India Tidal Power Market Size, Share, Trends and Forecast by Power Generation Method, Tidal Energy Converters, and Region, 2025-2033

India Tidal Power Market Overview:

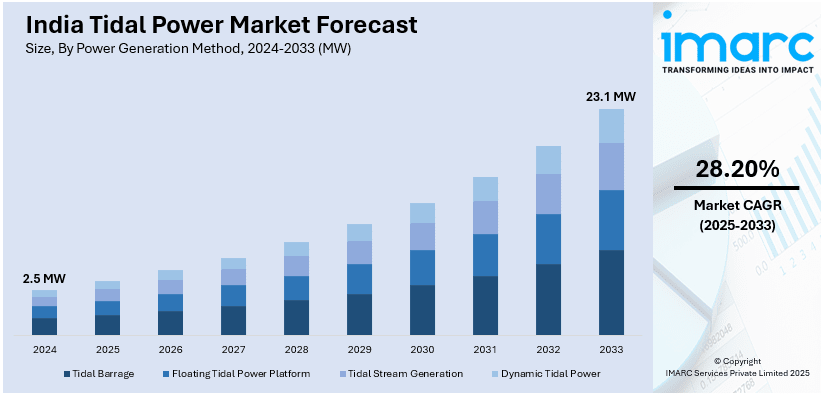

The India tidal power market size reached 2.5 MW in 2024. Looking forward, IMARC Group expects the market to reach 23.1 MW by 2033, exhibiting a growth rate (CAGR) of 28.20% during 2025-2033. The market is advancing due to rising demand for clean energy, government initiatives promoting marine renewables, coastal energy security needs, and technological progress in underwater turbines. Favorable policies, environmental concerns, and energy diversification strategies are further accelerating interest in harnessing predictable tidal resources for electricity generation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 2.5 MW |

| Market Forecast in 2033 | 23.1 MW |

| Market Growth Rate (2025-2033) | 28.20% |

India Tidal Power Market Trends:

Rising Government Focus on Marine Renewable Integration

The Indian government is increasingly integrating marine renewable energy, including tidal power, into its broader energy transition plans. Initiatives such as the National Offshore Wind Energy Policy and the consideration of tidal power under the Ministry of New and Renewable Energy’s (MNRE) strategic framework highlight this shift. Coastal states like Gujarat and West Bengal, with significant tidal potential, are receiving greater attention for pilot and demonstration projects. For instance, the Standing Committee on Energy asked MNRE to report its actions on assessing India’s tidal, wave, and ocean thermal energy potential. Theoretical estimates suggest 12,455 MW tidal and 41,300 MW wave energy. It further urged MNRE to expedite a demonstration project, particularly in the Gulf of Kutch, and actively support R&D under the Renewable Energy Research and Technology Development Programme. Policy-level discussions are progressing around tariff mechanisms, environmental clearances, and private-public partnerships to foster investment in tidal infrastructure. These actions are gradually creating an enabling ecosystem for tidal energy development, with emphasis on long-term power purchase agreements (PPAs), grid connectivity, and alignment with India’s 500 GW renewable target by 2030.

To get more information on this market, Request Sample

Technological Advancements in Subsea Energy Harvesting

Technological innovation in subsea turbine design and deployment is a key enabler for the tidal power market in India. For instance, as per industry reports, the Indian government has officially declared ocean energy tidal, wave, and ocean thermal as a renewable energy source. The Ministry of New and Renewable Energy stated this move aims to boost ocean energy use. Estimated potential includes 12,455 MW from tidal (Khambhat and Kutch), 40,000 MW from wave energy, and 180,000 MW from ocean thermal. This recognition supports India's broader efforts to expand renewable infrastructure, stimulate innovation and technological advancements, create jobs, and meet climate goals by 2030. Advances in horizontal-axis turbines, bi-directional flow systems, and corrosion-resistant materials are improving efficiency and reducing maintenance burdens in saline environments. Research institutions are collaborating with global technology providers to customize systems for India’s unique tidal regimes. Enhanced monitoring systems and predictive maintenance tools are further optimizing operational lifespans and energy yield from tidal stream installations.

Growing Interest from Coastal Infrastructure Developers

Ports, coastal industrial zones, and special economic zones (SEZs) are beginning to explore tidal energy as a reliable, site-specific source of clean power. The predictable nature of tidal flows allows for better energy planning in regions with heavy industrial activity. Developers involved in maritime logistics, desalination, and shipbuilding are recognizing tidal power’s potential to lower dependence on diesel-based generation and reduce carbon footprints. Pilot initiatives in estuarine regions are aligning tidal energy integration with microgrid development and hybrid renewable systems. This trend is encouraging distributed generation models where tidal power can complement solar and wind resources in off-grid or partially electrified coastal areas. Institutional interest is also growing in using tidal energy to power climate-resilient coastal infrastructure. For instance, in June 2024, Eco Wave Power Global, an Israeli onshore wave energy developer, announced plans to install power floaters at Vizhinjam Port in Kerala, India, to harness wave energy for electricity generation. Preliminary discussions with Adani Vizhinjam Port Private Limited are underway. Initially, floaters will be installed along a 980-meter section of the port's embankment. This project aims to be India's first to generate electricity from waves. Eco Wave Power's technology uses sea-level floaters attached to breakwaters; their vertical movement with waves drives hydraulic pistons, pumping fluid to an onshore generator.

India Tidal Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on power generation method and tidal energy converters.

Power Generation Method Insights:

- Tidal Barrage

- Floating Tidal Power Platform

- Tidal Stream Generation

- Dynamic Tidal Power

The report has provided a detailed breakup and analysis of the market based on the power generation method. This includes tidal barrage, floating tidal power platform, tidal stream generation, and dynamic tidal power.

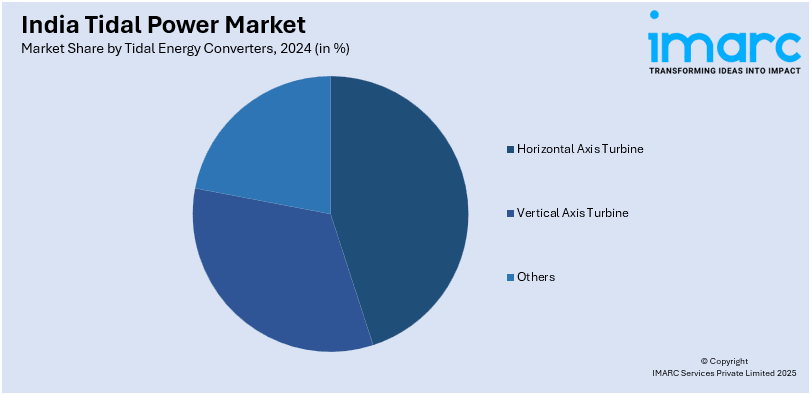

Tidal Energy Converters Insights:

- Horizontal Axis Turbine

- Vertical Axis Turbine

- Others

A detailed breakup and analysis of the market based on the tidal energy converters have also been provided in the report. This includes horizontal axis turbine, vertical axis turbine, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tidal Power Market News:

- In February 2025, Eco Wave Power showcased its onshore wave energy technology at India Energy Week 2025 and signed its first collaboration with a Fortune 500 Indian company for a pilot project in Maharashtra. Partnering with a major Indian energy corporation, the company aims to introduce wave energy to India's renewable strategy.

India Tidal Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | MW |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Generation Methods Covered | Tidal Barrage, Floating Tidal Power Platform, Tidal Stream Generation, Dynamic Tidal Power |

| Tidal Energy Converters Covered | Horizontal Axis Turbine, Vertical Axis Turbine, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tidal power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tidal power market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tidal power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tidal power market in India reached at 2.5 MW in 2024.

The India tidal power market is projected to exhibit a CAGR of 28.20% during 2025-2033, reaching 23.1 MW by 2033.

The India tidal power market is fueled by the India’s vast coastline and increasing need for renewable energy diversification. Government support for clean energy, advancements in tidal turbine technology, and the potential for consistent, predictable power generation make tidal energy an emerging and strategic solution for sustainable electricity development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)