India Tower Fan Market Size, Share, Trends and Forecast by Product Type, Type of Use, Functionality, Distribution Channel, and Region, 2025-2033

India Tower Fan Market Size and Share:

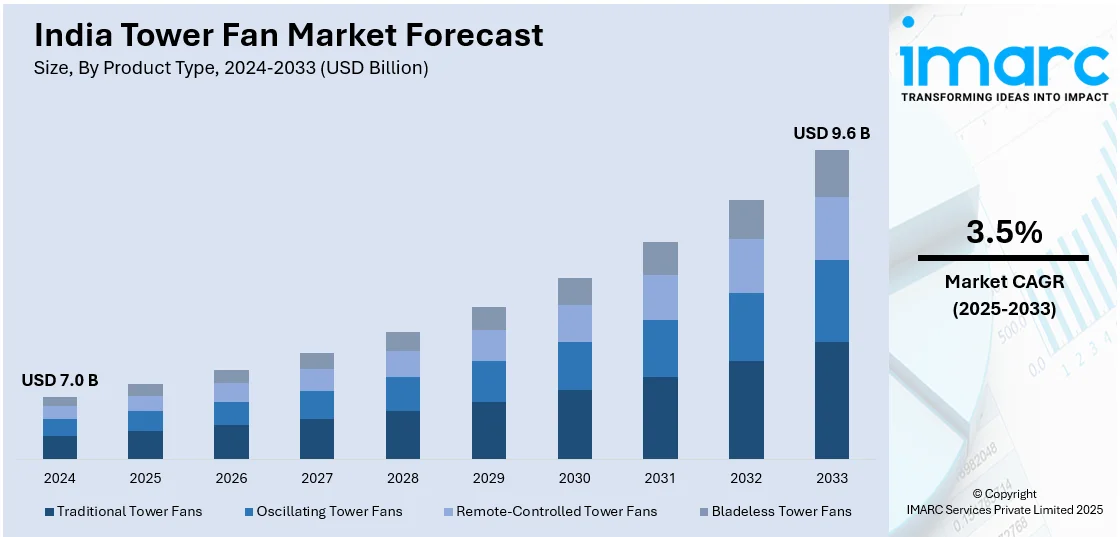

The India tower fan market size reached USD 7.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. The market is growing due to rising electricity costs, increased preference for energy-saving appliances, changing weather patterns, and compact housing trends, encouraging manufacturers to develop efficient, space-saving, and smart-enabled cooling solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.0 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Market Growth Rate (2025-2033) | 3.5% |

India Tower Fan Market Trends:

Rising Demand for Energy Efficiency

Buyers are increasingly choosing tower fans that consume less power while delivering high airflow. With urban power bills going up and electricity shortages common in semi-urban areas, the shift toward energy-efficient appliances is steady. Compact design and lower wattage consumption are becoming essential features. Buyers from both Tier-I and Tier-II cities are showing a preference for models rated under 60W, pushing manufacturers to improve motor efficiency and blade design. In the lower segment of the market, local brands are offering models with basic functionality but improved energy savings, targeting middle-income households. At the same time, premium brands are releasing inverter-compatible tower fans with BLDC motors. These models consume up to 50% less energy than conventional models, which is catching attention in higher-income urban households. Another area of focus is smart control compatibility—fans with Wi-Fi or Bluetooth modules that allow remote operation through smartphones are now being introduced in mid-range models. This convergence of energy-saving and smart control is driving customer interest in new models launched in early 2024 by companies like Crompton and Usha.

To get more information on this market, Request Sample

Climate Variability Boosting Seasonal Sales

Frequent heatwaves across major Indian cities are increasing the seasonal demand for tower fans. As summer temperatures continue to rise, demand peaks between April and July, with retailers reporting stockouts in high-demand zones. Tower fans are emerging as preferred cooling appliances over air conditioners in cost-sensitive areas, especially where ventilation is limited and space-saving cooling is necessary. Households in regions like Delhi NCR, Rajasthan, and parts of Maharashtra are showing repeat seasonal buying behavior. In response, manufacturers are improving airflow distance and oscillation features in mid-range models. Multi-speed operation and noise reduction are also becoming important to urban buyers. Additionally, dual-purpose tower fans with built-in air purifiers are gaining popularity in metro cities affected by rising pollution levels. In early 2024, companies like Havells and Orient Electric launched hybrid tower fans equipped with ionizer technology and air purification filters. These additions are attracting working professionals and elderly consumers, especially in cities like Bengaluru and Mumbai. Retailers are adapting by pushing pre-summer promotions and offering extended warranties, aiming to increase off-season purchases as well. This demand shift is reshaping the product strategy of both domestic and multinational fan manufacturers operating in India.

India Tower Fan Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, type of use, functionality, and distribution channel.

Product Type Insights:

- Traditional Tower Fans

- Oscillating Tower Fans

- Remote-Controlled Tower Fans

- Bladeless Tower Fans

The report has provided a detailed breakup and analysis of the market based on the product type. This includes traditional tower fans, oscillating tower fans, remote-controlled tower fans, and bladeless tower fans.

Type of Use Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the type of use have also been provided in the report. This includes residential, commercial, and industrial.

Functionality Insights:

- Cooling

- Air Purifying

- Humidifying

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes cooling, air purifying, and humidifying.

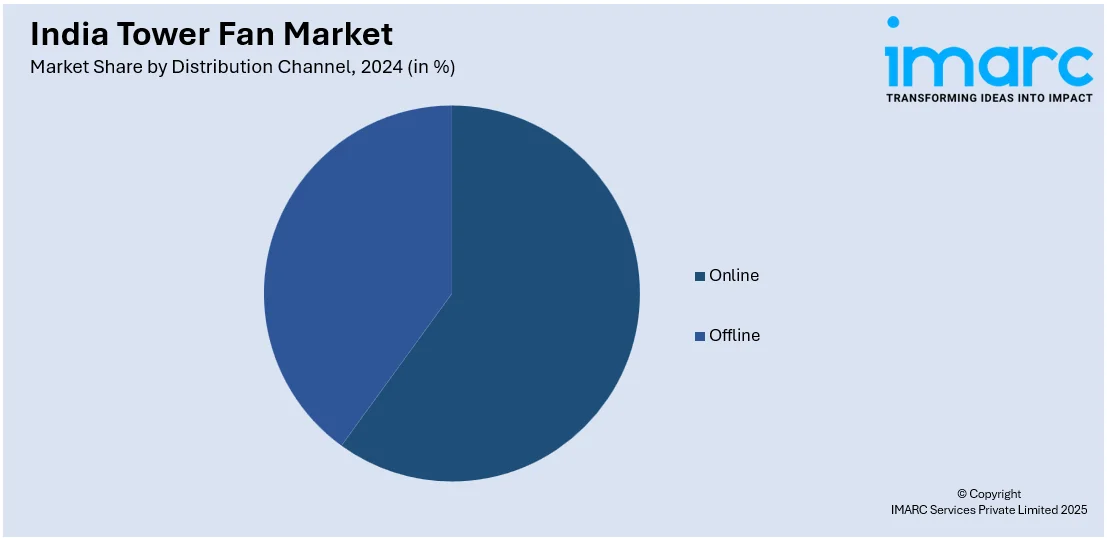

Distribution Channel Insights:

- Online

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline (supermarkets/hypermarkets, specialty stores).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tower Fan Market News:

- May 2024: DREO introduced the MC710S purifier tower fan with dual-motor and dual-filtration technology. Combining cooling and purification, it redefined tower fan performance, offering faster airflow, reduced noise, and smart control, boosting innovation and consumer demand in the tower fan market segment.

India Tower Fan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Traditional Tower Fans, Oscillating Tower Fans, Remote-Controlled Tower Fans, Bladeless Tower Fans |

| Types of Use Covered | Residential, Commercial, Industrial |

| Functionalities Covered | Cooling, Air Purifying, Humidifying |

| Distribution Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tower fan market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tower fan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tower fan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tower fan market in India was valued at USD 7.0 Billion in 2024.

The India tower fan market is projected to exhibit a (CAGR) of 3.5% during 2025-2033, reaching a value of USD 9.6 Billion by 2033.

The tower fan market growth in India is driven by the increasing demand for energy-efficient cooling solutions, rising temperatures, urbanization, and growing awareness about space-saving appliances. Additionally, affordability, improved air quality features, and advancements in technology contribute to the growing popularity of tower fans as a practical alternative to traditional air conditioning systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)