India Titanium Dioxide Market Size, Share, Trends and Forecast by Grade, Production Process, Application, and Region, 2025-2033

India Titanium Dioxide Market Size and Share:

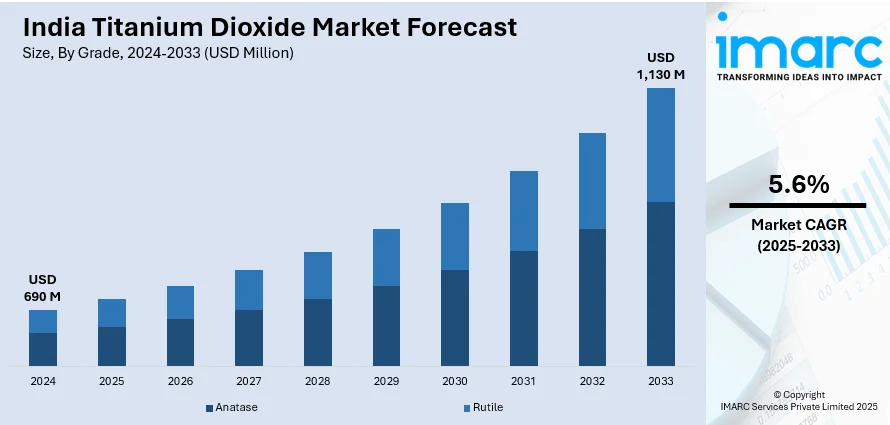

The India titanium dioxide market size reached USD 690 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,130 Million by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The market share is mainly driven by the rising demand in plastics and paints. In addition, the increasing use in sunscreens and beauty products is strengthening market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 690 Million |

| Market Forecast in 2033 | USD 1,130 Million |

| Market Growth Rate 2025-2033 | 5.6% |

India Titanium Dioxide Market Trends:

Rising Demand in Cosmetics

The rising demand in cosmetics is significantly influencing the India titanium dioxide market outlook due to its extensive use in sunscreens, foundations, and lotions for its excellent ultra-violet (UV)-blocking properties. Increasing awareness among masses about sun protection is fueling the demand for titanium dioxide-based cosmetic products. The growing beauty and personal care industry is compelling manufacturers to incorporate high-quality, safe ingredients. For instance, in June 2024, Moha launched a Tinted Sunscreen Gel with SPF 50, offering broad-spectrum UV protection and a universal tint. Infused with Sariva for hydration and Manjishtha for antioxidants, it provides a matte, non-greasy finish, highlighting the demand for titanium dioxide in multifunctional products. Titanium dioxide provides enhanced opacity, brightness, and whitening effects, making it ideal for premium cosmetic formulations. The shift towards natural and mineral-based cosmetics is further increasing the demand for titanium dioxide. Regulatory approvals for titanium dioxide as a safe cosmetic ingredient are supporting its market adoption. Rising disposable income in India is encouraging higher spending on skincare and beauty products. Changing lifestyle preferences are increasing demand for cosmetics containing titanium dioxide for added benefits. Its ability to enhance product texture, stability, and longevity makes it highly desirable. Increasing concerns over skin aging and environmental damage are further driving the demand for UV-protective formulations.

To get more information on this market, Request Sample

Growing Plastics Industry

Titanium dioxide is widely used in plastic manufacturing to enhance opacity, brightness, and UV resistance. The rising demand for durable and aesthetically appealing plastic products is fueling titanium dioxide usage across various sectors. Increasing plastic usage in packaging, automotive, and construction industries is further supporting India titanium dioxide market growth. In FY25, India’s plastic exports reached US$ 2.93 billion, reflecting strong industry expansion. During this period, exports of plastic films and sheets grew by 24.9%, while packaging items increased by 10.4%. Titanium dioxide plays a crucial role in improving plastic stability, color retention, and resistance to environmental degradation. The shift toward lightweight and high-performance plastics is influencing the need for advanced additives like titanium dioxide. Expanding e-commerce and consumer goods sectors are increasing demand for high-quality plastic packaging materials. The automotive industry’s preference for durable plastic components is supporting the increased use of titanium dioxide. Regulatory emphasis on sustainable and recyclable plastics is compelling manufacturers to incorporate titanium dioxide-based formulations. Rapid urbanization and industrialization in India are driving demand for plastics with enhanced durability and appearance. Titanium dioxide is a key component in producing colored plastics, ensuring uniform pigmentation and long-lasting vibrancy. Continuous advancements in polymer technology are enabling better integration of titanium dioxide in plastic applications.

India Titanium Dioxide Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on grade, production process, and application.

Grade Insights:

- Anatase

- Rutile

The report has provided a detailed breakup and analysis of the market based on the grade. This includes anatase and rutile.

Production Process Insights:

- Sulfate

- Chloride

A detailed breakup and analysis of the market based on the production process have also been provided in the report. This includes sulfate and chloride.

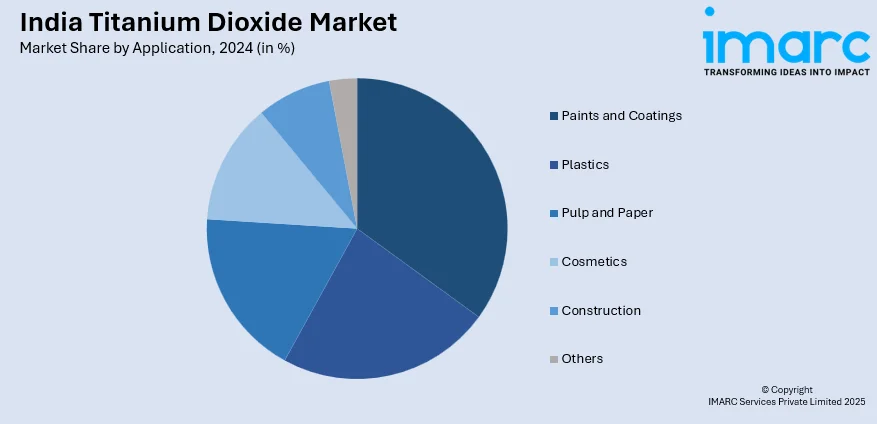

Application Insights:

- Paints and Coatings

- Plastics

- Pulp and Paper

- Cosmetics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes paints and coatings, plastics, pulp and paper, cosmetics, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Titanium Dioxide Market News:

- In March 2025, the IMMT-CSRIO collaborated to extract titanium dioxide (TiO₂) from Indian minerals, driving domestic production and reducing import dependency. Aligned with India’s National Critical Mineral Mission, it promotes sustainable processing of ilmenite for TiO₂, benefiting industries like paints, plastics, and cosmetics, while strengthening India’s self-reliance in critical minerals.

India Titanium Dioxide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Anatase, Rutile |

| Production Processes Covered | Sulfate, Chloride |

| Applications Covered | Paints and Coatings, Plastics, Pulp and Paper, Cosmetics, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India titanium dioxide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India titanium dioxide market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India titanium dioxide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The titanium dioxide market in India was valued at USD 690 Million in 2024.

The India titanium dioxide market is projected to exhibit a CAGR of 5.6% during 2025-2033, reaching a value of USD 1,130 Million by 2033.

Rising awareness about hygiene and aesthetics in consumer goods is enhancing the usage of titanium dioxide in personal care and cosmetic products. Besides this, government initiatives aimed at promoting domestic manufacturing and favorable trade policies are supporting local production. Technological advancements aid in improving product quality and application range, attracting more industrial users.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)