India Toys and Games Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

India Toys and Games Market Summary:

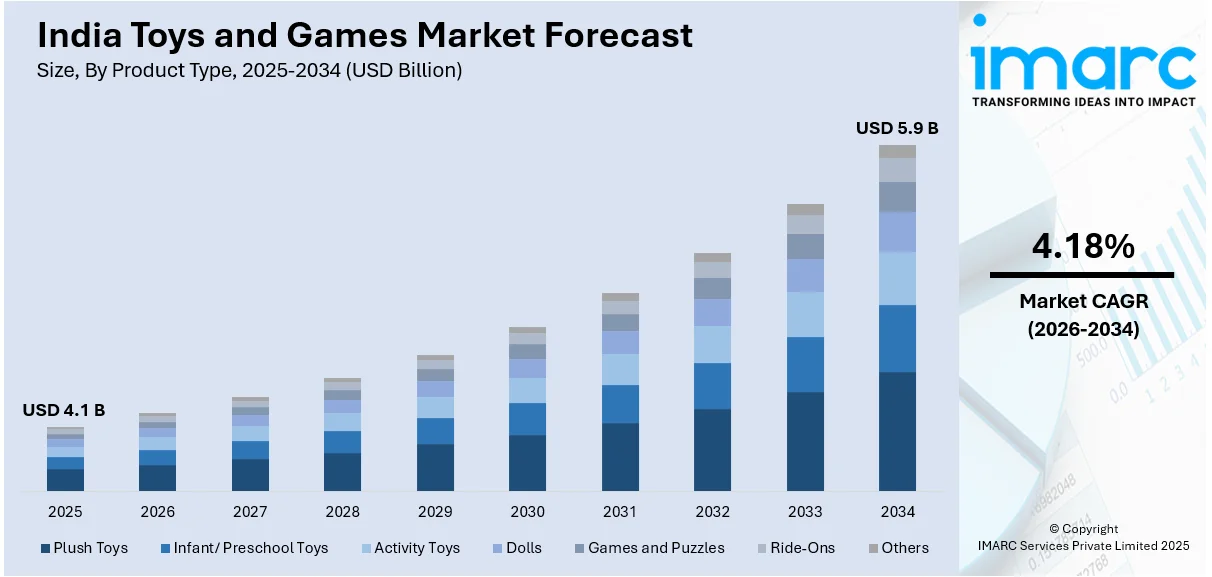

The India toys and games market size was valued at USD 4.07 Billion in 2025 and is projected to reach USD 5.89 Billion by 2034, growing at a compound annual growth rate of 4.18% from 2026-2034.

The India toys and games market is propelled by growing disposable incomes, rising urbanization, and increasing demand for learning-based toys. The trend towards online retailing, expanding e-commerce platforms, and the influence of social media are also key market drivers. Government initiatives under the Make in India campaign, along with strict quality control measures and rising customs duties on imports, have fostered domestic manufacturing capabilities. The increasing middle-class population continues to encourage higher entertainment spending, particularly on educational and developmental toys for children.

Key Takeaways and Insights:

- By Product Type: Plush toys dominate the market with a share of 18% in 2025, driven by the emotional appeal of soft toys among children and their significance as comfort items, along with growing demand for character-themed plush toys from popular media franchises.

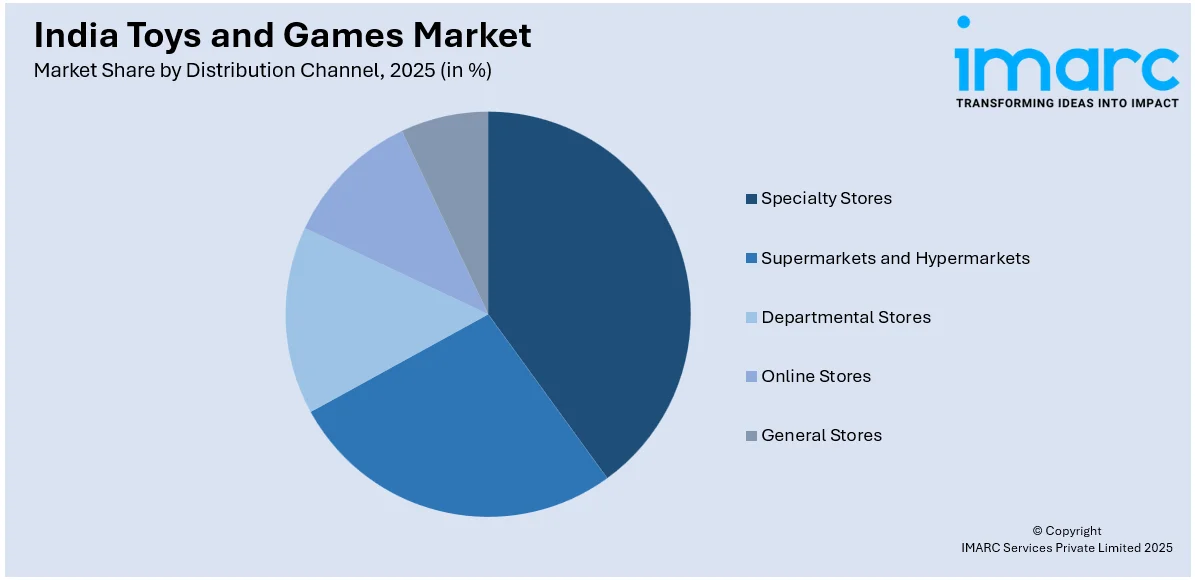

- By Distribution Channel: Online stores lead the market with a share of 31% in 2025, owing to the convenience of doorstep delivery, wider product variety, competitive pricing, and the expanding reach of e-commerce platforms into tier II and tier III cities.

- By Region: North India is the largest segment with a market share of 33% in 2025, supported by the robust manufacturing base in the Delhi-NCR belt, higher purchasing power, greater exposure to global toy trends, and supportive government policies.

- Key Players: The India toys and games market exhibits moderate competitive intensity, with multinational corporations competing alongside regional manufacturers across price segments. Major domestic players focus on localized content and manufacturing capabilities, while international brands leverage global expertise and licensing agreements to capture market share.

To get more information on this market Request Sample

The India toys and games market is experiencing a significant transformation driven by evolving consumer preferences and regulatory changes. The government's National Action Plan for Toys and Production Linked Incentive schemes have substantially boosted domestic manufacturing, resulting in a fifty-two percent decline in toy imports and a two hundred thirty-nine percent increase in exports from fiscal year 2014-15 to 2022-23. Parents are increasingly looking for toys that blend fun with learning, especially STEM-focused products that support cognitive development. A leading domestic manufacturer has expanded its production capabilities to keep pace with rising demand both within India and abroad. The company has also ventured into electronic toys, introducing products under its interactive learning brand to cater to the growing interest in educational and engaging play experiences for children.

India Toys and Games Market Trends:

Rise of Educational and STEM-Based Toys

Parents across India have become increasingly aware of developmental needs during childhood, driving demand for learning, creativity, and brain-skill-promoting toys. Educational toys such as puzzles, building blocks, and science kits are experiencing strong demand as they aid early learning and foster problem-solving capabilities. This trend aligns with the growing emphasis on STEM education and the integration of technology into classrooms. The government's e-Toycathon 2025 initiative has further spurred young innovators to develop indigenous electronic toys, promoting an ecosystem that combines education with entertainment.

E-Commerce Transformation of Distribution Channels

The expansion of e-commerce is significantly reshaping the India toys and games market outlook. With increasing internet penetration and smartphone usage, online shopping has become the preferred way to purchase toys for many consumers. E-commerce platforms make a wide variety of products accessible to customers in both urban and rural areas, offering convenience, better price comparisons, and doorstep delivery. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034. Digital marketing and targeted advertisements have boosted awareness of different toy brands, attracting more buyers while facilitating the entry of global toy brands into India.

Growing Focus on Sustainability and Eco-Friendly Materials

Environmental consciousness is increasingly influencing consumer purchasing decisions in the toy industry. Parents now favor eco-friendly products made from sustainable materials such as FSC-certified wood, recycled plastics, and non-toxic dyes. Manufacturers are responding by investing in sustainable sourcing and environmentally responsible manufacturing processes. This shift toward green products is being supported by government initiatives promoting sustainable toy production, including incentives outlined in the Union Budget 2025-26 for eco-friendly toy manufacturing clusters.

Market Outlook 2026-2034:

The India toys and games market is poised for sustained growth over the forecast period, supported by favorable demographic trends, government policy support, and evolving consumer preferences. The Union Budget 2025-26 announcement to create a comprehensive scheme for making India a global hub for toys will accelerate cluster development, skill enhancement, and manufacturing ecosystem growth. Rising urbanization and expanding middle-class populations will continue driving demand for both traditional and technology-integrated toys. The market generated a revenue of USD 4.07 Billion in 2025 and is projected to reach a revenue of USD 5.89 Billion by 2034, growing at a compound annual growth rate of 4.18% from 2026-2034.

India Toys and Games Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Plush Toys |

18% |

|

Distribution Channel |

Online Stores |

31% |

|

Region |

North India |

33% |

Product Type Insights:

- Plush Toys

- Infant/Preschool Toys

- Activity Toys

- Dolls

- Games and Puzzles

- Ride-Ons

- Others

Plush toys dominates with a market share of 18% of the total India toys and games market in 2025.

Plush toys continue to be a top product category due to their wide appeal across different age groups and their role as comfort items for children. The segment thrives on the strong emotional connections that soft toys foster, as well as their popularity as gifts during festivals and special occasions. Products featuring popular cartoon characters have seen particularly strong demand, highlighting the influence of familiar themes on consumer preference. Overall, plush and stuffed toys remain a staple in the market, combining entertainment, comfort, and gifting appeal.

The rising demand for character-themed plush toys from popular media franchises, including animated television series and movies, continues to drive segment expansion. Manufacturers are increasingly incorporating premium materials and sustainable fabrics to appeal to environmentally conscious parents. The growing trend of personalization and customization in plush toys has also opened new revenue streams, with consumers seeking unique products that cater to individual preferences and developmental needs.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Specialty Stores

- Supermarkets and Hypermarkets

- Departmental Stores

- Online Stores

- General Stores

Online stores lead with a share of 31% of the total India toys and games market in 2025.

E-commerce platforms have revolutionized toy distribution in India by making diverse product ranges accessible to consumers across urban and rural areas alike. Online channels offer significant advantages including competitive pricing, doorstep delivery, detailed product information, and convenient return policies. Major e-commerce platforms have expanded their toy categories substantially, while leading manufacturers now derive substantial portions of their revenue from digital sales channels.

The rapid growth of digital payments and increasing smartphone penetration has further accelerated online toy purchases. Seasonal sales events on major platforms generate significant demand spikes, with toys emerging as popular categories during festive periods. The online channel has also facilitated the entry of international toy brands into India, diversifying the available product range and intensifying competition that ultimately benefits consumers through better prices and wider selection.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 33% share of the total India toys and games market in 2025.

North India commands the largest regional share owing to its robust manufacturing base and supportive government policies. More than eighty percent of toy manufacturing plants in India are based in the northern region, primarily concentrated in the Delhi-NCR belt. The region benefits from higher purchasing power among consumers, greater exposure to global toy trends, and the presence of numerous retail outlets catering to diverse consumer segments.

State-level policy initiatives have further strengthened North India's position as a toy manufacturing and innovation hub. For instance, Haryana's Draft Electronic Toys Manufacturing Policy 2024 aims to attract investments worth one thousand crore rupees while generating ten thousand jobs in the sector. The Toy Park at Greater Noida represents a dedicated cluster for toy production, providing manufacturers with infrastructure and logistical advantages that support both domestic sales and export operations.

Market Dynamics:

Growth Drivers:

Why is the India Toys and Games Market Growing?

Government Initiatives and Policy Support for Domestic Manufacturing

The Indian government has implemented comprehensive measures to transform the country into a global hub for toy manufacturing. The Make in India initiative, combined with the National Action Plan for Toys and Production Linked Incentive schemes, has created a favorable ecosystem for domestic production. Strategic interventions including raising import duties from twenty percent to seventy percent and enforcing strict quality control orders through the Bureau of Indian Standards have substantially reduced reliance on imports while encouraging local manufacturing. The Union Budget 2025-26 further strengthens this momentum through increased tax benefits for domestic manufacturers, expanded toy manufacturing clusters, and incentives for eco-friendly production. In February 2025, the Ministry of Electronics and Information Technology established a strategic partnership between CDAC-Noida and the LEGO Group to develop electronic toys and equip young engineers with design skills.

Rising Disposable Incomes and Expanding Middle-Class Population

India's economic development has led to substantial growth in household purchasing power, enabling families to allocate greater spending toward children's entertainment and development. The expanding middle class increasingly views quality toys as investments in child development rather than mere leisure expenditure. Urban consumers demonstrate willingness to pay premium prices for branded, educational, and technology-integrated toys that offer developmental benefits. This economic transformation has doubled private consumption from approximately one trillion dollars to over two trillion dollars in the past decade, with toys and games capturing a growing share of discretionary spending. Parents today are more informed about the developmental benefits of play and actively seek products that combine entertainment with learning outcomes.

E-Commerce Expansion and Digital Retail Transformation

The proliferation of e-commerce platforms has fundamentally transformed toy distribution and accessibility across India. Major platforms now reach consumers in tier two and tier three cities where physical toy retail infrastructure remains limited, substantially expanding the addressable market. Online channels offer advantages including extensive product selection, competitive pricing through direct manufacturer relationships, customer reviews for informed decision-making, and convenient delivery options. The growth of digital payments and increasing smartphone penetration have removed friction from online purchasing, while social media marketing has enhanced brand awareness and product discovery. Leading domestic toy manufacturers now generate significant portions of their revenue through e-commerce channels, reflecting the structural shift in consumer shopping preferences.

Market Restraints:

What Challenges the India Toys and Games Market is Facing?

Limited Rural Market Penetration and Infrastructure Gaps

Urban market development does not fully penetrate rural regions, which represent a significant part of the population, as their purchasing power is lower and the retail infrastructure is less developed. Market expansions in these areas are limited by distribution issues and low connectivity of the last miles. Although the internet penetration in rural regions has improved tremendously, physical retail outlets of branded toys are few in the non-metropolitan regions.

Intense Competition from Unorganized Sector and Counterfeit Products

The challenges in India toy market have not been eradicated by the unorganized manufacturers that provide low-priced substitutes, which in most cases affect the quality standards and safety measures. The imitated products that are copies of the widely recognized brands discredit the original manufacturers and confuse the consumer. Although quality control regulations have enhanced the market dynamics, it is difficult to enforce them in the dispersed retail environment.

Supply Chain Constraints and Raw Material Dependencies

The domestic toy producers are still struggling with issues related to the sourcing of raw materials and efficiencies in the supply chain. Despite the policy interventions, some elements and specialized materials remain imported, leaving the manufacturers to the fluctuations in currency and disruption of supply. The development of local supply chains of various types of toys requires long-term investment and capacity building.

Competitive Landscape:

The India toys and games market exhibits a fragmented competitive structure characterized by the presence of established multinational corporations alongside prominent domestic manufacturers and numerous regional players. Leading domestic players have strengthened their market positions through expanded manufacturing capabilities, strategic licensing agreements with international brands, and investments in product innovation. Global toy companies leverage brand recognition, diverse product portfolios, and content licensing relationships to maintain market share. Competition increasingly centers on product differentiation through educational value, technological integration, and alignment with popular entertainment properties. The organized retail segment continues to consolidate, with manufacturers focusing on direct consumer engagement through e-commerce channels while maintaining relationships with traditional distribution partners.

Recent Developments:

- January 2026: KV Toys India, a locally established toy brand from Old Delhi, launched its SME IPO. Chairman and Managing Director Karan Narang highlighted the company’s journey, unique strengths, and future growth strategies. The proceeds from the IPO were intended to enhance working capital, support product innovation, and provide financial backing, enabling KV Toys to strengthen its market presence and compete on a global scale.

- December 2025: Funskool India announced its entry into the electronic toys category with the launch of a new product range, including learning pads, interactive laptops, and melody books under its Giggles brand, leveraging upgraded electronic assembly lines at its Ranipet and Goa facilities.

- April 2024: Funskool India completed a major expansion at its Ranipet facilities, adding 163,000 square feet of manufacturing space to effectively double production capacity, with a dedicated wing focusing on wooden toy manufacturing.

India Toys and Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plush Toys, Infant/ Preschool Toys, Activity Toys, Dolls, Games and Puzzles, Ride-Ons, Others |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Departmental Stores, Online Stores, General Stores |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India toys and games market size was valued at USD 4.07 Billion in 2025.

The India toys and games market is expected to grow at a compound annual growth rate of 4.18% from 2026-2034 to reach USD 5.89 Billion by 2034.

Plush toys dominated the India toys and games market with an 18% share in 2025, driven by their universal appeal as comfort items and gifting products, along with strong demand for character-themed plush toys from popular media franchises.

Key factors driving the India toys and games market include supportive government initiatives under Make in India, rising disposable incomes and expanding middle-class population, e-commerce expansion enabling wider market access, and growing demand for educational and STEM-based toys.

Major challenges include limited rural market penetration due to infrastructure gaps, intense competition from unorganized sector and counterfeit products, supply chain constraints affecting raw material availability, and the need for sustained investment in domestic manufacturing capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)