India Transmission Repair Market Size, Share, Trends and Forecast by Vehicle Type, Repair Type, Component, and Region, 2025-2033

India Transmission Repair Market Overview:

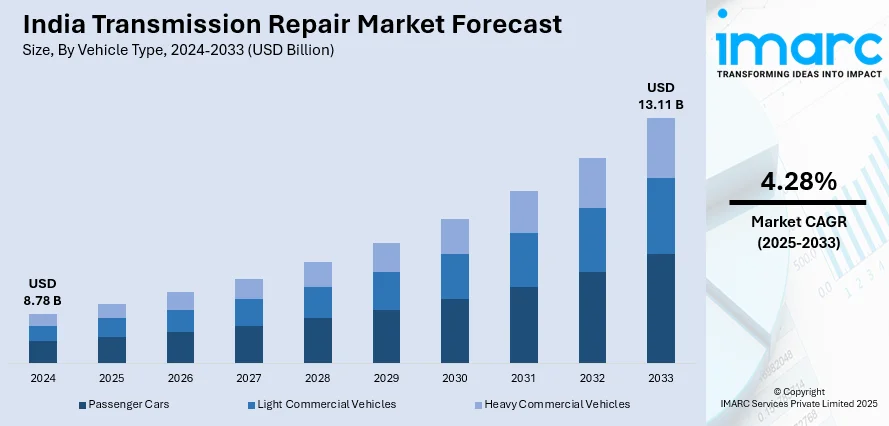

The India transmission repair market size reached USD 8.78 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.11 Billion by 2033, exhibiting a growth rate (CAGR) of 4.28% during 2025-2033. The rising number of aging vehicles, the increasing demand for preventive maintenance, the expanding automotive aftermarket, and technological advancements in transmission systems are among the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.78 Billion |

| Market Forecast in 2033 | USD 13.11 Billion |

| Market Growth Rate 2025-2033 | 4.28% |

India Transmission Repair Market Trends:

Increasing Vehicle Ownership and Aging Fleet

India’s automotive sector has experienced a notable surge in vehicle ownership in recent years, resulting in a significantly expanding vehicle fleet. As more vehicles remain in use for extended periods, often surpassing 10 years, especially in the commercial segment known for durability and prolonged operation. This expanding aging fleet, combined with the steady increase in average annual vehicle miles traveled, is contributing to heightened wear and tear on transmission systems, thereby driving demand for regular maintenance and repair services. The passenger vehicle segment, in particular, has seen remarkable growth, with sales rising from around 2.7 million units in 2020–21 to over 4.2 million units in 2023–24. This expansion directly correlates with a larger volumes of vehicles requiring ongoing transmission upkeep.

To get more information on this market, Request Sample

Growth of Ride-Sharing Services and Commercial Vehicle Usage

The rapid expansion of ride-sharing services in India has significantly altered vehicle utilization patterns, leading to increased strain on automotive systems, particularly transmissions. Ride-sharing vehicles typically clock higher mileage over shorter periods compared to privately owned cars. For instance, Uber currently has over 1.1 million active drivers in India, and the number continues to rise. Additionally, trip volumes by users engaging with multiple services on the platform have grown by 50% year-on-year, outpacing the overall growth rate. This surge in usage accelerates wear and tear on key vehicle components, elevating the demand for regular transmission maintenance and repairs. Moreover, the commercial vehicle segment, especially in logistics and goods transportation, has seen robust growth, contributing further to rising average vehicle miles traveled. These heavy-duty vehicles are particularly susceptible to transmission issues due to continuous operation under demanding conditions. This increased reliance on high-mileage vehicles across both ride-sharing and commercial sectors is driving strong growth in India’s transmission repair services market.

India Transmission Repair Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, repair type, and component.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

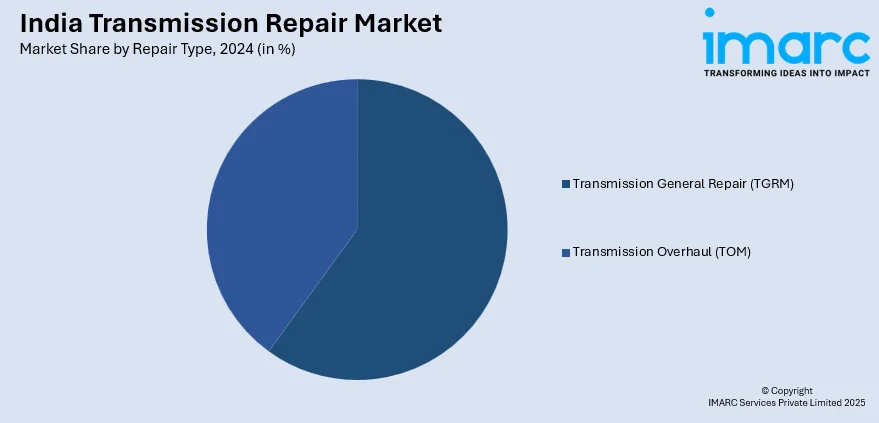

Repair Type Insights:

- Transmission General Repair (TGRM)

- Transmission Overhaul (TOM)

A detailed breakup and analysis of the market based on the repair type have also been provided in the report. This includes transmission general repair (TGRM) and transmission overhaul (TOM).

Component Insights:

- Gasket and Seal

- Transmission Filter

- O-Ring

- Fluid

- Flywheel

- Pressure Plate

- Oil Pump

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes gasket and seal, transmission filter, O-ring, fluid, flywheel, pressure plate, oil pump, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Transmission Repair Market News:

- April 2025: BluSmart announced plans to cease its independent ride-hailing services and transition to supplying its electric vehicle (EV) fleet to Uber. The shift will commence with 700–800 EVs, eventually encompassing the entire fleet. While the announcement doesn't specifically address vehicular transmission repair, such maintenance remains integral to fleet operations, ensuring vehicle reliability and performance.

- March 2025: The Indian government announced plans to launch a cooperative-run ride-hailing platform as an alternative to Uber and Ola. This initiative aims to empower drivers by allowing them to retain full earnings without commission cuts. The platform will encompass two-wheeler taxis, autorickshaws, and four-wheelers, operating under a multi-state cooperative society.

India Transmission Repair Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Repair Types Covered | Transmission General Repair (TGRM), Transmission Overhaul (TOM) |

| Components Covered | Gasket and Seal, Transmission Filter, O-Ring, Fluid, Flywheel, Pressure Plate, Oil Pump, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India transmission repair market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India transmission repair market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India transmission repair industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The transmission repair market in India was valued at USD 8.78 Billion in 2024.

The India transmission repair market is projected to exhibit a CAGR of 4.28% during 2025-2033, reaching a value of USD 13.11 Billion by 2033.

The India transmission repair market is driven by increasing demand for reliable power supply, aging infrastructure requiring maintenance, rapid industrialization, and expansion of power grids. Growing adoption of advanced diagnostic and repair technologies, along with government initiatives to improve grid efficiency and reduce downtime, further supports market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)