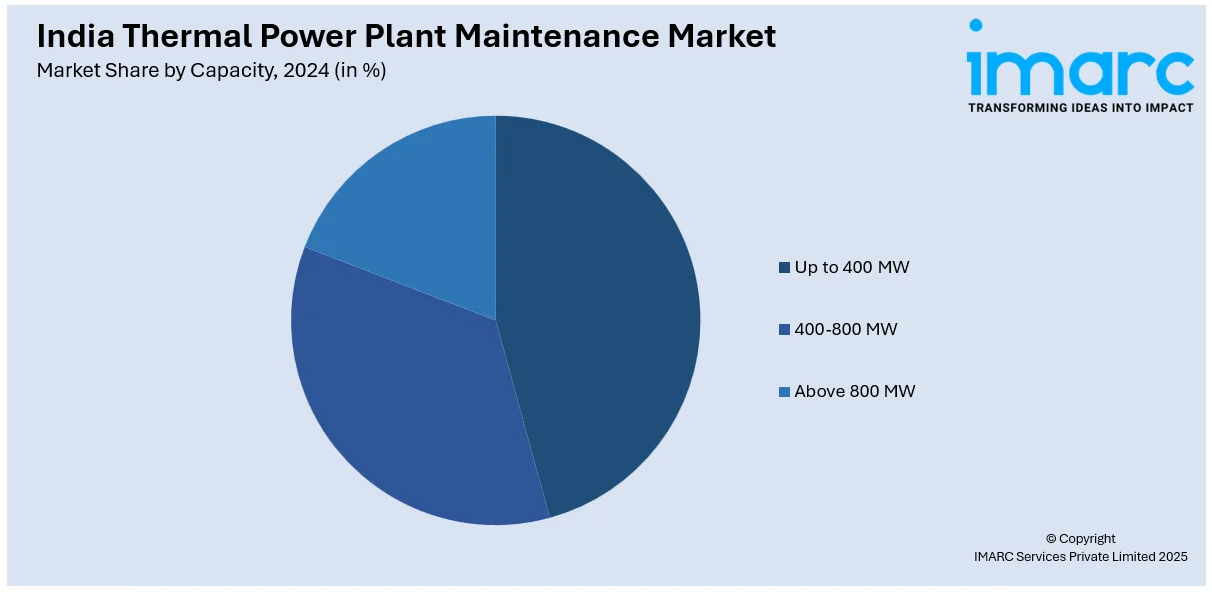

Capacity Insights:

- Up to 400 MW

- 400-800 MW

- Above 800 MW

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 400 MW, 400-800 MW, and above 800 MW.

Turbine Type Insights:

- Simple Cycle

- Combined Cycle

The report has provided a detailed breakup and analysis of the market based on the turbine type. This includes simple cycle and combined cycle.

Service Insights:

- Preventive Maintenance

- Corrective Maintenance

- Predictive Maintenance

- Condition-Based Maintenance

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes preventive maintenance, corrective maintenance, predictive maintenance, and condition-based maintenance.

Equipment Insights:

- Turbines

- Generators

- Boilers

- Balance of Plant (BoP) Systems

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes turbines, generators, boilers, and balance of plant (BoP) systems.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Thermal Power Plant Maintenance Market News:

- In January 2025, the Solar Energy Corporation of India (SECI) released a tender for the planning, development, sourcing, building, setup, examination, complete operation, and maintenance for ten years of a 10 MW ‘Floating Solar Photovoltaic (FSPV)’ project situated at the Singareni Thermal Power Plant (STPP) in Telangana, India. This initiative marked a major advancement in green energy efforts and energy independence for SCCL, utilizing the rich solar energy potential in the state.

- In January 2025, Karnataka's energy department asked thermal plants to accelerate maintenance in preparation for a rise in power demand from a severe summer, aiming to match or surpass 2024's record output of 3,600MW. The energy minister highlighted the preparedness of solar energy and strategic electricity exchange with northern Indian states to effectively handle requirements.

India Thermal Power Plant Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Coal, Natural Gas, Nuclear, Others |

| Capacities Covered | Up to 400 MW, 400-800 MW, Above 800 MW |

| Turbine Types Covered | Simple Cycle, Combined Cycle |

| Services Covered | Preventive Maintenance, Corrective Maintenance, Predictive Maintenance, Condition-Based Maintenance |

| Equipment Covered | Turbines, Generators, Boilers, Balance of Plant (BoP) Systems |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India thermal power plant maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the India thermal power plant maintenance market on the basis of fuel type?

- What is the breakup of the India thermal power plant maintenance market on the basis of capacity?

- What is the breakup of the India thermal power plant maintenance market on the basis of turbine type?

- What is the breakup of the India thermal power plant maintenance market on the basis of service?

- What is the breakup of the India thermal power plant maintenance market on the basis of equipment?

- What is the breakup of the India thermal power plant maintenance market on the basis of region?

- What are the various stages in the value chain of the India thermal power plant maintenance market?

- What are the key driving factors and challenges in the India thermal power plant maintenance?

- What is the structure of the India thermal power plant maintenance market and who are the key players?

- What is the degree of competition in the India thermal power plant maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India thermal power plant maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India thermal power plant maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India thermal power plant maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)