India Towel and Linen Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, End User, and Region, 2025-2033

India Towel and Linen Market Overview:

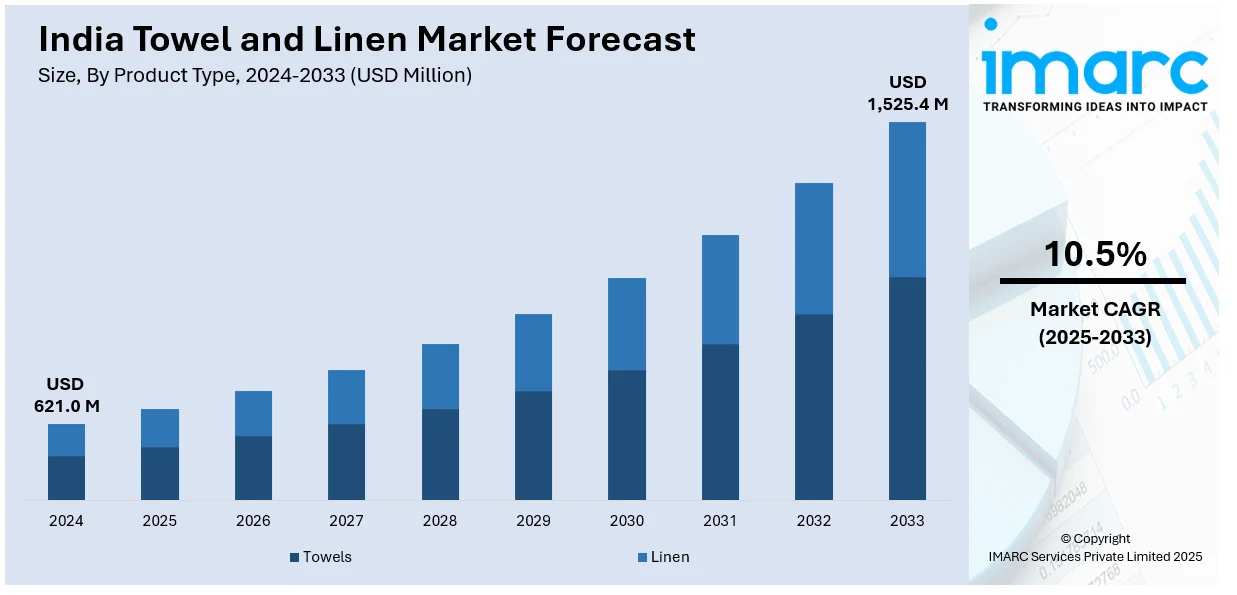

The India towel and linen market size reached USD 621.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,525.4 Million by 2033, exhibiting a growth rate (CAGR) of 10.5% during 2025-2033. The market is growing due to rising hospitality demand, urbanization, and premium home textiles. Key drivers include hotel expansion, e-commerce growth, and export opportunities. Manufacturers nowadays are mainly focusing on quality, sustainable materials, and branding strategies thereby creating a positive market outlook across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 621.0 Million |

| Market Forecast in 2033 | USD 1,525.4 Million |

| Market Growth Rate (2025-2033) | 10.5% |

India Towel and Linen Market Trends:

Rise in Demand for Eco-Friendly Materials

The shift toward ecofriendly materials is significantly influencing product development in the home textile industry. Consumers are becoming more conscious of their environmental impact and are actively seeking products made from sustainable sources which in turn drives the demand of ecofriendly towel and linen market growth across the country. Organic cotton is preferred for being pesticide-free and water-efficient while bamboo-based textiles are valued for their softness, antibacterial properties, and biodegradability. Manufacturers are also experimenting with recycled yarns sourced from post-consumer textile waste to reduce the industry’s carbon footprint. Certifications such as GOTS (Global Organic Textile Standard) and OEKO-TEX are gaining importance among buyers, especially in export markets. Several Indian companies are showcasing leadership in sustainable product innovation. For instance, in February 2025, Alok Industries made a notable appearance at Heimtextil showcasing innovative and sustainable home textiles, including towels made from Kasturi cotton. As a leading textile company in India, Alok focuses on eco-friendly products and advanced technologies to meet global demand while reinforcing its commitment to sustainability and quality. Indian textile producers are adapting their supply chains and sourcing practices to meet this growing demand for environmentally responsible and ethically produced towels and bed linens.

To get more information on this market, Request Sample

Online Retail Expansion

Online retail is reshaping the India towel and linen market by offering consumers greater product accessibility, convenience, and variety. Platforms like Amazon, Flipkart, and niche home textile e-commerce sites are driving sales across urban and semi-urban areas. India towel and linen market share is increasingly being captured by online-first brands that focus on design, pricing, and doorstep delivery. With mobile internet penetration deepening and digital payments becoming seamless, consumer buying behavior is shifting toward online channels, especially for home essentials like bath towels, bedsheets, and comforters. Customization features, subscription models, and influencer-led marketing are further accelerating online adoption. Additionally, the rise of D2C brands is intensifying competition and bringing more innovation to the segment. These factors are creating a positive India towel and linen market outlook.

Rising Hospitality Sector Demand

The rising demand from the hospitality sector is a key driver in the growth of India’s towel and linen market. With the expansion of hotels, resorts, homestays and serviced apartments across tourist and business destinations there is a consistent need for high-quality, durable and aesthetically appealing towels and bed linens. Hospitality businesses prioritize comfort, hygiene and presentation prompting procurement of premium products that meet specific standards for softness, absorbency and long-lasting use. Frequent laundering and high turnover rates further fuel bulk demand. Additionally, boutique hotels and luxury resorts are focusing on offering a refined guest experience often sourcing customized linens that align with their branding. This growth in hospitality infrastructure is translating into higher procurement volumes and increased innovation in product quality and design across the towel and linen segment.

India Towel and Linen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel and end user.

Product Type Insights:

- Towels

- Bath Towels

- Hand Towels

- Face Towels

- Kitchen Towels

- Beach Towels

- Sports and Gym Towels

- Linen

- Bed Linen

- Table Linen

- Bathroom Linen

- Kitchen Linen

The report has provided a detailed breakup and analysis of the market based on the product type. This includes towels (bath towels, hand towels, face towels, kitchen towels, beach towels and sports and gym towels) and linen (bed linen, table linen, bathroom linen and kitchen linen).

Material Type Insights:

- Cotton

- Microfiber

- Linen

- Bamboo and Eco-friendly Fabrics

- Blended Fabrics

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes cotton, microfiber, linen, bamboo and eco-friendly fabrics and blended fabrics.

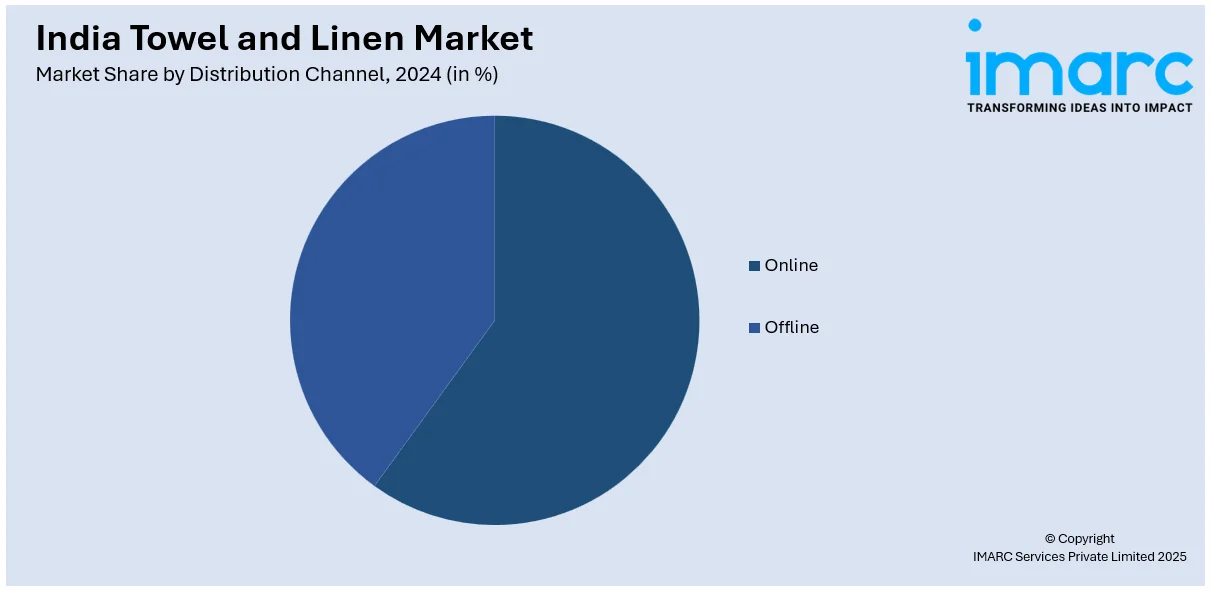

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Towel and Linen Market News:

- In March 2025, Welspun, a dominant player in home textiles, announced its plans to transform India's market by promoting innovative towels and sustainable products. CEO Keyur Parekh highlights the importance of consumer education on comfort. The company also expands into flooring, targeting diverse needs with premium brands like Spaces and Christy.

- In September 2023, Welspun launched a national 3D campaign for its quick dry towels featuring the tagline ‘Jaldi Sukhe, Jaldi Sukhaye.’ Targeting value-seeking consumers the campaign emphasizes their innovative drying technology. It is being promoted across major metros including Mumbai, Delhi and Bangalore through various out-of-home media outlets.

India Towel and Linen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Material Types Covered | Cotton, Microfiber, Linen, Bamboo And Eco-Friendly Fabrics, Blended Fabrics |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India towel and linen market performed so far and how will it perform in the coming years?

- What is the breakup of the India towel and linen market on the basis of product type?

- What is the breakup of the India towel and linen market on the basis of material type?

- What is the breakup of the India towel and linen market on the basis of distribution channel?

- What is the breakup of the India towel and linen market on the basis of end user?

- What is the breakup of the India towel and linen market on the basis of region?

- What are the various stages in the value chain of the India towel and linen market?

- What are the key driving factors and challenges in the India towel and linen market?

- What is the structure of the India towel and linen market and who are the key players?

- What is the degree of competition in the India towel and linen market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India towel and linen market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India towel and linen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India towel and linen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)