India Tooling Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2026-2034

Market Overview:

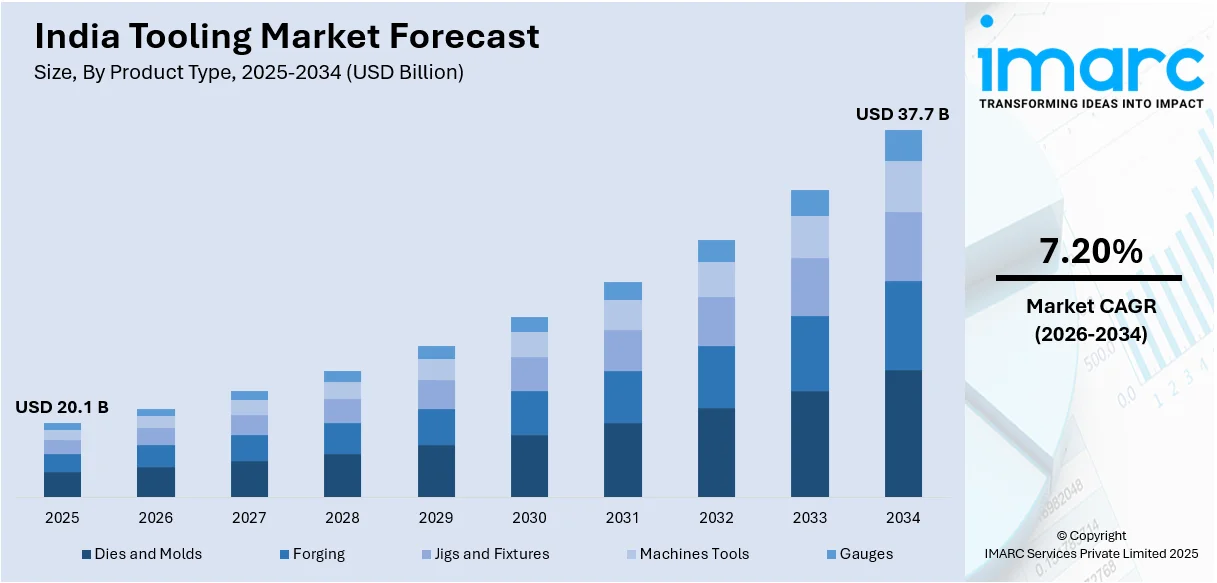

The India tooling market size reached USD 20.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 37.7 Billion by 2034, exhibiting a growth rate (CAGR) of 7.20% during 2026-2034. The growing demand for advanced tooling solutions, increasing emphasis on product customization and shorter time-to-market and the widespread adoption of environmentally friendly tooling materials and processes represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 20.1 Billion |

| Market Forecast in 2034 | USD 37.7 Billion |

| Market Growth Rate (2026-2034) | 7.20% |

Tooling is an essential aspect of manufacturing and production processes, referring to the design, development, and manufacturing of tools and equipment used in various industries. Tooling plays a crucial role in shaping and forming raw materials into finished products. It encompasses a wide range of activities, including the design and fabrication of molds, dies, jigs, fixtures, cutting tools, and other specialized equipment. These tools are instrumental in enhancing the efficiency, precision, and quality of manufacturing operations. Cutting tools, such as drills, end mills, and inserts, are also part of the tooling domain. These tools are essential for material removal processes like milling, turning, drilling, and grinding. They are designed to withstand the high forces and temperatures generated during machining operations while providing excellent cutting performance and longevity. In India, the tooling market has been witnessing significant growth due to the country's flourishing manufacturing sector and increasing demand for innovative and high-quality products across industries.

To get more information on this market Request Sample

India Tooling Market Trends:

The India tooling market is experiencing robust growth, driven by the growing demand for advanced tooling solutions. With numerous initiatives that promote domestic manufacturing, numerous industries, such as automotive, aerospace, electronics, and consumer goods are witnessing substantial growth, leading to a rise in tooling requirements. Additionally, there is a growing emphasis on product customization and shorter time-to-market, which has propelled the adoption of advanced tooling technologies. Indian businesses are increasingly focusing on agile manufacturing processes and lean production methods, necessitating the use of efficient and precise tooling solutions to optimize productivity and reduce production lead times. Moreover, the rising trend of automation and Industry 4.0 has significantly impacted the tooling market in India. Manufacturers are increasingly adopting advanced technologies such as robotics, computer numerical control (CNC) machines, and additive manufacturing, which require specialized tooling for their operation. The integration of digital technologies and automation in manufacturing processes has not only improved efficiency but also enhanced the precision and quality of the end products, thereby driving the demand for advanced tooling solutions. Furthermore, there is a growing awareness among manufacturers about the significance of sustainable and eco-friendly practices. This has led to the adoption of environmentally friendly tooling materials and processes, including the use of recycled materials and energy-efficient machining techniques. The demand for sustainable tooling solutions is expected to witness significant growth as businesses strive to reduce their environmental footprint and meet regulatory requirements. Some of the other factors driving the market include rapid urbanization and industrialization.

India Tooling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India tooling market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Dies and Molds

- Forging

- Jigs and Fixtures

- Machines Tools

- Gauges

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dies and molds, forging, jigs and fixtures, machines tools, and gauges.

Material Type Insights:

- Stainless Steel

- Iron

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type has also been provided in the report. This includes stainless steel, iron, aluminum, and others.

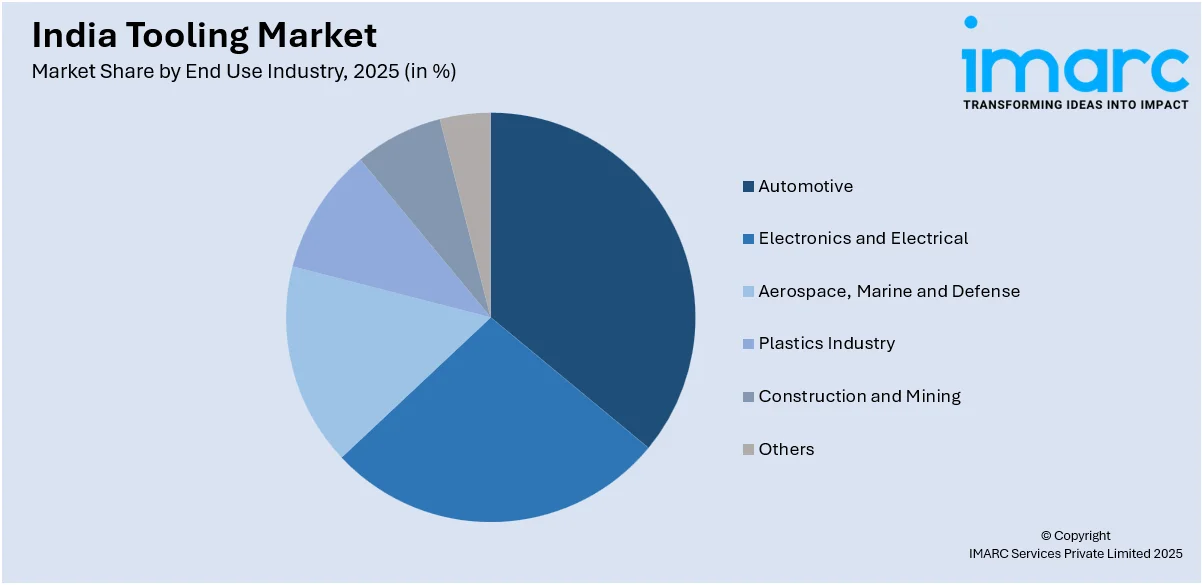

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electronics and Electrical

- Aerospace, Marine and Defense

- Plastics Industry

- Construction and Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electronics and electrical, aerospace, marine and defense, plastics industry, construction and mining, and others.

Regional Insights:

- South India

- North India

- West and Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West and Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tooling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Dies and Molds, Forging, Jigs and Fixtures, Machines Tools, Gauges |

| Material Types Covered | Stainless Steel, Iron, Aluminum, Others |

| End Use Industries Covered | Automotive, Electronics and Electrical, Aerospace, Marine and Defense, Plastics Industry, Construction and Mining, Others |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India tooling market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India tooling market?

- What is the breakup of the India tooling market on the basis of product type?

- What is the breakup of the India tooling market on the basis of material type?

- What is the breakup of the India tooling market on the basis of end use industry?

- What are the various stages in the value chain of the India tooling market?

- What are the key driving factors and challenges in the India tooling market?

- What is the structure of the India tooling market and who are the key players?

- What is the degree of competition in the India tooling market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tooling market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India tooling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)