India Tidal Energy Solutions Market Size, Share, Trends and Forecast by Technology, Deployment Type, Component, End Use, and Region, 2025-2033

India Tidal Energy Solutions Market Overview:

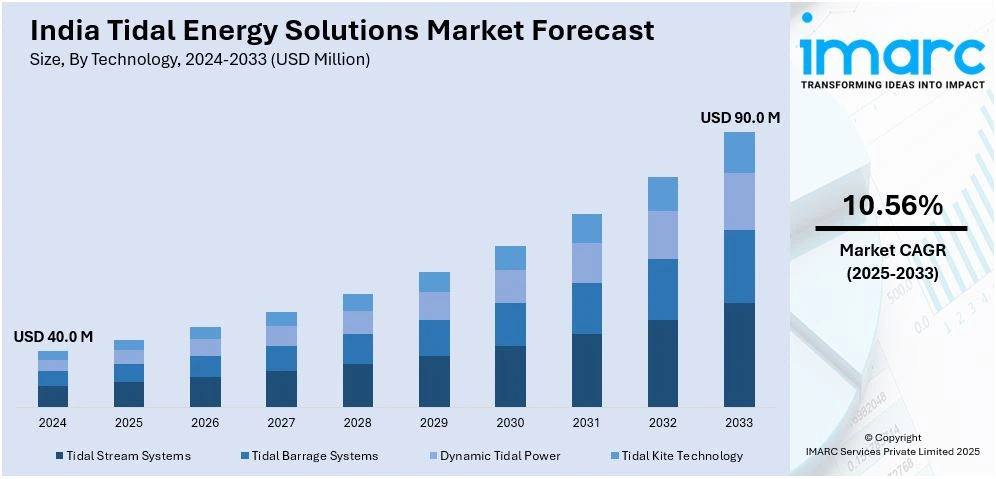

The India tidal energy solutions market size reached USD 40.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 90.0 Million by 2033, exhibiting a growth rate (CAGR) of 10.56% during 2025-2033. The market is fueled by growing demand for clean energy, government initiatives to support clean energy, and increasing investments in sustainable power schemes. Technological developments in marine technology, the desire to minimize the use of fossil fuels, and energy demands along the coast further enhance market growth. Furthermore, collaborations in green energy infrastructure hasten the growth of the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.0 Million |

| Market Forecast in 2033 | USD 90.0 Million |

| Market Growth Rate 2025-2033 | 10.56% |

India Tidal Energy Solutions Market Trends:

Government Support and Policy Initiatives

Government support significantly drives the growth of India's tidal energy sector through policies like the National Renewable Energy Mission and incentives from the Ministry of New and Renewable Energy (MNRE). These initiatives promote favorable conditions for tidal projects, encouraging Public-Private Partnerships (PPPs) and private investments. India's commitment to achieving net-zero goals further accelerates the sector's attractiveness. Collaborations with international agencies provide technological expertise and financial backing, strengthening confidence in the sector. For instance, as per industry reports, India plans to generate 12,455 MW of tidal and 41,300 MW of wave power by 2030, contributing to its renewable energy mix. Currently, the nation’s total power generation capacity stands at 416,059 MW. Additionally, 42 hydro-power projects with a combined capacity of 18,034 MW are under construction, advancing its sustainability goals.

To get more information on this market, Request Sample

Technological Advancements in Tidal Energy Infrastructure

Technological innovations are reshaping the tidal energy landscape in India. The development of advanced tidal turbines and floating energy platforms has enhanced the efficiency and scalability of tidal power projects. Smart grid integration and the use of real-time data monitoring systems ensure better energy management and grid stability. Furthermore, the emergence of subsea cabling and energy storage solutions facilitates reliable energy transmission from tidal plants to the mainland. Research in hydrodynamic modeling and the application of artificial intelligence (AI) for predictive maintenance are also reducing operational risks and maintenance costs. These innovations are making tidal energy a more viable and competitive option in the renewable energy mix. For instance, in March 2025, WaveGen Energy successfully tested its 200W proof-of-concept (POC) wave energy technology at the National Institute of Technology Karnataka (NITK), achieving an impressive 52% efficiency rate, well above the industry standard of 20%. In addition to generating electricity, the system facilitates seawater desalination and combats coastal erosion. With plans for commercial deployment, WaveGen aims to establish India as a global leader in wave energy within the expanding blue economy.

Focus on Coastal and Island Energy Solutions

India’s vast coastline and numerous islands offer immense potential for tidal energy generation. Coastal regions, particularly in Gujarat and West Bengal, are witnessing increased feasibility studies and pilot projects aimed at harnessing tidal power. The government's efforts to provide sustainable energy to remote coastal villages and island territories are driving the demand for localized tidal energy solutions. Additionally, tidal energy serves as a reliable power source for islands with limited access to conventional electricity grids. Establishing microgrid networks using tidal energy can ensure energy security in these regions. With a growing emphasis on decentralized power generation, tidal energy projects are becoming integral to India’s renewable energy roadmap. For instance, in September 2024, the Indian National Centre for Ocean Information Services (INCOIS) developed the Integrated Ocean Energy Atlas, estimating India's potential to generate 9.2 lakh TWh of renewable energy annually from its Exclusive Economic Zone (EEZ). Covering solar, wind, wave, tidal, ocean thermal, and salinity gradients, the atlas provides detailed data via a WebGIS interface. It aids policymakers and industries in identifying coastal and island sites for localized tidal energy projects, promoting sustainable energy solutions in remote areas with limited grid access.

India Tidal Energy Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology, deployment type, component, and end use.

Technology Insights:

- Tidal Stream Systems

- Tidal Barrage Systems

- Dynamic Tidal Power

- Tidal Kite Technology

The report has provided a detailed breakup and analysis of the market based on the technology. This includes tidal stream systems, tidal barrage systems, dynamic tidal power, and tidal kite technology.

Deployment Type Insights:

- Onshore

- Offshore

- Hybrid Systems

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes onshore, offshore, and hybrid systems.

Component Insights:

- Turbines

- Generators

- Control Systems

- Pontoons

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes turbines, generators, control systems, and pontoons.

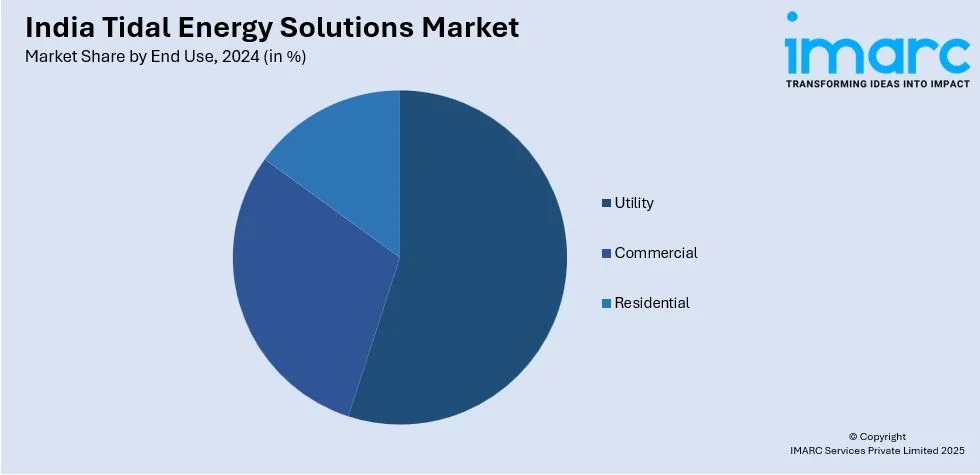

End Use Insights:

- Utility

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes utility, commercial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tidal Energy Solutions Market News:

- In February 2025, Bharat Petroleum Corporation Limited (BPCL) signed an agreement with Eco Wave Power Global AB to explore wave energy opportunities across India. As part of this collaboration, a 100 kW demonstration system will be installed at BPCL’s oil terminal in Mumbai. BPCL will oversee permits and site-related formalities, while Eco Wave Power will contribute its proprietary wave-to-electricity technology and handle performance optimization studies. This joint effort reflects India's growing interest in marine-based renewables, tapping into nearly 40,000 megawatts of unused potential along its shores.

- In July 2024, RMC Switchgears Limited established RMC Green Energy Private Limited, holding a 51% stake, to drive renewable energy initiatives with a significant focus on tidal and wave energy. The subsidiary will explore the potential of harnessing ocean energy alongside other renewable sources like solar, wind, and green hydrogen. Supporting India’s COP26 target of 500 GW non-fossil fuel energy by 2030, it aims to advance tidal power solutions, contributing to sustainable energy development, reducing carbon emissions, and promoting innovative energy technologies across domestic and international markets.

India Tidal Energy Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Tidal Stream Systems, Tidal Barrage Systems, Dynamic Tidal Power, Tidal Kite Technology |

| Deployment Types Covered | Onshore, Offshore, Hybrid Systems |

| Components Covered | Turbines, Generators, Control Systems, Pontoons |

| End Uses Covered | Utility, Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tidal energy solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tidal energy solutions market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tidal energy solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tidal energy solutions market in India was valued at USD 40.0 Million in 2024.

The India tidal energy solutions market is projected to exhibit a CAGR of 10.56% during 2025-2033, reaching a value of USD 90.0 Million by 2033.

The India tidal energy solutions market is driven by growing demand for renewable power, government initiatives promoting clean energy, and the vast coastline offering significant tidal potential. Advancements in marine technology, coupled with increasing focus on reducing carbon emissions, further support adoption of tidal energy projects across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)