India Toll Roads Infrastructure Market Size, Share, Trends and Forecast by Type of Road, Type of Toll Collection System, Ownership, Funding Source, and Region, 2025-2033

India Toll Roads Infrastructure Market Overview:

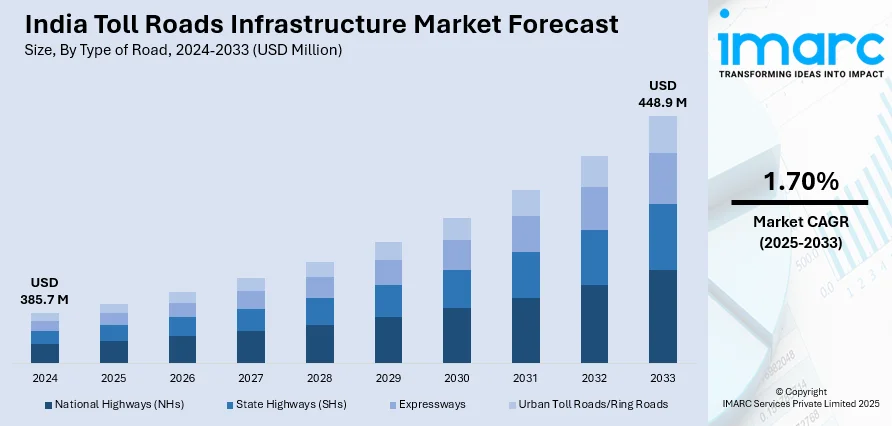

The India toll roads infrastructure market size reached USD 385.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 448.9 Million by 2033, exhibiting a growth rate (CAGR) of 1.70% during 2025-2033. The market is growing due to government's emphasis on developing infrastructure, and use of electronic toll collection technology, like FASTag that has made toll operations more efficient, minimizing congestion and enhancing revenue collection efficiency. The increase in traffic volume, driven by economic development and urbanization, has also increased toll revenues, making toll roads a viable investment option. The use of public-private partnership models has drawn in private investments, enabling the construction and upkeep of toll road projects further increasing the India toll roads infrastructure market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 385.7 Million |

|

Market Forecast in 2033

|

USD 448.9 Million |

| Market Growth Rate 2025-2033 | 1.70% |

India Toll Roads Infrastructure Market Trends:

Adoption of Smart Technologies in Toll Collection

The Indian market for toll roads infrastructure is increasingly embracing smart technologies to make operations more efficient and convenient for users. The use of electronic toll collection systems, like FASTag, has made tolling faster, cutting congestion and waiting times at toll plazas. The systems employ RFID technology to facilitate automatic deduction of tolls, allowing for smooth travel on national highways. In addition, real-time traffic monitoring and management systems, when integrated, enable dynamic toll pricing to maximize traffic flow and revenue collection. The implementation of these technologies enhances the efficiency of operations and also supports carbon emissions reduction through the reduction of idling times of vehicles at toll plazas. In addition, the information gathered from these systems can be highly beneficial in infrastructure planning and development, facilitating the development of more efficient and sustainable toll road infrastructure. According to recent reports, India is even poised to transform its highway toll collection system with a GPS-based tolling method beginning on May 1, 2025. This new system seeks to supplant the current FASTag method, improving efficiency, lessening congestion, and providing more precise toll fees for travelers.

To get more information on this market, Request Sample

Public-Private Partnerships Driven Infrastructure Development

Public-private partnerships (PPPs) have come up as a major trend in the development and upkeep of India's toll roads. The National Highways Authority of India (NHAI) has been actively engaging with private participants under different models, including Build-Operate-Transfer (BOT) and Hybrid Annuity Model (HAM), to push the development of infrastructure. Such associations take advantage of private sector competence and efficacy and share the fiscal risks inherent in large projects. For example, monetization of current toll assets via Infrastructure Investment Trusts (InvITs) has drawn significant investments from both domestic and foreign investors, allowing the development and upgradation of toll road networks. This strategy reduces the financial burden on the government while also allowing timely completion and upkeep of toll road projects, thereby helping improve and propel the India toll roads infrastructure market growth.

Emphasis on Sustainable and Green Infrastructure

Sustainability has become an important factor in the planning and construction of toll roads in India. Initiatives such as the Delhi–Mumbai Expressway and Bengaluru–Chennai Expressway are being planned with elements that reduce environmental footprint. These include the integration of green belts, wildlife corridors, and the use of environmentally friendly materials in construction. Furthermore, the establishment of exclusive lanes for electric vehicles (EVs) and the installation of EV charging stations on toll roads are encouraging the use of clean energy transportation. These measures are in accordance with the government's initiative to cut carbon emissions and ensure sustainable development. By incorporating environmental aspects into toll road infrastructure, India is establishing a model for green transportation networks that balance development and ecological conservation.

India Toll Roads Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of road, type of toll collection system, ownership, and funding source.

Type of Road Insights:

- National Highways (NHs)

- State Highways (SHs)

- Expressways

- Urban Toll Roads/Ring Roads

The report has provided a detailed breakup and analysis of the market based on the type of road. This includes national highways (NHs), state highways (SHs), expressways, and urban toll roads/ring roads.

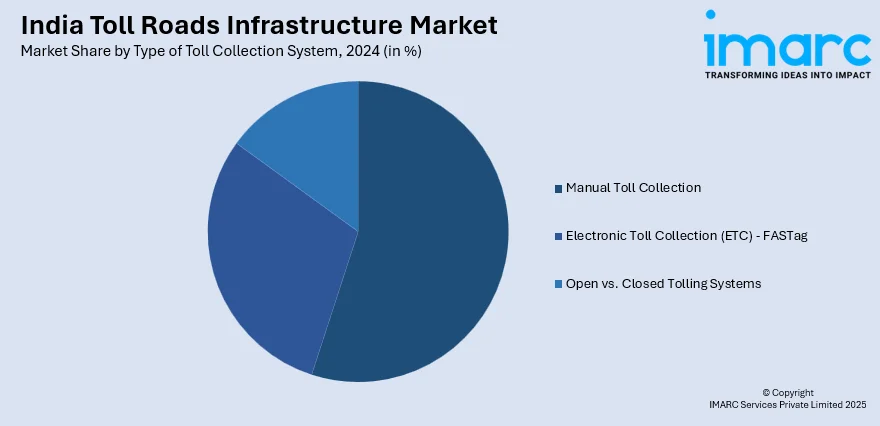

Type of Toll Collection System Insights:

- Manual Toll Collection

- Electronic Toll Collection (ETC) - FASTag

- Open vs. Closed Tolling Systems

The report has provided a detailed breakup and analysis of the market based on the type of toll collection system. This includes manual toll collection, electronic toll collection (ETC) - FASTag, and open vs. closed tolling systems.

Ownership Insights:

- Public-Private Partnership (PPP)

- Build-Operate-Transfer (BOT - Toll / Annuity)

- Hybrid Annuity Model (HAM)

- EPC (Engineering, Procurement and Construction)

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes public-private partnership (PPP), build-operate-transfer (BOT - toll / annuity), hybrid annuity model (HAM), and EPC (engineering, procurement and construction).

Funding Source Insights:

- Government Budgetary Allocation

- Institutional Investments and Private Equity

- Infrastructure Investment Trusts

The report has provided a detailed breakup and analysis of the market based on the funding source. This includes government budgetary allocation, institutional investments and private equity, and infrastructure investment trusts.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Toll Roads Infrastructure Market News:

- In April 2025, the NHAI stated that travelers on national highways and expressways would face higher costs for their journeys, as the National Highways Authority of India (NHAI) raised toll fees by an average of 4-5% on highway segments nationwide.

India Toll Roads Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Roads Covered | National Highways (NHs), State Highways (SHs), Expressways, Urban Toll Roads/Ring Roads |

| Types of Toll Collection Systems Covered | Manual Toll Collection, Electronic Toll Collection (ETC) - Fastag, Open Vs. Closed Tolling Systems |

| Ownerships Covered | Public-Private Partnership (PPP), Build-Operate-Transfer (BOT - Toll / Annuity), Hybrid Annuity Model (HAM), EPC (Engineering, Procurement and Construction) |

| Funding Sources Covered | Government Budgetary Allocation, Institutional Investments and Private Equity, Infrastructure Investment Trusts |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India toll roads infrastructure market performed so far and how will it perform in the coming years?

- What is the breakup of the India toll roads infrastructure market on the basis of type of road?

- What is the breakup of the India toll roads infrastructure market on the basis of type of toll collection system?

- What is the breakup of the India toll roads infrastructure market on the basis of ownership?

- What is the breakup of the India toll roads infrastructure market on the basis of funding source?

- What is the breakup of the India toll roads infrastructure market on the basis of region?

- What are the various stages in the value chain of the India toll roads infrastructure market?

- What are the key driving factors and challenges in the India toll roads infrastructure market?

- What is the structure of the India toll roads infrastructure market and who are the key players?

- What is the degree of competition in the India toll roads infrastructure market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India toll roads infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India toll roads infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India toll roads infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)