India Thermal and Winter Wear Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, End User, and Region, 2026-2034

India Thermal and Winter Wear Market Size and Share:

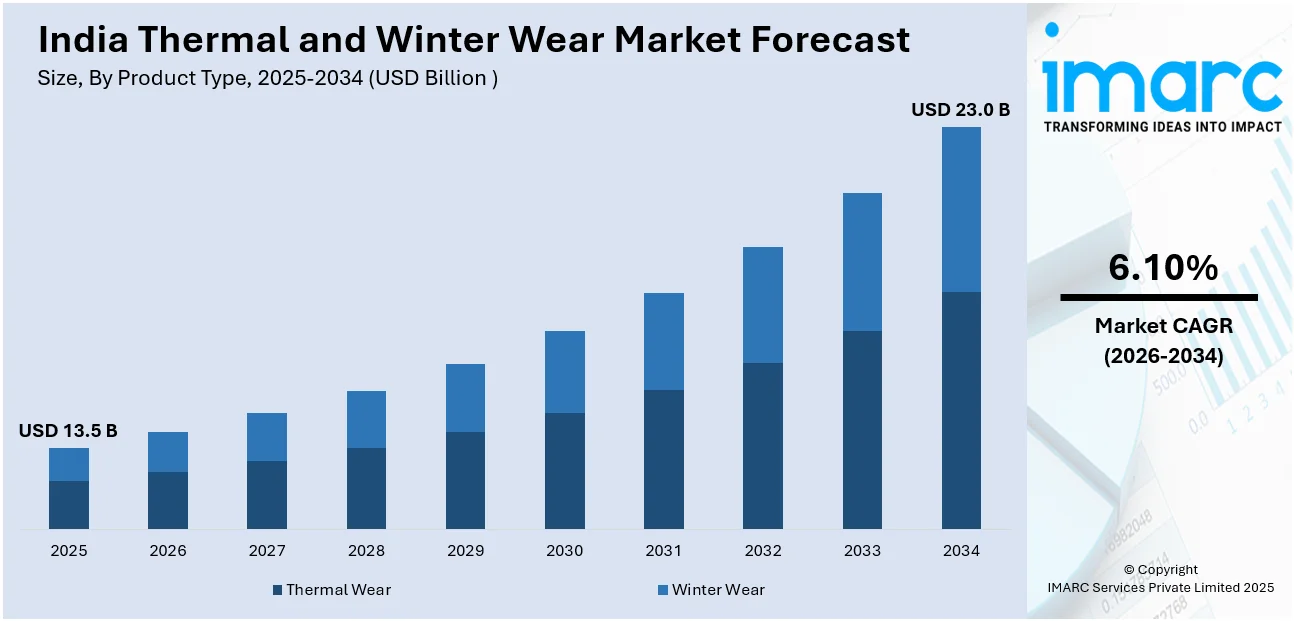

The India thermal and winter wear market size reached USD 13.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 23.0 Billion by 2034, exhibiting a growth rate (CAGR) of 6.10% during 2026-2034. The market is driven due to rising demand for sustainable, innovative, and adaptable clothing that is comfortable, warm, and functional in changing climates and geographies, with an emerging trend towards eco-friendly and technology-integrated fabrics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13.5 Billion |

| Market Forecast in 2034 | USD 23.0 Billion |

| Market Growth Rate 2026-2034 | 6.10% |

India Thermal and Winter Wear Market Trends:

Rising Demand for Sustainable and Eco-friendly Materials

In India, heightened environmental awareness has a pronounced impact on the thermal and winter wear industry. Consumers are nowadays intensely focusing on sustainability, contributing to an increasing demand for ecologically friendly products. Natural textiles, such as organic cotton and wool, which can be biodegradable and are renewable, are becoming popular among consumers for wearing in winter. There is also a rising desire for recycled textile materials, such as polyester from plastic containers. Brands are meeting this demand by providing sustainable options, with environmentally aware consumers attracted to these products due to their green credentials. In addition to environmentally friendly materials, brands are also emphasizing ethical production methods, utilizing low-impact dyes and minimizing carbon footprints. This trend is changing the India thermal and winter wear market because both young and older consumers are more inclined towards investing in apparel that not only serves functional requirements but also resonate with their sense of sustainability and responsibility.

To get more information on this market Request Sample

Smart and Tech-Integrated Winter Wear

In India, there has been growing usage of technology in the fashion sector, resulting in rising popularity of smart and technologically enabled thermal and winter clothing. Such products include heated jackets, thermally managed textiles, and wearables that are embedded with wearable technology. For example, in January 2024, H2C introduced StayWarm, a battery-free thermal solution offering 6-8 hours of heat. For home, office, and outdoor use, it provides an environmentally friendly option compared to coal or wood burning. Further, the garments apply technologies like battery-driven heating materials to deliver customizable heat, satisfying consumer demand for cold-weather regions. Intelligent winter clothing also features moisture-wicking technology that ensures the wearer stays dry and at ease, and even ultraviolet (UV) protection for winter sports. Moreover, improvements in textile technology make temperature adjustments possible, with the clothing responding to the wearer's body temperature. It is particularly favored by young, tech-savvy consumers who are interested in innovative solutions fusing fashion and functionality. As technology advances, integrating smart capabilities into winter apparel is also likely to become increasingly popular, providing Indian consumers with increased comfort and functionality for enduring varying weather conditions.

Growing Popularity of Layered Winter Wear

Layered winter clothing is now a trending fashion in India, particularly in areas with mild winters or temperature fluctuations. As per the sources, in November 2024, Monte Carlo has unveiled its Winter 2024 collection, presenting a mix-and-match assortment of sweaters, thermals, jackets, and accessories for men, women, and children. The company also presented its first-ever ethnic wear collection, fusing Indian traditional beauty with contemporary winter style. Moreover, rather than depending on thick, cumbersome winter clothes, consumers are going for multi-layered, adjustable clothing that suits the weather. This style permits layers like thermal undergarments, fleece jackets, and light down vests to be added or removed in order to stay comfortable throughout fluctuating temperatures during the day. Layered garments not only provides practical warmth but is also highly flexible, which is suited for cities and areas with greatly fluctuating winter temperatures. Customers enjoy the convenience and fashion that layering provides, as it enables them to achieve stylish appearances while remaining warm. The trend is especially well-known among younger generations who seek both comfort and looks. As the demand for versatile winter apparel continues to grow, layering is likely to remain a top style in India's changing winter apparel market.

India Thermal and Winter Wear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, material type, distribution channel, price range, and end user.

Product Type Insights:

- Thermal Wear

- Tops

- Bottoms

- Sets

- Winter Wear

- Jackets

- Sweaters

- Coats

- Accessories

The report has provided a detailed breakup and analysis of the market based on the product type. This includes thermal wear (tops and bottoms and sets), winter wear (jackets and sweaters and coats and accessories).

Material Type Insights:

- Wool

- Cotton

- Synthetic Fibers

- Blends

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes wool and cotton and synthetic fibers and blends.

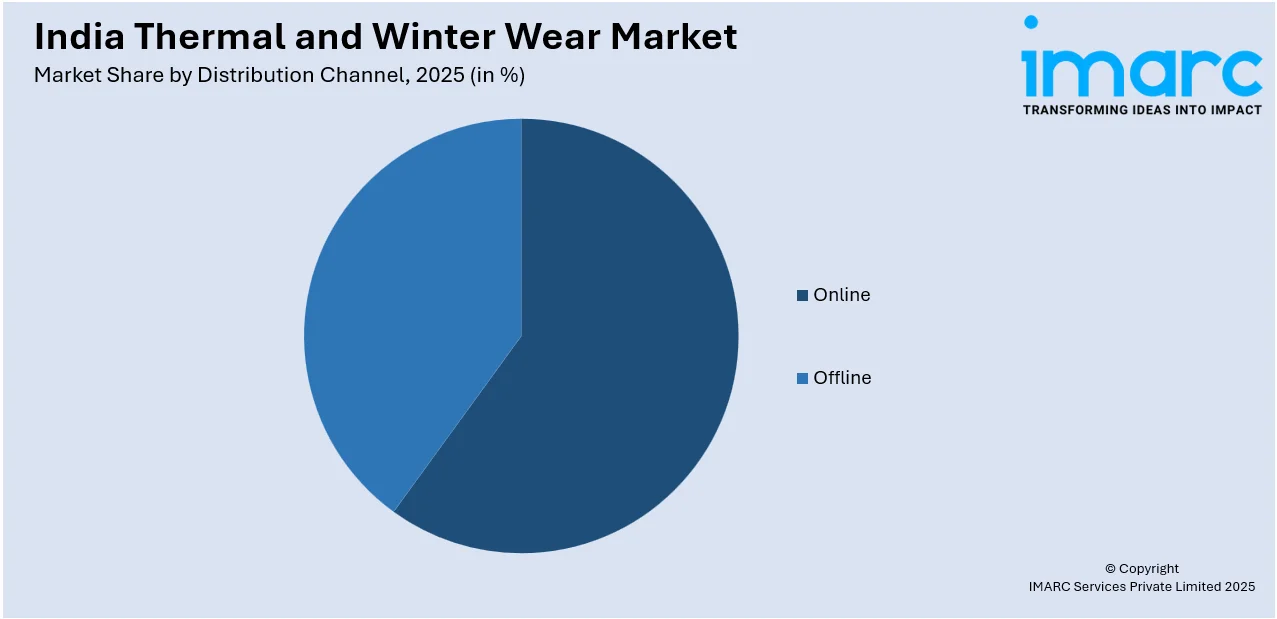

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Price Range Insights:

- Premium

- Mid-Range

- Economy

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes premium and mid-range and economy.

End User Insights:

- Men

- Women

- Children

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men and women and children.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Thermal and Winter Wear Market News:

- In September 2024, U.S. Polo Assn. India has launched Autumn Winter 2024 campaign with actor Suniel Shetty. The collection is a mix of Americana with contemporary flair, and there are high-neck pullovers, suede jackets, and earthy coloured chinos. The campaign is heavy on winter layering, which provides tasteful but functional fashion for the modern Indian man.

- In August 2024, BIBA, India's first ethnic wear brand, launched its Autumn-Winter 2024 collection, embracing cultural heritage with modern designs. With bold colors, rich fabrics, and fusion styles, the collection features traditional Indian wear and an exclusive range for young girls. The collection is available across the country as well as online and appeals to all ages.

India Thermal and Winter Wear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Material Types Covered | Wool, Cotton, Synthetic Fibers, Blends |

| Distribution Channels Covered | Online, Offline |

| Price Ranges Covered | Premium, Mid-Range, Economy |

| End Users Covered | Men, Women, Children |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India thermal and winter wear market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India thermal and winter wear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India thermal and winter wear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The thermal and winter wear market in India was valued at USD 13.5 Billion in 2025.

The India thermal and winter wear market is projected to exhibit a CAGR of 6.10% during 2026-2034, reaching a value of USD 23.0 Billion by 2034.

The India thermal and winter wear market is driven by increasing consumer awareness about functional clothing, rising disposable incomes, and growing demand in colder regions and urban areas. Expanding fashion trends, improved retail penetration, and the popularity of branded and stylish winter apparel also fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)