India Titanium Market Size, Share, Trends and Forecast by End Use and Region, 2025-2033

India Titanium Market Overview:

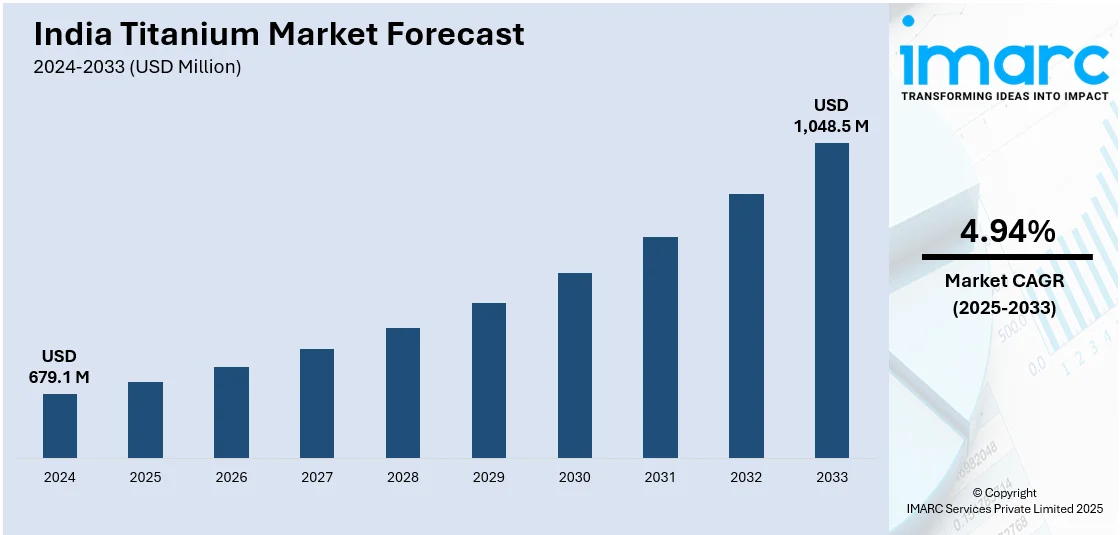

The India titanium market size reached USD 679.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,048.5 Million by 2033, exhibiting a growth rate (CAGR) of 4.94% during 2025-2033. The market is growing because of the increasing use in deep-sea exploration and aerospace applications, where its strength, corrosion resistance, and thermal stability are essential, supported by expanding domestic production to reduce reliance on imported high-grade titanium alloys.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 679.1 Million |

| Market Forecast in 2033 | USD 1,048.5 Million |

| Market Growth Rate 2025-2033 | 4.94% |

India Titanium Market Trends:

Growing Adoption in High-Pressure Deep-Sea Exploration Systems

The heightened emphasis of India on deep-sea exploration is boosting the need for titanium, especially in high-pressure settings where standard materials are inadequate. The corrosion resistance of titanium in salty environments and its capability to endure intense underwater pressure are vital for deep-sea apparatus, such as manned submersibles, underwater drones, and sensor pressure housings. Government-initiated projects are speeding up the progress of local deep-sea technologies, generating an ongoing demand for marine-quality titanium alloys. Public research organizations and private engineering companies are also working together on titanium components intended for sampling tools, structural frameworks, ballast systems, and hatches. This is resulting in investments in precision machining and alloy processing designed for subsea environments. The extended duration of ocean research initiatives is further motivating local vendors to increase production and uphold superior quality standards. With India aiming to map mineral resources and establish permanent subsea infrastructure, titanium is becoming a foundational material in the marine technology roadmap of the country. In 2025, India unveiled Matsya-6000, its first titanium alloy human submersible designed for deep-sea exploration at 6,000 meters. Developed by the National Institute of Ocean Technology (NIOT) under the Deep Ocean Mission, it can carry three scientists and is equipped with advanced safety, communication, and navigation systems. The submersible will play a key role in India’s ocean exploration efforts.

To get more information on this market, Request Sample

Rising Aerospace Demand

The growing aerospace sector in India is catalyzing the demand for titanium because of its excellent strength-to-weight ratio, resistance to corrosion, and thermal stability. These traits are vital for airframe structures, engine parts, landing gear systems, and other crucial assemblies in military and civilian aircraft. Indigenous aircraft initiatives, expanding defense acquisitions, and rising partnerships with international aerospace producers are generating ongoing material needs. Titanium is being adopted in unmanned aerial vehicles and satellite frameworks, where minimizing weight and enhancing performance are essential concerns. As manufacturing standards in India match international aerospace requirements, the adoption of titanium alloys is increasing throughout production and assembly processes. The dependability of the material in high stress and temperature situations makes it a favored option for engineers prioritizing performance and safety. In response to this growing demand, the local production of aerospace-grade titanium is progressively rising, aiding in lowering import reliance and strengthening the resilience of India's aerospace supply chain. In 2025, Aerolloy Technologies, part of PTC Industries, commissioned India's first vacuum arc remelting (VAR) furnace for manufacturing aerospace-grade titanium alloys in Lucknow. The facility, with an annual capacity of 1,500 tons, marks a significant step towards reducing India’s dependence on imported titanium for aerospace applications. This development strengthens India’s aerospace manufacturing capabilities and aligns with the "Make in India" initiative.

India Titanium Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on end use.

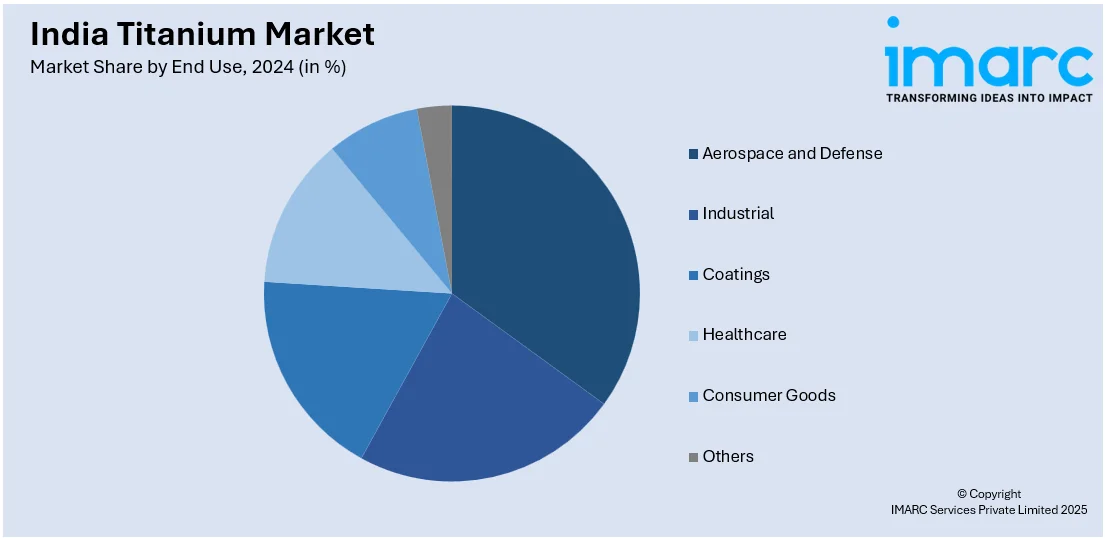

End Use Insights:

- Aerospace and Defense

- Industrial

- Coatings

- Healthcare

- Consumer Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes aerospace and defense, industrial, coatings, healthcare, consumer goods, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Titanium Market News:

- In March 2025, the Institute of Minerals and Materials Technology (IMMT), Bhubaneswar, signed a research agreement with Australia's CSIRO to explore the recovery of titanium dioxide and vanadium from Indian titanium minerals. Funded by the India-Australia Critical Minerals Research Partnership, the project aims to enhance processing technologies for critical minerals. This initiative supports India's National Critical Mineral Mission to ensure a sustainable supply of such minerals.

- In January 2025, PTC Industries signed an MoU with the Government of Odisha to establish a titanium sponge manufacturing facility for aerospace-grade products. This initiative aims to reduce India's reliance on foreign suppliers and strengthen its titanium manufacturing capabilities.

India Titanium Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Aerospace and Defense, Industrial, Coatings, Healthcare, Consumer Goods, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India titanium market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India titanium market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India titanium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The titanium market in India was valued at USD 679.1 Million in 2024.

The India titanium market is projected to exhibit a CAGR of 4.94% during 2025-2033, reaching a value of USD 1,048.5 Million by 2033.

The India titanium market is primarily driven by rising demand from aerospace, defense, and medical sectors due to titanium’s high strength-to-weight ratio and corrosion resistance. Additionally, increasing industrial and infrastructure development and government initiatives supporting domestic metal production are fueling the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)