India Tobacco Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034

India Tobacco Market:

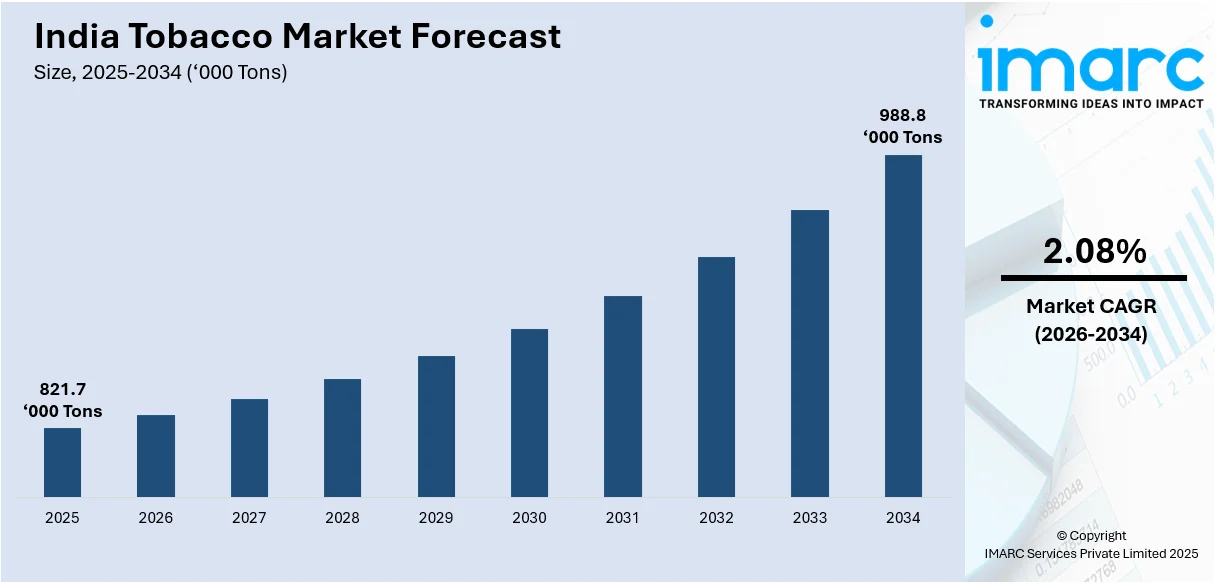

The India tobacco market size reached 821.7 Thousand Tons in 2025. Looking forward, IMARC Group expects the market to reach 988.8 Thousand Tons by 2034, exhibiting a growth rate (CAGR) of 2.08% during 2026-2034. The rising cultural acceptance of tobacco consumption in India, the increasing number of tobacco users, and inflating consumer disposable incomes represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 821.7 Thousand Tons |

| Market Forecast in 2034 | 988.8 Thousand Tons |

| Market Growth Rate (2026-2034) | 2.08% |

India Tobacco Market Analysis:

- Major Market Drivers: The expanding population across the country represents one of the primary factors driving the growth of the tobacco market in India. Moreover, the presence of a significant rural population, where tobacco farming and consumption are prevalent, has augmented the India tobacco market demand.

- Key Market Trends: The increasing affordability and accessibility of tobacco products due to inflating disposable income among the middle-class population in India is positively influencing the market growth. In line with this, the easy availability of tobacco products, ranging from cigarettes to smokeless tobacco ensuring convenient access for consumers across various distribution channels has catalyzed the India tobacco market growth.

- Competitive Landscape: The India tobacco market analysis report has also provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: North India exhibits a clear dominance in the market. In many parts of the region, tobacco consumption is deeply ingrained in cultural and social practices. Products like bidi, gutka, and khaini are often used in traditional ceremonies and social gatherings, further driving the market's demand.

- Challenges and Opportunities: Stringent regulations on the consumption of tobacco, especially in public areas, and rising awareness towards associated health risk are hampering the market's growth. However, there is growing interest in alternative products like smokeless tobacco, e-cigarettes, and heated tobacco products, which could appeal to different consumer segments.

To get more information on this market Request Sample

India Tobacco Market Trends:

Growing Population

India's large and growing population contributes significantly to the expansion of the tobacco market. For instance, according to Statista, India's annual population growth rate grew by 0.1 percentage points (+14.71%) in 2023. India's predicted total population in 2023 was 1.43 billion. With over a billion people, even a small percentage of smokers translates into a substantial market size. These factors are further positively influencing the India tobacco market forecast.

Rising Consumption of Tobacco Products

As urbanization increases, lifestyle changes often include higher consumption of tobacco products. For instance, according to an article published by Global Action to End Smoking, in 2022, an estimated 253 million individuals (200 million men and 53 million women) aged 15 and older used tobacco products in India. In terms of tobacco consumption, the country ranks second in the world and first in the WHO South-East Asia Region. These factors are further contributing to the India tobacco market share.

Increasing Cigarettes Consumption

The rising consumption of cigarettes has been a significant factor driving growth in the Indian tobacco market. For instance, according to IMARC, the India cigarette market size reached US$ 24.1 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 60.4 Billion by 2032, exhibiting a growth rate (CAGR) of 10.4% during 2024-2032. Tobacco companies have developed extensive distribution networks that ensure cigarettes are widely available, often in convenient and easily accessible locations, which supports continued consumption. These factors are augmenting the market growth.

India Tobacco Market Segmentation:

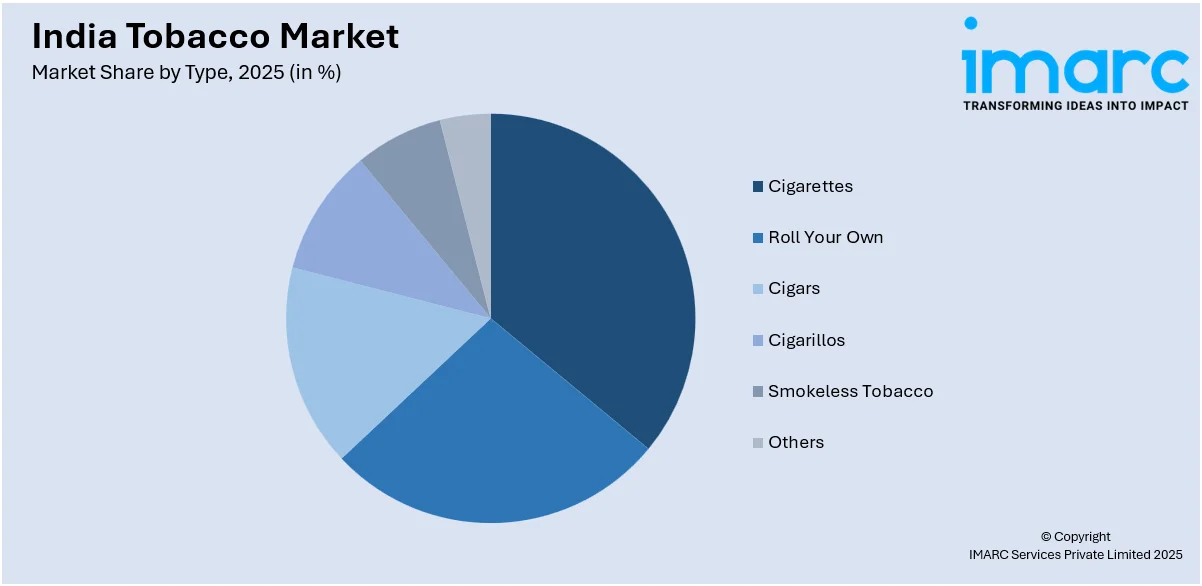

IMARC Group provides an analysis of the key trends in each segment of the India tobacco market report, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type.

Breakup by Type:

Access the comprehensive market breakdown Request Sample

- Cigarettes

- Roll Your Own

- Cigars

- Cigarillos

- Smokeless Tobacco

- Others

Cigarettes represented the largest segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes cigarettes, roll your own, cigars, cigarillos, smokeless tobacco, and others. According to the report, cigarettes represented the largest segment.

According to the India tobacco market outlook, cigarettes have a large and diverse consumer base, ranging from daily smokers to occasional users. This widespread appeal contributes to their significant market share. Moreover, increased disposable income among certain segments of the population can lead to higher consumption of tobacco products. Apart from this, numerous tobacco companies often have strong marketing strategies and extensive distribution networks, making cigarettes easily accessible.

Breakup by Region:

- South India

- North India

- West & Central India

- East India

North India acquired the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India. According to the India tobacco market report, North India was the largest market.

Some of the factors driving the North India tobacco market included the introduction of premium tobacco products, surging investments in research and development (R&D) activities by key players, the rising popularity of e-cigarettes among young consumers, etc. In many parts of North India, tobacco consumption, including smoking and chewing, is embedded in cultural practices and social rituals. This can contribute to sustained demand. Moreover, in North India, tobacco use is integrated into social and cultural practices. Products like beedis, gutkha, and khaini are popular. These items are often consumed in social settings and have deep roots in regional traditions.

Competitive Landscape:

The India tobacco market research report has also provided a comprehensive analysis of the competitive landscape in the India tobacco market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tobacco Market News:

- July 2024: Government allowed the sale of excess FCV tobacco produced by registered farmers on auction platforms in Andhra Pradesh for the crop season 2023-2024.

- July 2024: Finance Minister of India promised no changes to tobacco taxation in the budget statement, providing relief to businesses such as ITC, which rely largely on cigarettes for revenue.

- September 2023: Council of Scientific & Industrial Research (CSIR) developed a tobacco variety, reducing nicotine content by 40-50% to mitigate its health impact.

India Tobacco Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Cigarettes, Roll Your Own, Cigars, Cigarillos, Smokeless Tobacco, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tobacco market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tobacco market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tobacco industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India tobacco market size reached 821.7 Thousand Tons in 2025.

The India tobacco market is projected to exhibit a CAGR of 2.08% during 2026-2034, reaching a volume of 988.8 Thousand Tons by 2034.

The India tobacco market is driven by rising consumption of smokeless tobacco products, cultural acceptance in certain regions, and strong rural demand. Despite regulatory challenges, factors such as low cost, easy availability, and product variety continue to sustain demand across both urban and rural areas.

North India accounts for the largest India tobacco market share due to high consumption levels, strong distribution networks, and deep-rooted cultural habits that support both smoking and smokeless tobacco product usage.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)